S&U (LON:SUS) reports that growth in lending at Advantage and Aspen has been somewhat constrained by the supply of used vehicles and houses for sale, but collections have been strong. At Advantage the level of impairment has been lower than expected, more than offsetting lower loan growth and prompting increases in our earnings estimates.

Share Price Performance

Business description

S&U’s Advantage motor finance business lends on a simple hire-purchase basis to lower- and middle-income groups who may have impaired credit records that restrict their access to mainstream products. It has c 63,000 customers. The Aspen property bridging business has been developing, following its launch in early 2017.

Trading update for May to July

S&U’s trading update for the period from 20 May to 31 July indicated that it is trading well, with profitability, collections and book debt quality ahead of expectations. Advantage motor finance has seen strong levels of applications though transactions are slightly below an ambitious target (with cautious underwriting and limitations on supply of vehicles) leaving net receivables similar to the year-end level of £247m. This has been more than offset by strong collections with bad debt and impairment levels below expectation so the divisional H122 profit is expected to show a significant increase, ahead of budget. Advantage continues to work on improvements including refining its product offering, easing online payments and enhancing social media marketing. Aspen has benefited from a strong housing market (albeit with some supply constraints) and participation in the government-backed Coronavirus Business Interruption Loan Scheme (CBILS) and net receivables have reached nearly £58m (versus over £50m in the 20 May AGM update and £18.5m a year ago). Book quality and repayments remain good. Aspen has also refined its product offering and has strengthened its underwriting team to ensure delivery of a prompt and bespoke service.

Financial position, outlook and new estimates

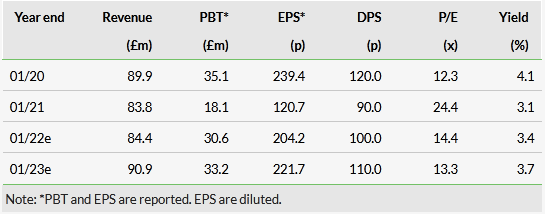

The group reported current borrowing of £116m compared with £110m at the beginning of the period and total funding facilities of £180m. Looking ahead, Advantage should benefit from a gradual return to normal levels of business, subject to the evolution of the pandemic and UK economy. Aspen may see some further CBILS benefit in the current month and underlying growth in FY23, although replacing the CBILS lending as it matures may represent a challenge. Reflecting the trading update, our EPS estimates for FY22 and FY23 are increased by 28% and 5% respectively. For further detail see page 4.

Valuation

On our new forecasts the shares are trading on prospective P/Es of 14.4x and 13.3x for FY22 and FY23 respectively and a historic yield of 3.1%. Further potential recovery and growth are supportive factors.

Background

This section provides updates on some of the indicators we monitor when assessing trends in the markets for the Advantage and Aspen businesses.

Exhibit 1 shows independent forecasts for UK GDP and unemployment as collected by the UK Treasury in July. Compared with the May data shown in our last note, the average of new GDP forecasts has shown a further increase for 2021 and is marginally lower for 2022. The mitigation provided by the vaccination programme during the current wave of COVID-19 and the ability to push ahead with the easing of restrictions are likely to have been influential in the estimate increases. Unemployment expectations have been lowered further for both years and on all the measures shown. This should be positive for Advantage, if realised, as unemployment is a key sensitivity.

Click on the PDF below to read the full report: