Taylor Swift’s “The Eras Tour” ended yesterday in Vancouver. The extraordinary singer started this sixth concert tour in Glendale, Arizona on March 17, 2023. The tour consisted of 149 shows spanning five continents. Two of my daughters enjoyed her show in Toronto last month.

My “Roaring 2020s Tour” started in Dallas, Texas last Tuesday morning. That afternoon, after a great Tex-Mex lunch with a few accounts, I traveled to Fort Worth to meet with more accounts. A car service took me to Austin that night for my gig there on Wednesday. It was on to San Antonio for a small group dinner that evening at Bistr09. Then I was off to Houston to stay at the Houstonian Hotel for a group breakfast on Thursday. Next, I flew to San Diego to speak at the NIRI Senior Roundtable Annual Meeting on Friday morning.

I enjoyed my discussions with our accounts. They all are pleased with the bull market in stocks. They are also rooting for our Roaring 2020s scenario. But they are nervous that stocks aren’t cheap now that valuation multiples are near previous bull market peaks. Their main concern for the fundamentals is that President Donald Trump might start a trade war.

Everyone is also wondering whether the new administration will succeed in reducing the size, regulatory powers, headcount, and budget deficits of the federal government. In addition, a few people noted that mass deportation of illegal migrants might hamper some industries that rely on these workers. Everyone is uneasy about making so many policy changes at the same time. That could have unintended negative consequences for the economy and the financial markets.

Debbie, Eric, Joe, Melissa, and I share these concerns and are focusing our team’s research efforts on these mostly “known unknowns.” Our current assessment is that on balance Trump 2.0 will support our Roaring 2020s scenario for the remainder of the decade. To be politically fair, our scenario has unfolded very well under the current administration’s mix of policies favoring business regulations, open borders, lots of deficit-financed spending, and onshoring incentives.

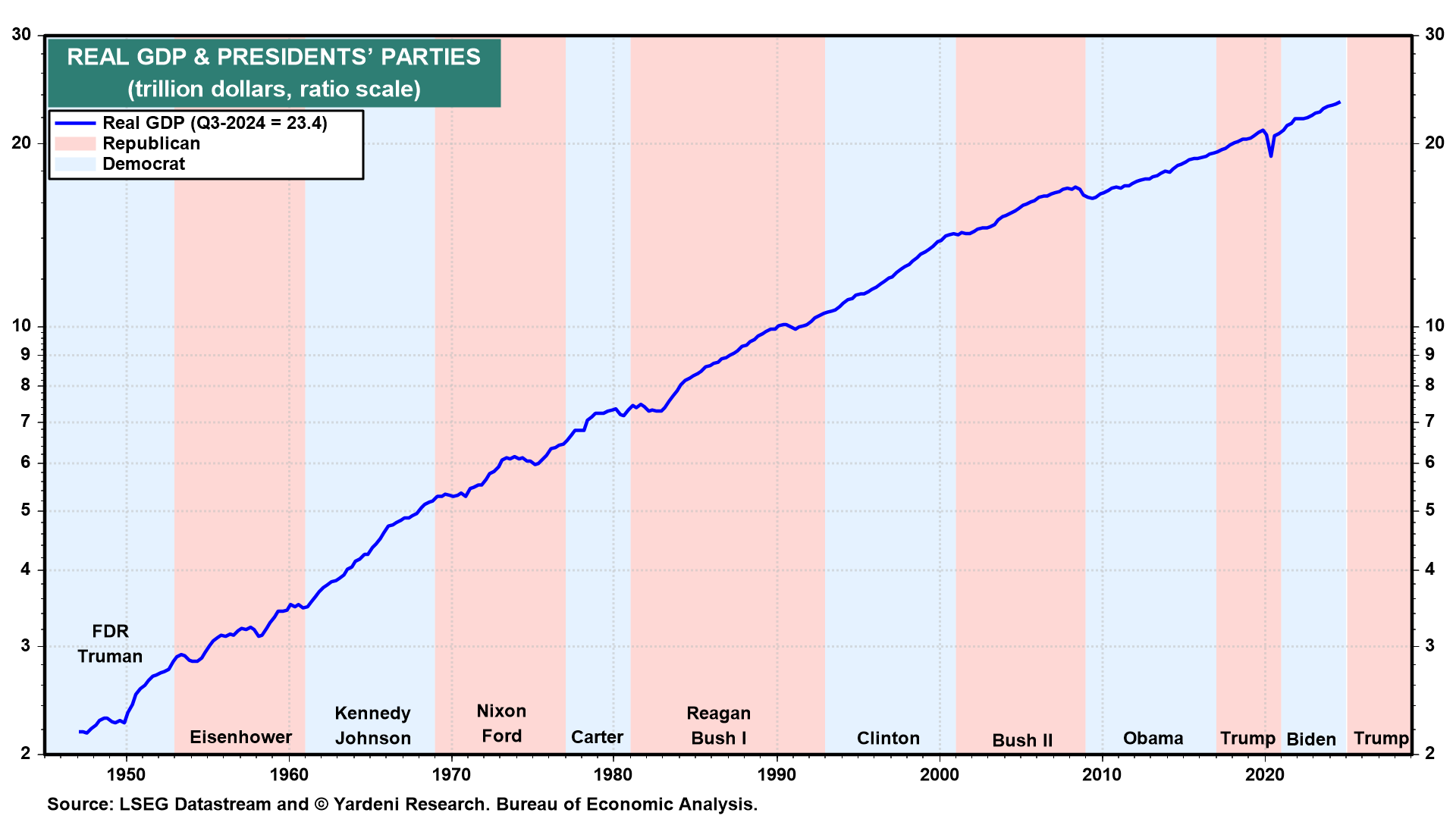

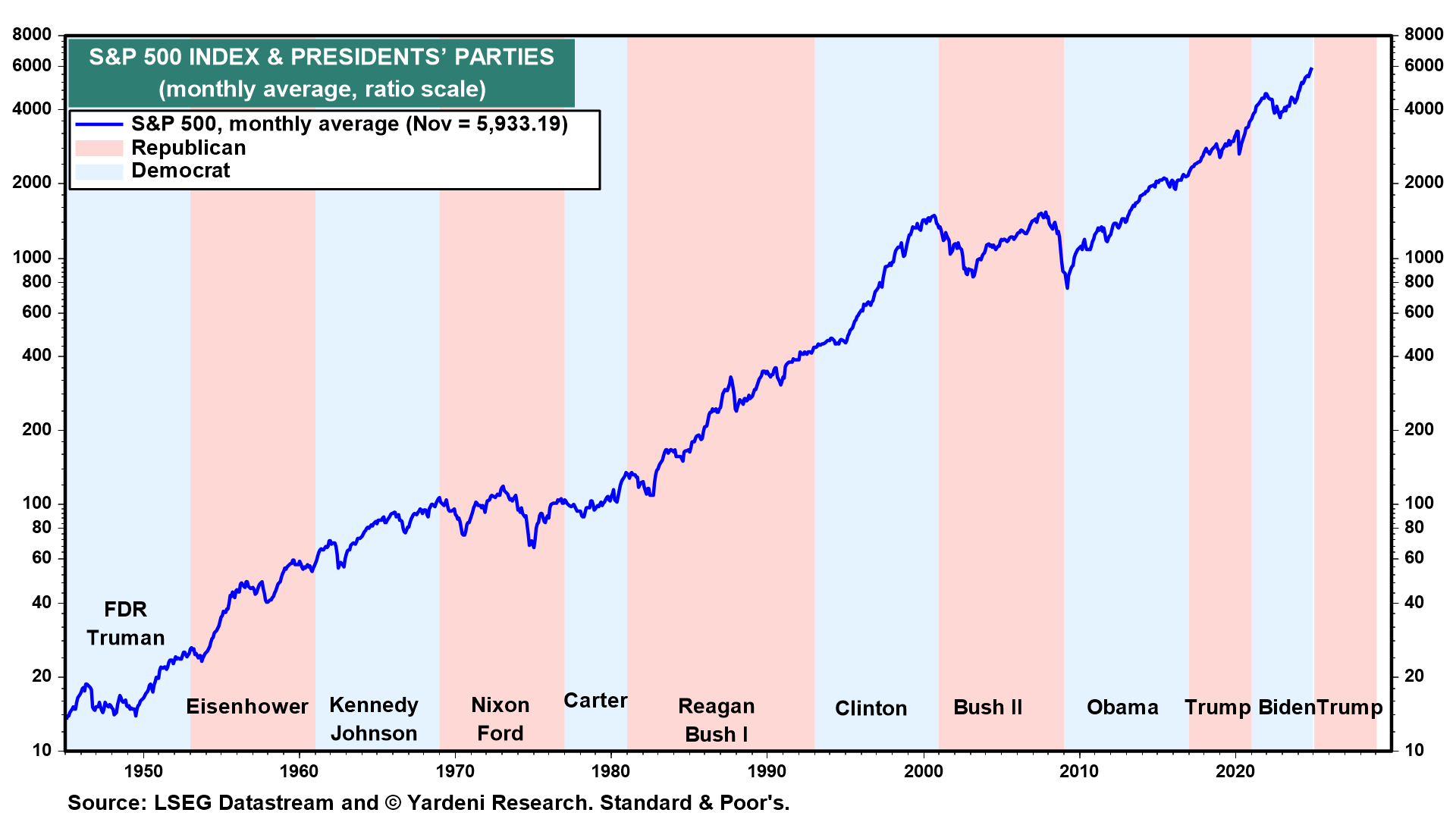

Our central investment thesis is that the economy and stock market are resilient; they have a long history of performing well notwithstanding Washington’s meddling and regardless of which party has the White House.

We the People of the United States make this country work, not the elected and unelected federal government officials in Washington. The US stands out among nations because it’s among the few that are prospering, and it’s doing so because entrepreneurial capitalism is flourishing. That’s what makes it exceptional.

European economies are stagnating under the regulatory regime of the European Union. Immigration has heightened a clash of civilizations within the region, exacerbating political partisanship. The region also has an increasingly geriatric profile. And Europe’s transition to clean energy has been costly and ineffective.

China began its shift toward a more market-oriented economy in 1978 under the leadership of Deng Xiaoping. The resultant economic boom started to fizzle in recent years as the Chinese Communist Party clamped down on capitalism, fearing that too many entrepreneurs were becoming too wealthy and powerful. A property depression and a rapidly aging population are also weighing on the country’s economy.

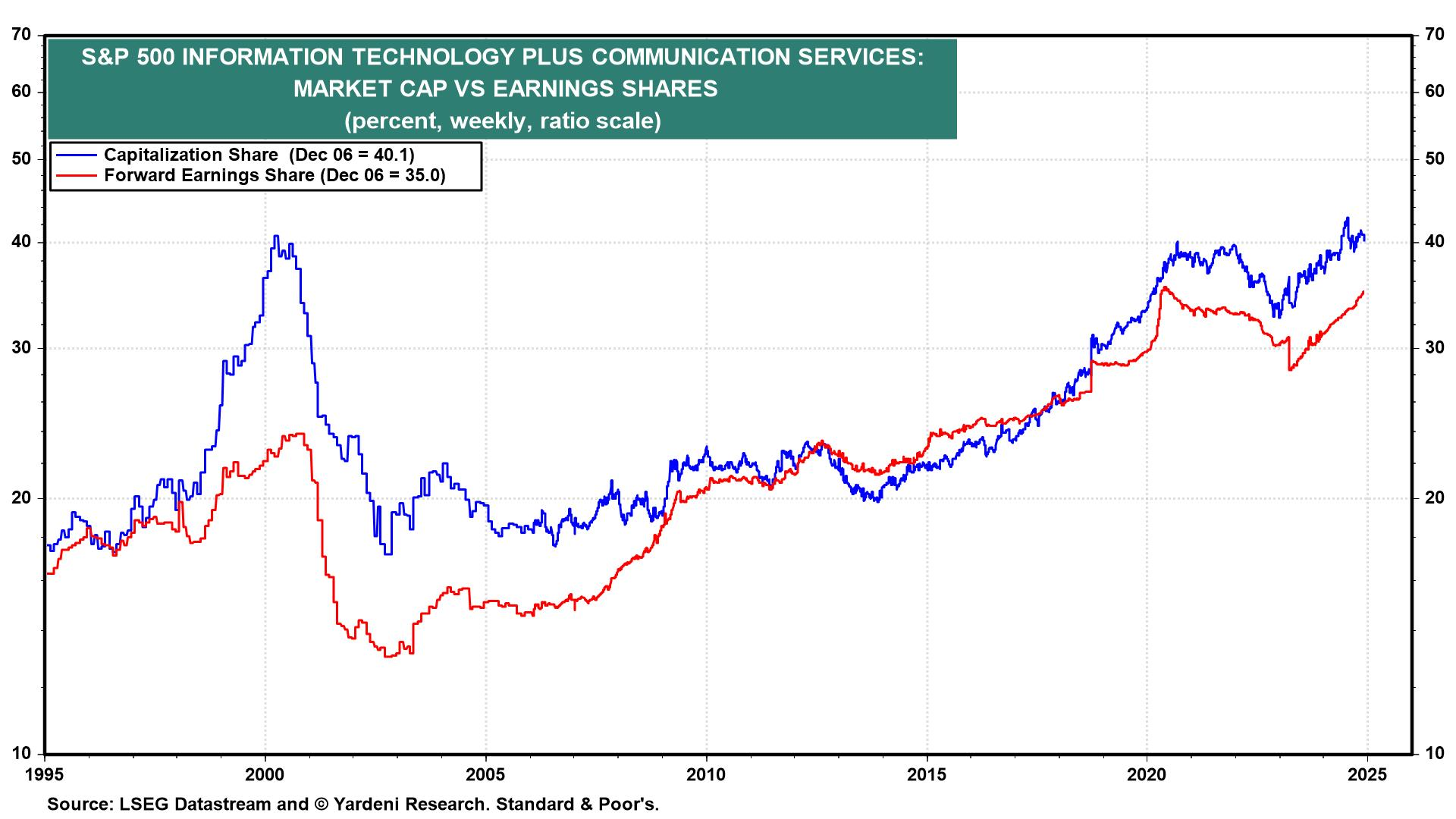

America’s entrepreneurial spirit and comparative advantage is widely recognized in the realm of technological innovation, financed by a highly developed venture capital industry. That’s very evident in the US and global stock markets. The S&P 500 Information Technology and Communication Services sectors combined account for 40.1% of the S&P 500 market capitalization.

That’s the same market-cap weighting those two sectors represented just before the Tech Wreck of 2000. However, this time, such a large proportion of the broad index’s market cap is more justified because the sectors together account for 35.0% of the earnings share of the S&P 500 compared to 24.0% back then.

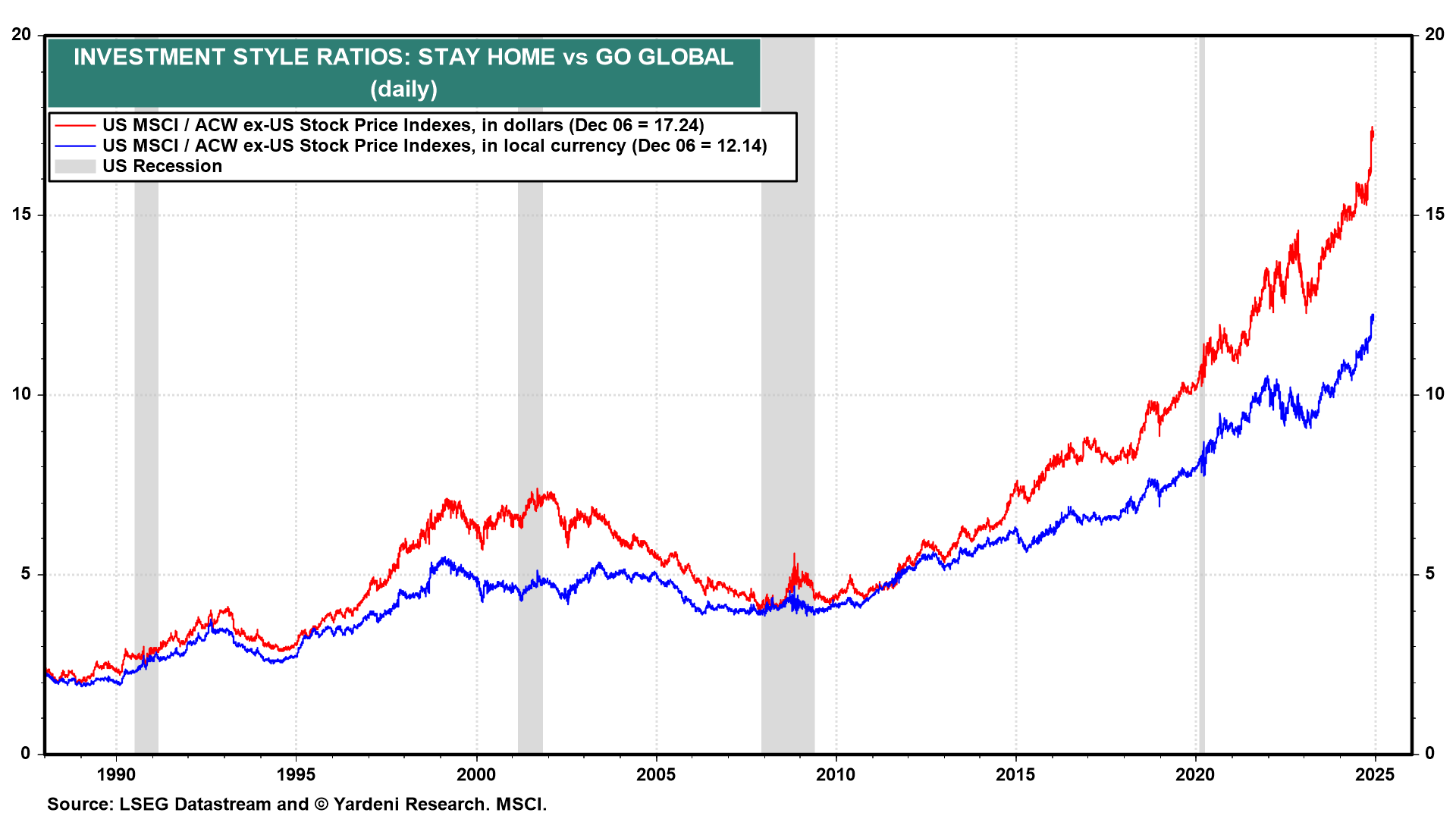

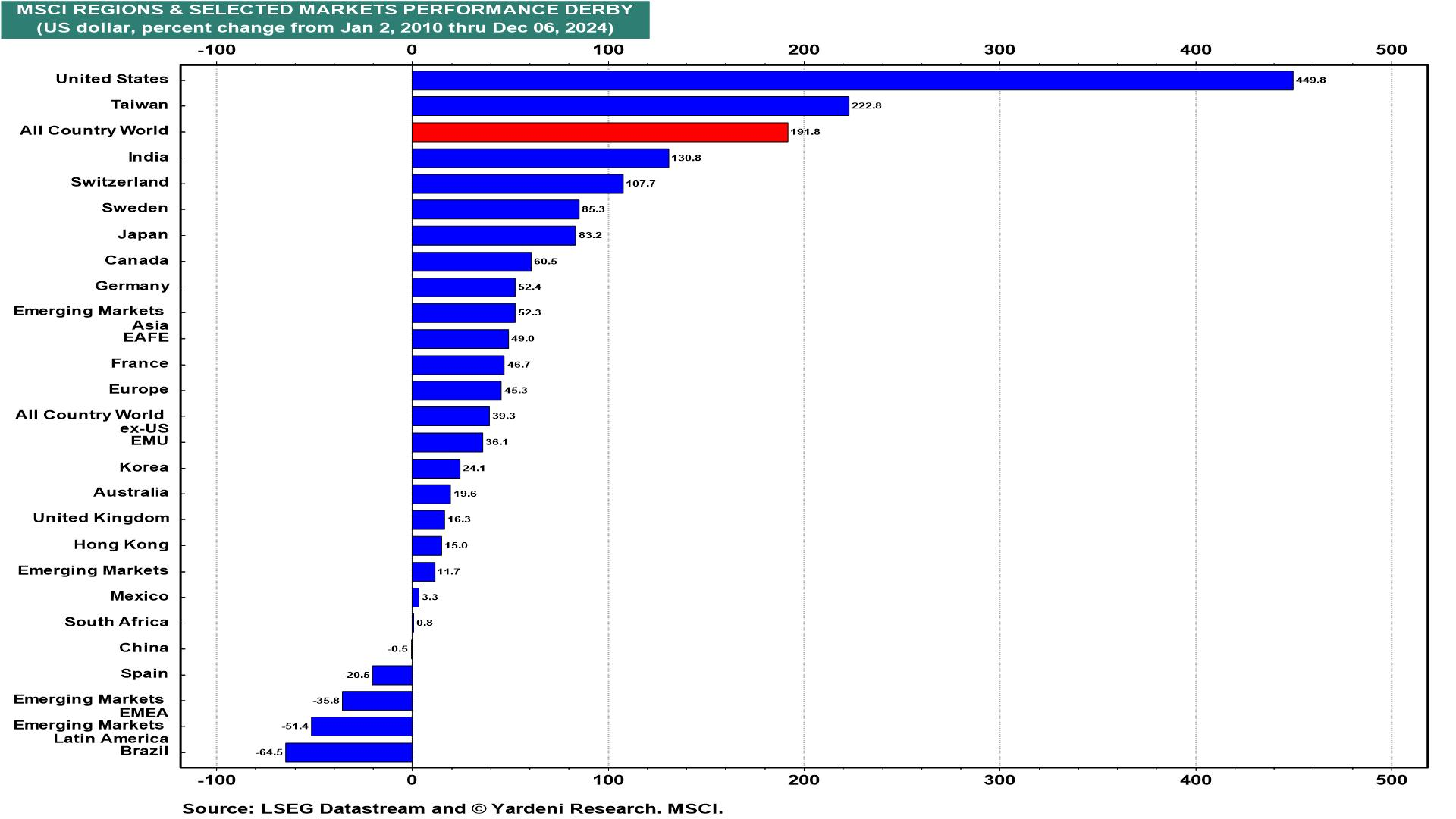

This is one of the main reasons why the US MSCI stock price index has dramatically outperformed the All Country World ex-US stock price index since 2010.

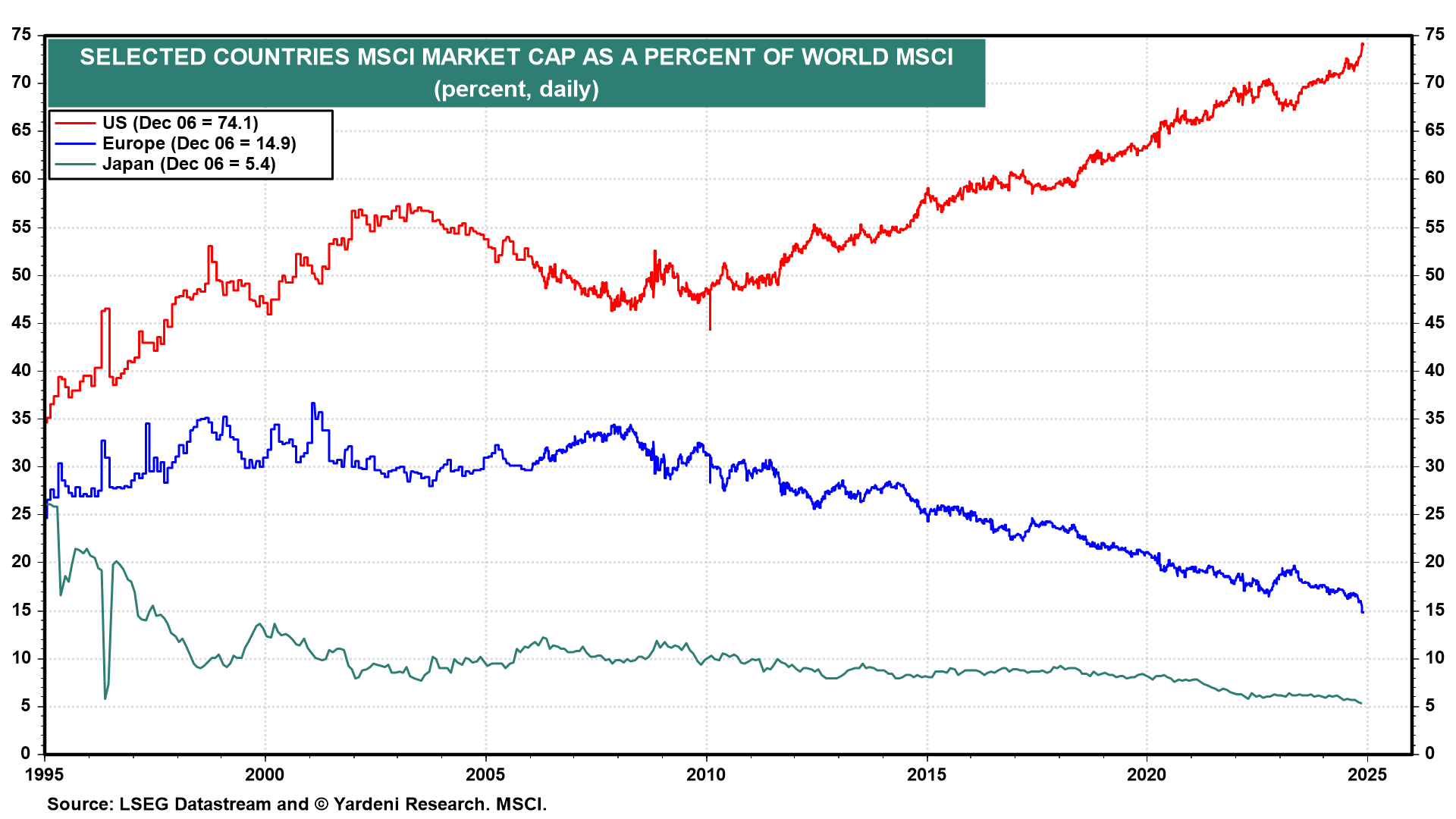

Furthermore, the US MSCI now accounts for a staggering 74% of the market capitalization of the All Country World MSCI.

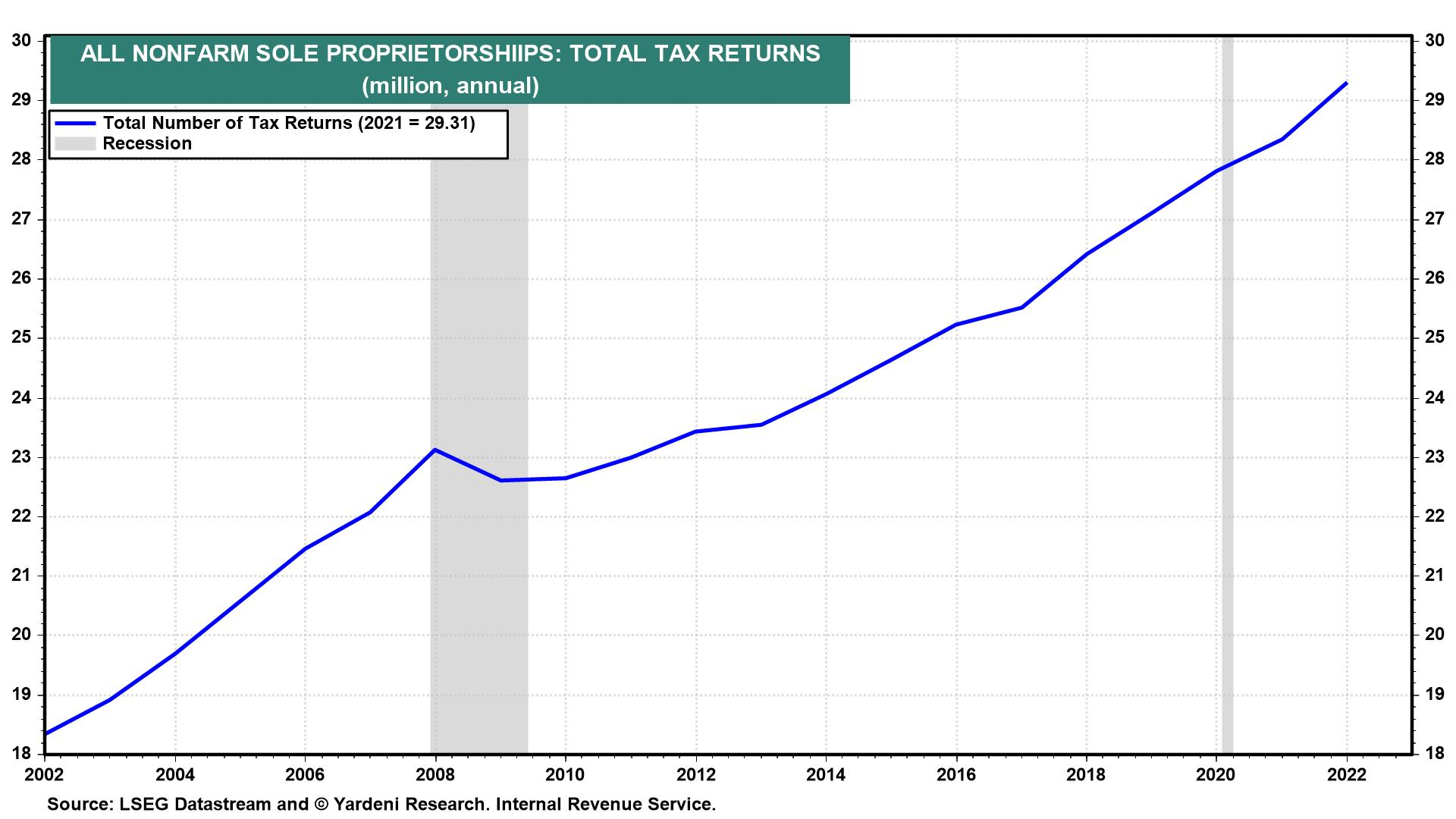

Less well-known about America’s entrepreneurial juices is that there are over 30 million nonfarm sole proprietorships in America.

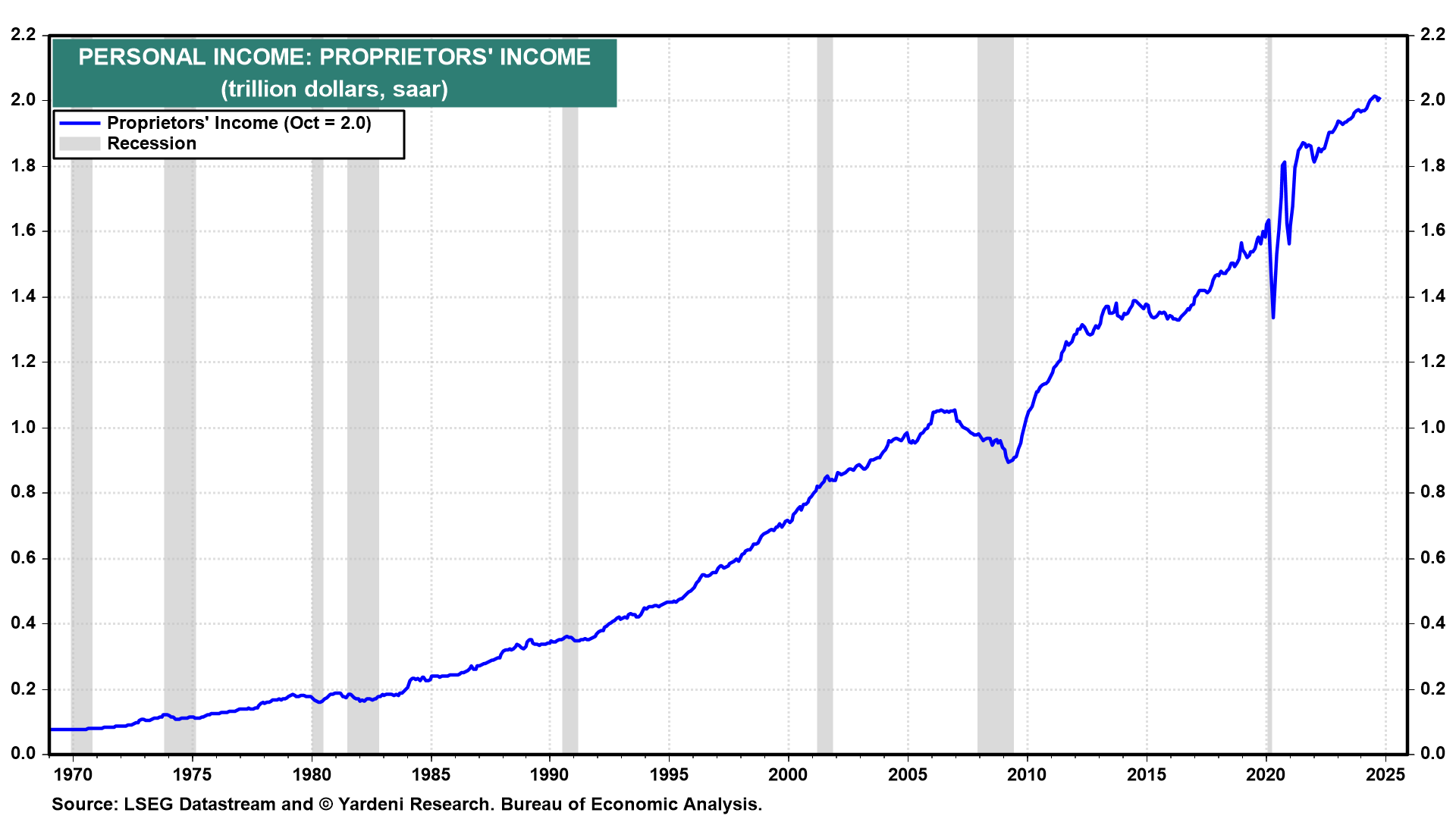

Proprietors’ income in personal income totaled $2.0 trillion (saar) during October.

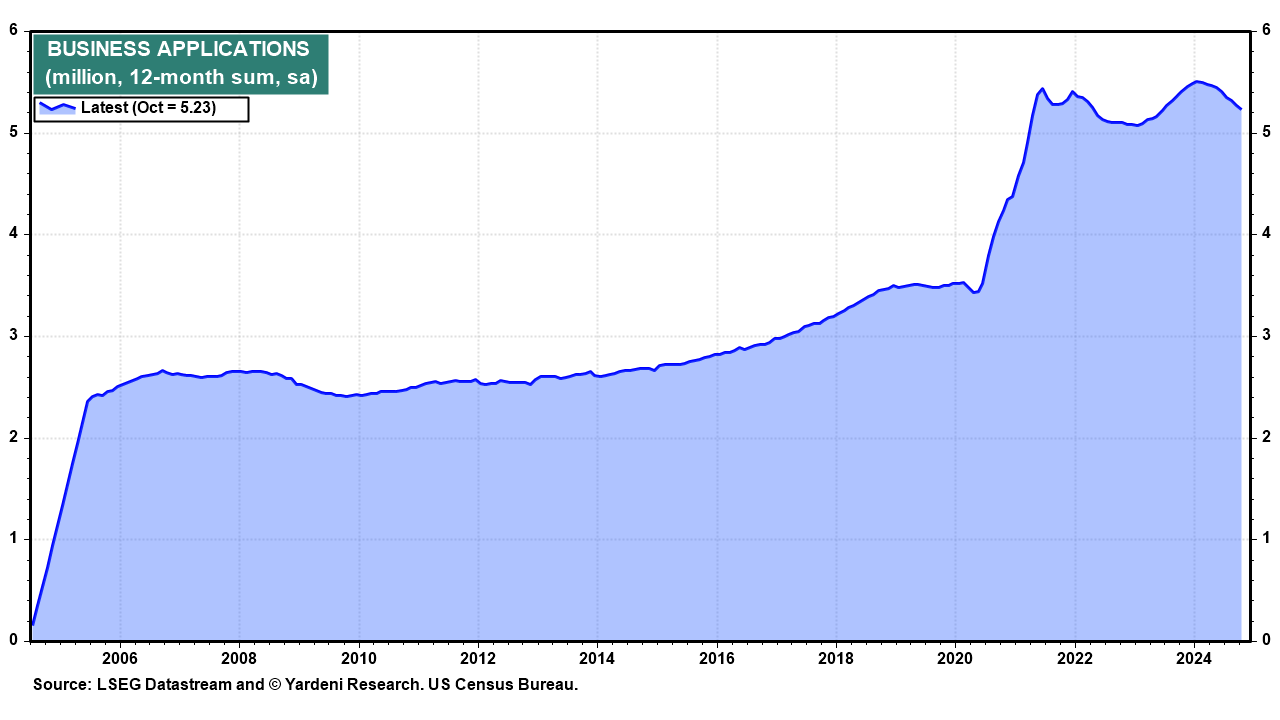

Furthermore, the pace of new business applications has been hovering just above 5.0 million on a 12-month-sum basis since the pandemic. That’s up from around 3.3 million before the pandemic.