Over the last several weeks, see here and here, we were looking for the S&P 500 to ideally top around $4505+/-5 based on the Elliott Wave Principle (EWP) standard Fibonacci-impulse patterns and retraces.

However, the index decided to provide us with an extension, which can always happen but cannot be known beforehand. In other terms, the markets don’t owe us anything. It is, therefore, why we always say:

“All we can do is 1) anticipate, i.e., in this case, reach the 161.80% extension, which equals the 76.40% retrace, 2) monitor, i.e., markets move beyond it, and 3) adjust, if necessary, i.e., the wave is extending to the next Fibonacci-levels.”

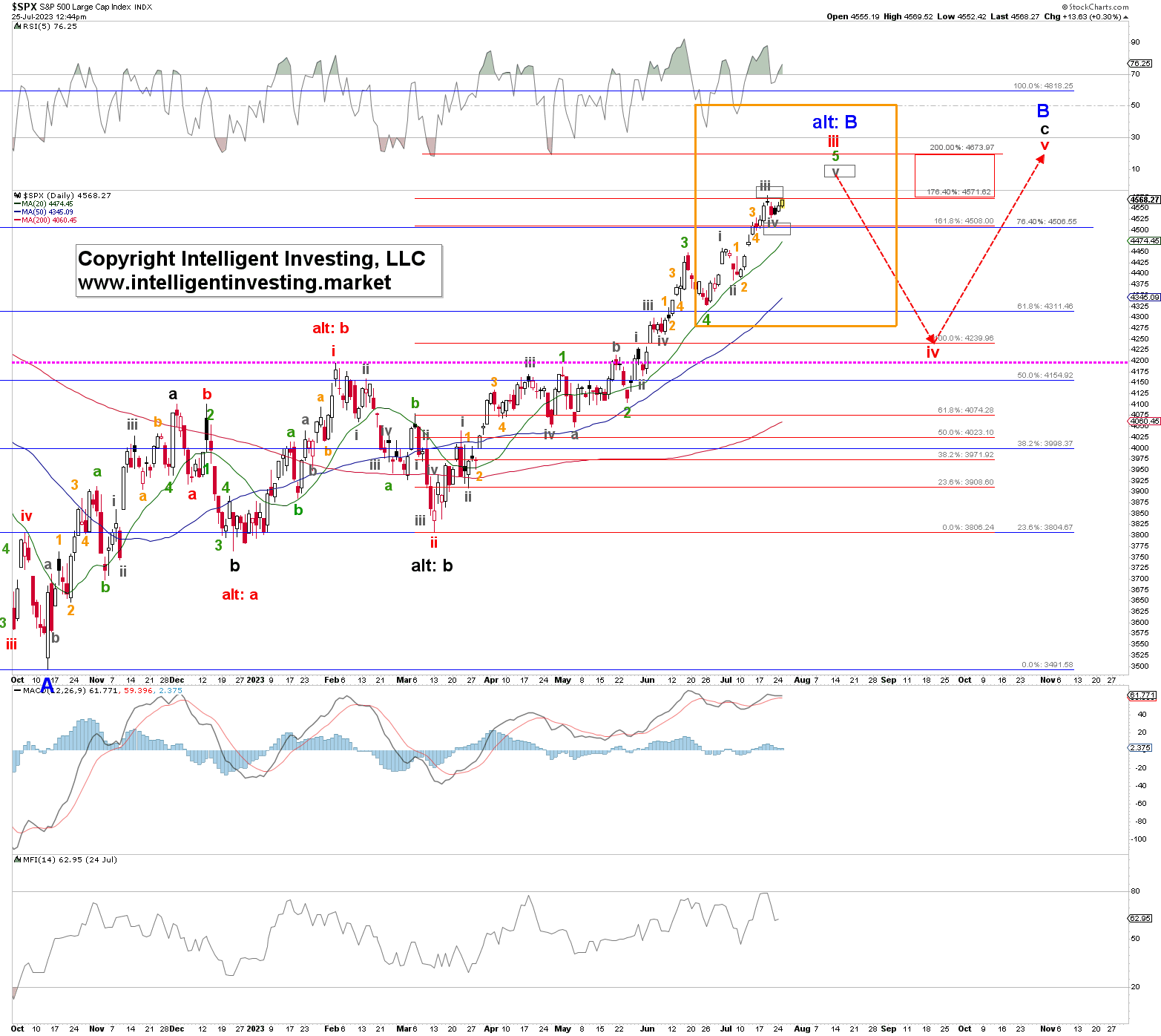

Today, our focus is on the price action highlighted in the orange box in Figure 1 below.

Figure 1

Since the June 26 low (SPX4328), labeled as green W-4, the index has been forming another subdividing impulse, green W-5 higher. The “subdividing” relates to the grey W-i, ii, iii, iv, and v. Moreover, grey W-iii comprised five smaller orange waves (W-1 to 5). Thus, last week’s high at SPX4578 was most likely grey W-iii, and last Thursday’s low at SPX4527 was grey W-iv. The index should now be in grey W-v to ideally the SPX4620-50 target zone (upper grey box). That should then complete an extended red W-iii, alternatively blue W-B.

The former means the red W-iv and -v sequence is yet to come, whereas, for the latter, the index will have to drop below the red W-i (February 2) high at SPX4195 to tell us the W-B counter-trend rally has completed and is working its way lower to the SPX2700-2900 zone. Please note these upside levels have been on our radar since October last year. See here when we were looking for the index to reach SPX4350-4650.

The S&P500 will have to drop below last Thursday’s low, followed by a move below the grey W-i high (06/30 high at $4458) to tell us the more extensive correction is already underway, and $4600+ will not be reached.