Recently, we have seen a 10% drop in the S&P 500. And, there is no shortage of reasons that the financial media pundits have ascribed to that decline. While many point to the bad jobs data, we have to at least be honest in recognizing that the market began this decline well before those poor jobs numbers were announced. So, we can easily dismiss that superficial reason.

But, the most common reason for the market decline to which the pundits point was the unwinding of the yen carry trade. I counted at least 3 articles on Seeking Alpha alone with that reason in their title, with at least another 5 or 6 proffering that reason within the heart of their articles.

And, I am sure that many of you read at least one of those articles and agreed with their reasoning. This is quite typical of most investors. If they hear something repeated in several places, then they assume that it must be the accurate cause of the market move.

Yet, how many of you did any research into whether this was accurate? Or did you simply accept it as gospel and move on? The great majority of you simply accepted it as gospel, and some of you probably even related that reason in conversation to your colleagues or friends, with great assurance as to the accuracy of that “fact.”

Well, I hate to provide a dose of reality into your world of “belief,” but it was not the reason for the market decline.

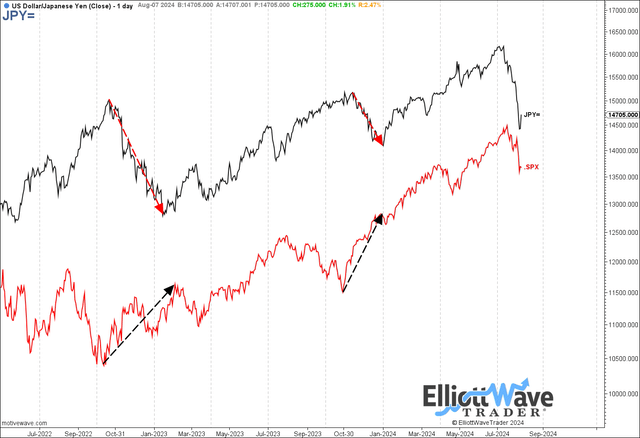

Let’s look at a chart that compares the action of the “carry trade” to the SPX. And, I want to thank Garrett Patten, one of our lead analysts at Elliottwavetrader, who put this chart together for me:

As you can see, we have 3 instances of the Japanese Yen seeing sizeable declines over the last two years. Yet, in two of those three instances, the SPX was rallying opposite of the Yen decline. So, based on this chart, do you think it would be accurate to ascribe the decline we have recently seen to the “unwinding of the yen carry trade?” Or, would it be more accurately described as coincidental?

But, in truth, do you really think anyone cares? Do you think if you show this chart to all those authors who proposed this as the cause of the decline they will retract their “analysis” or even write another article explaining that they were wrong? I highly doubt it.

You see, there is so much misinformation being published throughout the financial media which is accepted as truth by most readers. And, they continue to regurgitate this reason in their conversations with others, and then it eventually becomes ubiquitous as the accepted reason for how the market moves.

So, I am again going to remind you of the wise words of Robert Prechter from his seminal book The Socionomic Theory of Finance (a book which I strongly urge each and every investor to read):

“Observers’ job, as they see it, is simply to identify which external events caused whatever price changes occur. When news seems to coincide sensibly with market movement, they presume a causal relationship. When news doesn’t fit, they attempt to devise a cause-and-effect structure to make it fit. When they cannot even devise a plausible way to twist the news into justifying market action, they chalk up the market moves to “psychology,” which means that, despite a plethora of news and numerous inventive ways to interpret it, their imaginations aren’t prodigious enough to concoct a credible causal story.

Most of the time it is easy for observers to believe in news causality. Financial markets fluctuate constantly, and news comes out constantly, and sometimes the two elements coincide well enough to reinforce commentators’ mental bias towards mechanical cause and effect. When news and the market fail to coincide, they shrug and disregard the inconsistency. Those operating under the mechanics paradigm in finance never seem to see or care that these glaring anomalies exist.”

So, I strongly urge you to take these words to heart, internalize them, and then apply them to every article you read from this point forth. In the meantime, those who have read me through the years, know that I have been quite consistent in my views that market sentiment is the primary driver of the stock market as a whole.

Moreover, if you have been following me for many years, you would know that my long-term target for the top to this bull market was 5350-6000SPX; a target that I presented well over 4 years ago. However, due to the depth of the pullback we saw in 2021, I was questioning whether we would be able to reach that target, and I began to approach the market in a step-by-step approach.

And, with the market not giving us the setup for which I was watching which would indicate that the top of the market was in place, I continued to look higher to our next targets. And, once we got to the 5350SPX region, I became very conservative and started raising cash.

At this point, the markets are again potentially setting up in a crash-type structure. Over the coming two or three weeks, we will have a much better idea if the market is going to follow through on that structure, thereby signaling that a long-term bear market has likely begun, or if, instead, it will be presenting us with a structure that is next pointing to the 5840SPX region for a potential final top to this long-term bull market.