Selecting the right strategy is the second most important decision when it comes to investing. Asset allocation is considered to be the most impactful decision, but how the allocation is implemented in the portfolio can also make a huge difference in the overall results.

Considering the very large number of funds and ETFs available for each investment category, it is impossible even for the biggest organisation to run detailed due diligence on every strategy. Investors need an initial filter to restrict the number of strategies that they will then review in detail using their own process. Morningstar can provide this filter.

Morningstar's comprehensive coverage extends to approximately 294,000 open-end funds, 12800 closed-end funds, and 23,400 exchange-traded funds (ETFs) on a global scale.1. They have been rating funds since 1985. They offer two ratings for strategies:

The Morningstar Rating

This rating, often called the star rating, is based on historical risk-adjusted performance over the last three years. It helps inform investment decision-making and illuminates the performance NET of fees of the different strategies. Only the top 10% of funds in a category receive the best rating, i.e. five stars.

The Morningstar Medalist Rating

This rating offers a forward-looking assessment of the strategy for the next five years. It reflects Morningstar’s conviction that a fund will outperform peers on a risk-adjusted basis over a market cycle. It is based on three pillars: People, Process, and Parent. The objective is to assess the team that manages the fund, the investment philosophy and strength of the research and processes, and finally, the quality of the asset management firm itself. Gold-rated funds are the ones that rank in the top 15% of their category with expected positive net of fee alpha.

WisdomTree stands out from other ETF providers by focusing on proprietary and research-driven strategies that combine the best elements of active and passive investing. We aim to provide equity ETFs with the potential to outperform the market or generate better risk-adjusted returns, not just track it.

The three ETFs below exhibit a five-star rating as well as a gold medalist rating from Morningstar making them a leading strategy among active funds and ETF in their category.

WisdomTree US Quality Dividend Growth UCITS ETF - 5 Stars and Gold Medalist

WisdomTree US Quality Dividend Growth UCITS ETF has outperformed the S&P 500 net TR Index by 1.4% per annum over the last three years. Since its launch in June 2016, it has delivered a better Sharpe ratio, lower volatility, and lower drawdowns than the market and most of its peers. This ETF leverages high-quality, dividend-growing companies in the most efficient way. It is constructed around dividend-paying companies with the best-combined rank of earnings growth, return on equity and return on assets within an environmental, social and governance (ESG) filtered universe of companies with sustainable dividend policies. Stocks are also risk-tested using a proprietary risk screen (Composite Risk Score), which uses Quality and Momentum metrics to rank companies and screen out the riskiest companies and potential value traps. Each company is then weighted based on its cash dividend paid (market capitalisation x dividend yield), which introduces valuation discipline in this high-quality portfolio. Those steps, in combination, deliver a core, all-weather strategy that can be used as a strategic holding to withstand market volatility. It can limit the impact of downturns while capturing the upside. This is particularly obvious in Figure 1.

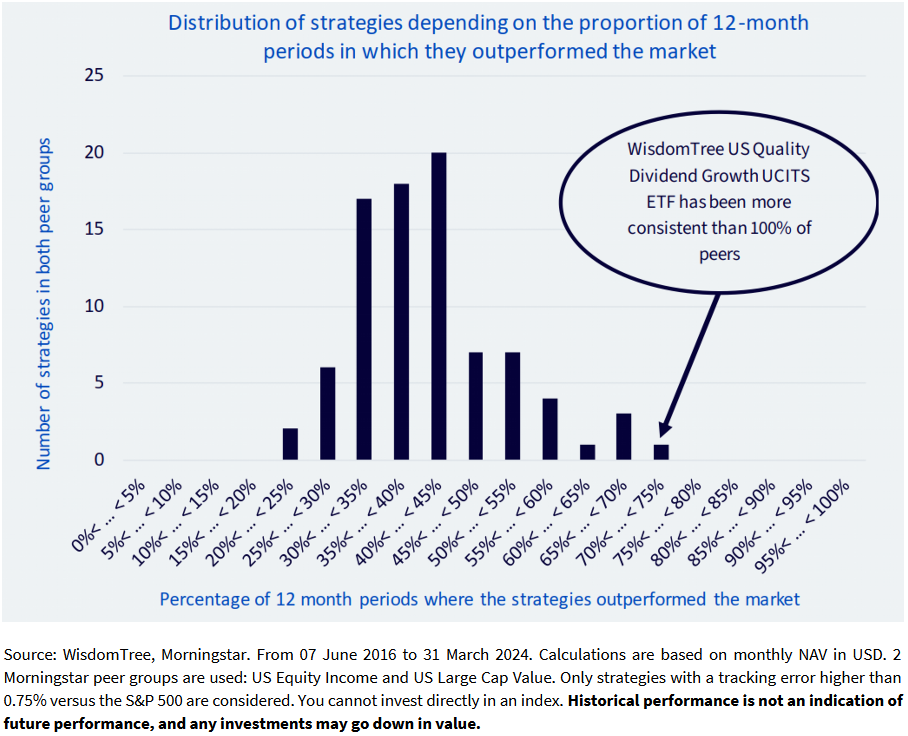

Figure 1 shows that the ETF outperformed the market in 73% of all 12-month rolling periods since its launch in June 2016. No other fund or ETF in its category has been as consistent. All the other strategies outperformed in less than 73% of those periods.

The developed equity version of this strategy, the WisdomTree Global Quality Dividend Growth UCITS ETF, has also consistently outperformed the market, delivering higher performance, a higher Sharpe ratio, lower volatility, and lower drawdown than the markets and most peers. Morningstar also rates this strategy very positively with a five-star rating and a silver medalist rating.

WisdomTree Japan Equity UCITS ETF - 5 Stars and Gold Medalist

WisdomTree Japan Equity UCITS ETF had a strong 2023 when it returned 34.75% compared to 30.40% for the Nikkei 2252. It has also had a good start to 2024 where it has outperformed by 7.4% (as of 30 April 2024). The WisdomTree Japan Equity UCITS ETF is well-positioned and enables investors to gain broad-based exposure to dividend-paying, export-oriented companies that meet WisdomTree’s ESG criteria. Export-oriented companies are defined as those companies that derive at least 20% of their revenue from countries outside Japan. By using one of the many currency-hedged share classes of the ETF, investors can look to reap the potential opportunities of not only a weaker Yen but also corporate governance reforms.

WisdomTree Emerging Markets Equity Income UCITS ETF - 5 Stars and Gold Medalist

In a very challenging market, WisdomTree Emerging Markets Equity Income UCITS ETF has continued to deliver. In 2023 it outperformed by 13%. The Equity Income strategy was launched in 2007 and provides exposure to the highest dividend-yielding companies in emerging markets. The strategy reconstitutes annually and holds the highest (top 30%) dividend-yielding companies in EM, screening out those with the highest risk – according to our Composite Risk Screen measure.

Sources

1 https://www.morningstar.com/views/research/ratings

2 Source: WisdomTree, Bloomberg. Data from 31st December 2022 to 31st December 2023.

________________________________________________________

IMPORTANT INFORMATION

Marketing communications issued in the European Economic Area (“EEA”): This document has been issued and approved by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Marketing communications issued in jurisdictions outside of the EEA: This document has been issued and approved by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

WisdomTree Ireland Limited and WisdomTree UK Limited are each referred to as “WisdomTree” (as applicable). Our Conflicts of Interest Policy and Inventory are available on request.

For professional clients only. Past performance is not a reliable indicator of future performance. Any historical performance included in this document may be based on back testing. Back testing is the process of evaluating an investment strategy by applying it to historical data to simulate what the performance of such strategy would have been. Back tested performance is purely hypothetical and is provided in this document solely for informational purposes. Back tested data does not represent actual performance and should not be interpreted as an indication of actual or future performance. The value of any investment may be affected by exchange rate movements. Any decision to invest should be based on the information contained in the appropriate prospectus and after seeking independent investment, tax and legal advice. These products may not be available in your market or suitable for you. The content of this document does not constitute investment advice nor an offer for sale nor a solicitation of an offer to buy any product or make any investment.

An investment in exchange-traded products (“ETPs”) is dependent on the performance of the underlying index, less costs, but it is not expected to match that performance precisely. ETPs involve numerous risks including among others, general market risks relating to the relevant underlying index, credit risks on the provider of index swaps utilised in the ETP, exchange rate risks, interest rate risks, inflationary risks, liquidity risks and legal and regulatory risks.

The information contained in this document is not, and under no circumstances is to be construed as, an advertisement or any other step in furtherance of a public offering of shares in the United States or any province or territory thereof, where none of the issuers or their products are authorised or registered for distribution and where no prospectus of any of the issuers has been filed with any securities commission or regulatory authority. No document or information in this document should be taken, transmitted or distributed (directly or indirectly) into the United States. None of the issuers, nor any securities issued by them, have been or will be registered under the United States Securities Act of 1933 or the Investment Company Act of 1940 or qualified under any applicable state securities statutes.

This document may contain independent market commentary prepared by WisdomTree based on publicly available information. Although WisdomTree endeavours to ensure the accuracy of the content in this document, WisdomTree does not warrant or guarantee its accuracy or correctness. Any third party data providers used to source the information in this document make no warranties or representation of any kind relating to such data. Where WisdomTree has expressed its own opinions related to product or market activity, these views may change. Neither WisdomTree, nor any affiliate, nor any of their respective officers, directors, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this document or its contents.

This document may contain forward looking statements including statements regarding our belief or current expectations with regards to the performance of certain assets classes and/or sectors. Forward looking statements are subject to certain risks, uncertainties and assumptions. There can be no assurance that such statements will be accurate and actual results could differ materially from those anticipated in such statements. WisdomTree strongly recommends that you do not place undue reliance on these forward-looking statements.

WisdomTree Issuer ICAV

The products discussed in this document are issued by WisdomTree Issuer ICAV (“WT Issuer”). WT Issuer is an umbrella investment company with variable capital having segregated liability between its funds organised under the laws of Ireland as an Irish Collective Asset-management Vehicle and authorised by the Central Bank of Ireland (“CBI”). WT Issuer is organised as an Undertaking for Collective Investment in Transferable Securities (“UCITS”) under the laws of Ireland and shall issue a separate class of shares ("Shares”) representing each fund. Investors should read the prospectus of WT Issuer (“WT Prospectus”) before investing and should refer to the section of the WT Prospectus entitled ‘Risk Factors’ for further details of risks associated with an investment in the Shares.

Notice to Investors in Switzerland – Qualified Investors

This document constitutes an advertisement of the financial product(s) mentioned herein.

The prospectus and the key investor information documents (KIID) are available from WisdomTree’s website: https://www.wisdomtree.eu/en-ch/resource-library/prospectus-and-regulatory-reports

Some of the sub-funds referred to in this document may not have been registered with the Swiss Financial Market Supervisory Authority (“FINMA”). In Switzerland, such sub-funds that have not been registered with FINMA shall be distributed exclusively to qualified investors, as defined in the Swiss Federal Act on Collective Investment Schemes or its implementing ordinance (each, as amended from time to time). The representative and paying agent of the sub-funds in Switzerland is Société Générale (EPA:SOGN) Paris, Zurich Branch, Talacker 50, PO Box 5070, 8021 Zurich, Switzerland. The prospectus, the key investor information documents (KIID), the articles of association and the annual and semi-annual reports of the sub-funds are available free of charge from the representative and paying agent. As regards distribution in Switzerland, the place of jurisdiction and performance is at the registered seat of the representative and paying agent.

For Investors in France:

The information in this document is intended exclusively for professional investors (as defined under the MiFID) investing for their own account and this material may not in any way be distributed to the public. The distribution of the Prospectus and the offering, sale and delivery of Shares in other jurisdictions may be restricted by law. WT Issuer is a UCITS governed by Irish legislation, and approved by the Financial Regulatory as UCITS compliant with European regulations although may not have to comply with the same rules as those applicable to a similar product approved in France. The Fund has been registered for marketing in France by the Financial Markets Authority (Autorité des Marchés Financiers) and may be distributed to investors in France. Copies of all documents (i.e. the Prospectus, the Key Investor Information Document, any supplements or addenda thereto, the latest annual reports and the memorandum of incorporation and articles of association) are available in France, free of charge at the French centralizing agent, Societe Generale at 29, Boulevard Haussmann, 75009, Paris, France. Any subscription for Shares of the Fund will be made on the basis of the terms of the prospectus and any supplements or addenda thereto.

For Investors in Malta: This document does not constitute or form part of any offer or invitation to the public to subscribe for or purchase shares in the Fund and shall not be construed as such and no person other than the person to whom this document has been addressed or delivered shall be eligible to subscribe for or purchase shares in the Fund. Shares in the Fund will not in any event be marketed to the public in Malta without the prior authorisation of the Maltese Financial Services Authority.

For Investors in Monaco: This communication is only intended for duly registered banks and/or licensed portfolio management companies in Monaco. This communication must not be sent to the public in Monaco.