With indexed rental growth continuing and rent collection recovering, Triple Point Social Housing REIT’s (SOHO’s) Q323 dividend was fully covered, and we expect this to continue. Meanwhile, while the board continues its focus on closing the share price discount to NAV, it has concluded that any further capital return is dependent on significant additional liquidity being generated through property sales.

Rents growing and collection recovering

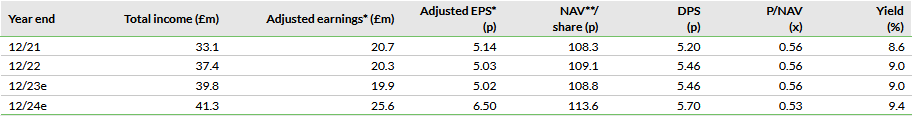

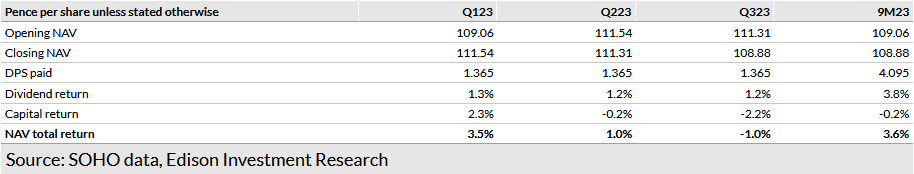

The Q323 DPS of 1.365p was 1.04x covered by EPRA earnings, a significant improvement from 0.80x in H123. On an adjusted earnings basis, excluding non-cash loan fee amortisation, we expect cover to have been slightly higher (H123: 0.81x). The increase in Q3 earnings is in line with our expectations, which in addition to indexed rent growth, include a recovery in rent collection and lower provisions against rent receivables, reflecting progress with SOHO’s two (of 27) underperforming tenants, while the broader portfolio continues to perform as expected. Parasol is paying all monthly rents due under its creditor agreement and Triple Point Social Housing REIT PLC (LON:SOHO) expects to conclude a creditor agreement with My Space by end-Q124. Q323 NAV per share was 2.2% lower at 108.9p (Q223: 111.3p) as result of property yield widening (16bp to a net initial yield of 5.84%), primarily relating to market-wide conditions and partly to the My Space and Parasol assets. NAV total return was -1.0% (+3.6% year to date). Our NAV/share forecasts are reduced c 3% in each of FY23 and FY24.

Continuing focus on closing the discount to NAV

The board remains focused on creating shareholder value, particularly on closing the material discount to NAV. It completed an accretive £5m repurchase programme in H1 and the subsequent sale of a four-property portfolio indicated a robustness of asset valuations and published NAV. Following consultations with shareholders representing c 21% of the share register, SOHO’s board has concluded that any further return of capital to shareholders is dependent on the generation of additional liquidity through asset sales. In turn, asset sales are dependent on market conditions and the board says that while it will continue to consider further asset sales, it is unlikely these will occur before the end of 2023.

Valuation: Still pricing in very significant risk

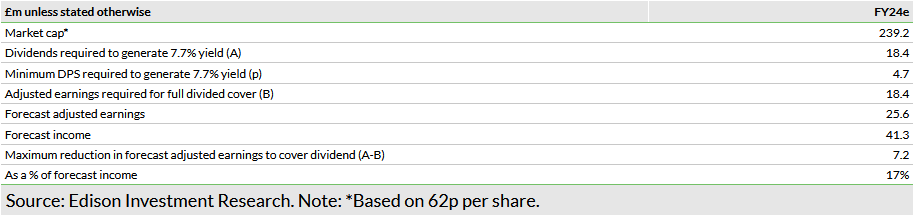

The FY23e yield is c 9%. We estimate that even a c 17% decline in FY24 income would support a fully covered DPS of at least c 4.5p, or a yield of c 7.7%, a c 50 basis point (0.5%) premium to the peer average.

Further details from the quarterly update

Fully covered dividend

The 2.43p reduction in Q3 NAV included a 2.48p portfolio valuation loss, while EPRA EPS of 1.42p fully covered the 1.365p Q2 dividend paid. A similar quarterly DPS was declared for Q3, in line with the full year target of 5.46p (unchanged on FY22).

Q3 EPRA earnings is consistent with our H223 forecast, which includes a significant reduction in credit loss provisions compared with H123. The impact of this within the Q3 NAV is not at this stage clear. H123 EPRA EPS of 2.18p included 0.79p per share of credit losses. Our H224 EPRA EPS of 3.11p includes a reduction of 0.33p per share in credit losses and we forecast no further charge in FY24.

Continuing indexed rental growth is the other key driver of our forecast earnings growth, while at the same time underpinning capital values. Although we have reduced FY23 and FY24 NAV per share forecasts, the modest implied further yield widening (to net initial yield of c 6%) is more than offset by rental growth, generating increased values and NAV growth.

In order to align with Housing Benefit annual increases the company says that at least 65% of its 2024 annual rent increases will be linked to the September 2023 Consumer Price Index figure of 6.7%.

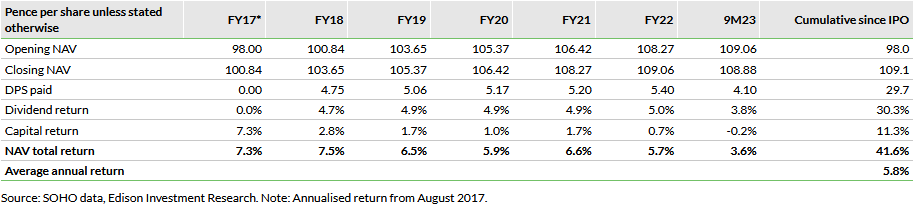

Dividend driven returns

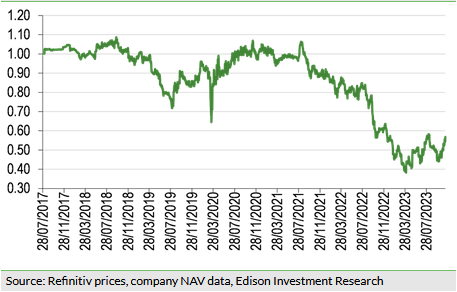

Dividends paid have contributed all of the 3.6% year to date total return and have been the consistent driver of returns since SOHO listed in August 2017.

During the period since listing, SOHO has delivered positive accounting/NAV total returns3 each year. Aggregate NAV total return to end-Q323 was 41.6%, or an annual average of 5.8%, with dividends paid accounting for more than 70% of the total. Capital returns have mostly been positive and have been significantly more robust than the wider UK commercial property market over the past year.

Progress with Parasol and My Space

SOHO has leases with a diverse range of 27 approved providers (APs),[1] and the majority of these have performed steadily over the past year, successfully navigating the twin challenges of inflation and labour shortages well. However, as previously reported, two APs, Parasol (9.2% of H123 rents) and My Space (7.7%), fell behind with their rental payments over the course of 2022 and continuing through H123. As reported with the interim results, a creditor agreement is in place with Parasol, which is now paying all monthly rent due under the agreement.[2]

[1] SOHO refers to all its lessees as APs, of which 25 of the 27 are regulated by either the Regulator of Social Housing, the Care Quality Commission or Ofsted, representing 98% of the portfolio by rent roll. In this report we also refer to registered providers (RPs) or those registered with and regulated specifically by the Regulator of Social Housing. This applies to all SOHO’s SSH properties.

[2] The creditor agreement sets a minimum level for monthly rent payments over a six-month period. At the end of the six-month agreement, full rent becomes due again.

SOHO hopes to finalise a creditor agreement with My Space by March 2024, required to help enable My Space to address its solvency position, and expects it to cover both the rent that will be due going forward and arrears. My Space has been in a process of significantly strengthening its leadership, including a new CEO and CFO as well as several new board appointments, which, while a positive development, is in our view likely to have lengthened the time taken to complete the agreement. Simultaneously, the company is working with My Space to move certain properties to alternative providers.

Further return of capital under consideration

The successful sale of four diverse properties, announced in early September, for £7.6m, just 3.6% below the 30 June 2023 book value, provided both supportive evidence of the robustness of published valuations and NAV and also demonstrated continued investor demand for specialised supported housing (SSH) properties.

Cash balances amount to £31.0m[3] compared with £23.8m at H123, or £31.7m adjusted for the proceeds of the now completed asset sale. Of the £31.0m, £5.1m is held in restricted bank accounts and a further £14.4m is held back for working capital purposes, leaving £11.5m freely available. This provides SOHO with a very limited opportunity to return capital to shareholders without increasing existing leverage[4] and the board has decided that any further return of capital is dependent on significant additional liquidity being delivered through property sales.

[3] As at the date of the trading update, 13 November 2023.

[4] Gross leverage at H123, defined as gross borrowing as a share of total gross assets, was 37.9%.

Capital return to shareholders offers immediate accretion, and to us it seems most likely that the focus will be on asset sales and capital return in the near term. Over the medium term, we continue to expect a pragmatic approach to further capital allocation, and we expect the company will continue to invest in its existing portfolio and remain open to additional opportunities where these are financially and strategically attractive. With the interim results, SOHO gave some details of a potential forward funding partnership with Golden Lane, a leading provider of SSH with strong regulatory credentials.

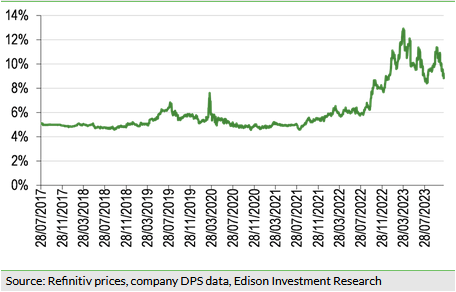

The valuation remains low in contrast to financial returns

Despite SOHO delivering low volatility and consistently positive accounting returns, its valuation remains low. FY23e DPS of 5.46p represents a yield of c 9%, while the shares are trading at a more than 40% discount to Q323 NAV.

Material discount to peer group

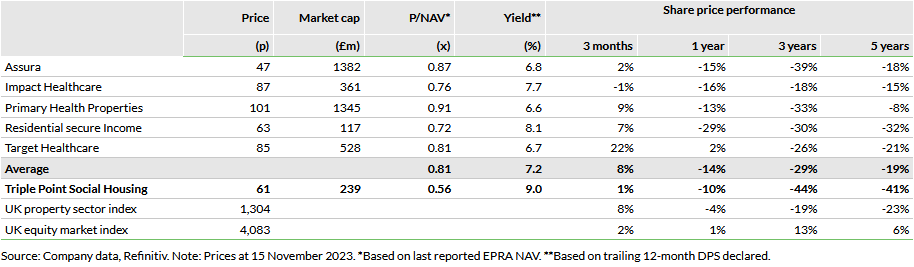

Compared with a selected group of companies that we would consider to be the closest peers to SOHO, investing in housing and healthcare properties, SOHO shares offer a noticeably higher yield than the average and trade at a significantly lower P/NAV ratio, despite its track record of positive financial and operation performance and delivery of material social benefit.

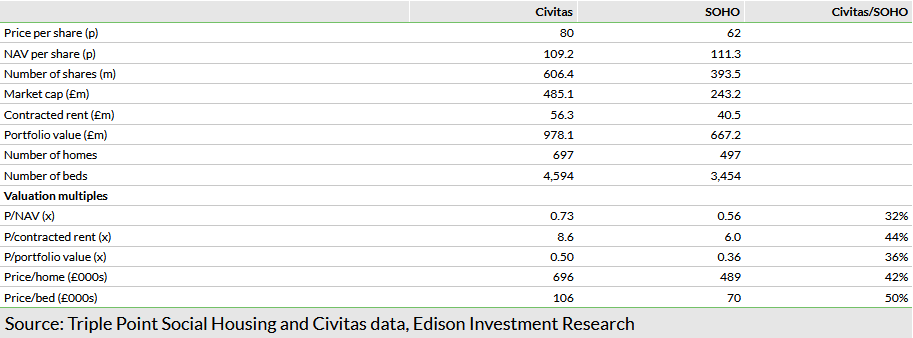

SOHO’s closest comparator, Civitas, was acquired by Hong Kong-based property developer CK Asset Holdings[5] in June 2023[6] for 80p in cash. In recommending the offer, the board of Civitas commented that while it believed it undervalued the long-term prospects of the company, it recognised that Civitas, and its sector as a whole, was facing a number of challenges in sentiment, which the public markets were unlikely to overcome in the short to medium term. In this context, its decision was swayed by the immediate liquidity that the bid would provide to shareholders, with the opportunity to exit in full and in cash at a significant premium to the prevailing share price, in a time of macroeconomic uncertainty.

[5] Through its subsidiary, CK Bidco.

[6] The date at which the offer became unconditional. Civitas subsequently de-listed on 4 August 2023.

Taking the Civitas data as of 31 March 2023 (end-FY23), the bid represented a 27% discount to NAV, much narrower than the c 30% discount on which SOHO shares continue to trade. Including this with a range of portfolio metrics, we estimate the Civitas acquisition price to have been at least c 30–50% above the current SOHO rating, a strong indicator of value in the SOHO shares.

Discounting an almost 20% decline in income

The average trailing yield of the peer group excluding SOHO is c 7.2%. Based on our FY24 forecasts, we estimate that SOHO could withstand a c 17% reduction in forecast income7 while still generating sufficient earnings to pay a fully covered DPS of c 4.5p, reflecting a yield of 7.7%, a 0.5% premium to the peer group.

[7] We previously calculated 20% based on the historically lower market cap and correspondingly lower DPS requirement.

General disclaimer and copyright

This report has been commissioned by Triple Point Social Housing REIT and prepared and issued by Edison, in consideration of a fee payable by Triple Point Social Housing REIT. Edison Investment Research standard fees are £60,000 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services.

Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the research department of Edison at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations.

Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.

No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors.

Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison's policies on personal dealing and conflicts of interest.

Copyright: Copyright 2023 Edison Investment Research Limited (Edison).

Australia

Edison Investment Research Pty Ltd (Edison AU) is the Australian subsidiary of Edison. Edison AU is a Corporate Authorised Representative (1252501) of Crown Wealth Group Pty Ltd who holds an Australian Financial Services Licence (Number: 494274). This research is issued in Australia by Edison AU and any access to it, is intended only for "wholesale clients" within the meaning of the Corporations Act 2001 of Australia. Any advice given by Edison AU is general advice only and does not take into account your personal circumstances, needs or objectives. You should, before acting on this advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If our advice relates to the acquisition, or possible acquisition, of a particular financial product you should read any relevant Product Disclosure Statement or like instrument.

New Zealand

The research in this document is intended for New Zealand resident professional financial advisers or brokers (for use in their roles as financial advisers or brokers) and habitual investors who are “wholesale clients” for the purpose of the Financial Advisers Act 2008 (FAA) (as described in sections 5(c) (1)(a), (b) and (c) of the FAA). This is not a solicitation or inducement to buy, sell, subscribe, or underwrite any securities mentioned or in the topic of this document. For the purpose of the FAA, the content of this report is of a general nature, is intended as a source of general information only and is not intended to constitute a recommendation or opinion in relation to acquiring or disposing (including refraining from acquiring or disposing) of securities. The distribution of this document is not a “personalised service” and, to the extent that it contains any financial advice, is intended only as a “class service” provided by Edison within the meaning of the FAA (i.e. without taking into account the particular financial situation or goals of any person). As such, it should not be relied upon in making an investment decision.

United Kingdom

This document is prepared and provided by Edison for information purposes only and should not be construed as an offer or solicitation for investment in any securities mentioned or in the topic of this document. A marketing communication under FCA Rules, this document has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This Communication is being distributed in the United Kingdom and is directed only at (i) persons having professional experience in matters relating to investments, i.e. investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "FPO") (ii) high net-worth companies, unincorporated associations or other bodies within the meaning of Article 49 of the FPO and (iii) persons to whom it is otherwise lawful to distribute it. The investment or investment activity to which this document relates is available only to such persons. It is not intended that this document be distributed or passed on, directly or indirectly, to any other class of persons and in any event and under no circumstances should persons of any other description rely on or act upon the contents of this document.

This Communication is being supplied to you solely for your information and may not be reproduced by, further distributed to or published in whole or in part by, any other person.

United States

Edison relies upon the "publishers' exclusion" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. This report is a bona fide publication of general and regular circulation offering impersonal investment-related advice, not tailored to a specific investment portfolio or the needs of current and/or prospective subscribers. As such, Edison does not offer or provide personal advice and the research provided is for informational purposes only. No mention of a particular security in this report constitutes a recommendation to buy, sell or hold that or any security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

London │ New York │ Frankfurt

20 Red Lion Street

London, WC1R 4PS

United Kingdom