FTSE 100 today: Pound falls as UK unemployment rises, wage growth slows; Index up

Russian Roulette Putin ordered his troops into Ukraine. By Friday they were closing in on Kyiv in a bid to overthrow the Ukrainian govt

Anyone needing proof that cryptocurrencies are not a 'safe haven' investment got it on Thursday, as Bitcoin and Ethereum fell with all other risk assets

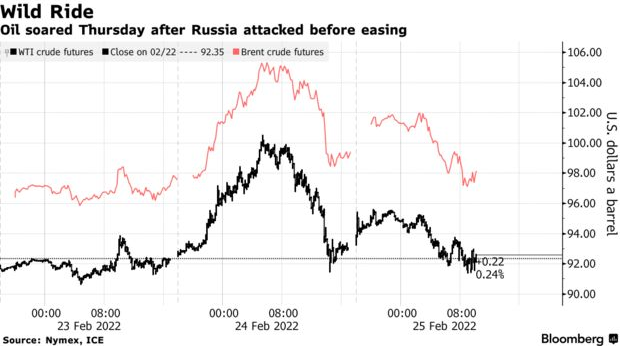

$100 Oil, both Brent and WTI breached the sacred $100 barrier on Thursday, only to then sell off over 1000 ticks as US sanctions spared the Russian energy sector

Family With Benefits: Just one day before Elon Musk went on Twitter to suggest he sells his stock, his brother sold $108mm of Tesla (NASDAQ:TSLA) shares. The SEC are not amused!

Trump Truth: Donald Trump launched his Truth Social which will aim to rival Twitter (NYSE:TWTR), Netflix (NASDAQ:NFLX), Disney (NYSE:DIS) and CNN, we won't hold our breath

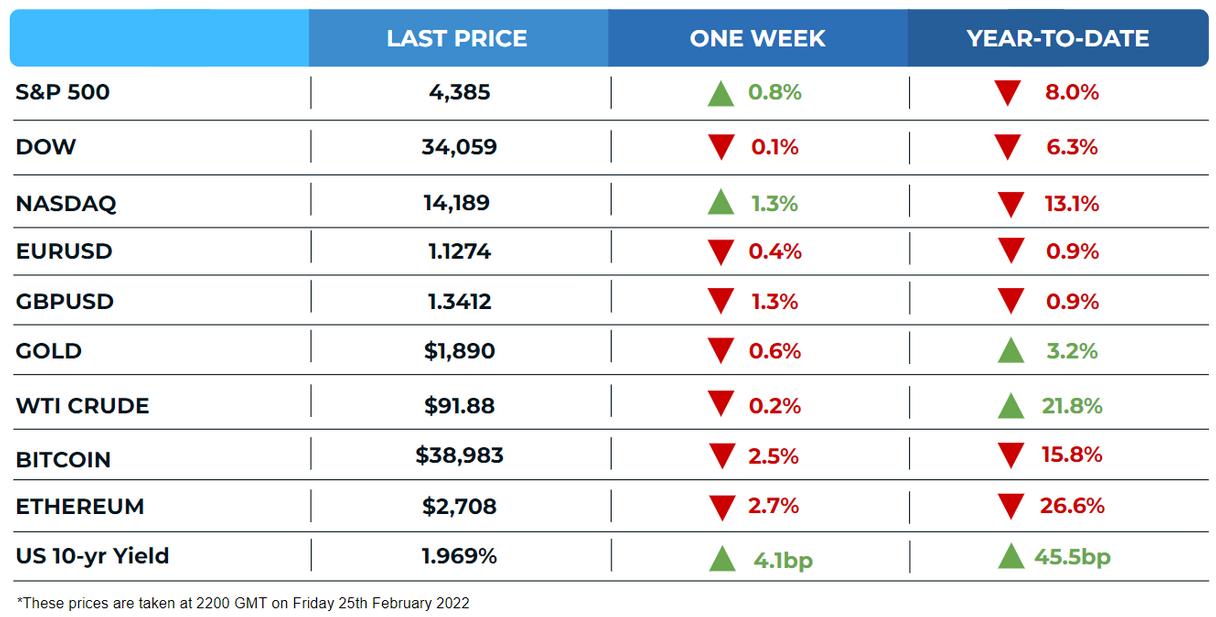

MARKETS

Markets: US stocks climbed Friday to close out a volatile week of trading. Market sentiment got a boost after the Kremlin reportedly said that Putin is ready to send a delegation to Belarusian capital Minsk for negotiations with Ukraine. The Dow posted its third-straight losing week despite the two-day surge, however, the S&P 500 and the Nasdaq 100 finished the week 0.8% and 1.3% higher, respectively.

Crypto: Bitcoin and other cryptocurrencies rose on Friday after Russia agreed to negotiate with Ukrainian officials. Some investors expect the rebound in crypto prices to continue because of the spike in volatility. Bitcoin's one-week implied volatility jumped to an annualized 75% on Thursday, topping the one-, three- and six-month gauges, similar to what occurred after the May 2021 crash. Further, bitcoin's inverted volatility structure typically precedes price bottoms, according to CoinDesk's Omkar Godbole.

DEALS PAY THE BILLS

M&A and Private Equity

Celanese (NYSE:CE), a global chemical and speciality materials company has agreed to buy a majority stake in Dupont's (NYSE:DD) mobility and materials arm for $11bn

SoFi (NASDAQ:SOFI), an American online personal finance company has agreed to buy banking-software maker Technisys for upwards of $1bn

KKR (NYSE:KKR), the American PE giant has agreed to buy a majority stake in Refresco at a reported $7.8bn valuation

Venture Capital

Volta Trucks, a Swedish EV startup has raised $260m in a Series C round led by Luxor Capital at a $490m valuation

Amber Group, a Crypto trading platform has raised a $200m round at a $3B valuation led by Temasek

Somatus, a value-based kidney care firm has raised a $325m Series E round at a $2.5bn valuation led by Wellington Management

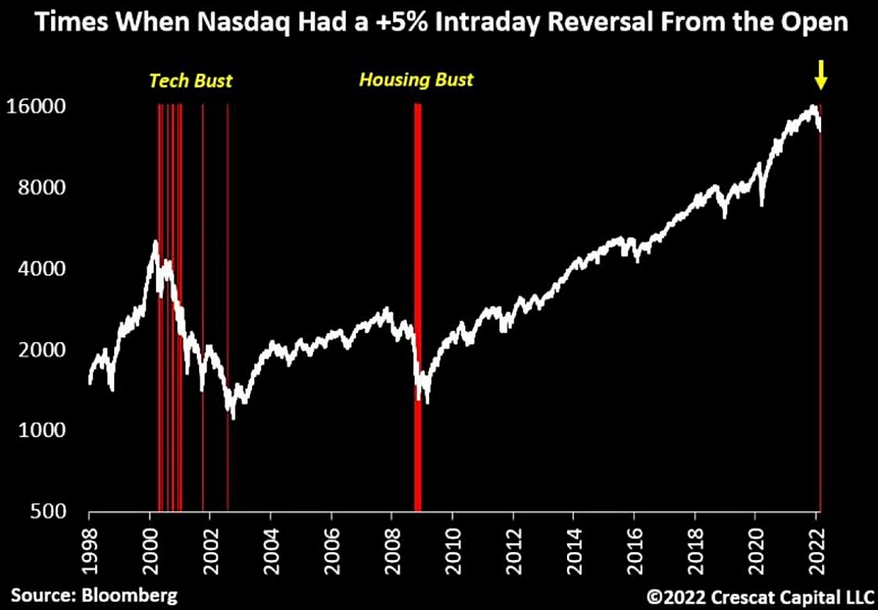

CHART OF THE WEEK

The last 21 times Nasdaq had an intraday reversal of +5% happened during brutal bear markets

WALL STREET CALL OF THE WEEK

Goldman Sachs is warning oil could rise to $125 and that risks remain to the upside. In a note today, GS's Jeff Currie commented:

"In our view, until the uncertainty around the rapidly escalating situation is resolved, commodity price risk remains skewed to the upside, with further escalation likely to send European natural gas, wheat, corn, and oil prices higher from already-elevated levels.

Crucially, we see a clear risk of $125/bbl in crude should the global market need to balance by summer 2022, as opposed to our current summer 2023 base case, in the face of these supply concerns, as we believe oil demand destruction would be required around the world to drive the faster rebalancing in global oil markets."

QUOTE OF THE WEEK

“This is genius. How smart is that? Here’s a guy who’s very savvy."

Former US President Donald Trump comments on Putin's tactics this week on a conservative podcast, recorded at his Mar-a-Lago resort.