TRENDING TOPICS

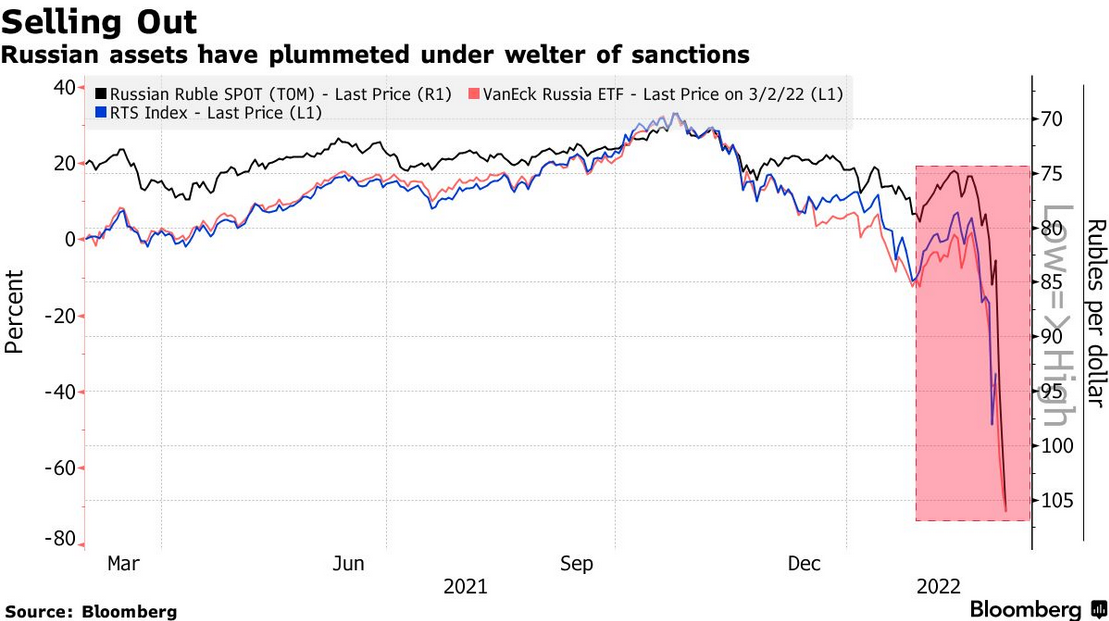

Freefall: Russian stocks collapse as the world rejects Russian assets amid an intensification of Western sanctions.

Commodities spike: Oil hits the highest level since 2008, but it's not just energy, as wheat and other base metals also rally sharply.

Junkyard Russia's sovereign rating was downgraded this week to 'Junk' status by rating agencies Moody's and Fitch.

Bye-bye 50! Fed Chair Powell backs a 25bps hike in March in his semi-annual testimony, but multiple rate hikes are still on the table.

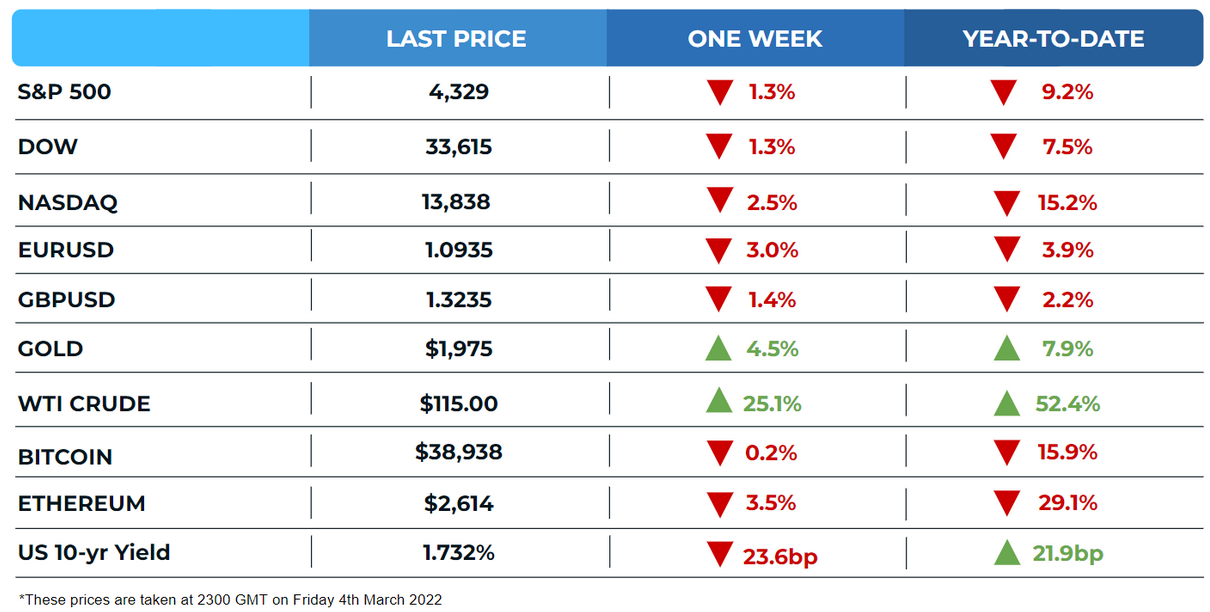

MARKETS

Markets: WTI Crude futures finished the week up 25%, with a last-minute bid into the close last night on reports that the Biden administration is weighing a ban on US imports of Russian crude oil. The flight to quality continued to support gold prices, while US yields dropped significantly as markets recalibrate for a more graduated tightening cycle from the Federal Reserve.

Crypto: Despite a rally in prices early in the week, Bitcoin futures continue to run into significant resistance around the $45,500 mark, a key inflection point for price over the last 12-months. Although Bitcoin finished marginally lower on the week (-0.2%) its outperformance relative to altcoins suggests a lower appetite for risk among crypto investors as geopolitical tensions remain high.

DEALS PAY THE BILLS

M&A

TD, the American bank has agreed to purchase First Horizon in a $13.4bn deal, their biggest deal ever.

Spectris (LON:SXS), a British electrical engineering firm is in talks to acquire Oxford Instruments (LON:OXIG) for $2.4bn.

BP (LON:BP), the British oil and gas company is looking to sell its 20% stake in Rosneft, the state-backed Russian O&G explorer - this will likely be at a huge discount.

Howden, a Scottish engineering firm is being touted for potential IPO or sale by KPS Capital Partners, it could be worth up to $3.5bn.

Venture Capital

Weee!, an ethnic electronic grocer has just raised a $425m series E round led by the Softbank Vision Fund.

Aurora Solar, a software platform for solar sales has raised a fresh $200m Series D round led by Coatue and Energize Ventures.

Gorilla Technologies, a grocery delivery company is looking to raise $700m in new funding in 2022.

Fanatics, a sports merchandise company has raised a fresh $1.5bn round at a $27bn valuation, it was led by Fidelity, BlackRock and MSD Partners.

CHART OF THE WEEK

The Dow Jones Russia GDR Index, which tracks London-traded Russian companies, has plunged 98% in two weeks! Depositary receipts for Sberbank have slumped 99% this week, while Gazprom (MCX:GAZP) fell 98%.

MEME OF THE WEEK

Enjoy your weekend!