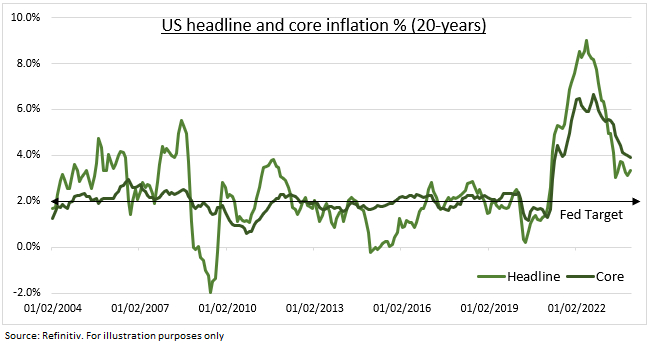

REBOUND RISK: Risk of a US inflation comeback is under-priced and rising. With the US labour market surprisingly healthy and economic growth strong. The Q1 GDP NOWCast is an above average 3.4%. 10-year bond yields are up, Fed rate cut hopes pushed back, and US dollar the best performing major currency this year. Stocks welcomed the lower recession risk and firmer profits outlook. But may be under-pricing the tail-risk of an inflation upside surprise. It’s the most important number in markets, the biggest investment risk, and our inflation tracker (see below) is now flashing yellow. A first sub-3% headline inflation print is needed from today’s January report to validate the benign consensus of a productivity boom driven ‘immaculate disinflation’.

NOWCAST: The Cleveland Fed NOWCast is showing a reassuring inflation ease this month. With the headline increase cooling sharply to +0.2% MoM and +2.9% YoY. Likely driven by easing gasoline, food, and used car prices. This would be the first 2%-handle this cycle and a number not seen in 33 months. Whilst core prices, excluding energy and food, are seen edging lower to 3.8%. The NOWCast also sees further inflation easing next month. This lower prices outlook is also supported by the Truflation measure at an even lower 1.4%. This is an innovative real-time blockchain-driven tracker of inflation from 30+ data sources and 13+ million prices.

TRACKER: But our tracker of 13 leading and coincident indicators shows a stalling of price falls. It’s -40% from peak 2022 levels but +4% the past month. With large gains in forward-looking PMI employment and price indicators, alongside a firming housing market and Red sea driven supply chains. This was only partly offset by lower used car prices and consumer inflation expectations. We track labour (employment ISM, JOLTS), housing (Zillow rent, NAHB index), goods (Used cars, Manufacturing ISM prices), commodities (Gasoline, broad commodities), supply chains (GSCP index, container rates), and expectations (Michigan survey, Break-evens).

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Tail-risk of an Inflation Comeback

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.