A major tech outage has caused disruptions in banks, airports and major news outlets on Friday morning. Many of these outages are linked to Microsoft (NASDAQ:MSFT) products and a ‘software update gone bad’ seems to be the culprit. For now, it doesn’t seem to be a malicious hacking act but rather an internal issue. This has been linked to another major outage at cybersecurity firm Crowdstrike.

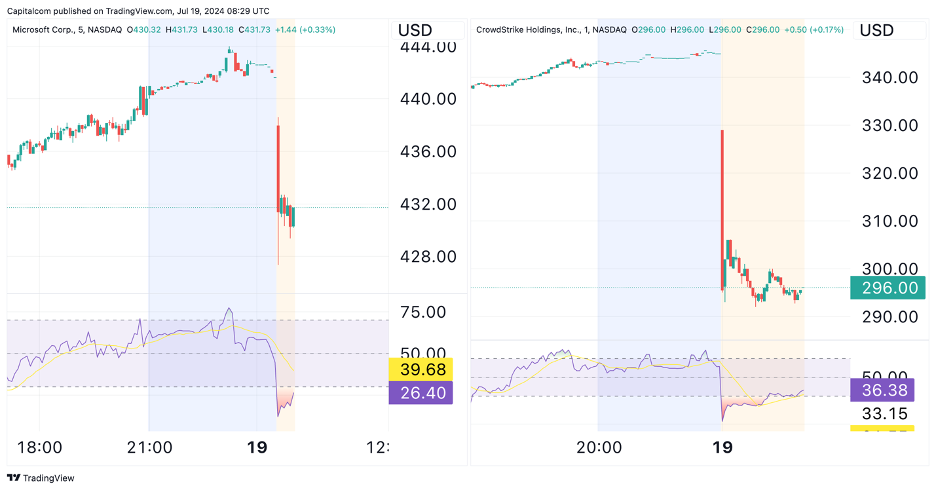

The full extent of the outage is still unknown as most of the issues are still ongoing. Both Microsoft (MSFT) and CrowdStrike Holdings (CRWD) have dropped at the start of pre-market trading in the US. The latest updates seem to suggest this is a Crowdstrike issue so the latter has taken the brunt of the fall with the stock down 15% from the close on Thursday. Microsoft dropped almost 3% at the open but has recovered some ground since then.

MSFT and CRWD 5-minute charts

Past performance is not a reliable indicator of future results.

The bearish sentiment seems to have spilt over into other parts of the stock market on Friday morning. Tech stocks are taking the brunt of the bearish pressure with NVIDIA (NASDAQ:NVDA) and Apple (NASDAQ:AAPL) dropping 1.9% and 1.4% respectively. This comes at a time when major tech stocks had already started to face increased selling pressure brought on by overbought conditions. Geopolitical concerns caused NVIDIA’s stock to face a heavy selloff on Wednesday in what many analysts called an overreaction.

Major global equity indices are also feeling the pressure. The Nasdaq 100, which is mostly tech-focused, is facing its worst weekly performance since April, dropping over 3% at the start of Friday in a pull-back that originated at the end of last week. The reversal should be of no real concern just yet given the extent of the preceeding rally and how overbought the market was. For now, it seems like a technical correction, but traders may be paying close attention to how the momentum evolves next week. The US earnings season is also in full swing, with major tech stocks expected to report in the last few days of July and the beginning of August.

Meanwhile, European indices are also struggling this week. The DAX 40 is heading for its fifth day of losses and has almost wiped out the gains of the last months. The index has failed to find support at its 100-day SMA (18,268) which has been a key level since the last pullback in mid-June. The RSI has also crossed below the 50 line indicating a shift in momentum in the short-term, so we could see further pullback towards the 18,000 mark if the selling pressure intensifies.

DAX 40 daily chart

Past performance is not a reliable indicator of future results.

Disclaimer: This is for information and learning purposes only. The information provided does not constitute investment advice nor take into account the individual financial circumstances or objectives of any investor. Any information that may be provided relating to past performance is not a reliable indicator of future results or performance. Social media channels are not relevant for UK residents.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 84.01% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

The information provided is not to be considered investment advice or investment research. Capital.com will not be liable for any losses from the use of the information provided.'

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Stock selloff continues as Microsoft and CrowdStrike outages weigh on sentiment

Published 19/07/2024, 09:52

Stock selloff continues as Microsoft and CrowdStrike outages weigh on sentiment

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.