Elon Musk's Tesla: Visions without tangible progress

Tesla founder Elon Musk is increasingly disappointing with his strategic direction. Initially, he was able to set himself apart from the competition by reducing the price of his electric cars, but cost reduction alone is no longer enough to meet the high expectations of the company. Musk's robotaxi event, at which he presented autonomous taxis and humanoid robots like ‘Optimus’, left a bad taste in the mouth. While the vision of autonomous driving and robots as everyday helpers sounds great, in reality there are still considerable doubts about its feasibility. According to a report by Bloomberg, the robots were said to be remotely controlled at the presentation, which calls the credibility of the project into question.

The stock market is reacting with increasing scepticism as Tesla's former technological advantage is no longer clearly visible. The market capitalisation, which remains very high, is increasingly difficult to justify. Tesla's autonomous driving technology is still not market-ready, and Musk's promises that ‘Optimus’ could become the greatest product ever seem increasingly unrealistic to many analysts and investors. In addition, Tesla is coming under increasing competitive pressure as both traditional automakers and emerging Chinese companies are catching up in various areas.

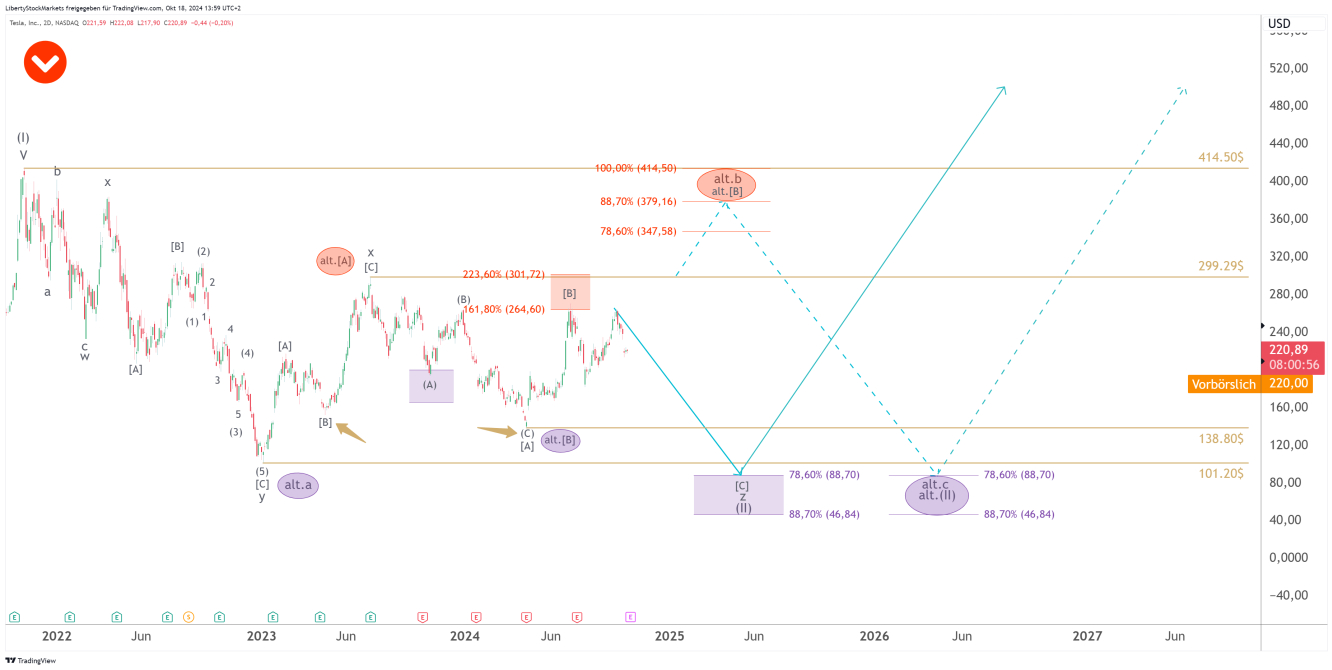

Unfortunately, these problems are also reflected in Tesla's stock chart. The stock has already experienced a very strong correction in the period from November 2021 to January 2023, dropping from an all-time high of $414.50 to $101.20.

The rise from the low of $101.20 initially appeared very promising. The stock was able to recover to $299.29. But then the chart problem occurred:

You can philosophise for hours about whether chart technique is useful or not. We have been achieving outstanding results with it for years. And maybe we can prevent one or two people from making the wrong decision.

Tesla had the chance to form a very nice multi-part upward impulse structure since the low at $101.20. Unfortunately, however, the stock fell below the low marked with a [B] at the last low (marked in the chart by [A] on the beige arrow) at $138.80, technically breaking the upward trend.

This means that Tesla is still likely to be in the big correction wave (II), whose target we see in the range of the purple box at $88.70 to $46.84. The stock can reach this target in two ways: either directly or via a detour upwards. It could well be that Tesla saves itself to or even above the previous all-time high and only collapses afterwards.

We prefer the direct route. Then the drama would be over faster and Tesla could really break free and move up again. However, it is to be feared that we will first see an extreme bull trap, which is our alternative.

Take advantage of our autumn promotion now and save 20% on all our analysis packages. Coupon code: LIBERTY. You can find the link to the website above next to my profile picture.

Carlos Tavares and Stellantis (LON:0QXR): Optimising costs at the expense of the future

While Musk is criticised for exaggerated visions, Carlos Tavares, CEO of Stellantis, faces a different problem: he has focused too much on cost reduction and profit optimisation, but neglected the company's future viability. Tavares' strategy of maximising short-term profits has led him to miss out on important future trends. This is now backfiring, particularly in the US market, where customers, especially for the Jeep brand, are no longer on board. The result was a profit warning that led to a significant drop in the share price.

Tavares, once considered a star manager, now faces the possible end of his career. His lack of innovation and lack of investment in future-oriented technologies such as electric cars or autonomous driving make Stellantis look old compared to competitors.

Shared challenges. Transformation of the automotive industry

Both companies are emblematic of the profound challenges the auto industry is currently facing. While Tesla has visionary plans but is unable to implement them in time, Stellantis suffers from an excessive fixation on short-term profits and a lack of a forward-looking strategy. Both approaches are causing the companies' market position to deteriorate and their share prices to come under pressure.

All in all, it is clear that the automotive industry is being shaken up by the transformation that is often harmlessly referred to as ‘change’. Companies not only have to optimise their traditional production methods, but also develop future technologies at the same time – a challenge that both Tesla and Stellantis are currently failing at.

Take advantage of our autumn promotion now and save 20% on all our analysis packages. Coupon code: LIBERTY. You can find the link to the website above, next to my profile picture.

Disclaimer/Risk warning:

The information provided here is for informational purposes only and does not constitute a recommendation to buy or sell. It should not be understood as an explicit or implicit assurance of a particular price development of the financial instruments mentioned or as a call to action. The purchase of securities involves risks that may lead to the total loss of the capital invested. The information provided does not replace expert investment advice tailored to individual needs. No liability or guarantee is assumed, either explicitly or implicitly, for the timeliness, accuracy, appropriateness or completeness of the information provided, nor for any financial losses. These are expressly not financial analyses, but journalistic texts. Readers who make investment decisions or carry out transactions based on the information provided here do so entirely at their own risk. The authors may hold securities of the companies/securities/shares discussed at the time of publication and therefore a conflict of interest may exist.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Tesla and Stellantis – Both in crisis, but for different reasons

Published 18/10/2024, 14:17

Tesla and Stellantis – Both in crisis, but for different reasons

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.