It’s a pretty flat though mildly positive start to trade in Europe again after a decent handover from Asia, whilst Wall Street again registered fresh all-time highs. The S&P 500 hit a record closing high, advancing 0.15% for a fourth-straight day of gains, led again by a strong showing for energy stocks as oil rallied for a second day, whilst reopening stocks also did well. Big banks were the biggest drivers of the index gains as 10-Year yields hit 1.3%. There is still room for these names to go higher. The Nasdaq also broke intraday and closing highs, rallying 0.5%. All looking like a low-volatility grind-up with the odd minor wobble gobbled up by dip-buyers, but valuations are stretched, and the indices are now roughly 10-11% away from their 200-day moving averages.

Meme stocks are back! AMC (NYSE:AMC) surged 20% and GameStop (NYSE:GME) rallied 27% on heavy volume as the frenzy made a comeback on Tuesday. Might just be to do with typically low liquidity in August leaving retail with an outsized influence.

In London, real estate and consumer cyclicals led the FTSE 100 higher with the biggest contributors to the early gains from AstraZeneca (LON:AZN) (NASDAQ:AZN) and Diageo (LON:DGE). Weir Group (LON:WEIR) and British Land (LON:BLND) were the top performers, whilst Sainsbury's (LON:SBRY) was among the worst as the glow from that takeover target rumour faded for a second day. Shares in Deliveroo (LON:ROO) tumbled 11% at the open but have recovered to trade roughly 2.5% lower. Across the Stoxx 600 travel & leisure and food & beverage stocks were the strongest in the early part of the session.

Morrisons (LON:MRW) shares held at 291p thereabouts despite the company’s pension trustees warning that both the CD&R and Fortress offers would weaken the schemes. The intervention suggests there is an increased risk of intervention by regulators whatever bid is successful. Shares are solid this morning though, suggesting there is no worry at present.

Oil is a tad weaker in early trade, with spot WTI easing back from the 100-day line at 67.88 to around 67.40. Looking for a potential MACD bullish crossover on the daily below. Crude oil inventories are expected to show a draw of 1.9m barrels. API reported Tuesday that US oil stockpiles declined by 1.6m barrels vs the draw of 2.4m barrels expected. Delta concerns seem fairly well priced in and fundamentals remain positive.

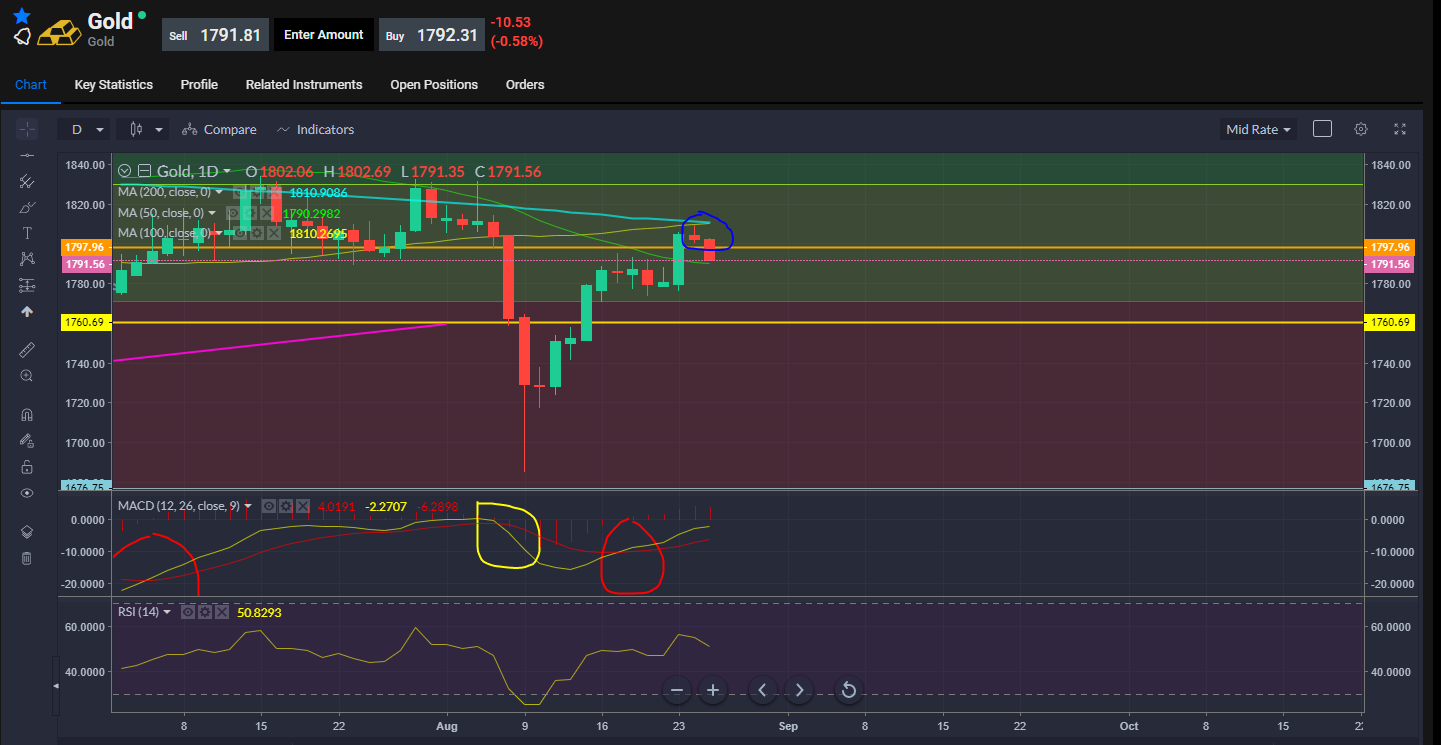

Gold just trapped between the MAs, finding support at the 50-day line after easing back from its 100-day line, where we can note it’s ready to break above the 200-day SMA.