FX Brief:

- Optimism surrounding trade talk progress between the US and China saw AUD and NZD extend their rallies, stopping just short of key resistance levels. Given the extent of gains this past week, it’s possible we could see some profit-taking around current levels.

- After a shaky start, Just Trudeau looks set to retain power in the Canadian elections. Yet with only 157 seats under his belt (below the 170 thresholds for a majority), there’s no majority government on the horizon. The Canadian dollar is stronger over the session, seeing CAD/JPY hit a 3-month high and USD/CAD touch a 3-month low.

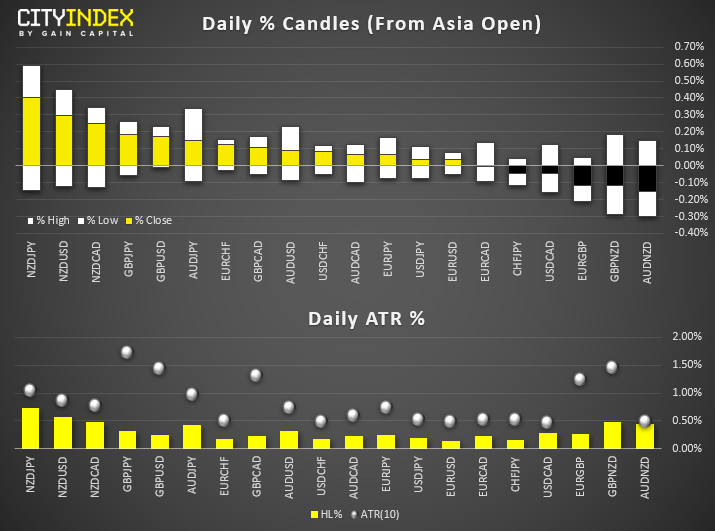

- NZD and GBP are the strongest majors, CHF is the weakest.

- A day of compression overall, with the majority of FX pairs, we track remaining well beneath their daily ATR’s. With economic data relatively light, we could find ranges to be smaller unless headline risk provides a catalyst for markets. That said, with Canadian retail sales out, it puts CAD crosses into focus, particularly if it is a strong miss given CAD pairs are arguably overstretched over the near-term.

Equity Brief:

- Asian stock markets have taken the cue from the positive performances seen on the key U.S. benchmark stock indices overnight, where the S&P 500 and Nasdaq 100 have rallied by 0.70% and 0.90%, respectively. “Trade deal optimism” has taken center stage again over Brexit uncertainties as U.S. President Trump has commented that trade negotiations are in progress that has raised the expectation of the “Phase One” U.S.-China trade deal to be signed off in Nov.

- The top performer today is South Korea’s Kospi 200 that has rallied by 1.41% led by heavy semiconductor weights; Samsung Electronics and SK Hynix have soared by 1.5% and 2.00% respectively in line with stellar performance seen in U.S. semiconductor stocks overnight. The U.S. PHLX Semiconductor Sector Index that comprises 30 stocks, has recorded a gain of 1.90%.

- Singapore’s stock market bulls have awoken as well for today, where the Straits Times Index (STI) has rallied by 0.80% so far on the backdrop of mergers and acquisition headlines.

- Keppel Corporation has jumped up to 15% after a surprise S$4 billion partial offer from Singapore’s state-owned Temasek that will raise its stake in Keppel Corporation to 51%. The latest action from Temasek has increased market speculation that there might be consolidation soon in Singapore’s offshore and marine sector (Q&M). Another Q&M stock, Sembcorp Marine, has continued to rally by 1.50% today after it rocketed 11.6% yesterday. Temasek also has an indirect stake in Sembcorp Marine via its parent firm, Sembcorp Industries.

- The S&P 500 E-Mini futures have managed to consolidate its overnight U.S. session gains in today’s Asian session as it holds above the 3000 psychological levels and inches up higher by 0.20% to print a current intraday high of 3014.

Up Next

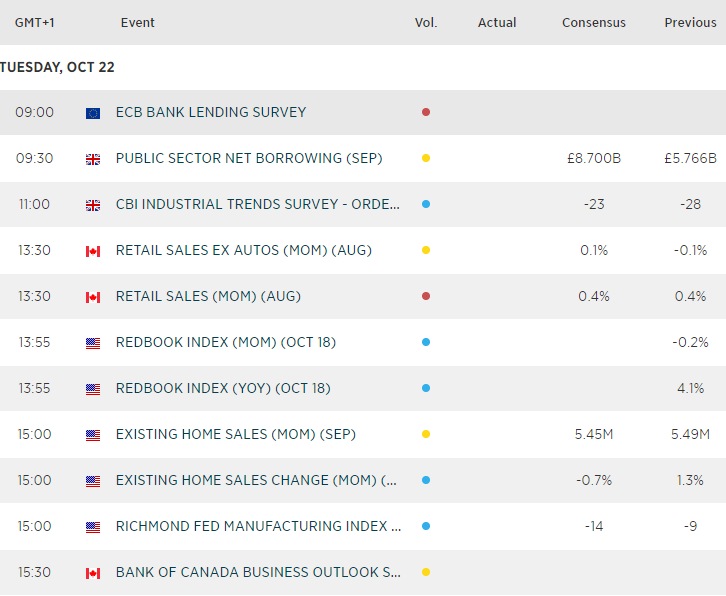

- Canadian retail sales put CAD pairs into focus right after the election. Expected to remain steady at 0.4% MoM, it could take a read at 0.2% or lower to have a materially negative impact on CAD, given it is currently supported by a Trudeau win and improved relations between US and China.

- However, we’ll also keep an eye on BOC’s quarterly business outlook survey as it will provide them with a pulse check over investment and sentiment from the sector. And the therefor, likely direction of their economy and monetary policy. Given their rates remain relatively high and one of the few developed nations not to be easing, then any whiff of weakness form the business sector could change sentient towards the Canadian dollar.

"Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation, and needs of any particular recipient.

Any references to historical price movements or levels are informational based on our analysis, and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions."