Gold prices set for weekly gains on dovish Fed outlook; silver near record high

Australia’s Reserve Bank (RBA) has published its monthly Monetary Policy Decision statement with an astonishing rise in the official cash rate (OCR) of 50 basis points, up to 0.85%, citing rampant inflation and very low-interest rates as the basis for the increase. It has also increased the Exchange Settlement balances interest rate by 50 basis points to 75 basis points.

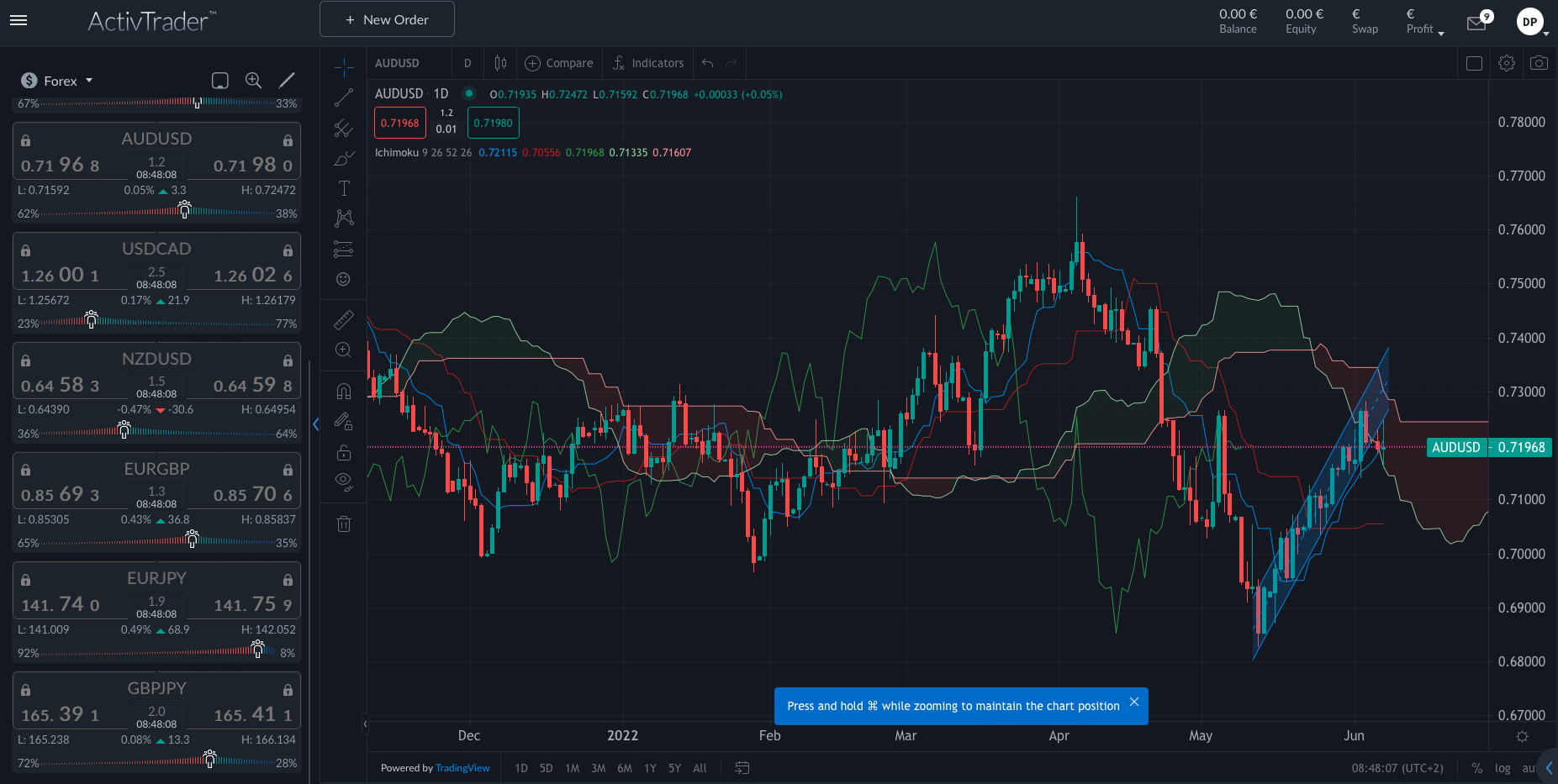

While the AUD/USD initially jumped on the RBA announcement to 0.72472, the currency pair quickly lost ground and is flat at the time of writing, now at around 0.7196 after reaching a low point of 0.71592. Trader sentiment is rather bearish on the pair, as shown by the market sentiment functionality of the ActivTrader platform, as 62% of the community is selling the currency pair, compared to 38% buying it.

Biggest one-month lift in interest rates for 22 years

Today’s decision by the RBA to raise the OCR by any amount again on the back of last month’s increase (which is the first in a decade and the first back to back increase in 12 years) comes as little surprise to market analysts and investors, but this unexpectedly high increase has caught many off guard, as the majority predicted rates would only go up between 25 and 40 basis points today.

The minutes from last month’s meeting suggested borrowers should brace for today’s move, having narrowly escaped a much larger rate rise than the 25 basis points in May, and from what we can see from today’s announcements, the pain could just be beginning for struggling Australian home owners, as experts say this is just the ‘tip of the iceberg.’

The RBA is on track now to lift the OCR to 2.5 per cent by the end of the year in line with Governor Lowe’s statements back in May, and if the forecasted increases are passed on to mortgage holders, the average variable mortgage rate would climb from the current 3.7 per cent to anywhere between 5.85 percent and 6.85 percent by the middle of 2023.

RBA aggressive move to lower inflation

In a desperate bid to curb rising inflation, which reached 5.1% over the previous twelve months to the March 2022 quarter according to the Australian Bureau of Statistics, the RBA’s attempts to increase the cash rate to a ‘normal level’ post-pandemic, could see the beginnings of the Australian economy being thrown into recession.

With around $500 billion worth of fixed-rate mortgage terms set to expire around the close of 2023, thousands of Australian home owners will be feeling the pain of steep increases in their repayments. Inflation is still expected to increase this year as a result of high fuel and gas prices according to the report, but should start to decline towards 2 or 3 per cent by next year.

This extra stress from higher repayments and the generally higher cost of living could have a real impact on household consumption, which accounts for over 50% of the Australian economy. Also, a factor affecting people's buying habits is the almost certain dip in housing prices that will follow the OCR jump. The RBA’s Financial Stability Review and Monetary Policy Statements predicted housing prices would fall by around 15% to 20% over the next two years, which will make Australians feel less optimistic about their financial position.

Many Australians took advantage of record-low mortgage rates (below 2.5 per cent) and government stimulus packages during the height of the pandemic, which has seen housing prices across the country skyrocket by 23.7% over 12 months in 2021. For those that may have over-extended themselves to enter a property market buoyed by the pressure of rising prices and fear of missing out, there could be tough times ahead as the market corrects itself.

Will the Australian economy remain strong with rising interest rates?

Mr. Lowe pointed to Australia’s resilience during the pandemic in his report, and that the lifting of the cash rate was in response to the country no longer needing the ‘extraordinary support’ in the form of low-interest rates.

RBA’s Governor also stated that the economy had grown by .08 per cent in the March quarter and 3.3 per cent over the year, all despite Covid-related disruptions to supply chains and other global and local factors, such as the tight labor market, flooding in the eastern states and the war in Ukraine.

Also of mention in the report was the country’s low unemployment figure of 3.9 per cent, the lowest in 50 years, and the positively high number of job vacancies.

Mr. Lowe assures that all of these factors would be closely monitored by the Board when deciding on future rate increases, in combination with other incoming data, to ensure that inflation returns to target levels over time.

While many Australians will be re-working their household budgets this week, these decisions should be good news for savers and those still waiting to enter the property market. While the ‘big four banks’ in Australia, the CBA, ANZ, NAB, and Westpac are still yet to respond to today’s announcements, they’re tipped to raise savings rates within the coming days and weeks.