Topps Tiles (LON:TPT) has reported a good profit outturn for FY24, ahead of our prior expectations, which is encouraging in the context of the challenging external environment. Management believes the overall revenue decline of 5% means TPT has once again outperformed the market that it estimates to have declined by 10–15%. TPT has made good early progress on the key growth areas under its recently announced Mission 365 strategy, which are expected to drive the bulk of the growth in the medium term. With respect to the outlook for FY25, TPT has returned to positive revenue growth in the first eight weeks of the year, and management continues to highlight more favorable housing-related indicators. From a cost perspective, there are inflationary pressures, which management is hopeful of mitigating, as it has previously. Our forecasts are under review.

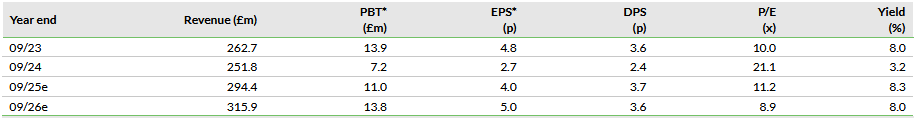

Note: *PBT and EPS are normalized, excluding amortization of acquired intangibles, exceptional items and share-based payments.

Group adjusted revenue of £248.5m, which excludes a small contribution from CTD Tiles, a year-on-year decline of 5.4%, had already been indicated in the year-end trading update.

Cost control contributed to TPT’s adjusted profit before tax of £6.3m exceeding our prior estimate (using the company’s definition, after share-based payments and amortization of acquired intangibles) of £5.8m. The figure naturally excludes exceptional costs, which now include a new impairment charge on right-of-use assets to reflect the challenging operating environment.

The full-year dividend of 2.4p/share is equivalent to a 100% payout ratio on company-defined adjusted EPS and is ahead of our prior estimate of 1.4p/share.

With respect to current trading and outlook, the total group, excluding CTD Tiles, has returned to marginal growth, against a weak comparative, with revenue +1.2% in the first eight weeks of the year. Within this number, like-for-like sales in Topps Tiles remain marginally negative at down 0.4%. As in previous updates, and in common with comments from other companies, it is clear the trade customer is more resilient than the retail customer. Management continues to highlight that more favorable housing-related macroeconomic indicators are supportive of a better performance in FY25, although the recent weakness in consumer confidence means the timing of any recovery remains uncertain.

With respect to the outlook for costs, TPT has indicated the changes to employers’ national insurance contributions in the UK budget and the National Living Wage (+6.7% from April 2025) will lead to incremental costs of £4m on an annual basis from FY25, and £2m in FY25. Management is currently formulating plans to mitigate the costs as far as possible, suggesting no change to our profit estimates.

Management continues to work constructively with the CMA on its review of the acquisition of CTD Tiles.