Sector investing has been around for decades but has failed to evolve with time

As a distinct investment strategy, sector investing emerged and gained prominence in the 1980s and 1990s. However, its roots can be traced back to earlier developments in the financial markets. The concept of sector investing evolved from the broader trend of categorising stocks and creating specialised investment products. This evolution was driven by several factors:

-

Development of sector indices: In the 1970s and 1980s, financial data providers began creating sector-specific indices, allowing investors to track different industries' performance more easily

-

Expansion of mutual funds and the introduction of ETFs: The 1980s saw significant growth in mutual funds, including sector-specific funds focused on particular industries or economic sectors. The launch of the first exchange-traded fund (ETF) in 1993 and competition in the industry thereafter also paved the way for sector-specific ETFs

-

Technological advancements: The rise of computerised trading and improved data analysis capabilities in the 1980s and 1990s enabled more sophisticated sector-based investment strategies

-

Economic shifts: The increasing importance of certain sectors, such as technology, in the overall economy during the 1990s drew more attention to sector-based investing

While the concept of investing in specific industries has existed for much longer, the formalisation of sector investing as a widespread strategy, supported by specialised financial products and indices, primarily took shape in the 1980s and 1990s. This period saw the birth of sector investing as we know it today, with investors able to easily allocate their portfolios based on specific economic sectors or industries.

Thematic investing could offer better exposure to trends while improving diversification

Thematic investing became more relevant in the 2000s with the rise of the internet and rapid technological advancements. While sector investing focuses on specific industries, thematic investing takes a broader approach by identifying and capitalising on long-term trends that are expected to reshape society and the economy across multiple sectors.

Thematic investing can be considered advantageous over sector investing in several ways:

-

Broader perspective: Thematic investing looks at the bigger picture, identifying powerful cross-cutting trends that can drive growth across various industries and regions rather than focusing on a single sector

-

Future-oriented: It allows investors to buy into a vision of the future, potentially capitalising on transformative forces shaping the world. It allows investors to hold smaller pure-play companies aligned with long-term trends and on the road to becoming large/mega caps

-

Flexibility: Thematic investing is not constrained by traditional sector boundaries, which have not kept pace with the market evolution, allowing for more adaptable investment strategies as trends to evolve

-

Diversification within themes: A single theme can encompass companies from multiple sectors. For example, a "clean energy" theme might include energy companies, electric car manufacturers, and battery producers, and an “artificial intelligence” theme might be focused on semiconductors, information technology, and even financials and real estate

-

Potential for higher returns: By identifying and investing in emerging trends early and in turn focusing on the next potential mega caps, thematic investing may offer the potential for higher returns compared to broader market indices, which tend to be concentrated on mega caps of today

-

Alignment with personal values: Thematic investing often allows investors to align their portfolios with their beliefs and values, making it appealing for those seeking both financial and impact-driven outcomes

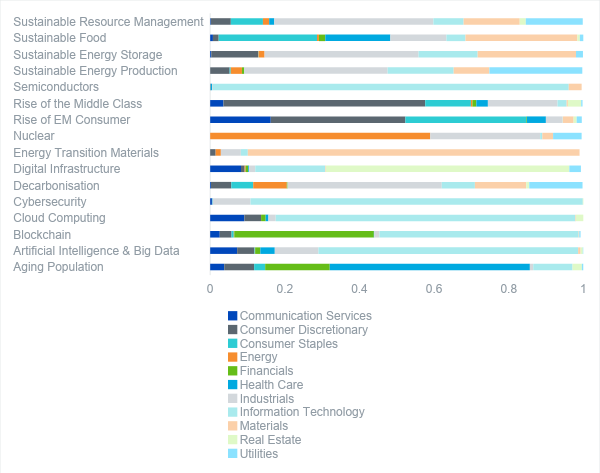

Figure 1: Themes traverse through sectors and provide diversification

The WisdomTree Megatrends UCITS Index: An innovative approach to multi-thematic investing

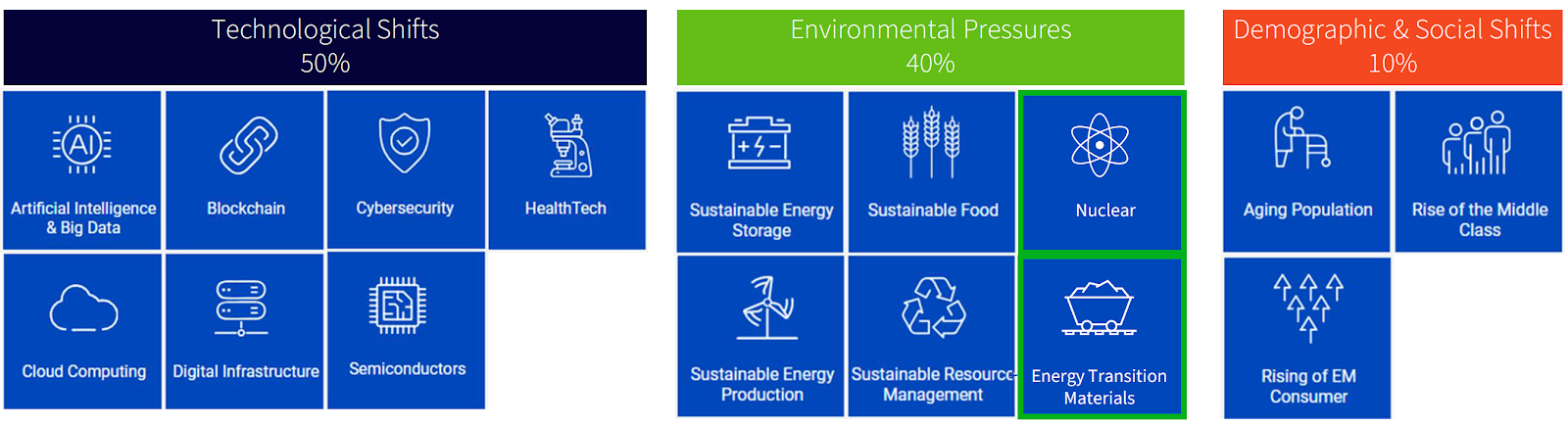

For investors looking for multi-thematic exposure that can provide broad-based, pure-play exposure to themes that can provide exposure to the most relevant trends and their evolution over time, the WisdomTree Megatrends UCITS Index consists of 16 themes in three broader megatrends, as shown below.

Figure 2: Themes in the WisdomTree Megatrends UCITS Index

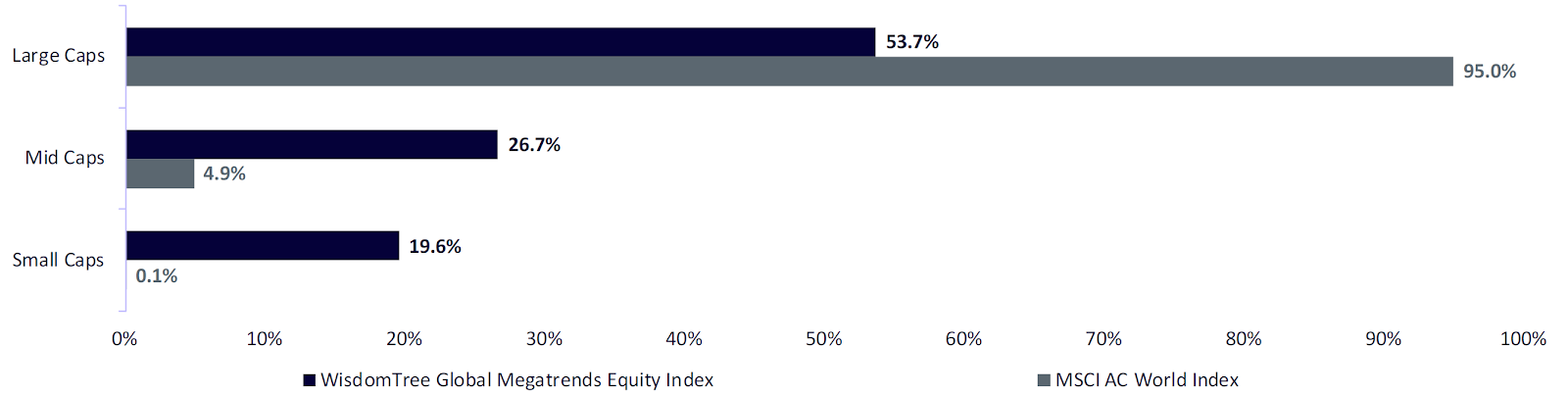

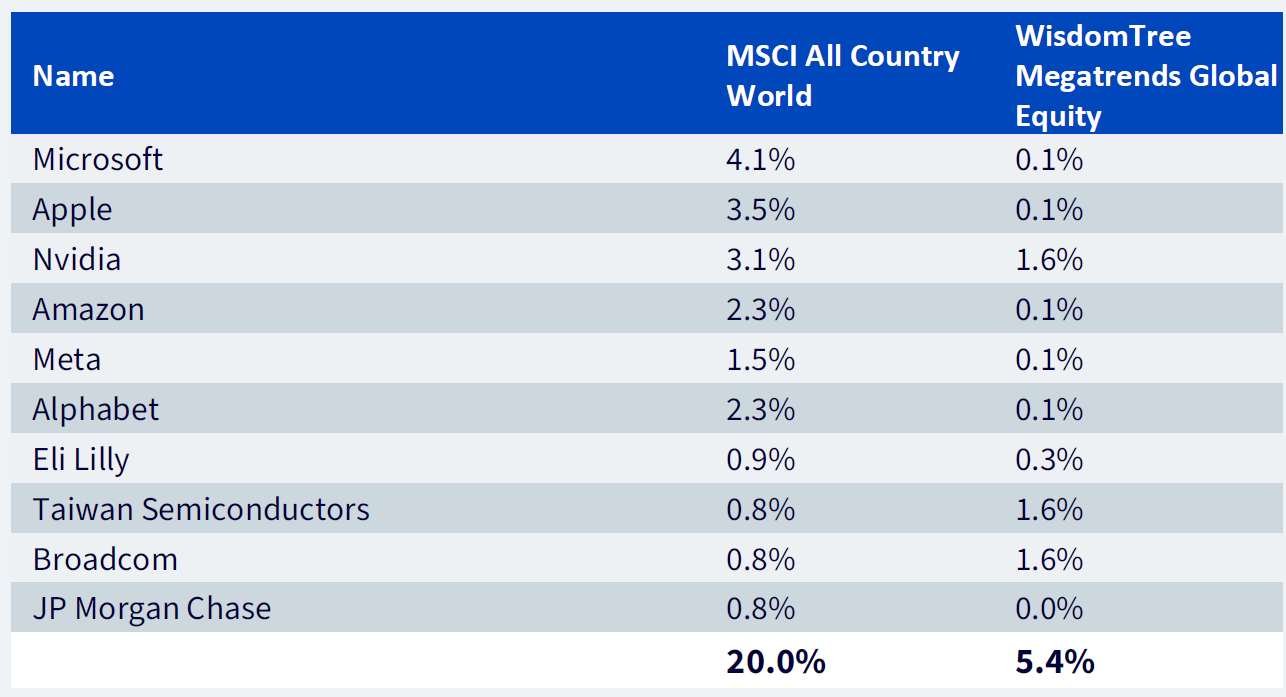

The MSCI AC World could be looked at as a multi-sector investment strategy. Contrast that to the multi-theme investment strategy of the WisdomTree Megatrends UCITS index, which, despite taking a broad approach to include a wide range of themes, maintains low overlap with the MSCI AC World, which as of 22 April 2024 was just 17.9%. Holding true to its promise of capturing next-generation mega-caps, the overlap with the current mega-caps also remains low, with weight allocated more evenly to companies with high potential and alignment with long-term trends. This can be seen in the market cap distribution below and the overlap with the top 10 stocks in MSCI AC World.

Figure 3: Market-cap distribution versus MSCI AC World

Figure 4: Overlap with the top stocks in MSCI AC World (Mega Caps)

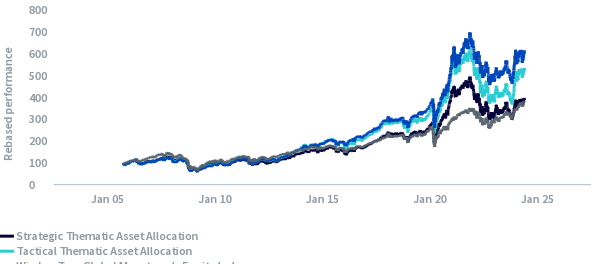

The WisdomTree Megatrends UCITS Index deploys multiple levels of alpha generation, wherein the strategic thematic asset allocation relies on long-term trends and relevance of the themes (reviewed annually in April), the tactical thematic asset allocation overlay captures short-term trends and momentum in selected themes (reviewed quarterly), and the final overlay removing laggards from each theme to avoid stocks within themes that have underperformed the broader theme (reviewed quarterly). This alpha generation process has added performance with each layer in the last 20 years of backtested data, all outperforming the MSCI ACWI net total return index.

Figure 5: Multiple layers of alpha generation in 20 years of backtested data

___________________

IMPORTANT INFORMATION

Marketing communications issued in the European Economic Area (“EEA”): This document has been issued and approved by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Marketing communications issued in jurisdictions outside of the EEA: This document has been issued and approved by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

WisdomTree Ireland Limited and WisdomTree UK Limited are each referred to as “WisdomTree” (as applicable). Our Conflicts of Interest Policy and Inventory are available on request.

For professional clients only. Past performance is not a reliable indicator of future performance. Any historical performance included in this document may be based on back testing. Back testing is the process of evaluating an investment strategy by applying it to historical data to simulate what the performance of such strategy would have been. Back tested performance is purely hypothetical and is provided in this document solely for informational purposes. Back tested data does not represent actual performance and should not be interpreted as an indication of actual or future performance. The value of any investment may be affected by exchange rate movements. Any decision to invest should be based on the information contained in the appropriate prospectus and after seeking independent investment, tax and legal advice. These products may not be available in your market or suitable for you. The content of this document does not constitute investment advice nor an offer for sale nor a solicitation of an offer to buy any product or make any investment.

An investment in exchange-traded products (“ETPs”) is dependent on the performance of the underlying index, less costs, but it is not expected to match that performance precisely. ETPs involve numerous risks including among others, general market risks relating to the relevant underlying index, credit risks on the provider of index swaps utilised in the ETP, exchange rate risks, interest rate risks, inflationary risks, liquidity risks and legal and regulatory risks.

The information contained in this document is not, and under no circumstances is to be construed as, an advertisement or any other step in furtherance of a public offering of shares in the United States or any province or territory thereof, where none of the issuers or their products are authorised or registered for distribution and where no prospectus of any of the issuers has been filed with any securities commission or regulatory authority. No document or information in this document should be taken, transmitted or distributed (directly or indirectly) into the United States. None of the issuers, nor any securities issued by them, have been or will be registered under the United States Securities Act of 1933 or the Investment Company Act of 1940 or qualified under any applicable state securities statutes.

This document may contain independent market commentary prepared by WisdomTree based on publicly available information. Although WisdomTree endeavours to ensure the accuracy of the content in this document, WisdomTree does not warrant or guarantee its accuracy or correctness. Any third party data providers used to source the information in this document make no warranties or representation of any kind relating to such data. Where WisdomTree has expressed its own opinions related to product or market activity, these views may change. Neither WisdomTree, nor any affiliate, nor any of their respective officers, directors, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this document or its contents.

This document may contain forward looking statements including statements regarding our belief or current expectations with regards to the performance of certain assets classes and/or sectors. Forward looking statements are subject to certain risks, uncertainties and assumptions. There can be no assurance that such statements will be accurate and actual results could differ materially from those anticipated in such statements. WisdomTree strongly recommends that you do not place undue reliance on these forward-looking statements.

WisdomTree Issuer ICAV

The products discussed in this document are issued by WisdomTree Issuer ICAV (“WT Issuer”). WT Issuer is an umbrella investment company with variable capital having segregated liability between its funds organised under the laws of Ireland as an Irish Collective Asset-management Vehicle and authorised by the Central Bank of Ireland (“CBI”). WT Issuer is organised as an Undertaking for Collective Investment in Transferable Securities (“UCITS”) under the laws of Ireland and shall issue a separate class of shares ("Shares”) representing each fund. Investors should read the prospectus of WT Issuer (“WT Prospectus”) before investing and should refer to the section of the WT Prospectus entitled ‘Risk Factors’ for further details of risks associated with an investment in the Shares.