President Tump ordered the Syrian strikes over dessert with President Xi, stellar Australian employment and Chinese trade data, the flight to safety; it’s been quite a morning already.

The USD has been generally weaker overnight into the Asia morning following on mostly from an interview published overnight in the Wall Street Journal. The comments that have had the most effect were that the USD was too strong and that China won’t be labelled a currency manipulator. This has weakened the USD across the board, continuing its poor run of the last few days. Especially against the yen.

We also saw US 10-year bonds rally aggressively to 2.24%. Among the more esoteric comments to emerge overnight was that Mr Trump ordered the Syrian airstrikes over dessert with China's President Xi. I am not sure if it was a chocolate bomb he was eating, but one could definitely say he served up a dessert storm. State dinners around the word will definitely be more poignant going forward. Diplomats would be well advised to note President Trump likes his steak well done. Just saying.

Over in Europe, the French elections have become more muddied with the ascendance in the polls of the far-left candidate Jean-Luc Melechon. Readers should note that when I say far-left, this candidate makes Hugo Chavez look like an activist shareholder in a hedge fund. He is also vehemently anti-euro. This has raised the spectre of a nightmare scenario where the 2nd round run-off could be contested by the extreme right wing and left wing candidates. Despite safe-haven inflows into German Bunds, this reality-check has been capping euro rallies even as the USD is generally weaker.

Moving to Asia today, we have the unfortunate circumstance that the founder of North Korea, Kim Il-jung has his birthday anniversary tomorrow, on Easter Friday. North Korea’s unique interpretation of festive fare means that there is a chance that they will commemorate Eater Friday with a nuclear test. Apparently, they have gathered foreign journalists in Pyongyang for a “special event.”

Along with Russian intrusions into Japanese airspace and the U.S. Navy parking a fleet near the Korean peninsula, this has kept Asian traders and investors very nervous all week. It is, therefore, no surprise that precious metals have been vigorously bid all week in the Asian timezones as we roll into the long weekend.

Looking at the markets this morning in Asia.

FX

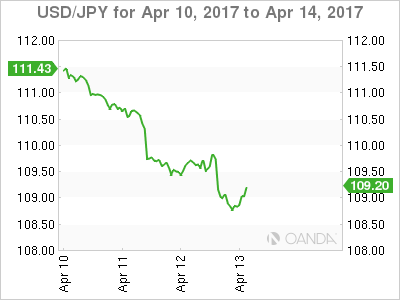

Continues to trade heavily as the US/Japan yield spread closes up and safe haven flows pile into Yen ahead of the weekend. The USD/JPY is trading just above its 200-day moving average (DMA) at 108.60 which marks first support. A close below opens a move to the 61.8% Fibonacci at 106.85 from a chart perspective.

Resistance is at 110.00 the breakdown level of a few days ago. Overall though the flight to safety still rules into Easter.

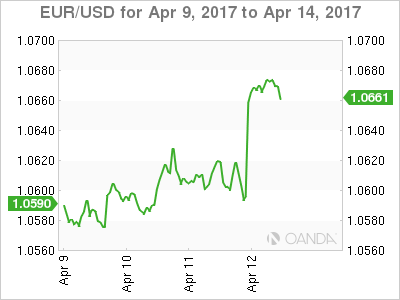

Euro has managed a benign rally from 1.0600 back to 1.0670 on the back of Trump’s USD comments and safe haven inflows into German Bunds. In the process breaking back up through its 100-dma at 1.0628. However, the adage that France changes by revolution not evolution is rearing its head vis-a-vis the first Presidential run-off, and this should help to cap gains in the single currency.

Euro has resistance at 1.0700 and 1.0775, with support at 1.0628 and then 1.0565.

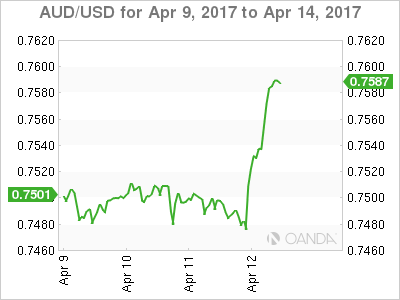

A weaker USD and spectacular employment numbers lift the lucky country off the floor today.

*(AU) AUSTRALIA MAR EMPLOYMENT CHANGE: +60.9K (16-month high) V +20.0KE; UNEMPLOYMENT RATE: 5.9% V 5.9%E- Full time Employment 74.5K v 27.1K prior – Part-time Employment -13.6K v -33.5K prior – Source TradeTheNews.com

AUD is showing no signs of the weaker commodity prices affecting it for now. AUD has resistance right here at 7585 followed by 7600 and then 7680.

Support lies at 7530, 7510 and then 7570.

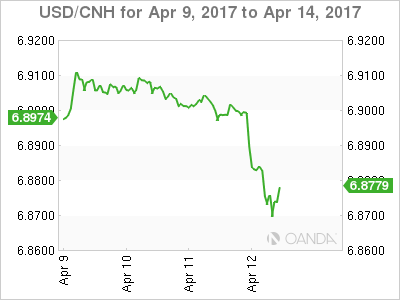

Excellent trade data sees the CNH rally continue following a weaker USD overnight.

*(CN) CHINA MAR TRADE BALANCE (CNY-TERMS): +164B V +76BE- Exports Y/Y: 22.3% v 8.0%e- Imports Y/Y: 26.3% v 15.0%e – Source TradeTheNews.com

USD/CNH has fallen back below the 6.9000 level which becomes solid resistance yet again.

Support lies at 6.8760 and then 6.8450.

PRECIOUS METALS

GOLD

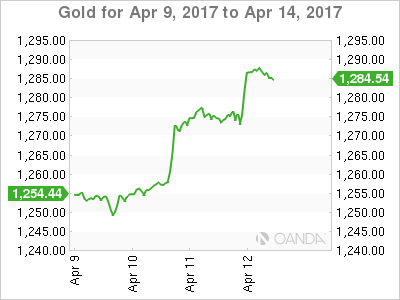

Mr.Trump and geopolitical turmoil around the world was all gold needed to jump another 15 USD last night. Although we are seeing some consolidation today in Asia, it is clear that the safe-haven bid is in place on any dips. Especially as we enter a long weekend. Precious metals will be very headline-driven into the weekend.

Gold has support at 1280 and 1272.50 with resistance at 1288, 1300 and then 1307.

SILVER

Although a few world leaders probably wish they had silver bullets at the moment, silver continues its safe haven march higher with its bigger cousin.

Silver has resistance at 18.5700 with a daily close opening a run at 19.0000 on the charts.

Support appears at 18.4500, 18.2400 and then the 200-DMA at 18.0700.

SUMMARY

Asia stocks are generally in the red to a small degree today. Most notably Australia and Japan as the Nikkei suffers from a stronger yen and uncertainty in the region. Safe havens reign supreme with precious metals and US bonds rallying hard overnight. Trump’s dessert storm set the ball rolling, but it seems the weekend will belong to North Korea. Expect investors to continue to seek safe harbours as we head into the long weekend.