Is it entirely coincidental that with the passing of our Queen to the new King that the old is giving way to the new? In terms of finance, has the old strong dollar trend ended with the Queen’s passing? Remember, the value of the US dollar is still the most important factor in finance, markets and world trade. And our own currency seems to be emerging from the depths of despair.

And is it also coincidental that the UK has a new three-day old government with a radically different approach to governing?

I do not think so and I believe this week will go down as an historic game-changer in more ways that one. The 70-year old Elizabethan Age has ended – what will the new Carolian Age look like?

Has the dollar finally turned?

Has it finally happened? I have been stalking the US dollar for what seems like an eternity anticipating an end to the mammoth near-vertical rally that has existed for over a year. It reached a high at 110.50 on Wednesday. So is that it?

If my trusty Headline Indicator is still giving me reliable contrarian signals, this Bloomberg one I saw on Thursday: “Nothing Will Stop the Dollar From Getting Stronger” will surely do the trick.

When a prominent pundit issues such a definitive statement in a headline in a major article, the hairs on my trigger finger twitch excitedly and hover over the Sell button like a tiger about to pounce on prey.

OK, so I am getting a little too dramatic here but such a forecast from a prominent pundit can only emerge when a clear obvious trend has been established for a long time. Why? Because that is what most public readers are thinking! The herd has been bombarded with positive stories about the dollar for months on end – and have seemingly reached a crescendo in recent days.

Last week I questioned the overwhelming consensus that sterling was heading for dollar parity. I quoted a dramatic headline “Pound risks dollar parity after worst month in six years” And on Friday, I spotted another one that states even more confidently the pound is set for more losses: “The battered pound is sinking towards dollar parity“.

Do these headlines tell more of extreme herding by the pundits than anything insightful about the future path of the market? All of the ‘reasons’ laid out in these articles are well known and contain no surprise factor. They are what has brought sterling down to the lowly 1.14 level. All of that data is in the market and all participants know it.

In fact, the media pundits are the Voices of the Herd. They write market opinions that most of their readers are already signed up to. That’s why they can earn a good living doing just that.

Contrarians rarely get a MSM voice.

It is a little known observation that very often major tops and bottoms are put in by stealth when there is little new news breaking. A major low is made when the selling pressure (dwindling numbers of new shorts plus stale longs) equals the buying pressure (new bottom fishers plus take-profit shorts). Gradually or explosively, the buying swamps the selling and prices rise and that attracts more buying.

Here is one option I am following closely

At the current 1.14 region, it has entered the zone where previous long term lows have been made. There is evident major long term support here. Also note the huge mom div on the weekly chart that usually signals a sharp reversal once the low is in.

In addition, the latest COT data shows a massive 20% increase last week in short futures positions taken by the trend-following hedge funds with a corresponding increase in longs by the commercials (smart money). We know that hedge funds often are positioned the wrong way in size at trend reversals. Any advance here would force many to cover shorts that could develop into a strong short squeeze.

It appears the odds for dollar parity are much lower that for a sharp reversal – contrary to what the herd believes.

Too big to fail? Now it’s the public’s turn to be bailed

The worm turns… In the financial crash of 2007/2008, it was the banks that were too big to fail. They were vilified for almost bringing the economy down. The UK government was forced to bail them out to the tune of £500 Billion (about 20% of GDP).

Today, the mammoth size of the energy crisis means it is the public who are too big to fail. The UK government is being forced to bail them/us out to the tune of an estimated £150 Billion (about 5% of GDP).

In each case, it is the state (us as taxpayers) that is the bailer of last resort. It’s a variation on the old maxim: If you owe the bank £1,000 and can’t pay, you have a problem. But if you owe the bank £100 Billion. it is the the bank that has the problem.

But it is robbing Peter to pay Paul as we are all taxpayers and pay utility bills. But here, Peter and Paul are the very same person!

So does this support package mean all will be well with the economy this winter now that energy bills will be paid in full? I don’t think so. In my experience, I find that many households who often live in old leaky homes keep the thermostat at 22 degrees or higher all winter 24/7. They love to live in T-shirts all winter. Weaning such families off that habit would be a very tough ask especially when there are young children in the house. Energy bills of such families will remain high.

Therefore, I expect that even with this energy support, retail sales will be depressed as disposable incomes remain under pressure.

Stocks rally – as expected

I have my Headline Indicator to show me when to take a contrarian position – and I also have my Flow of Funds Indicator. In the latest week, US retail fund investors sold a very large $11 Billion worth as they were gripped by fear of what’s to come as stocks plunged.

One headline on Friday told the story : “BofA says ‘appalling mood‘ fuels $11 Billion stock exodus” So guess what – stocks zoomed higher Thursday and Friday. In fact, the Dow was up over 1,000 pips from Wednesday’s low.

If you had just arrived from Mars and all you knew about the markets was this headline, you would be quids in if you filled your boots with top shares on reading it. One of my top picks this week was Meta (Facebook (NASDAQ:META)) that jumped a tidy $7 on Friday.

Yes, the retail crowd can be 100% relied on to be zigging when they should be zagging. It’s a mystery to me how they accumulate wealth in the stock market at all!

But early in the week, I warned members to expect a counter-trend bounce in the indexes based on my reading of the wave patterns and the large potential mom div forming. I also noted an extreme in the RSI (Relative Strength) oscillator that was entering oversold territory – here is the chart I posted Wednesday as the Dow had just hit the Fib 62% support:

I sometimes use this DSI especially when we have had a strong trend that is vulnerable to a possible reversal. The levels above 70 show an overbought market that is usually poised for a reversal (that did happen at the 16 August high where we entered new shorts).

Note the many arrows where DSI had reached the 30 in the oversold category that have always preceded decent rally phases going back to at least last year.

The evidence on Wednesday was clear – a high probability bounce was on the cards. And we got it.

But since this is another bear market rally, I do expect it to terminate at some point – and that could be very soon.

The ags are poised for major advances

MSM coverage of the Wheat, Corn and Soybean markets has gone quiet lately, except for the sparse news emerging of the grain exports from Ukraine courtesy of Mr Putin. It appears these Wheat exports are running at much lower levels than before the war for several reasons including a reluctance of ship owners to send their vessels in while the mine danger is still very much present.

Soybeans is not a crop grown much in Ukraine but the US is about to harvest a bumper crop and that prospect has hit prices. They have retreated by about 30% off their February highs and so has this correction run its course?

It is a well-observed fact that very often, soybean prices hit major year’s lows in the month of November just after the US harvest when supplies are plentiful and farmers have finished hedging.

Here is an interesting chart showing the pattern (of course, not every year sees lows in November)

The most recent accurate November hit was last tear prior to a huge surge (and similar in 2020) – will history repeat this year and will it herald a similar huge gain into 2023?

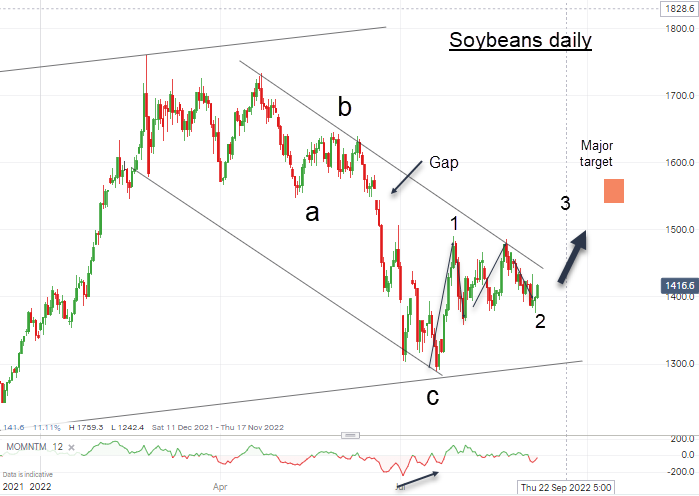

Here is the daily chart:

If this analysis is correct, an upward break of my upper tramline around 14.50 (currently 14.10) should herald a test of the June gap around 15.50 with higher potential. If so, then this year’s low will be two months early. Let’s see.