By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

The U.S. dollar traded slightly higher after the FOMC meeting but the Federal Reserve failed to impress so the greenback still remains under pressure and risk of further losses. The central bank said the case for a rate hike continued to strengthen and that inflation increased somewhat since earlier this year, but they want to wait for further evidence before raising interest rates. Only 2 members voted in favor of a rate hike this month as Rosengren sided with the majority, while Mester and George supported an immediate rate rise. The tone of the FOMC statement was relatively upbeat with policymakers describing job gains as solid and striking out the line that says inflation is expected to remain low in the near term, replacing it with a simple statement saying, “inflation is expected to rise to 2%” over the medium term." This suggests that even though many market participants see nonfarm payroll growth as disappointing, the shifting inflation outlook may be enough for the Fed to raise interest rates next month. While there was no specific mention of a possible hike in December or the next few months, there were sufficient positive tweaks to the statement to keep a hike next month in play. In fact, Fed Fund futures are now pricing in a 78% chance of a December hike up from 68% on Tuesday.

Unfortunately, a hawkish Fed will not be enough to strike a bottom in the U.S. dollar, especially after Wednesday's surprisingly weak ADP report. Only 147k jobs were added to corporate payrolls in October according to ADP, down from 202K in September. This was not only significantly weaker than expected but also the lowest reading in 5 months. For some reason, some economists believe this report hints at solid job gains on Friday, but between the deterioration in confidence and the relatively subdued ADP report, unless the employment component of Thursday’s non-manufacturing ISM jumps sharply, we don’t think stronger U.S. growth or a hawkish Fed will be enough for investors to overlook political risks. There are only 4 more trading days before one of the most dramatic U.S. presidential elections in recent history and the race is too close to call. That means uncertainty, which is never good for currencies and this case, it's particularly risky for to be long dollars.

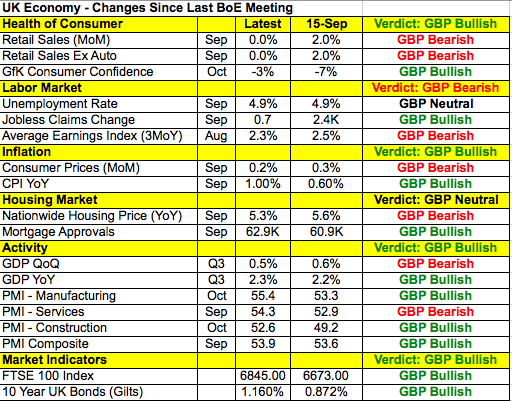

The Bank of England is up next with a monetary policy meeting and Quarterly Inflation Report. In many ways, sterling could have a far more dramatic reaction to its rate decision than the dollar did to FOMC. We know Mark Carney will stay on as Governor until June 2019 and he could make some comments related to that. However the key question Thursday will be whether the BoE will lower its economic forecasts and signal plans to ease. Taking a look at the table below, there’s been just as much improvement as deterioration in the U.K. economy since the September meeting but there was weakness where it counts in retail sales, wage growth and inflation. So while manufacturing activity may be on the rise and stocks have rallied, the Quarterly Inflation Report will most likely contain a cautious tone although it will be interesting to see their views on inflation because last month, sterling popped after Carney said there’s limit to BoE’s willingness to look past inflation overshoot. So if the BoE is unambiguously dovish, we should see sterling fall sharply, particularly against the euro and commodity currencies. If they put greater emphasis on inflation, GBP/USD could hit 1.24.

The euro extended its gains against the U.S. dollar Wednsday on the back of a falling dollar and a stronger employment report. The Euro moved above 1.11 for the first time since October 12. The Eurozone manufacturing PMI index was revised higher while the German manufacturing PMI index was revised slightly lower. The big story, though, was Germany’s employment report. Unemployment in Germany declined by 13,000, far outpacing the decline of 1,000 expected. The country’s unemployment rate also dropped to 6% from 6.1% expected. This data shows that labor conditions in the Eurozone’s largest economy are healthy, which is consistent with the changes reported in the PMIs. The recent rally in EUR/USD has taken the pair near some very important resistance levels. EUR/USD either fails below 1.1150 or it makes a run to 1.1300.

The New Zealand dollar ended the day sharply higher versus the greenback while the Australian and Canadian dollars were virtually unchanged. NZD was helped by stellar employment data. New Zealand’s unemployment rate dropped from 5.1% the previous quarter to 4.9% for the third quarter. Employment rose by 1.4% on a QoQ basis. Although this was less than the 2nd quarter’s 2.4% increase, it was significantly better than the 0.5% forecast. In addition to the outstanding employment report, the weakness in the U.S. dollar helped to lift NZD above 0.73. No economic reports were released from Australia but lower oil prices in Canada kept the Canadian dollar under pressure. Oil fell another 2% on the back of a larger-than-expected increase in oil inventories, which rose by 14.42 million barrels, far greater than the 1.58 million barrels expected. Australia’s PMI services report and trade balance were due Wednesday evening along with China’s Caixin Services and Composite PMI index.