Last week I briefly profiled the earnings yield as a tool for estimating the US stock market’s equity risk premium, the return on stocks over a “risk-free” rate. For comparison, let’s add the dividend yield model (DYM) in today’s update.

The formula for DYM draws on the frameworks of the Gordon Growth Model and Dividend Discount Model, which boils down to taking the current dividend yield and adding a growth estimate.

There are several variations for estimating growth — let’s use the rolling 10-year growth rate for the US economy (based on real GDP). The assumption here is that the stock market’s dividends will grow in line with economic activity over the long run.

The basic setup is using the 10-year US inflation-protected Treasury yield as the “risk-free” rate.

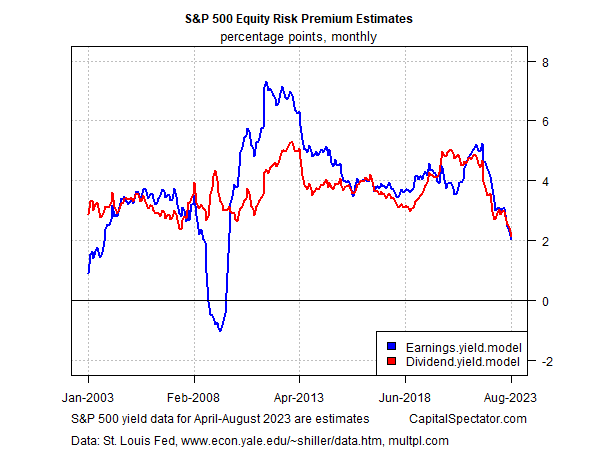

Running the numbers shows that DYM and the earnings yield model (EYM) for the S&P 500 Index closely track each other in recent history, although there’s wider variation over longer time windows.

The other key observation: both have been sliding relatively sharply over the past year or so as the real Treasury yield rises.

The equity risk premium estimates for DYM and EYM for August 2023: a bit over 2 percentage points. For EYM, that’s the lowest since the financial crisis; for DYM, the current ~2 percentage point premium marks a multi-decade low.

In future updates, I’ll add other models for comparison. Meantime, the message from DYM and EYM is clear: it’s time to manage expectations down for the US stock market’s equity risk premium. Let’s see if other models tell a similar story.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI