By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

The Federal Reserve is gearing up to raise interest rates for the first time in 2017 and instead rising, U.S. yields fell, dragging USD/JPY down with it. However the dollar did not fall against other major currencies -- instead it appreciated versus EUR, GBP, AUD, NZD and CAD. This price action tells us tha tTuesday’s move in bonds and USD/JPY is a function of profit taking ahead of the most important event risk of the month and the quarter. The market has completely priced in a rate hike on Wednesday and the only surprise would be if the Federal Reserve decided to keep rates steady, which is highly unlikely. Central bankers hate big moves and if they felt that the market was mispricing expectations for tightening, someone would have said something by now. Instead, we heard a chorus of U.S. policymakers who indicated that March is the right time for a hike. Of course none of this is surprising and our readers are primarily interested in whether they should trade or fade FOMC.

Fed fund futures are currently pricing in a 60% chance of a second hike in June and 80% chance of a hike by September. This tells us that investors are not convinced a second round of tightening will come quickly and its up to Janet Yellen to confirm or reject these expectations. If Yellen is hawkish, suggesting the Fed needs to be vigilant and emphasizes the need for continued to tightening, the trade is follow the price action and buy dollars post FOMC. However if she sounds more balanced and says they prefer to wait and see how the economy responds to tightening or for more details on the fiscal stimulus plan, the trade will be to fade the rate hike. Any ambiguity from Yellen would be interpreted as negative for USD/JPY. For the currency pair to sustain its gains, we need a clear commitment from Yellen to further tightening.

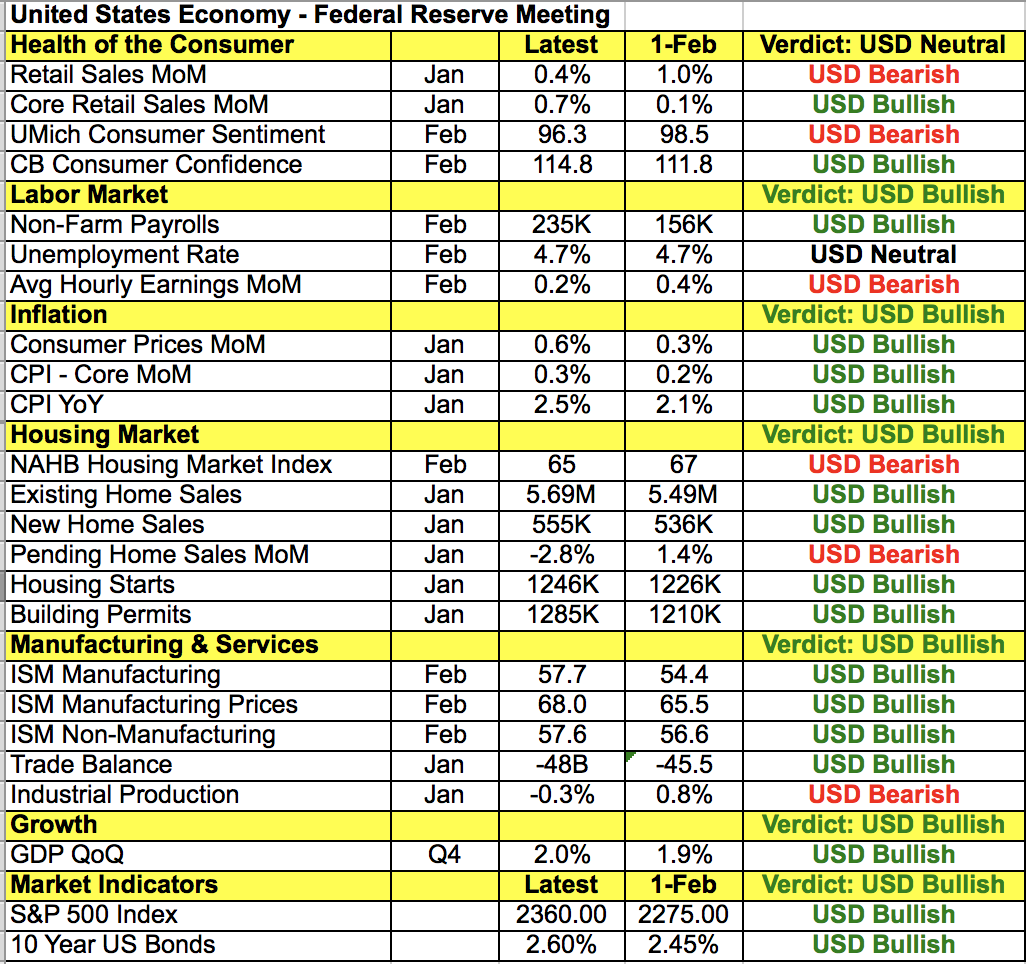

According to the table below, there has been widespread improvements in the U.S. economy since the last meeting with activity increasing in the service and manufacturing sectors, inflation on the rise, core spending growing, sentiment holding firm and housing market activity resilient despite higher mortgage rates. Stocks also climbed to fresh record highs over the past month thanks in part to President Trump’s infrastructure and security spending plans. In light of all this, we think Janet Yellen will remain hawkish and her positive views will drive USD/JPY toward 116.

Tuesday's worst-performing currency was sterling, which sold off against all of the major currencies. After the House of Commons voted to overturn the amendments to the Brexit bill, the bill was sent back to the House of Lords who backed down on the amendment and passed a bill that would allow Prime Minister May to trigger Article 50, formalizing the U.K.’s divorce from the European Union. According to the PM, they are on track to trigger the article by the end of March and more likely next week. When it happens, traders can expect a sharp but brief knee jerk breakdown in GBP. It won’t be long before investors realize that it will be months before the terms of exit are agreed to with the E.U. and years before an official exit happens. In the meantime, U.K. labor data is scheduled for release Wednesday and while the manufacturing, service and construction sectors all reported steady job growth, last month’s strong report may be difficult to beat.

The euro remained under pressure ahead of Netherland’s general election, which could influence elections in other parts of Europe. The anti-immigration, anti-EU parties have gained popularity across Europe and an unexpected victory by the far right party would spark fear of a similar victory in France. Thankfully it doesn’t seem likely but politics continue to drive uncertainty for the euro. French Presidential candidate Fillon was put under formal investigation today and it is only a matter of time before he withdraws. Unfortunately his problems have boosted the popularity of Marine Le Pen going into the first round of French elections next month. Data from the Eurozone was mixed with industrial production rising less than expected and German investor confidence falling short of forecast. However expectations for Eurozone growth rose sharply last month, which could be a reflection of the recent improvements in the region’s economy.

All 3 commodity currencies traded lower against the greenback. In the early part of the U.S. session, USD/CAD raced to a high of 1.3495 on the back of falling oil prices but gave up its gains as the greenback retreated. According to the latest economic report, house prices increased in Feb. In Australia business confidence and conditions fell sharply in March. Chinese data was mixed with retail sales growth slowing and industrial production growth accelerating. New Zealand current account numbers were scheduled for release Tuesday evening followed by Australia’s consumer confidence report and Canada’s existing home sales.