We are observing a true regime change in markets.

And for macro investors, it’s incredibly important to stay vigilant and on top of our game at this stage.

It all starts with this: the Fed is behind the curve, and it is playing with fire.

Consider this.

The recently released US job report showed the US private sector is only adding an average of 96,000 jobs per month over the last 3 months.

Such a weak pace of job creation has last been seen in summer of 2007.

The last CPI report also showed another friendly and disinflationary print: core CPI raised less than 0.2% on a MoM basis which is a trend in line with pre-pandemic ~2% yearly inflation trend the Fed targets.

So, why is the Fed playing with fire?

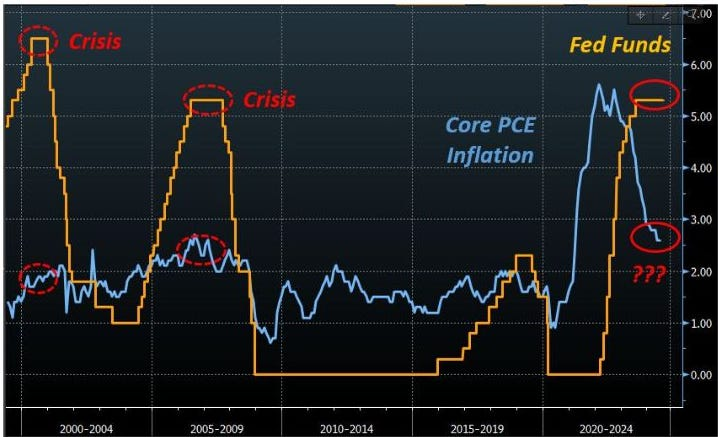

The chart below shows you why.

Fed Funds at 5.25% while core PCE is convincingly sub-3% represent a real Fed Fund rate of 2%+.

Real rates are what matter for the economy:

-

Investors care about their (risk-free) returns after accounting for inflation

-

Debtors care about their inflation-adjusted borrowing costs

With real rates now at 2%+ for quite some time, it's important to look back at past episodes and see what happened when the Fed forced such a tight policy for too long:

A) In 1999-2000, the Fed kept real rates at 3%+ for a sustained period of time and a crisis unfolded in 2001;

B) In 2007, the Fed kept real rates at 2%+ for a while and a crisis unfolded in 2008;

C) In 2024, the Fed is keeping real rates at 2%+.

On top of this, the Fed is also keeping policy very tight while the US job market is showing clear signs of weakness.

The Fed is behind the curve, and it is playing with fire here.

And when this happens, the bond market takes over.

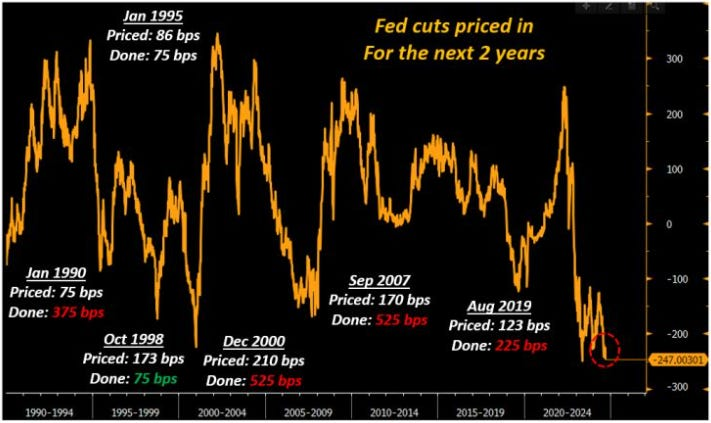

The chart above goes back to 1989 and it looks at the amount of rate cuts/hikes bond markets were pricing for the subsequent 2 years.

I focused on periods when the bond market was very, very dovish and it priced in a robust amount of cuts.

The big question is: what did the Fed deliver?

Did one make or lose money by buying bonds when markets were already super dovishly priced?

Let's look at the data:

1. January 1995, October 1998

Cuts priced for the next 2 years: on average 130 bps

Cuts delivered by the Fed: 75 bps

If you bought bonds while markets were already at peak dovish pricing, you lost money (cuts delivered were less than priced in).

2. January 1990, December 2000, September 2007, August 2019

Cuts priced for the next 2 years: on average 145 bps

Cuts delivered by the Fed: 412 bps (!)

If you bought bonds while markets were already at peak dovish pricing, you ended up making a ton of money.

The results are very interesting.

As a rule of thumb, I always advocate that in macro you don’t make money by only ‘’being right’’.

That’s a necessary but insufficient condition: you also need to surprise consensus, or in other words see something before the crowd does + position correctly for it + monetize when they converge to your view.

Yet it seems like the bond market is quite good at sniffing when something is about to go wrong.

The bond market is sending a loud message: are you listening?

But it’s not only about the bond market here.

It’s also about cross-asset correlations suggesting tectonic shifts are happening:

We are witnessing a massive regime change in markets.

Recently we experienced another large drawdown in equity markets lead by tech stocks - specifically, NVIDIA (NASDAQ:NVDA) stock prices dropped by almost 10% in a single session.

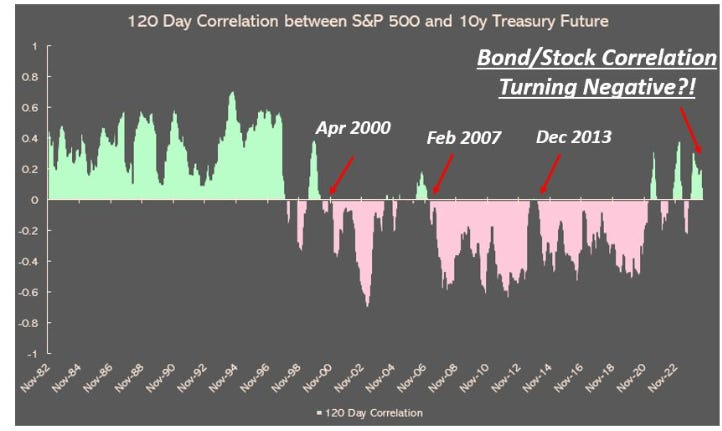

But the big news for investors is that bonds have started to exhibit one of their key features again.

For the first time in a few years, bonds are acting again as a hedge against stock market drawdowns.

In other words: after a period of positive correlation that wrecked 60/40 portfolios, the stock/bond correlation is turning negative again.

This is a huge deal.

The chart above shows the 6-month (120 trading days) correlation between the S&P 500 and 10-year Treasury future prices.

The correlation was negative for most of the last 15 years: this means investors could count on bonds acting as a diversifier during periods of equity drawdowns.

But as you can see from the chart, this wasn’t always the case: for most of the ‘80s and ‘90s bonds and stocks were doing pretty much the same thing at the same time – they were positively correlated.

The same happened in 2022-2023 as inflation was out of control.

Hear me out now, because this is the key message you should bring home.

When the stock/bond correlation changes sign, we are looking at tectonic macro shifts with huge implications for cross-asset portfolios.

This is because ''bad news is good news'' doesn't work anymore.

The market has switched to a regime in which:

The bad news is actually bad news.

Once bonds start acting as a diversifier for risky assets, we are likely on the verge of a massive regime change in macro and markets.

Macro tectonic shifts are happening.

Disclosure: This article was originally published on The Macro Compass. Come join this vibrant community of macro investors, asset allocators and hedge funds - check out which subscription tier suits you the most using this link.