“Well, here’s another nice mess you’ve gotten me into!” These immortal words of Laurel and Hardy come to mind as we are gripped by the financial earthquakes caused by the new UK government’s tax-cutting and a smaller state revolution – and the extremely violent reaction to it. And that’s just from her supporters! Conventional economists and much of the public are up in arms against it – and that is one solid reason it has value.

But imagine – a public revulsion to the prospect of paying less tax! My, my, we truly live in an Alice in Wonderland world (again).

Conventional economists (all of whom have taken the usual courses and degrees from all of the universities and who own straight edge rulers) have decried the move to cut taxes and call it madness to do so in the face of rising interest rates and bond yields with surging government borrowing. It goes against all the usual rules of Economics 101.

But this groupthink has dominated UK economic policy for decades – and where has it got us? It has got us to a permanently falling pound (from 2.12 in 2007 to the recent 1.03 -a steady decline of 50% in 15 years)) and depressed growth and productivity rates based on an ever higher taxed economy (now reaching WW2 levels). Oh, and the most indebted populace in history.

To my mind, Truss and Co cannot do much worse than that performance! And as they alone in power have seen the penny drop (finally) they have the courage to try something radically new.

Certainly, market sentiment must have temporarily reached the sub-basement this week with sterling and gilts hard down – but after very lengthy bear moves in what to me looks very much like a (temporary?) selling climax. Everyone was short sterling going into Monday but just as hedge funds (proxy for managed speculative money) had been adding to net shorts, we saw a sharp reversal with sterling up to 1.12 today up from 1.03 low.

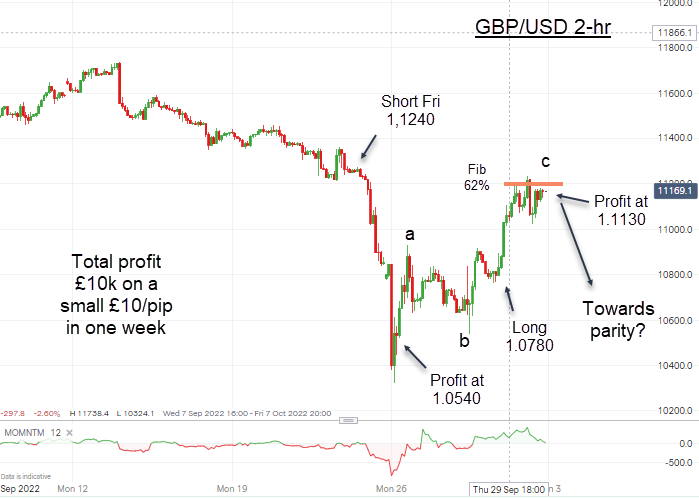

Luckily, I managed to capture the down part and the up part for VIP Traders Club members for stunning profits. In fact, we captured a total of well over 10 cents in GBP/USD in two trades this week alone. Here is the cable campaign (we also made good gains in EUR/USD):

But if there is one lesson from this week’s market action it is this: Conventional economic logic is a poor basis to forecast financial markets – or to make money trading them.

By the time everyone agrees stocks and the dollar have only one way to go (down and up), they go and do something else. That is the seemingly perverse law of the markets – and knowing that, we can avoid the very costly mistakes those who follow the usual pundits make. We can even profit handsomely.

Incidentally, there is a certain very well respected (at least by himself) Ambrose Evans-Pritchard in the Telegraph who writes on these matters. I have found that when he vehemently expresses a very strong opinion, that is usually a wonderful time to trade against him. He is a terrific contrary indicator – at least on a trading basis.

The big mistake conventional analysts make is this: Financial markets do not obey the same laws as economic markets (like cars, shoes, bread). They march to the drum of sentiment and its changes. They do not obey the same laws as physics such as action-reaction. And market movements are patterned in waves according to the Elliott wave theory.

One major difference is this: When stocks drop in price, selling usually increases and buying drops away. But when shoes drop in price, they are on sale and they fly off the shelves.

One fatal mistake conventional economists make is this: They believe that if you pull this lever, you will get that result. Ban fossil fuel development and suddenly cheap electricity for all will be provided by ‘free’ wind and sun.

I am old enough to remember the dawn of the nuclear power age when they said the same thing – almost fee limitless power for the nation. Hubris indeed. Hah!

The violent sell-off Monday is why I suggested that the huge spike in sterling and gilts on Monday was likely a selling climax – and a great reason to buy. Everyone else esp in the MSM were shouting gloom and doom with dollar parity near-certain with mass house repossessions round the corner. Yes, it took guts to swim against the crowd, but if you want to make real money, there are times such as these when the downside is limited with massive upside potential. The reward/risk ratios were looking very juicy and trades irresistible.

One other Top Tip – avoid having bull/bear opinions for the short to medium term. Trade the markets as you see them on the charts.

So now the armies of shorts have a problem. Do they cover shorts forcing markets ever higher or do they double up and sell into the rallies? That is not a problem I wish to have when almost everyone is on your side – my main problem is when to take profits – a much more relaxing affair.

As a matter of fact, this market and political turmoil is confirming the comment I made to members when the Queen died three weeks ago. I wrote then that her death likely marked a turning point not just in the monarchy, but in financial matters as well. And the certainties of the past would make way for new realities markedly different from those of the past. It was as if the 20th Century had finally died and a brave new world of the 21st was dawning – with a bang.

Examples of major disruptions to the old order abound, such as the idea of being a buy-to-let investor and landlord as replacement for a pension is now very suddenly not such a no-brainer (see below).

But I believe the slight relief in sterling and gilts towards the end of the week will be short-lived. Total chaos is growing in UK politics with reports of some Tories conspiring with the opposition Labour to try to de-throne Truss & Co. who are attempting the impossible – taking candy from a baby with no tears.

What a very sad commentary that a proposal to cut taxes should meet with such universal opposition. In much more laissez faire days when the state pretty much left citizens and businesses get on with what they wanted to do with minimum interference (and no box ticking), we had the growth-producing Victorians and their aftermath.

But since WW2 with the introduction of the welfare state, the need (and desire) of a citizen to actually work and provide for their family has been gradually leached out so that today, there are more people on a bewildering range of benefits than not. Why work when you can get the state to pay you m (i.e. taxpayers)ore than if you had a job?

That has, over the past few decades, nurtured almost universal feelings of entitlement where the state must provide all our needs if we can’t or won’t do it ourselves. That era is now coming to abumpy end as the Great Bear Market gathers pace.

That degree of state largesse worked when the state borrowed ever more at zero rates to pay these benefits and support zombie schemes, but now the tide has turned. Interest rates are moving up sharply and such largesse cannot be maintained. The state must be cut but just like my baby above, squeals of protest are drowning out the supporters.

Yes, the road to hell is paved with good intentions. The ‘safety net’ of the 1940s has morphed into lifestyle choices for many. Combine that with the huge increase in overweight/sedentary and junk food fed people and you have an NHS in a growing crisis. Nurses are leaving in droves while demand multiplies. How much longer can this continue?

As it stands, the political pressure on Truss to reverse her policy is being strongly mounted and will grow. There is even great doubt she can survive for much longer. There are just too many who suck at the state’s teat.

But what miracle worker could replace her with policies that are politically popular? Will the proposed tax cuts be reversed and government spending set to maintain its growth path ever upwards? Sadly, this is a recipe for higher price inflation, higher rates, weaker sterling and a house price crash along with the economy. I am afraid they are damned if they do and damned if they don’t.

But the die is cast. We will not see zero rates again for a very long time and we are entering a deflationary cycle with devastating effects into 2023.

A major reversal in housing market is coming

Last week, we had the first signs property sales and house prices are suddenly in decline. Today’s headline tells it all: “The dam has burst: property chaos as buyers pull out and sellers slash asking prices” With mortgage rates zooming higher, this is the inevitable result when prices have reached amazing heights and price-to-earnings ratios have likewise reached dizzying heights.

Until a week or so ago, the housing market was buoyant. But the ferocity of the overnight change in sentiment is a mark of the coming deflation and crash to come.

Now, as real incomes are in decline, the price-to-earnings ratios will fall with price declines magnified by the existing withdrawal of many mortgage products and a reduction in what the banks are prepared to lend.

Also, it is interesting that the top of the housing market should arrive months after that in shares. This follows the normal pattern where stocks top out first, followed by the other assets as they slowly realise the game is up and can fight the growing bearish forces no longer. The buy and sell decisions on housing is a slow grinding process, whereas stocks can be bought and sold instantly a click of a mouse.

My outlook for stocks in October

September was a down month – as I forecast – but October should be even more so. Many stock market crashes have occurred this month and odds are good we shall see one this year.

We have reached the stage of the large wave 3 of 3 of 3 down where the declines should accelerate. We had some down gaps open up recently based on the New York cash open. These are significant as it shows the thinking of the market in the period between the daily close and the next day opening. An accumulation of sell orders will be translated into an opening down gap.

We should now start to see more of them. They then become targets later for when it has declined and then rallied back. On our platforms, we have the 24/7 Globex trading and do not show these gaps.

Last week’s bounce was puny of only 1,000 pips and it looks like another leg down next week.

A gentle reminder– VIP Traders Club members should keep at least a core short Dow position (among others) in the back of your sock drawer taken much higher up first from the January 5 ATH and lately from the August high. My first main target is in the 26,000 region perhaps by Christmas.