- Palantir, Arm Holdings, and Super Micro Computer reported better-than-expected Q4 results.

- Their shares have exploded higher since the reports were published.

- Valuations now look stretched, and a correction could be on the cards.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

-

ProPicks: stock portfolios managed by a fusion of AI and human expertise, with proven performance

-

ProTips: digestible information to simplify masses of complex financial data into a few words

-

Fair Value and Health Score: 2 summary indicators based on financial data, providing instant insight into the potential and risk of each stock.

-

Advanced stock screener: Search for the best stocks according to your expectations, taking into account hundreds of financial metrics and indicators.

-

Historical financial data for thousands of stocks: To enable fundamental analysis pros to dig into all the details themselves.

-

And many more services, not to mention those we plan to add shortly!

Q4 earnings season is beginning to wind down amid several pleasant surprises that propelled key indexes to new highs.

But amidst the overall positive trend, there is a selected group of companies beyond the 'magnificent 7' that notably outperformed in terms of financial performance and warrant a closer look.

These are: Palantir (NYSE:PLTR), Arm Holdings ADR (NASDAQ:ARM), and Super Micro Computer (NASDAQ:SMCI), which have been absolutely soaring since reporting better-than-expected numbers, both in terms of EPS and sales.

But as the market keeps testing new all-time-highs, the question arises: have they gone too far?

In this article, we will review the remarkable performances of these companies and evaluate whether they still present attractive investment opportunities or if their recent gains have exhausted their bullish potential.

1. Palantir

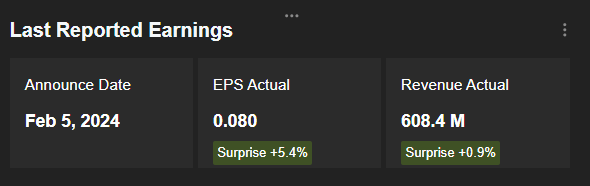

Intelligence and defense software company Palantir is undoubtedly one of the stocks that has rallied the most since the publication of its Q4 results.

At Wednesday's closing price of $25.17, PLTR posted a gain of 50.6% since the publication of its results on February 5 after the market close.

In particular, the stock gained over 30% the day after publication. EPS had risen by +100% compared with the same quarter the previous year and had also exceeded expectations.

Source : InvestingPro

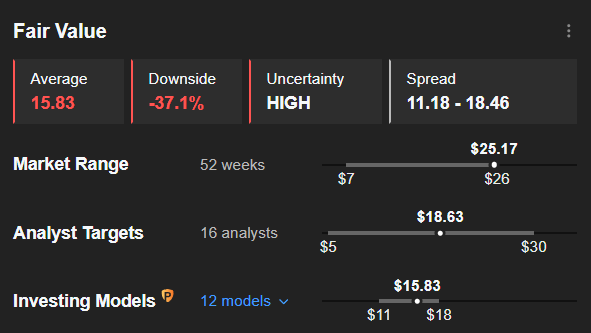

However, despite the quality of the results, there are indications that Palantir shares may now be overvalued.

Indeed, the InvestingPro fair value of the stock, which synthesizes several recognized financial models, stands at $15.83, more than 37% below the current price.

Source : InvestingPro

Analysts, although slightly more optimistic, with an average target of $18.63, also consider the stock to be grossly overvalued.

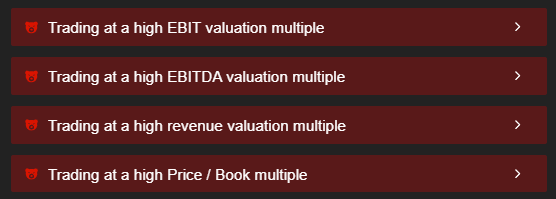

Moreover, the InvestingPro ProTips, which summarize the masses of financial data available for each stock in a list of intelligible strengths and weaknesses, underline Palantir's high valuation ratios:

Source : InvestingPro

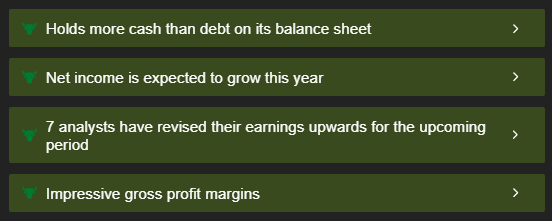

On the other hand, the ProTips also highlight several significant strengths:

Source : InvestingPro

Although the recent results were indeed solid and undoubtedly justified a bullish reaction in Palantir shares, the scale of the gains recorded since publication should prompt investors to be cautious about the risk of profit-taking.

2. Arm Holdings

Arm Holdings, a chip and semiconductor company, has also seen its share price soar since the publication of its results on February 7.

At Wednesday evening's closing price of $126.4, Arm Holdings shares were up 64%. However, it should be noted that the stock has corrected since Monday's peak of $164, on which the impact of the results was calculated at +112%.

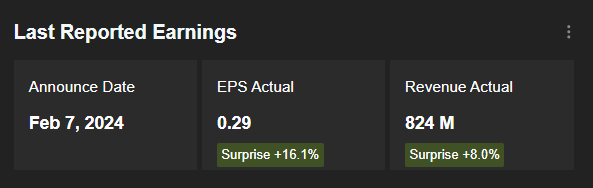

The company surprised many with its EPS and revenues:

Source : InvestingPro

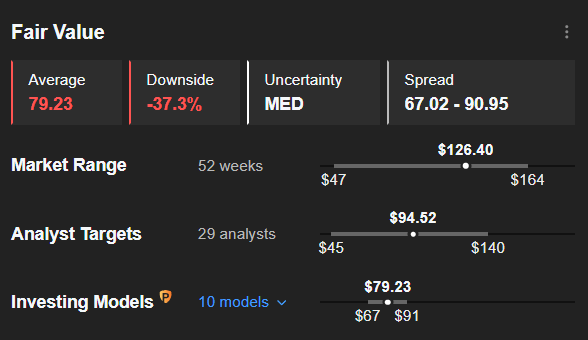

However, valuation models indicate that the recent rise has largely exhausted the share's potential. Fair value stands at $79.23, 37.3% below the current price, with valuations ranging from $67 to $91, depending on the model.

Source : InvestingPro

The 29 professional analysts who follow the stock are also cautious, with an average target of $94.52, representing a downside risk of over 25%.

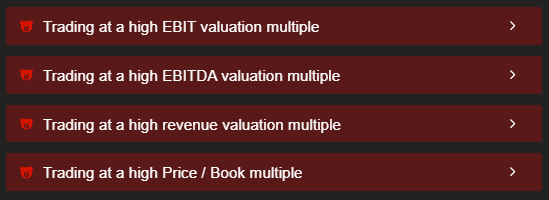

The ProTips also highlight the high level of several Arm Holdings valuation ratios:

Source : InvestingPro

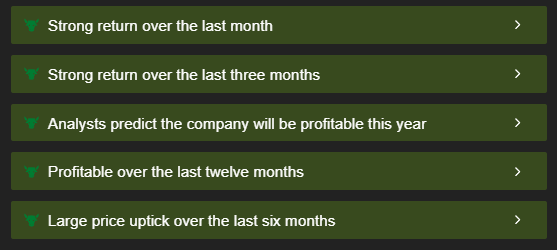

Apart from that, several key strengths should also be highlighted:

Source : InvestingPro

Given the scale of the gains posted following the results, some of which have already been corrected, buying Arm Holdings shares at the current price would undoubtedly be a timing error.

3. Super Micro Computer

In the 12 sessions between the release of Super Micro Computer results on January 29, and Tuesday's close, the stock declined in just one session (and by only -0.66%).

At yesterday's closing price of $880.55, the stock was up more than 77% on the day before publication.

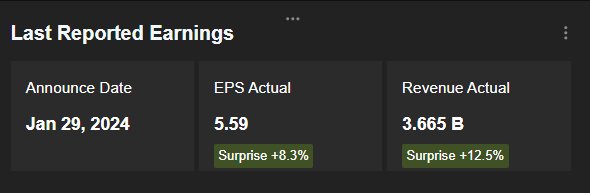

The company significantly exceeded EPS and sales expectations, while posting strong year-on-year growth.

Source : InvestingPro

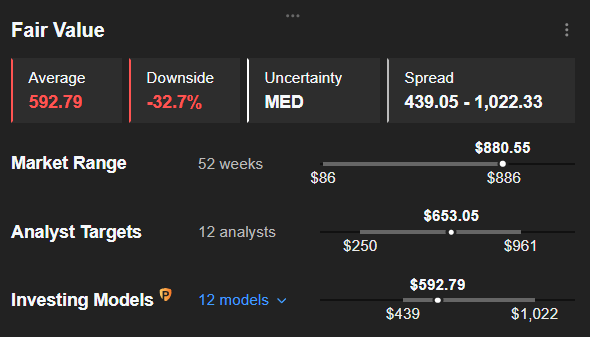

However, as with the other two stocks reviewed in this article, it seems that the powerful bullish reaction following the results has exhausted the upside potential, both according to analysts and InvestingPro valuation models.

Indeed, the fair value of $592.79 translates into a downside risk of 32.7%, although it should be noted that one of the models on which fair value is based for SMCI values the stock at $1022, or 16% above Wednesday's closing price.

Source : InvestingPro

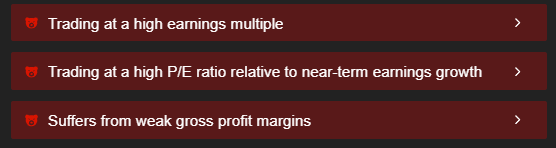

In addition, the InvestingPro ProTips highlight several worrying weaknesses, such as low gross margins:

Source: InvestingPro

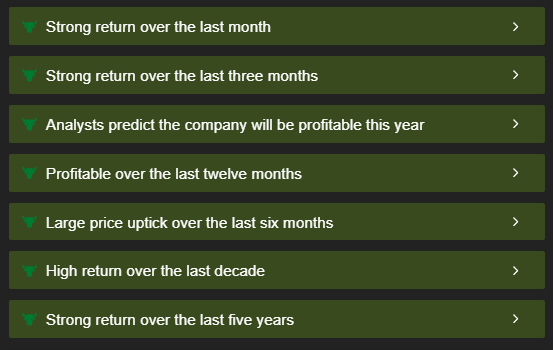

However, there are plenty of strengths too, as can be seen from the partial extract from Bullish Tips below:

Source : InvestingPro

Super Micro Computer therefore remains a solid stock, but its current valuation suggests that it's best to wait for a correction before buying.

Conclusion

Palantir, Arm Holdings, and Super Micro Computer are three technology companies whose strong potential has been proven by the quality of their results, and by the strongly bullish reaction of their share prices.

However, trees never grow to the sky, and the valuations of these stocks are now particularly stretched, suggesting that a correction is to be feared in the more or less short term.

This comes at a time when the macroeconomic prospects are becoming more bleak following the hotter-than-expected US inflation data published on Tuesday.

***

As a reader of our articles, you can take advantage of our InvestingPro stock market strategy and fundamental analysis platform at a reduced rate, with a 10% discount, thanks to the promo code "UKTopDiscount", valid for 1 and 2-year Pro+ and Pro subscriptions!

Don't face the market alone any longer, join the thousands of InvestingPro users and make the right decisions on the stock market to help your portfolio take off, whatever your profile or expectations.

Disclaimer:This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple perspectives and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.