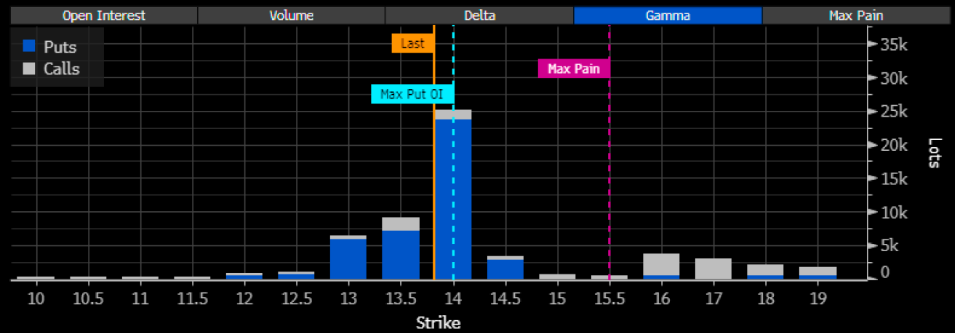

It was an implied volatility day yesterday ahead of the VIX expiration this morning. The important level for the VIX is 14, and as of yesterday, the VIX closed at 13.8.

Vixperiation officially isn’t until later on, so the VIX may manage to climb back above 14, but there is an A for effort here on the market’s part.

But while the VIX was falling, the VIX 1-day was rocketing higher ahead of today’s FOMC meeting, similar to what we saw ahead of the CPI report last week.

The main difference is that it hasn’t gotten as high yet. It still has time to do that today since the press conference doesn’t start until 2:30 PM ET.

So it would seem possible that today, between 2:35 and 2:45, we will see that volatility crush, which could send the equity market higher.

It doesn’t mean the market will finish higher; it doesn’t mean it will finish lower.

It just means that volatility needs to reset, and the higher the IV is when that Press Conference begins, the bigger the volatility crush; how long it lasts depends on the message from the Fed.

In the meantime, if the Fed doesn’t push back today and show some effort, you really have to wonder what the Fed may be thinking about this point.

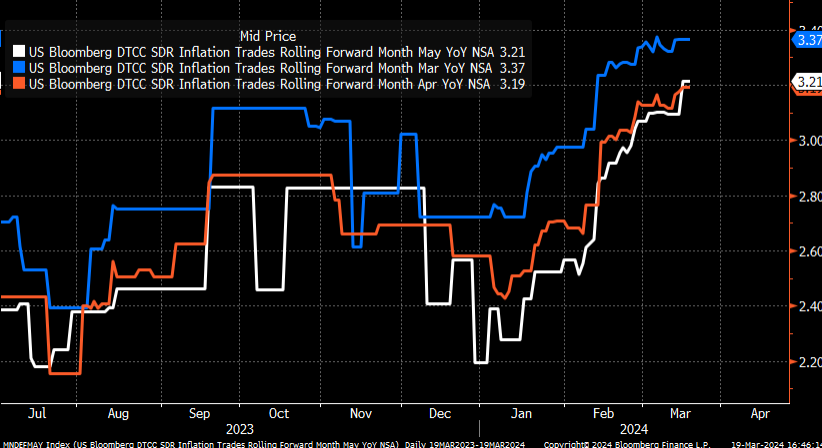

I think it is the correct call to show fewer rate cuts at this point, given the hotter inflation readings we have seen and the hotter inflation reading we are expected to get, with swaps for March seeing CPI around 3.4% y/y, April around 3.2% y/y, and May around 3.2%.

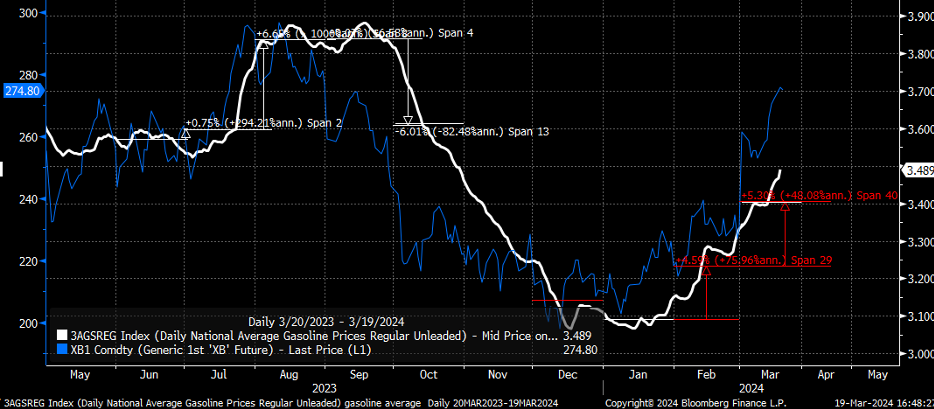

Of course, this assumes that things like gasoline do not keep rising. So far this month alone, the average price of gasoline is up more than 5%.

So, the Fed can ignore the risk and not push back, and face a bigger problem. I would think it is time for them to step up after what we just went through in 2022.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI