Mobeen Tahir, Director, Macroeconomic Research & Tactical Solution, WisdomTree

Alas, it is settled. Inflation is not transitory. Its persistent uptick has serious implications for the global economy. The ongoing conflict, in addition to all the suffering it is causing in Ukraine, has created a further inflationary shock for the world. How are investors hedging themselves?

Don’t be surprised by what the pandemic has done

Post-pandemic inflation is not a new phenomenon – that is not to say the COVID-19 pandemic is completely behind us. In the aftermath of the 14th century Black Death, the world faced a breakdown in trade, as efforts were made to contain the spread of the plague, and a shortage of workers – given the astonishingly high death toll. The world has, since then, become a lot more complex, and much more interconnected.

In the UK, airlines including British Airways and Easyjet (LON:EZJ) are scrambling to hire more workers as they struggle to meet the rampant growth in travel demand with a depleted workforce. London’s Heathrow airport recently stated that it is stretched as it races to hire 12,000 new staff ahead of summer[1]. The first lesson in economics 101 would tell us that this means high demand and tight supply, a perfect recipe for rising prices – inflation.

How the conflict has complicated things

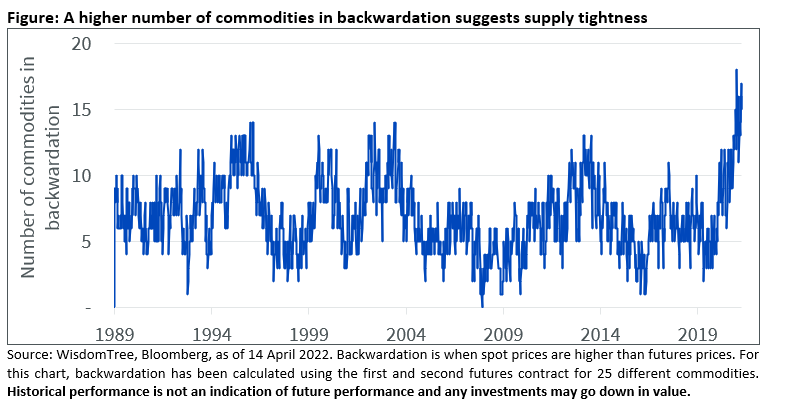

The conflict has exacerbated the inflation problem. It has exposed fault lines in already fragile global supply chains. Russia is among the largest producers of commodities including oil, natural gas, palladium, aluminium, nickel, and wheat among others. In certain cases, direct sanctions have been introduced. This is the starkest case of supply disruption. For example, sanctions from the US and UK on Russian oil and gas. For other commodities, there is a question mark. Direct sanctions may not have been introduced but several buyers are exploring alternatives. In an already tight global commodity market (see figure below), and options limited due to commodity supply being a function of natural resources, this is not necessarily easy.

Figure: A higher number of commodities in backwardation suggests supply tightness

It goes further. Ukraine is the world’s biggest exporter of corn, wheat, and sunflower oil[2]. Not only have the flows of these commodities out of Ukraine largely stalled, but spring planting for the next season could also be significantly hampered given the dislocation of people and destruction of infrastructure.

Moreover, Russia and Ukraine together export 28% of fertilizers made from nitrogen and phosphorus, as well as potassium[3]. Fertilizer shortages pose a danger to crop yields further tightening the supply of agricultural commodities and augmenting food price inflation.

What can central banks do

Central banks can’t send 12,000 new employees to Heathrow Airport. They can’t put an end to the conflict. And they certainly can’t ensure food or energy security. They can, however, cut back on monetary accommodation – the only lever at their disposal. Tightening monetary policy aims to control inflation by reducing growth. Higher rates should mean fewer people seeking new mortgages or maxing out their credit cards.

But monetary policy accommodation alone didn’t create inflation and its withdrawal alone won’t solve the problem.

What are investors doing?

Investors have been on the move in the last twelve months – even when the US Federal Reserve was clinging on to the ‘inflation is transitory’ narrative. In the last twelve months, there have been over $18bn in flows into broad based commodity basket exchange traded products worldwide. Almost $8bn of which, have come in the last three months, suggesting the trend is accelerating[4].

We see investors turning towards broad commodities for three distinct reasons. First, commodity market tightness is at the heart of the inflation conundrum. There is, therefore, a natural relationship between rising commodity prices, and rising prices more widely. Investors are seeking commodities exposure as an inflation hedge. Second, broad commodities help capture the structural demand growth for metals from the energy transition. And third, they offer diversification – not just against equities and bonds but also within the basket given the heterogeneity among the different commodity sectors.

Not a question of if, but how

Until last year, whether there is a strong case to add inflation protection was still a dilemma for many investors. Now, focus seems to have shifted towards how best to hedge against it. Commodities aren’t the only solution. They do appear to be the favoured solution right now for many.

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

[1] https://news.sky.com/story/heathrow-says-it-is-stretched-as-it-races-to-hire-12-000-new-staff-12587985

[2] https://www.bloomberg.com/news/features/2022-04-05/will-russia-s-war-in-ukraine-cause-wheat-shortages-raise-food-prices-more?sref=wxRzZOfT

[3] Source: Morgan Stanley (NYSE:MS) as reported by CNBC: https://www.cnbc.com/2022/04/06/a-fertilizer-shortage-worsened-by-war-in-ukraine-is-driving-up-global-food-prices-and-scarcity.html

[4] Source: Bloomberg, as of 14 April 2022.