Taiwanese export data show the growth rate cooling in the second quarter, corroborating recent PMI survey findings of slower export gains as the global economy cooled amid further COVID-19 waves. Strong pent-up demand for electronics goods in particular bodes well for Taiwan's export growth to pick up again, but this assumes recent supply chain disruptions will ease.

Official data showed Taiwan's export orders rising some 31.1% above levels of a year ago in June, marking the sixteenth month of continuous year-on-year expansion. Although down from a peak of 49.3% in January, the annual rate of increase remains higher than anything seen since 2010.

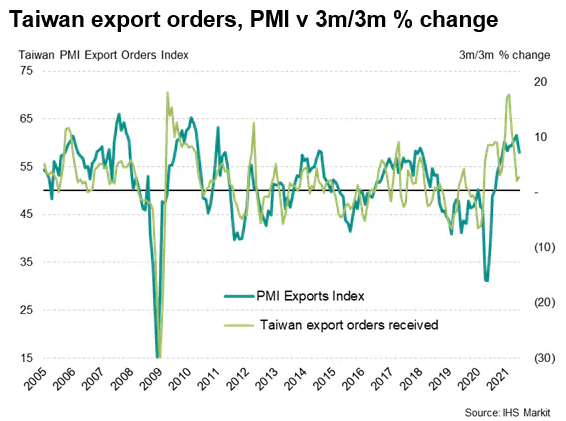

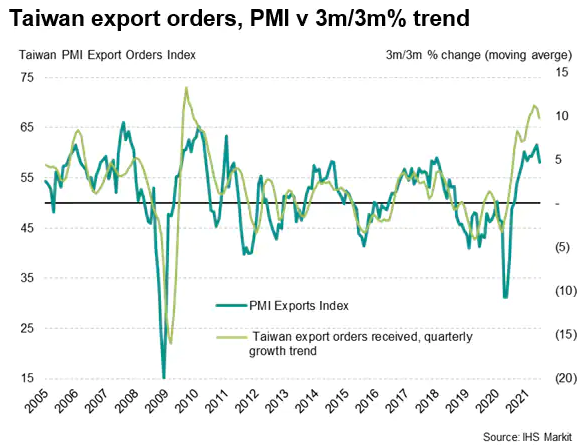

Given that the global economy was struggling in the first waves of the COVID-19 pandemic this time last year, it's perhaps not surprising that year-on-year growth has been strong in recent months. To get a more accurate picture of the current growth trend, it makes sense to look at month-on-month changes or, more preferably, three-month-on-three month changes, as the latter are usually less volatile and help identify turning points more easily.

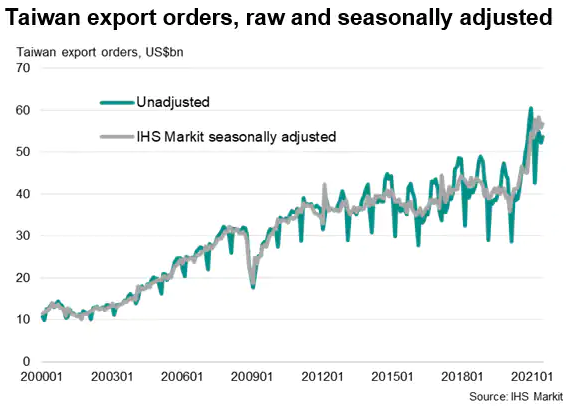

However, such comparisons are not straightforward as the published Taiwanese export orders series is not adjusted for seasonality. Hence, we've run the raw data through the X12-ARIMA program, which is widely used by statistical offices to remove seasonality, to produce a seasonally adjusted series. As can be seen, this is far less lumpy than the unadjusted raw data.

The seasonal adjustment process results in a new series which suggests export orders peaked in April 2021 at US$58.4bn, and have since eased to $56.8bn, the lowest since March - though clearly still very elevated by historical standards.

The change in the latest three months compared to the prior three months is now running at 2.74% for the second quarter, that's down from 10.8% in the first quarter. This tallies with the message from the IHS Markit PMI survey, which showed export orders growth slowing in June to the weakest since November.

This slowing of growth in the Taiwanese PMI series corresponded with a cooling of global manufacturing output growth in June, which moderated to the slowest since February.

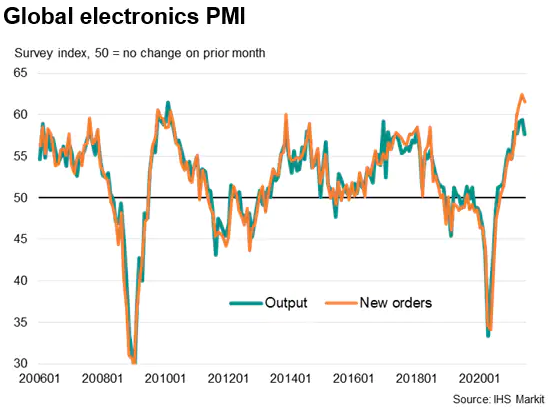

However, the good news is that the global economy continues to expand at a rate which is historically consistent with solid growth of demand for Taiwan's exports, with electronics goods and components seeing especially marked demand growth.

IHS Markit global electronics PMI in fact shows demand for electronic goods continuing to outstrip production, to a large extent due to input shortages curbing production capacity. Taiwan's electronics firms therefore look set to benefit from this developing backlog of work, assuming supply conditions can improve in coming months.

Such a supply improvement is by no means assured though, as the Delta variant continues to disrupt global supply lines, especially in Asia.

July's PMI surveys will provide updated insights into how Taiwan is faring amid the new virus waves, with data published 2nd August.

"Disclaimer: The intellectual property rights to these data provided herein are owned by or licensed to Markit Economics Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markit’s prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon.

In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers' Index™ and PMI™ are either registered trademarks of Markit Economics Limited or licensed to Markit Economics Limited. Markit is a registered trade mark of Markit Group Limited."