By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

It was an unusually volatile day in the foreign-exchange market. European currencies traded with a heavy bias for the first half of the North American trading session but rose quickly and aggressively ahead of the London close, only to reverse course minutes later. The rollercoaster ride was driven entirely by fixing flows, although it's worth noting that U.S. yields and the dollar also rebounded around the same time. USD/JPY raced to a high of 111.80 — its strongest level in 4 trading days. Part of the dollar’s move was driven by a strong bill auction but investors are also buying dollars ahead of Wednesday’s FOMC minutes. The minutes from the last Fed meeting are widely expected to reinforce the market’s expectations for June tightening. At the last Fed meeting, the central bank downplayed the weakness in jobs and consumer spending, choosing instead to focus on the positive outlook for the economy. Although more recent economic reports including Tuesday morning’s PMIs (Manufacturing, Services), New Home Sales and the Richmond Fed index highlight the vulnerability of the U.S. recovery, the Fed has done nothing to cast doubt on the market’s expectations for tightening. They’ve had a number of opportunities to suggest that investors are overly optimistic but they haven’t done so. USD/JPY could hit 112 leading up to or on the back of the FOMC minutes but the real resistance is at the 100-day SMA, near 112.60.

Despite better-than-expected Eurozone data, the EUR/USD sank below 1.12. The single currency traded with a heavy bias for most of the day and even when GBP/USD popped to 1.3034, the gains in EUR/USD were limited. The currency’s underperformance can be explained by the central bank and the market’s concerns for inflation. Although German business confidence increased in May thanks to stronger manufacturing activity, price pressures are easing. The price component of the Eurozone PMI report fell for the first time in 15 months and the recent strength of the euro could push inflation down even further. The ECB was reluctant to talk up the improvements in the economy because of low inflation and their worries would have only grown after Tuesday’s reports. Aside from the drop in PMI prices, service-sector activity in the region also slowed, giving euro bulls the perfect excuse to take profits after such an extended move.

Meanwhile, sterling experienced the greatest swings. GBP/USD raced as high as 1.3034 before reversing course and falling down to 1.2953. It ended the day near its lows, confirming the rejection of 1.30. While we still need to see the pair drop below 1.29 to put 1.30 in the rearview mirror, the path of least resistance should be lower. Monday night’s horrific terrorist attack put pressure on the currency and the pain was exacerbated by the larger-than-expected deficit.

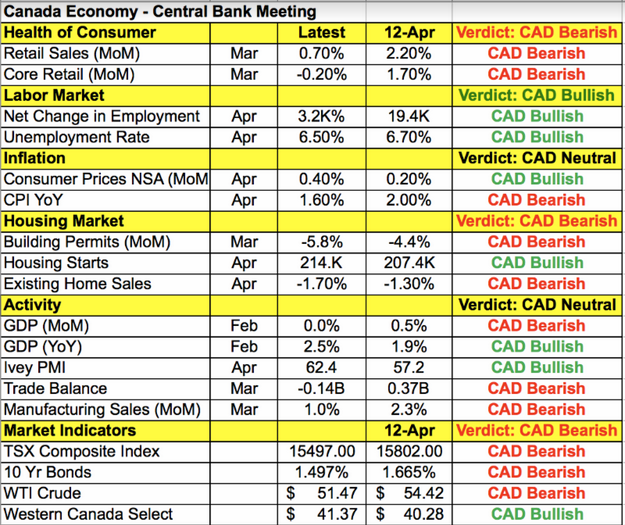

Looking ahead, everyone will be watching the Canadian dollar. The Bank of Canada’s monetary policy announcement on Wednesday will be followed by the OPEC meeting on Thursday. Oil prices are trading higher ahead of these 2 key events but USD/CAD has found its way above 1.35. At the last meeting, the central bank raised its growth forecast and brought forward its forecast for closing the output gap to the first half of 2018 sending the loonie sharply higher. Investors interpreted the announcement as the central bank moving away from its easing bias. Since then, there have been both improvements and deterioration in Canada’s economy as shown in the table below. Retail sales, inflation, housing and trade activity softened but employment and manufacturing activity increased. We don’t think there’s enough changes to alter the central bank’s views and put the CAD recovery at risk. OPEC nations are widely expected to extend the production cuts that they agreed to earlier this year. A 6-month extension would be negative for CAD, 9 months would be mildly positive and 12 months would lead to some nice gains for the currency. Both the Australian and New Zealand dollars ended the day off their highs. New Zealand’s trade balance Was due Tuesday evening and while higher dairy prices should boost the value of exports, manufacturing activity slowed according to the latest report. With that in mind, we still think the comm dollars could outperform European currencies in the near term.