This article was written exclusively for Investing.com

The last couple of weeks have been very volatile for the stock market, with a sharp drawdown in the S&P 500 followed by an equally sharp rebound. The culprit in all of this volatility has been rising interest rates, which have battered overvalued growth stocks, leading PE ratios to decline.

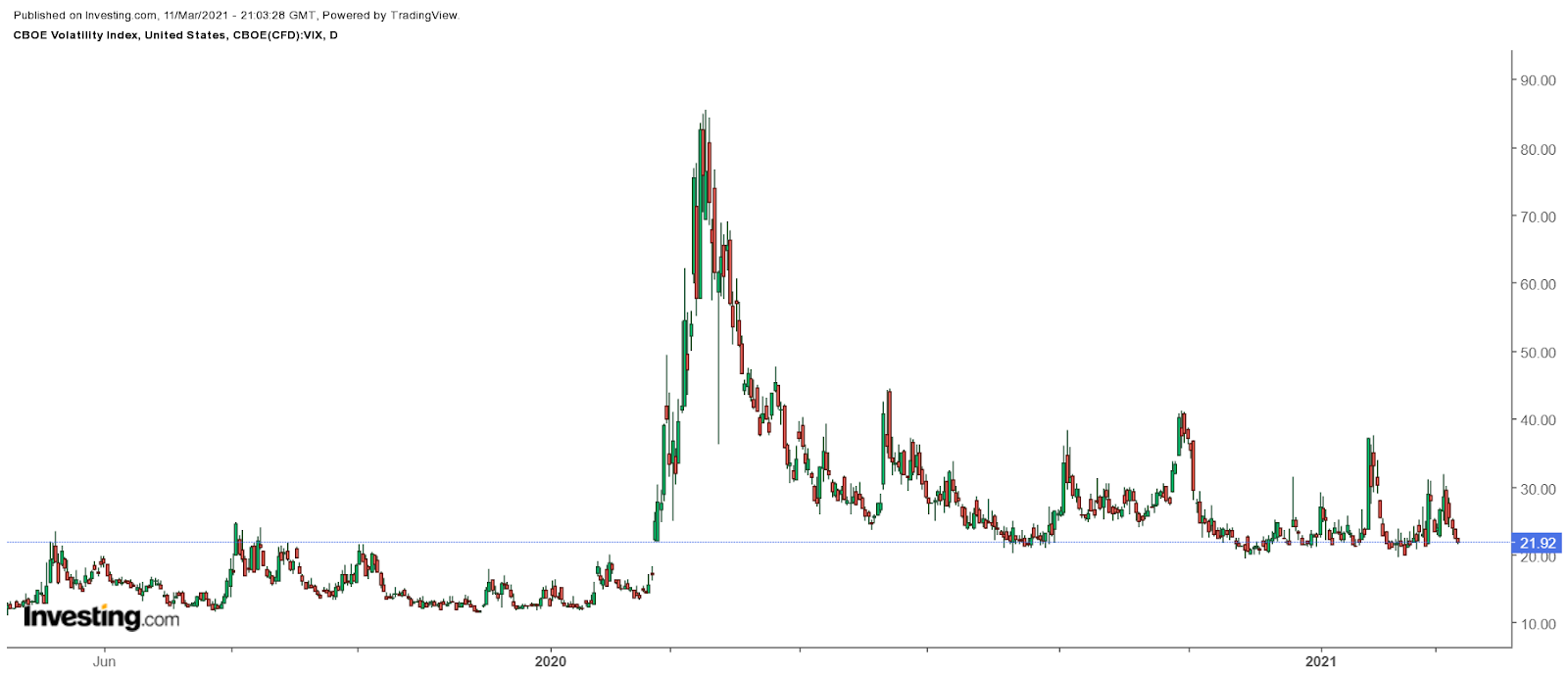

The push and pull of rising rates have left investors uncertain of what comes next. Some traders are betting that that uncertainty leads to more volatility. As a result, they have been actively betting that the VIX index spikes to much higher levels by buying call options in the volatility index.

Betting On Rising Volatility

The VIX Aug. 18 42.5 calls saw their open interest levels on Mar. 11 rise by almost 42,000 contracts. These calls were bought for more than $2.50 per contract. It would imply that the VIX will be trading at over 45 by the expiration date in the middle of August.

However, it is likely that if the VIX sees a significant spike before August, the value of the contract could rise much sooner, creating a profit well before the expiration date.

There was also a significant increase in the Apr. 21 VIX 60 calls on Mar. 11. The open interest levels rose by more than 26,000 contracts. These calls were bought for about $0.60 per contract and imply that the VIX spikes to those higher levels in just a few weeks. Additionally, on Mar. 10, the June 16 95 calls rose by more than 20,000 and were also bought.

The Lower End of the Range

It seems reasonable enough to make some bullish bets on rising volatility. The VIX has typically bottomed in this 20 to 22 region on several occasions since the March 2020 peak. The VIX has yet to even return to pre-pandemic levels, which would indicate that, at least for now, this could be the lower end of the trading range for the volatility index.

The relatively large and noticeable calls being bought indicate that some see a significant spike in volatility coming in the not too distant future. This would also suggest that the S&P 500 is likely to head lower due to their inverse relationship.

Higher Yields Will Hurt Growth

The NASDAQ 100 and specifically the technology sector and high growth areas of the stock market have been hit the hardest as rates have risen. Their valuations and PE ratios have climbed to much higher levels than sectors like industrials and energy. That has left the more richly valued growth parts of the market the most vulnerable to changes in yields in the Treasury market.

The market seems to be more unpredictable than at any other point in recent memory, with a large amount of the $1.9 trillion stimulus money likely to pour into the equity market over the next few weeks. It could quickly help to push the S&P 500 over 4,000 for the first time ever, while sending the NASDAQ back to its all-time highs. But then again, if rates continue to push higher, it seems highly likely that the stock market will need to reprice, and that makes the VIX bets even more intriguing.