In our previous update, we anticipated using the Elliott Wave Principle (EWP) for the S&P500:

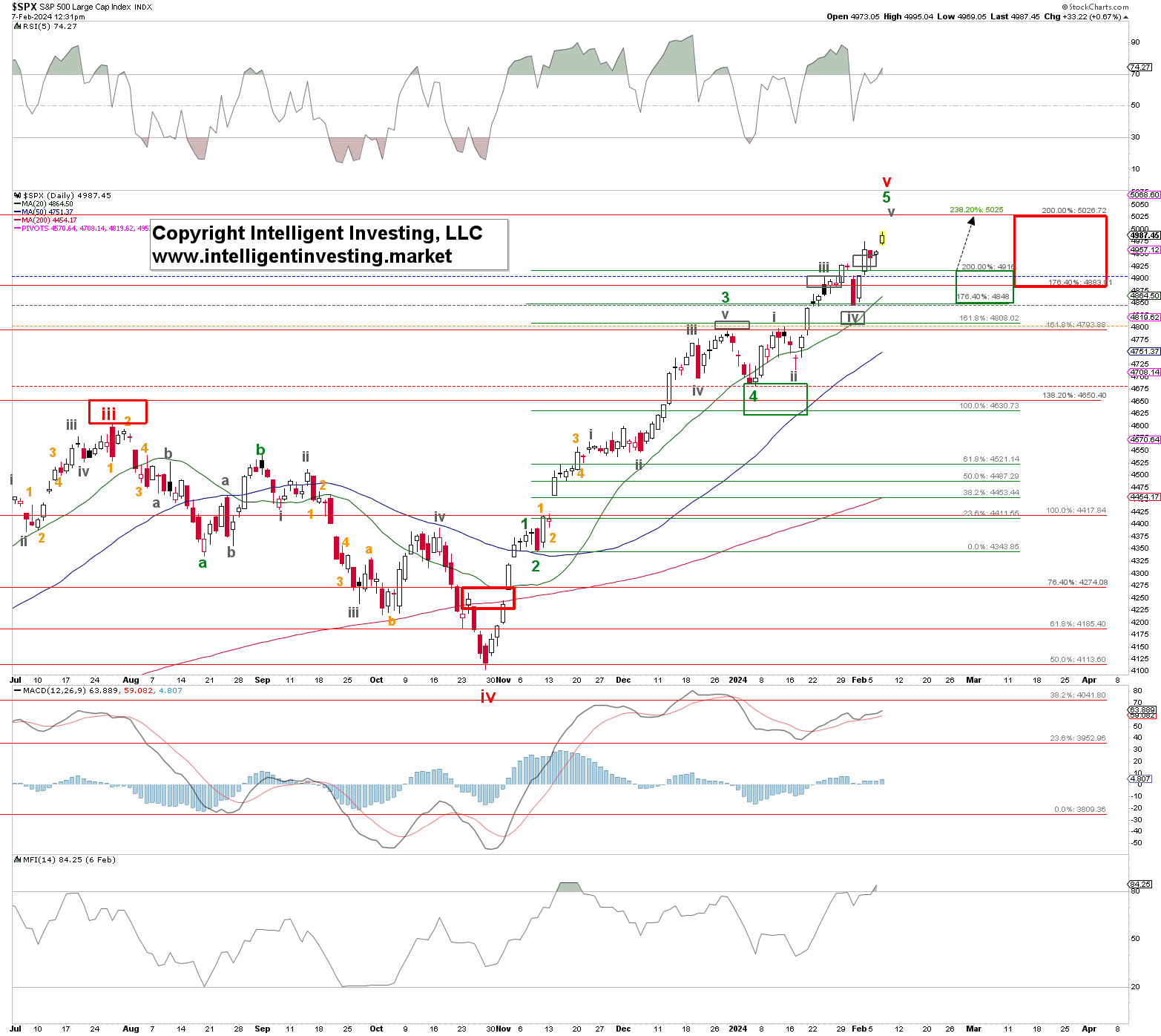

“… W-4 of W-iii to … around $4830+/-10, which is the 23.60-38.2% retracement zone of W-3. It could possibly go as low as $4805+/-5, but in uptrends, the downside often disappoints, and looking higher is preferred. Once W-4 is completed, we should see W-5 of W-iii to the ideal (grey) target zone of $4875-4900. From there, the grey W-iv and -v to ideally $4830-60 and $4915-4945 should materialize.

Please note that the ideal grey W-v target zone … falls within the [higher degree] target zone of $4883-5026 for red W-v. Thus, we have a relatively good agreement at three different wave degrees on where to expect the S&P500 to top.

Fast-forward: The index topped at $4903 on January 24 for W-3 of W-iii; bottomed that same day at $4865 for W-4 of W-iii, rallied to $4931 on January 30th for W-5 of W-iii, bottomed out at $4845 last Wednesday for W-iv, and has now rallied to $4995 for an extended W-v.

Thus, our assessment from three weeks ago unfolded well per the Fibonacci-based impulse pattern shown in Figure 1 below.

Figure 1. Daily SPX chart with detailed EWP count and technical indicators

With the extended (grey) W-v now underway, $5026 is the next logical target as it is the (red) 200% extension of red W-i, measured from the red W-ii low. It’s a very common 5th-wave target level. See Figure 2 below.

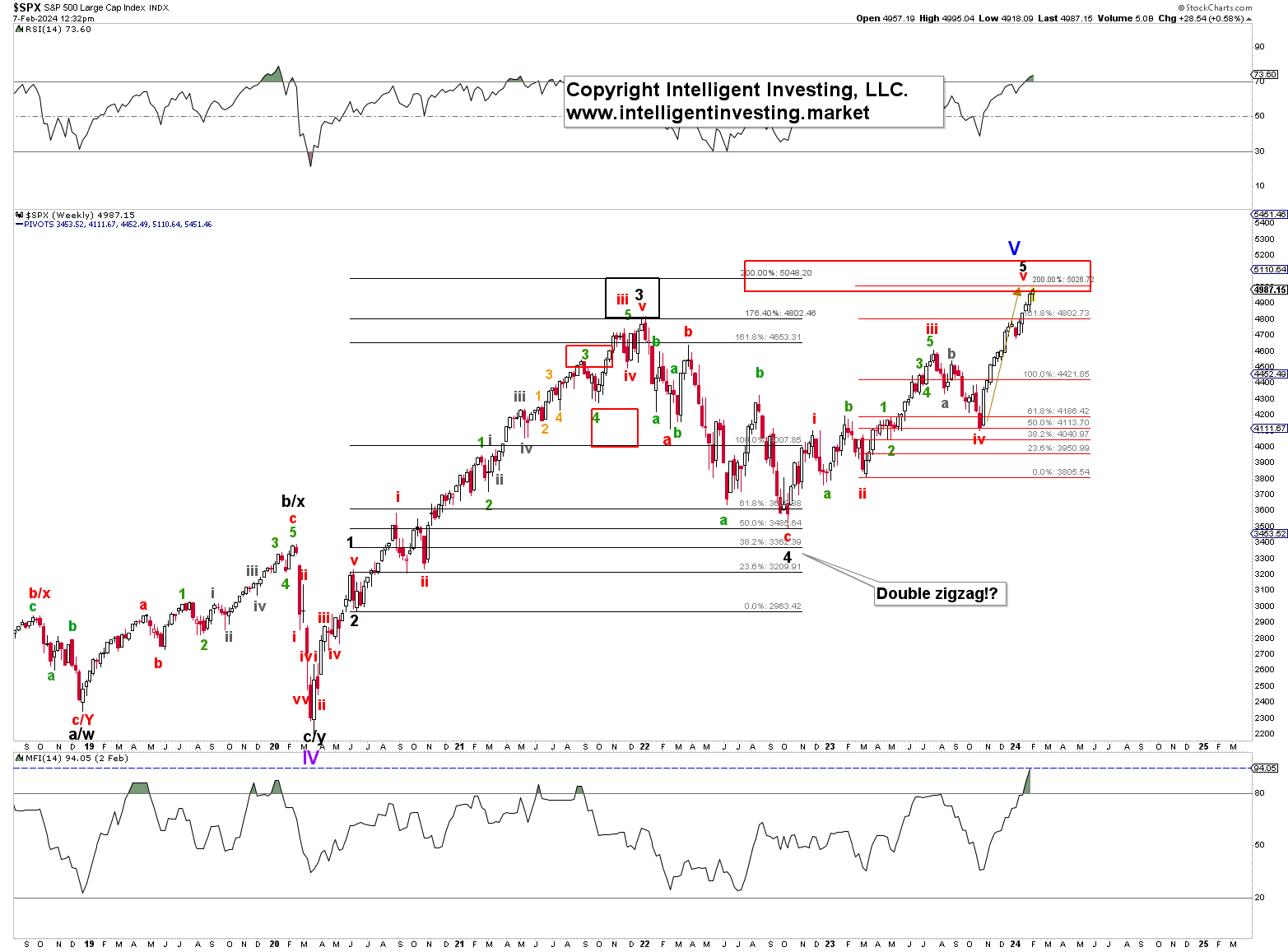

Besides, since we have re-labeled the rally from the October 2022 low to a 5th wave (black W-5) instead of a B-wave, we see that the (black) 200% extension of the black W-1, measured from the black W-2 to the low resides at $5046.

Figure 2. Weekly SPX chart with detailed EWP count and technical indicators

The now 15-week long rally from the October 2022 low has essentially been straight up: there’s only been one down week since. In EWP terms, it’s called a non-subdividing wave, typical for a 5th wave. For example, compare it with the red W-iii, which consists of five precise smaller (green) waves.

Moreover, the lower panel in Figure 2 shows the 14-week Money Flow Indicator (MFI14), which last week registered its 2nd highest reading (94.05) since data became available 42 years ago. Even readings above 92 are extremely rare. They happened only in 1995, 1997, 1998, 2011, 2012, 2014, and 2018.

Here, we want to look only at the MFI14>92 occasions after the 2009 Bear market to compare apples to apples. In 2011, the index gained ~2% over the next several weeks and lost 21% eight months later. In 2012, the index lost 11% three months later. In 2014, the index lost 5% a few weeks later. Regained all losses but then lost 10% six months after the extreme MFI14 reading.

In December 2018, the index gained ~8% over the next few weeks, lost 10% in the following two weeks, rallied 10% above the price level at which the MFI14 was >92, only to lose 20% into the end of 2019. The net gain in one year: -12%.

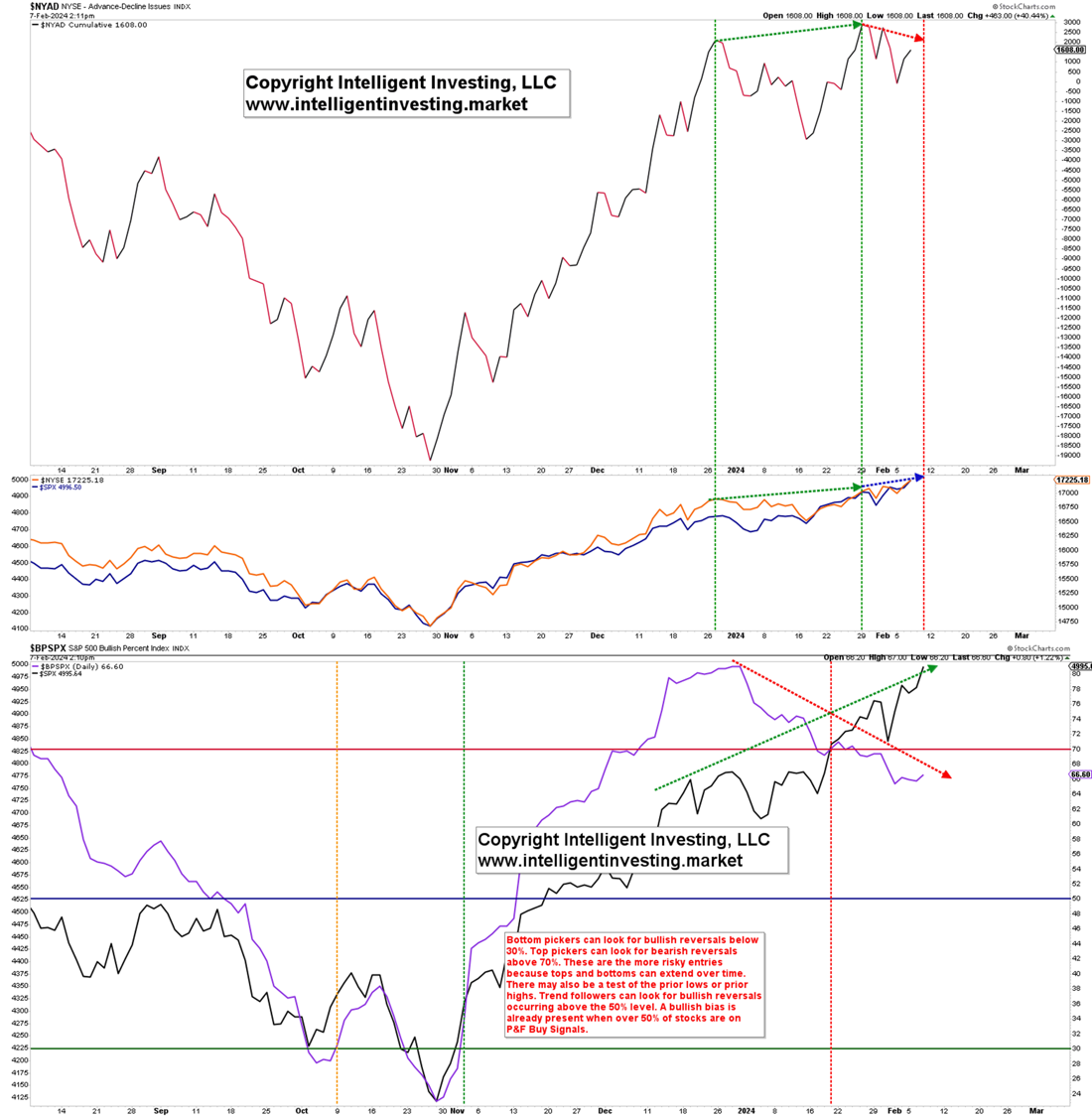

Figure 3. Daily Cumulative NYSE A/D line and the Bullish Percent Index for the S&P500

Lastly, a look at several market breadth indicators can also help us assess if the current rally has legs or not. Here we look at the cumulative A/D line for the broader NYSE index (NYAD) and the Bullish Percent Index for the S&P500 (BPI-SPX). The former tells us how many individual stocks that make up the index are on a bullish signal, whereas the latter tells us if the indexes are rising on more advancing issues or not.

Since late January, the NYAD has been making lower highs and lower lows. This means the stock markets are advancing while more individual stocks are starting to decline. Besides, the BPI-SPX already topped in December last year gave a sell signal in mid-January and has continued to make lower lows and lower highs since.

However, the indexes have marched higher. This means the stock markets are advancing while fewer individual stocks’ charts are Bullish.

Thus, while we are aware that

- price is always the final arbiter, and

- (negative) divergence is only divergence until it is not,

based on the EWP, Fibonacci-extension levels, extremely overbought conditions, and currently deteriorating underlying market breadth, the most likely conclusion is that a significant market top is brewing.