A look at how markets have performed following a US 10-2 yield curve inversion.

Unless you’ve been living under a rock, you may have heard a thing or two about the yield curve inverting in the news recently. In fact, you probably heard the several months lead-up to its potential too. Well, the yield curve has indeed inverted and sparked a fresh round of calls for a recession sometime over the next 20 or so months (although estimates do vary in the timing).

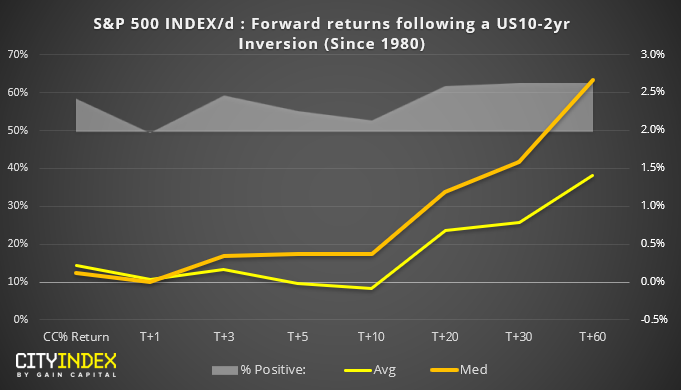

As my colleague Joe Perry pointed out, regardless of whether a session materializes, equities have tended to bounce after such a signal. So, we’ll start with backing this up with a chart and see how other markets reacted following an inverted 10-2 yr yield curve.

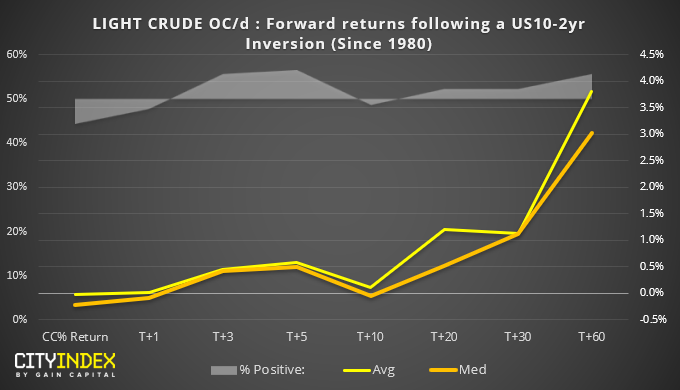

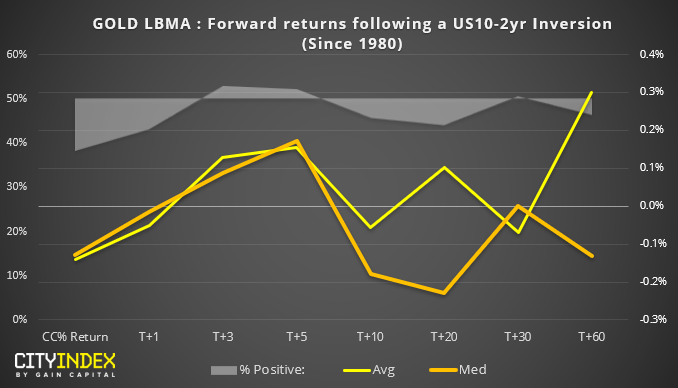

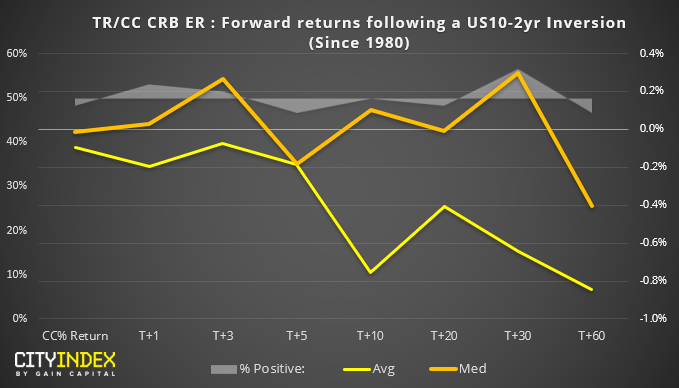

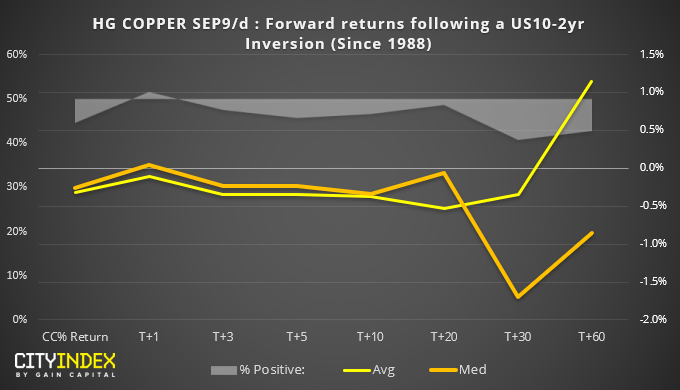

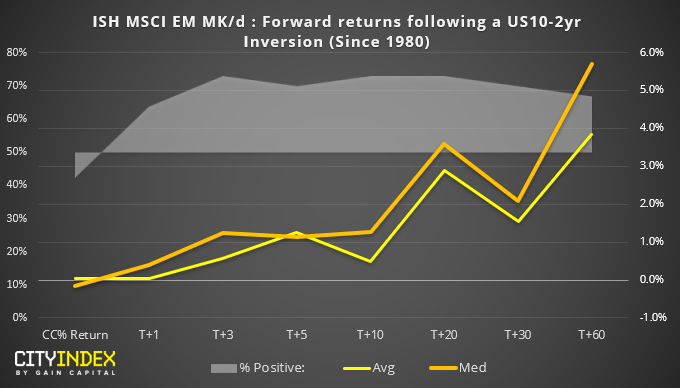

Basically, an inverted yield curve has been positive for stocks overallMedian prices (i.e., typically) trend higher between 0-3 months after the yield curve invertedInterestingly, on average the S&P500 was trading lower from 1-2 weeks out but, overall trends higher as it moves towards +3 monthsWith exception to the next day, average returns were positive over 50% of timeSomewhat surprisingly, appears to show an even clearer trend than the S&P500Average returns are positive (and over 50% of the time) around the first week and become increasingly more bullish from 1 to 3 months after the inversionIt’s good to see average and median prices moving in lockstep, as it suggests the average returns are not powered by a few outliersAnother surprise, this time from gold, where a trend is hard to decipherMy expectations of a bullish trend have not been metWith median prices negative one month after, with the average positive, there’s clearly some outliers here to push the average upOverall, gold’s pattern it too difficult to decipher to read much into it, surrounding inversions over this time horizonTaking a broader look at commodities (using the CRB Core Commodity Index) shows that, overall, commodities come under pressureThat said, the trend is clearer on bearish average forward returns (outliers weigh it down) whilst median (i.e., typical) prices meander between bullish and bearishWhilst we could argue broad commodity prices are bearish on average, the trend is not as compelling as seen on S&P500 or prices tend to come under pressure for the month following the yield curve inversionMedian prices remain bearish for up to 3-month, yet peak around six weeks after the signalAverage returns are notable bullish three months out, although likely fueled by outliers as median remains bearishOn average, forward returns are bearish over 50% of the time from T+3 onwardsIt appears that emerging markets (EEM EFT) love a good yield curve inversion.What’s compelling about this chart is how average and forward returns are clearly trending higher (and increasingly so towards +3 months) whilst also over 50% of the time (excluding the day of the signalHowever… it should also be noted that the technicals for EEM ETF do not currently align with this bullish view, so we’d urge to wait for a basing pattern to be confirmed before assuming a low might be in placeAnd this data set is only formed 2005 (so a smaller sample size means its statistical significance may be less reliable)"Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation, and needs of any particular recipient.

Any references to historical price movements or levels are informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions."

Original Post