FX Brief:

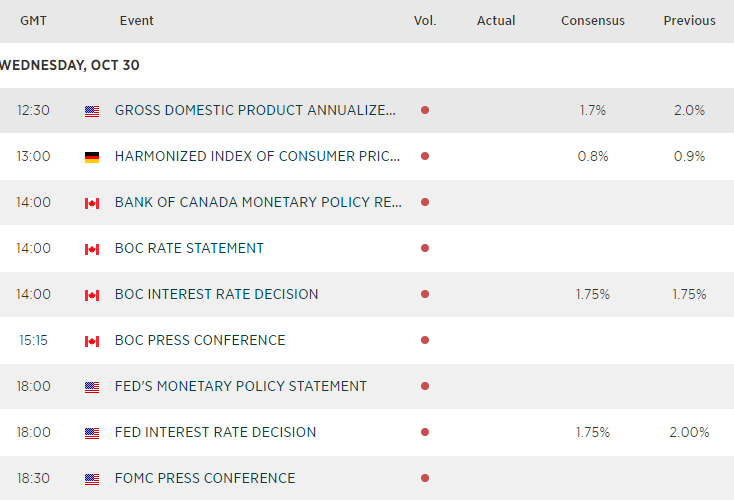

- After teasing markets with some sort of action, BOJ kept policy unchanged (rates at -0.1%, 10yr JGB ‘around’ 0%. Yet they modified their forward guidance on interest rates, to more clearly signal future chance of a cut.

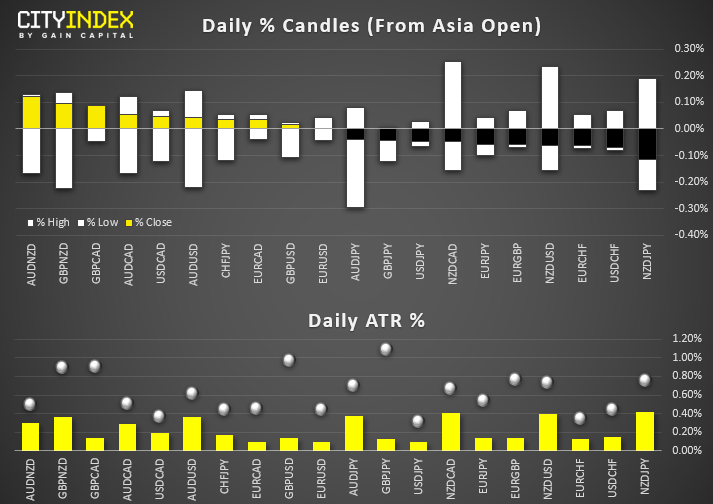

- The US dollar extended losses throughout the Asia session, seeing EUR/USD and NZD/USD touched a 7-day high whilst USD/CHF hit a 7-day low. Yet with most FX major approach key levels of support or resistance, it could make or ‘break’ for the USD as we head towards NFP tomorrow.

- China’s manufacturing PMI contracted for a 6th consecutive month, and at its fastest pace since February as the trade war continues to bite. The new order also contracted to show weak domestic demand, which points towards further weakness for the headline figure. And this is after GDP (which lags PMI) sank to a multi-decade low of 6%... Service PMI continues to expand at 52.8, but at its slowest pace since January 2016.

- Usually, such data would weigh on AUD and NZD, yet they pushed to new highs on the back of a weaker, post-Fed dollar. Instead, NZD and AUD are today’s strongest majors with NZD/USD, NZD/CAD and AUD/NZD exceeding their typical daily ranges. Without a new catalyst, we could find the better part of the movie is over, so traders could choose to step aside or consider fading if this is in line with their strategy.

Equity Brief:

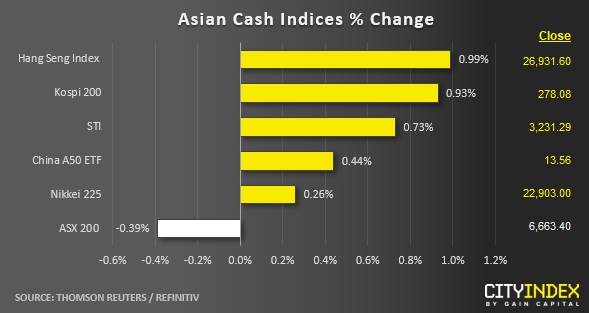

- Most Asia stock markets have rejoiced in “waves of optimism,” taking the cue from a late rally in the U.S. stock markets; post-Fed FOMC that elevated the S&P 500 to another fresh record closing high at 3046.

- Also, technology giant bellwether, Apple has posted stellar fiscal Q4 earnings numbers that beat expectations. In addition, Apple has given rosy guidance on potential stronger sales for its wearables, AirPods, and services for the upcoming holiday season. The share price of Apple had rallied by 3% in after-hours trading that saw a spike to 252.50 (above its current all-time high printed on 249.76 printed on 29 Oct) before it drifted down lower to settle at 248.19.

- Meanwhile, U.S-China trade-related news flow is positive at this juncture despite the cancellation of the APEC summit by Chile, where the expectations have been set for both Presidents, Trump and Xi, to sigh off “Phase 1 of the trade deal”. The U.S administration has reaffirmed it still aims to sign the U.S-China trade deal in Nov, and trade negotiators from both sides will have a phone call on this Fri.

- Best performers are Hong Kong’s Hang Seng Index and South Korea’s Kospi 200 as at today Asia mid-session. Apple’s component supplier, AAC Technologies, has recorded a rally close to 4% with other technology-related stocks such as Sunny Optical Technology, which is upped by 8.00%.

- Even Samsung Electronics; the biggest component stock in the Kospi 200 has rallied up 1.40% that outperformed the Kospi 200 today, joining the “technology optimism bandwagon” although its Q3 profit declined by -56% y/y to 7.8 trillion won (slightly above consensus estimates of 7.7 trillion) for four consecutive quarters.

- The outlier today is Australia’s ASX 200, which has dropped by -0.39% dragged down by the financials sector on the backdrop of weak earnings from Australia and New Zealand Banking Group (ANZ), one of the big 4 banks. ANZ’s fiscal H2 earnings fall -3% to A$2.91 billion, below consensus estimates of A$2.93 billion. ANZ share price has declined by -3.00% that triggered a negative feedback loop into the other three banks where NAB, CBA, and Westpac have dropped by -1.4% to -1.5%.

- The S&P 500 E-mini future is almost unchanged in today’s Asia session and traded within a range of 7 points with a current intraday low of 3044.

"Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation, and needs of any particular recipient.

Any references to historical price movements or levels are informational based on our analysis, and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions."