Services inflation is key for the Bank of England

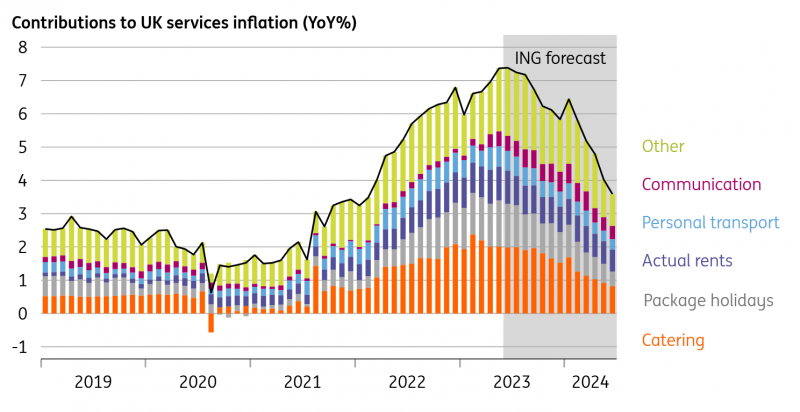

Whether or not the Bank of England repeats June’s 50 basis-point rate hike in two weeks comes down to one number in the UK inflation data due on Wednesday. That number is services inflation, and it’s likely to stay at 7.4%, its highest level in over 30 years. This is the bit of the inflation basket that the Bank of England is most interested in – it tends to exhibit the most persistent trends, and is generally less volatile than the likes of energy or goods.

Until now our base case has been for a 25bp rate hike when the BoE meets in early August. But unexpectedly strong wage data last week has moved the dial closer to a 50bp move, and that would be further cemented if Wednesday’s services inflation figure rises once again.

Hospitality has been a key driver of higher services inflation

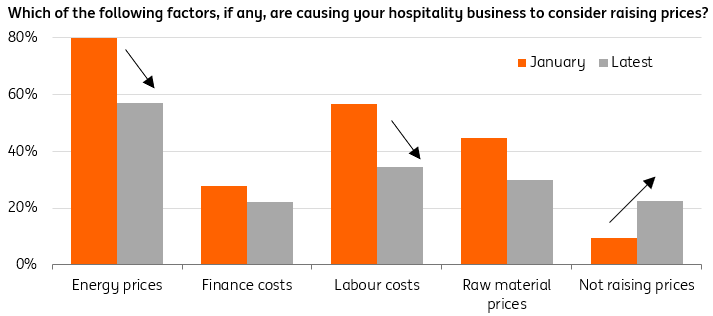

If various surveys are to be believed though, services inflation should be at its peak. Indeed if we look at hospitality – a key driver of services inflation over recent months – there are already signs of disinflation, which could be linked to the sharp fall in gas prices. Data from a January ONS survey of businesses showed that energy prices, much more than wage costs, was the primary driver of higher consumer prices in hospitality through winter.

By that logic, lower gas prices should help ease service sector price pressure over the coming months, and indeed the latest version of that ONS survey shows the percentage of hospitality firms that are expecting to raise prices has tumbled from 46% in April to 26% now. That signals disinflation in the services sector through the rest of the year, albeit stubbornly-high wage growth will ensure that’s a slow process.

Admittedly we might have to wait until later in the summer before this trend becomes more apparent, and for now the Bank of England appears sceptical that improvements in forward-looking inflation indicators are translating into better actual CPI figures. Like us, the BoE expects services inflation to flatline in the near-term, and any deviation above or below last month’s reading will be what helps cement either a 25bp or 50bp hike in early August.

Energy prices were the main driver of hospitality price rises over winter

Food and core goods inflation should start to come lower

Away from services, the news is a bit brighter and headline inflation should dip back noticeably in Wednesday's figures. Last June we saw a near-10% spike in petrol/diesel prices; this year, they fell by 2.6% across the month by our estimates. That alone shaves 0.4pp off the annual CPI rate, and the result is that inflation is likely to hit 8.1% (down from 8.7%). Expect an even more pronounced decline in July’s numbers, as the 17% fall in average household electricity/gas bills wipes almost another full percentage point off the annual rate of inflation.

The news on food prices should start to get better too. While still at a lofty 18%, food inflation does appear to have peaked and we've seen more noticeable early signs of slowing in the equivalent eurozone data. Given the UK's food inflation rate mirrored the eurozone until a few months ago, we don't see why this downward trend shouldn't also be replicated in Britain.

That's because producer prices have been rising much less aggressively over recent months, and on a seasonally-adjusted basis, the change in prices over the past three months is compatible with what we typically saw before pre-2022 (see chart below). We doubt the divergence between producer and consumer prices will persist for much longer.

Producer price inflation for food has slowed dramatically

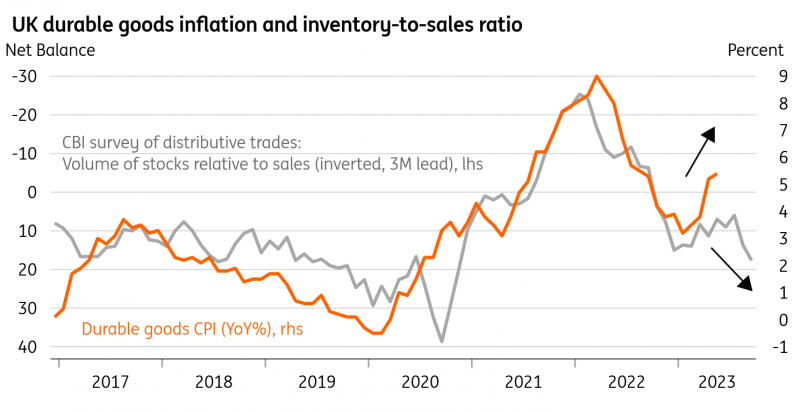

Finally, we’ll also be watching ‘core goods inflation’ after various categories showed unexpected strength over recent months. April saw a surprise spike in vehicle prices, and we’ve also seen stickiness in clothing as well as alcohol/tobacco. The chart below shows that durable goods inflation has picked up again, despite inventory levels rising relative to sales among retailers/wholesalers.

This isn’t unique to the UK, and we saw something similar in the US earlier this year. But we don’t expect this divergence between leading indicators and core goods inflation to continue. Base effects should also help disinflation among goods categories too over the next few months. We think this should help core inflation nudge fractionally lower in Wednesday’s data.

Durable goods inflation has picked up despite higher inventories/lower sales

Implications for the Bank of England

Throw all of that together, and the result is that headline CPI should end up a tad below 7% in July (released in August). And a further downshift in energy inflation in October should take us to around 5% on our current projections. Core inflation will be stickier, ending the year north of 5%, and services is likely to be closer to 6%.

If we’re right, then the Bank of England can probably get away with hiking slightly less than markets expect. Investors currently expect a peak for Bank Rate at 6.15%. Progress on services inflation should be enough to convince the committee to pause its hiking cycle in November, which would suggest a peak rate of either 5.50% or 5.75%. But given the tendency of inflation data to come in on the high side, we certainly shouldn't rule out a peak of 6% should services CPI fail to slow.

First published on Think.ing.com.