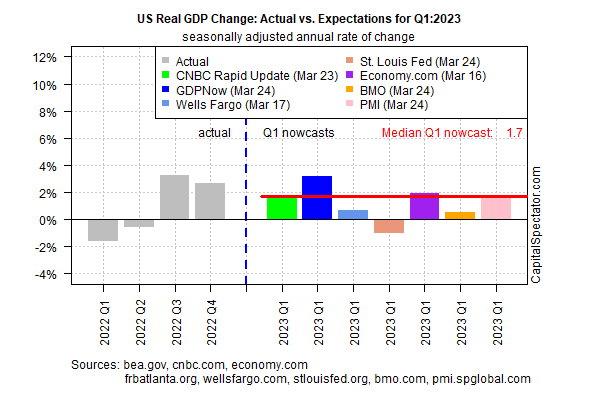

Despite warning signs flashing from several indicators, the U.S. economy is expected to report moderate growth in next month’s “advance” GDP report for the first quarter, based on a set of nowcasts compiled by CapitalSpectator.com.

The median estimate for Q1 firmed up to a 1.7% gain in today’s update (seasonally adjusted annual rate). Although the projection marks a slowdown from the 2.7% increase reported for Q4, today’s revision suggests that the economy will continue to skirt a recession in the first three months of the year.

Notably, today’s revised median nowcast firmed up from the weak 0.5% estimate posted in the previous update.

Optimists will focus on the strongest nowcast in the chart above: the Atlanta Fed’s GDPNow model, which is projecting a 3.2% increase in Q1 output for the upcoming release on April 27. If correct, this estimate would mark an acceleration in output vs. last year’s final quarter.

Overall, today’s median nowcast suggests that the economy remains resilient after a year of relatively sharp, rapid interest-rate hikes by the Federal Reserve. In turn, the resilience implies that the case for pausing, much less cutting, interest rates is weaker than some market indicators suggest.

“We don’t see rate cuts this year – that’s the old playbook when central banks would rush to rescue the economy as recession hit,” BlackRock advised in a note for clients. “Now they’re causing the recession to fight sticky inflation and that makes rate cuts unlikely, in our view.”

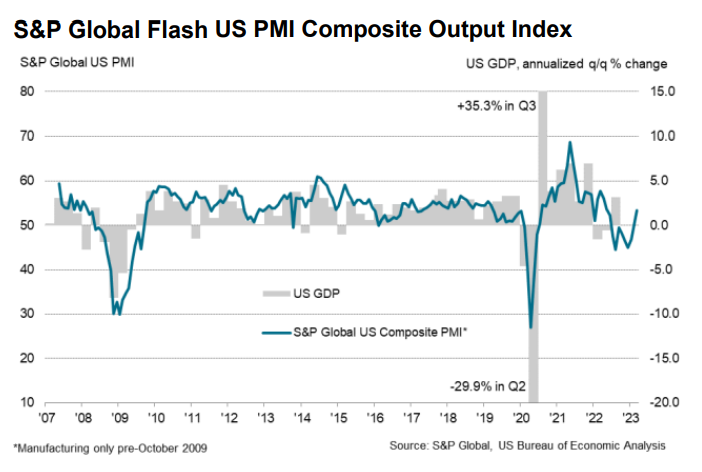

Meanwhile, “March has so far witnessed an encouraging resurgence of economic growth, with the business surveys indicating an acceleration of output to the fastest since May of last year,” says Chris Williamson, chief business economist at S&P Global, which last week revised its U.S. Composite PMI, a GDP proxy. PMI’s implied growth for U.S. output in Q1 is 1.7%, based on analytics run by CapitalSpectator.com.

Although the Q1 GDP outlook remains relatively upbeat, a number of indicators are still signaling elevated recession risk. An inverted Treasury yield curve, for example, continues to forecast economic contraction for the near term.

Another headwind is the expected pullback in lending, due to the recent bank turmoil after the collapse of Silicon Valley Bank. Minneapolis Fed President Neel Kashkari earlier this week said that elevated stress in the banking sector raises recession risk for the U.S.

The question is when or if these and other risk factors will take a bite out of GDP nowcasts.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI