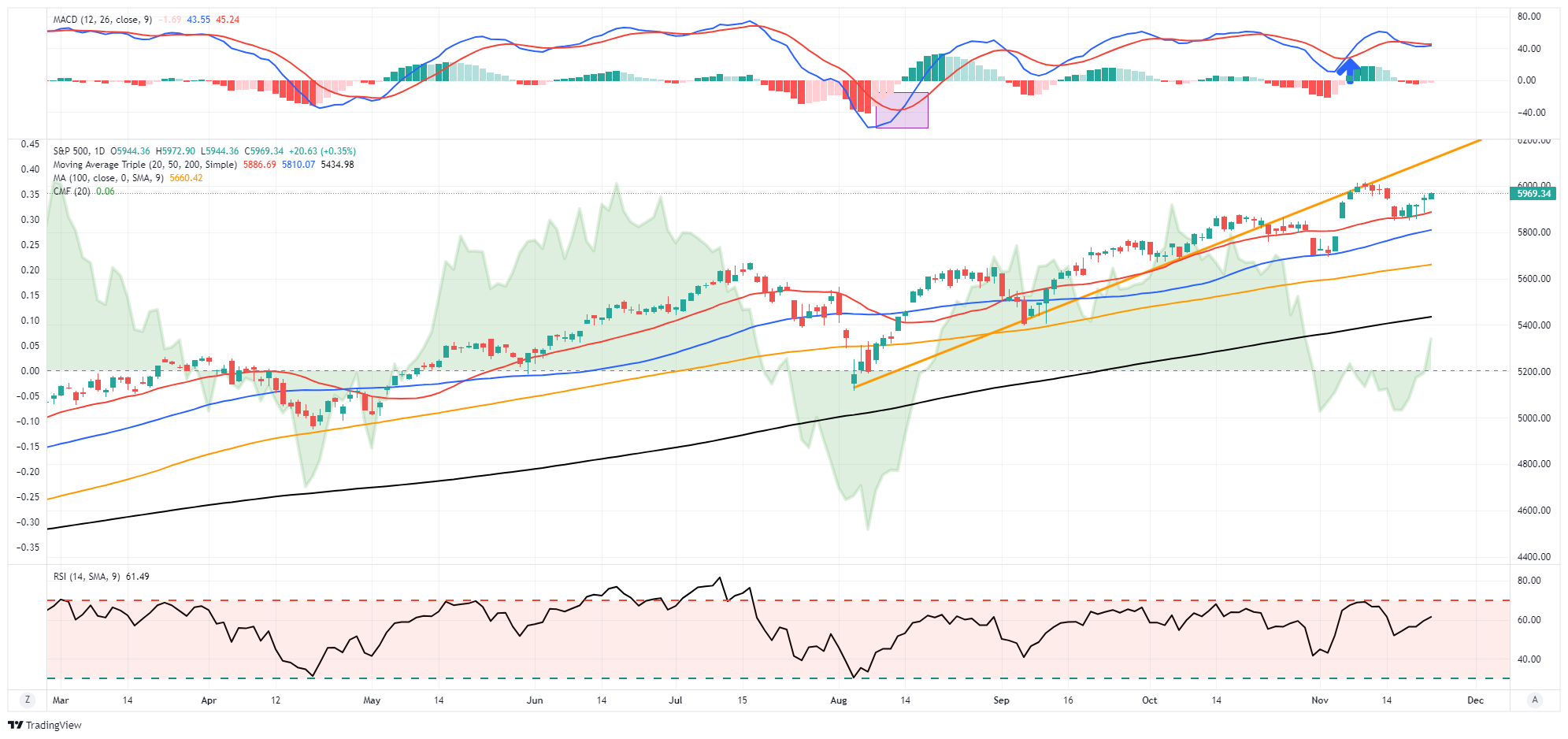

Last week, we discussed the impact of the Trump Presidency on the financial markets based on expectations of tax cuts, tariffs, and deregulation. Since then, the “Trump Trade” went into full swing, pushing the markets higher; however, as we noted, the trading had gotten a bit ahead of itself, and we saw some consolidation and profit-taking that reverted the market to the 20-DMA. Such is unsurprising given the overbought conditions with a more extreme deviation from the 50-DMA. However, the market recovered somewhat this past week, with buyers entering and reversing early morning market declines.

Notably, after holding support at the 20-DMA for several days, the market gained some traction late in the week. That buying pressure will likely reverse the short-term MACD sell signal, allowing the market to rally further next week.

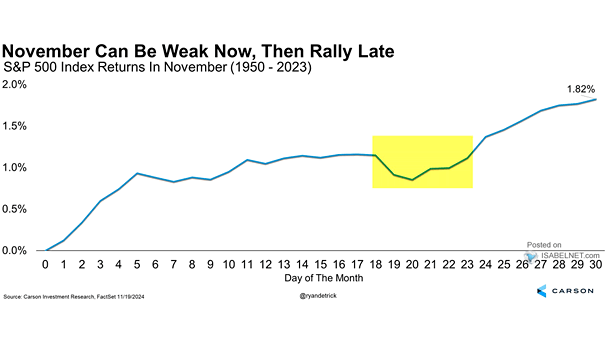

That action aligns with Friday’s Daily Market Commentary, wherein we noted the market seemed to be setting itself up for a pre and post-holiday trading bump into the end of the month. To wit:

“The good news is that we just past the normal “weak” period for the market in November. While not always the case, on average, the market trends to trade better the week before and after the Thanksgiving holiday. If that turns out to be the case again this year, a retest of recent highs at 6000 seems likely.”

While the trade into month-end tends to be positive, we expect to see another patch of weakness in early December as mutual funds complete their annual distributions. However, post that weakness, the bullish bias remains into year-end as professionals window dress their portfolios for year-end reporting.

If you are underweight equities, consider minor pullbacks and consolidations to add exposure as needed to bring portfolios to target weights. Pullbacks will likely be shallow, but being ready to deploy capital will be beneficial. Once we pass the inauguration, we can assess what policies will likely be enacted and adjust portfolios accordingly.

While there is no reason to be bearish, this does not mean you should abandon risk management. As we will discuss this week, the market forecasts for 2025 are exceedingly optimistic.

Need Help With Your Investing Strategy?

Are you looking for complete financial, insurance, and estate planning? Need a risk-managed portfolio management strategy to grow and protect your savings? Whatever your needs are, we are here to help.

Market Forecasts Are Very Bullish

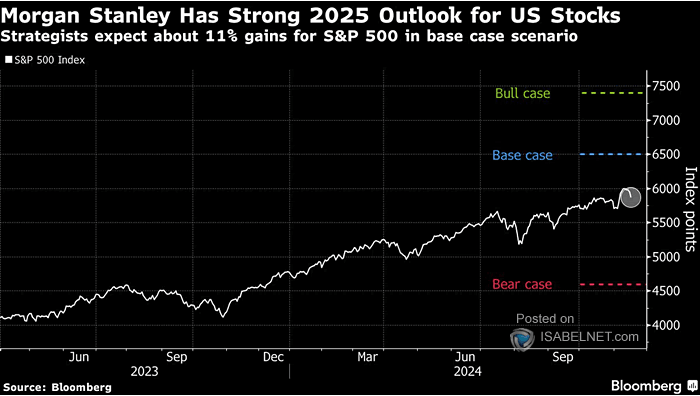

It’s that time of year when Wall Street analysts begin trotting out their predictions for where the S&P 500 index will be by the end of the coming year. As is always the case, these market forecasts are ALWAYS higher, and this year is no expectation.

Goldman Sachs (NYSE:GS) and BMO have already forecasted that the market will rise to 6500 and 6700, respectively, by the end of 2025. However, one of the more interesting market forecasts came from long-time bear Michael Wilson of Morgan Stanley (NYSE:MS). This past week, he matched Goldman’s forecast of 6500 as a base case with a bullish case of 7400. That is interesting because Michael Wilson has been a long-time market bear.

His basis for that call was quite interesting:

“A potential rise in corporate animal spirits post the election (as we saw following the 2016 election) could catalyze a more balanced earnings profile across the market in 2025.”

If you don’t understand the importance of “animal spirits,” we discussed this in detail concerning Yardeni’s recent prediction of S&P 10000 by the end of the decade:

“The term Animal Spirits” comes from the Latin term “spiritus animals,” meaning “the breath that awakens the human mind. Its modern usage came about in John Maynard Keynes’ 1936 publication, “The General Theory of Employment, Interest, and Money.” He used the term to describe the human emotions driving consumer confidence. Ultimately, the financial markets adopted the “animal spirits” to describe the psychological factors that drive investors to take action. This is why human psychology is essential in understanding the close linkage to short-term valuation measures.

Note that this has nothing to do with underlying fundamentals; it is purely “sentiment” or “hope” that things will improve. However, as investors, we must focus on the ultimate driver of market prices over time: earnings. Three very obvious facts about earning growth currently should concern investors heading into next year.

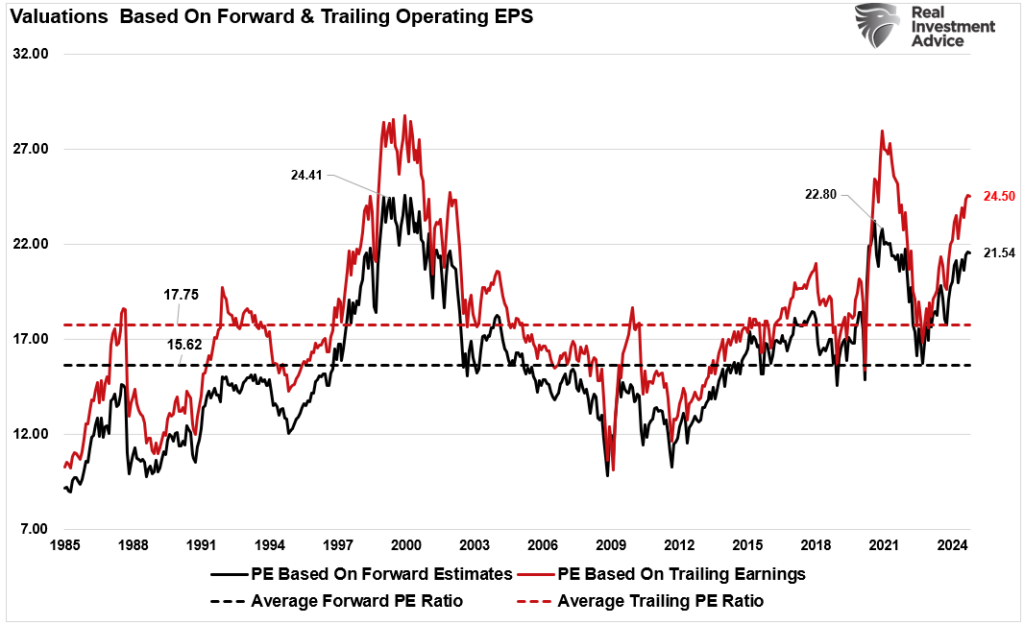

First, as noted in last week’s Bull Bear Report, valuations on both a forward and trailing basis are significantly elevated. While this does NOT mean the market is about to crash, it does suggest that earnings have not kept up with investor’s expectations. The problem with elevated valuations is the risk an event occurs that causes investors to realign expectations with actual reality.

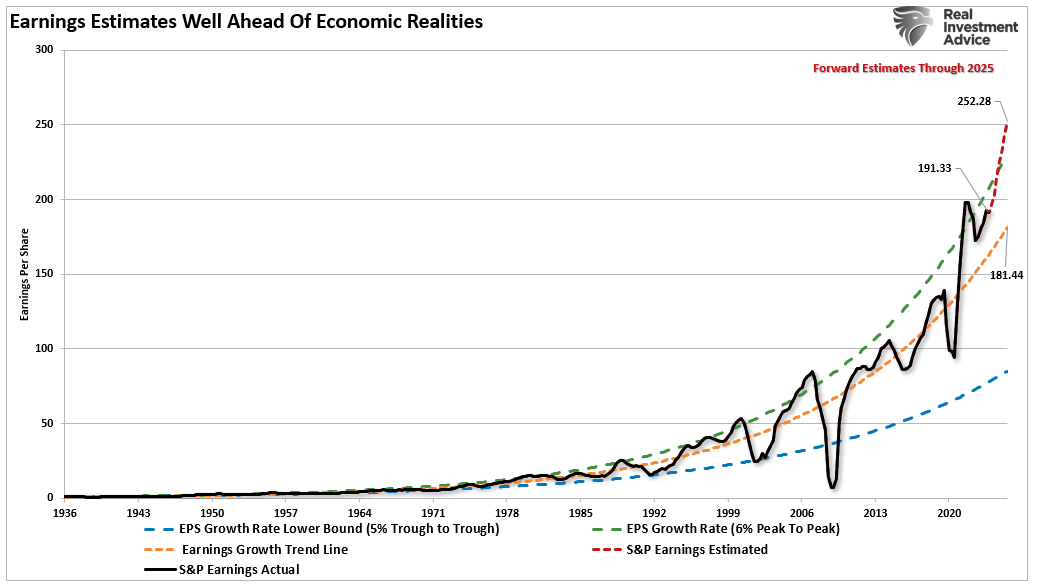

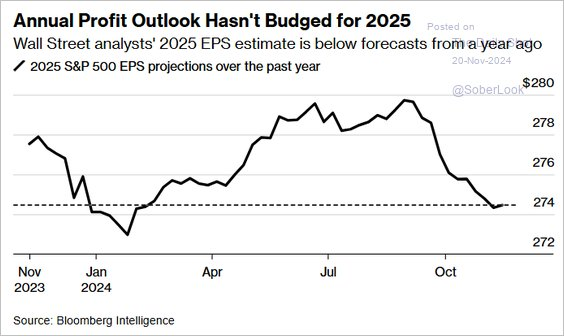

Secondly, earnings expectations, which support Wall Street’s market forecasts, are very optimistic.

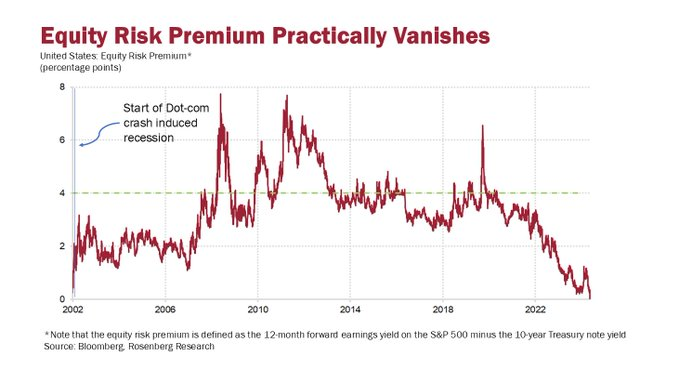

Lastly, the equity risk premium currently suggests that investors are not getting “paid” for the risk they are taking. We last saw equity risk premiums at these levels heading into the “Dot.com” bubble.

Let me reiterate that none of this data suggests a market crash is imminent. However, investors should be aware that given the current market conditions, the risk of disappointment in the future is much greater today than it was just two years ago.

The Historical Problem Of Analyst Market Forecasts

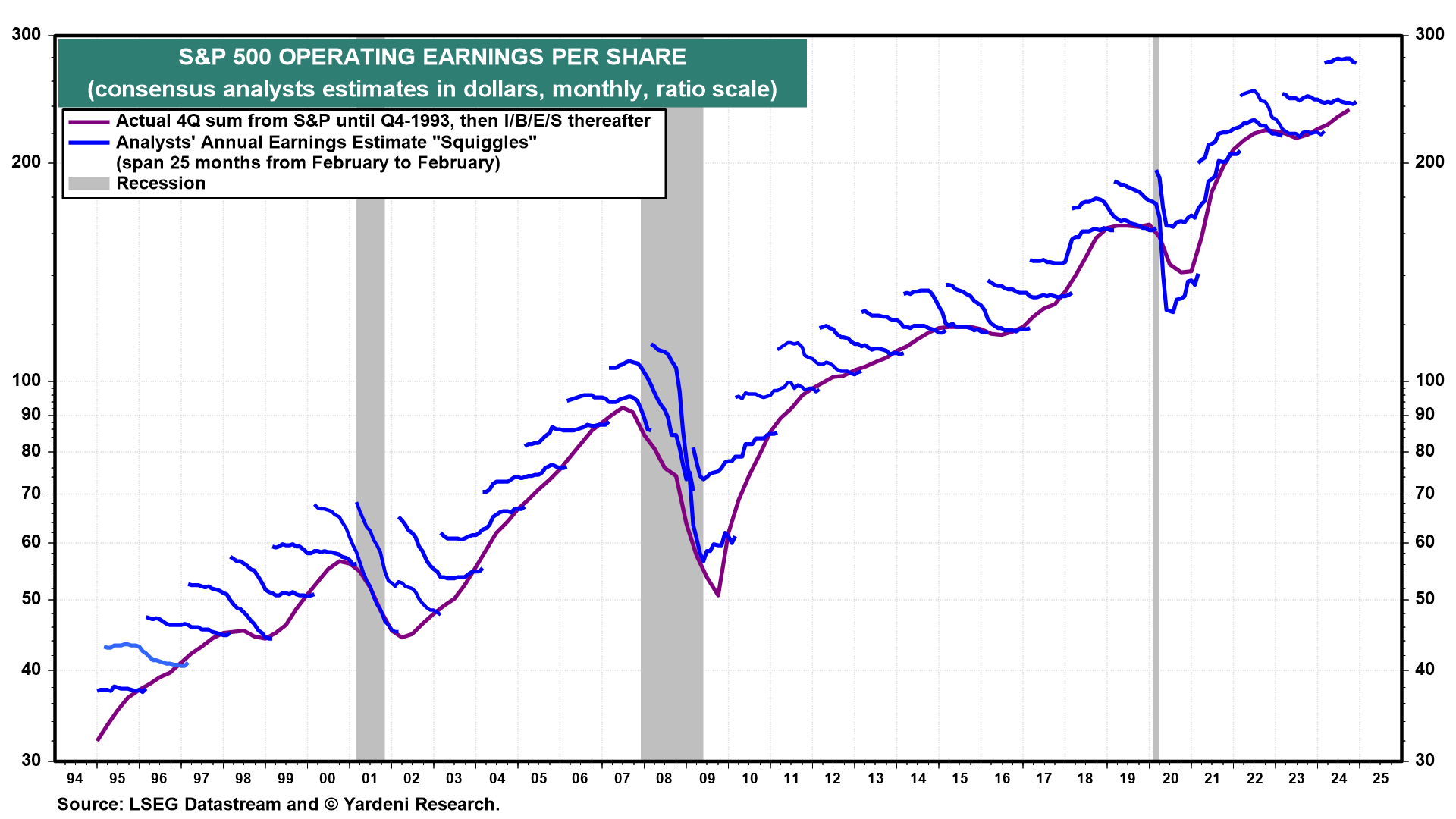

Here is the critical question for investors: “If the market is priced based on future earnings expectations, then how reliable are those estimates?” The chart below is from Yardeni Research and shows the evolution of earnings forecasts over time. You will notice that analysts’ initial forecasts were wrong in almost every case.

In other words, if you bought stocks at the beginning of virtually every analyst’s annual forecast, based on the assumption that earnings would grow, you overpaid for investments virtually every given year. However, in most cases, you make money anyway, so why worry about it?

The reason to worry is that over-estimation eventually leads to reverting events.

The biggest single problem with Wall Street today and in the past is the consistent disregard for the possibilities of unexpected, random events. In a 2010 study by the McKinsey Group, they found that analysts have been persistently overly optimistic for 25 years. During the 25-year time frame, Wall Street analysts pegged earnings growth at 10-12% a year when, in reality, earnings grew at 6%, which, as we have discussed in the past, is the economy’s growth rate.

This is why using forward earnings estimates as a valuation metric is so incredibly flawed—the estimates are always overly optimistic.

As the McKenzie study noted, on average, “analysts’ forecasts have been almost 100% too high,” which leads investors to make much more aggressive bets in the financial markets.

With valuations elevated, why are analysts once again pushing more optimistic forecasts?

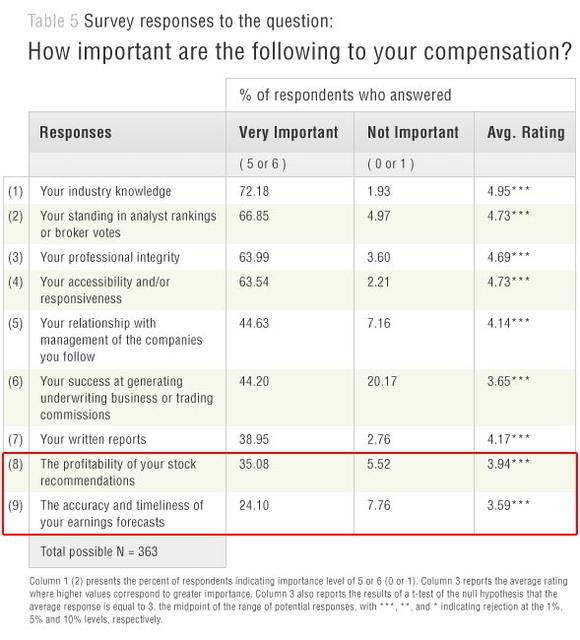

Why Are Analysts Always So Optimistic?

It’s a great question.

Wall Street is a group of highly conflicted marketing and PR firms. Companies hire Wall Street to “market” for them so that their stock prices will rise, and with executive pay tied to stock-based compensation, you can understand their desire. The chart below is from the survey conducted by WSJ researchers, showing the main factors that play into analysts’ compensation. What analysts are “paid” to do is quite different from what retail investors “think” they do.

If analysts are bearish on the companies they cover, their access to information about them is cut off. This reduces fees from the company to the Wall Street firm, hurting their revenue. Furthermore, Wall Street has to have a customer to sell their products to—you.

Talk about conflicted. Just ask yourself why Wall Street spends billions of dollars each year in marketing and advertising just to keep you invested at all times.

Since optimism is what sells products, it is not surprising, as we head into 2025, to see Wall Street’s average expectation ratcheted up another 7.5% this year. Of course, comparing your portfolio to the market is often a mistake anyway. Unsurprisingly, earnings have grown at 7.5% over the last 70 years because the companies that make up the stock market reflect real economic growth. Stocks cannot outgrow the economy in the long term.

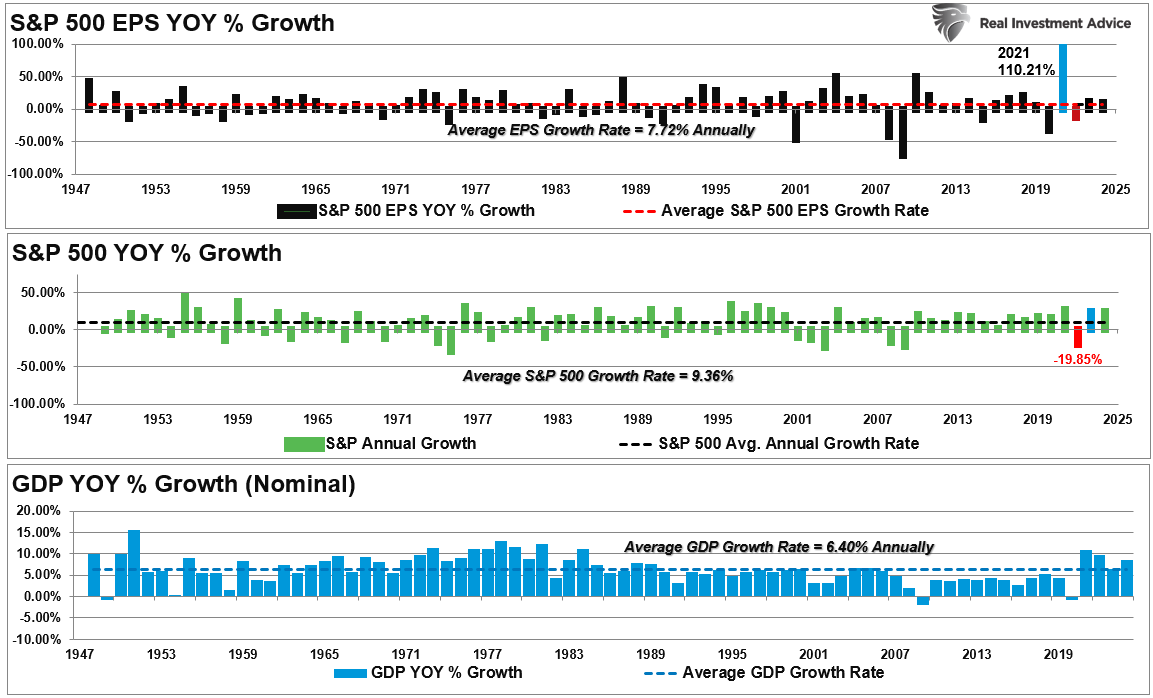

“Since 1947, earnings per share have grown at 7.7% annually, while the economy expanded by 6.40% annually. That close relationship in growth rates should be logical, particularly given the significant role that consumer spending has in the GDP equation.”

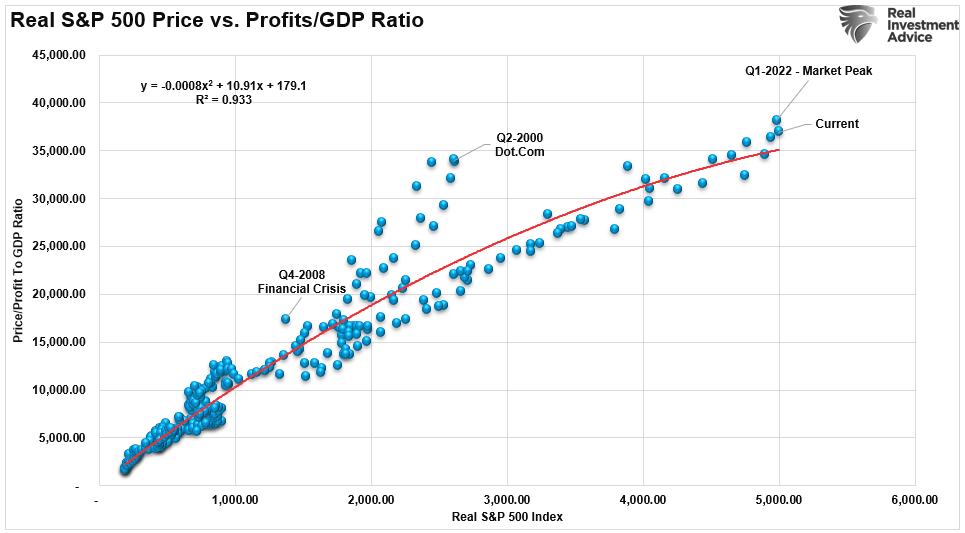

This correlation is more apparent when looking at corporate profits as a percentage of GDP versus stock prices.

With future earnings already being revised lower for 2025, as seen below, and corporate profitability at risk due to less government stimulus and fiscal support, the risk of current market forecasts being overly optimistic is likely elevated.

The Headwinds In 2025

The problem with current forward estimates is that several factors must exist to sustain historically high earnings growth and record corporate profitability.

- Economic growth must remain more robust than the average 20-year growth rate.

- Wage and labor growth must reverse (weaken) to sustain historically elevated profit margins.

- Both interest rates and inflation need to decline to support consumer spending.

- Trump’s planned tariffs will increase costs on some products and may not be fully offset by replacement and substitution.

- Reductions in Government spending, debt issuance, and the deficit subtract from corporate profitability (Kalecki Profit Equation).

- Slower economic growth in China, Europe, and Japan reduces demand for U.S. exports, slowing economic growth.

- The Federal Reserve maintaining higher interest rates and continuing to reduce its balance sheet will reduce market liquidity.

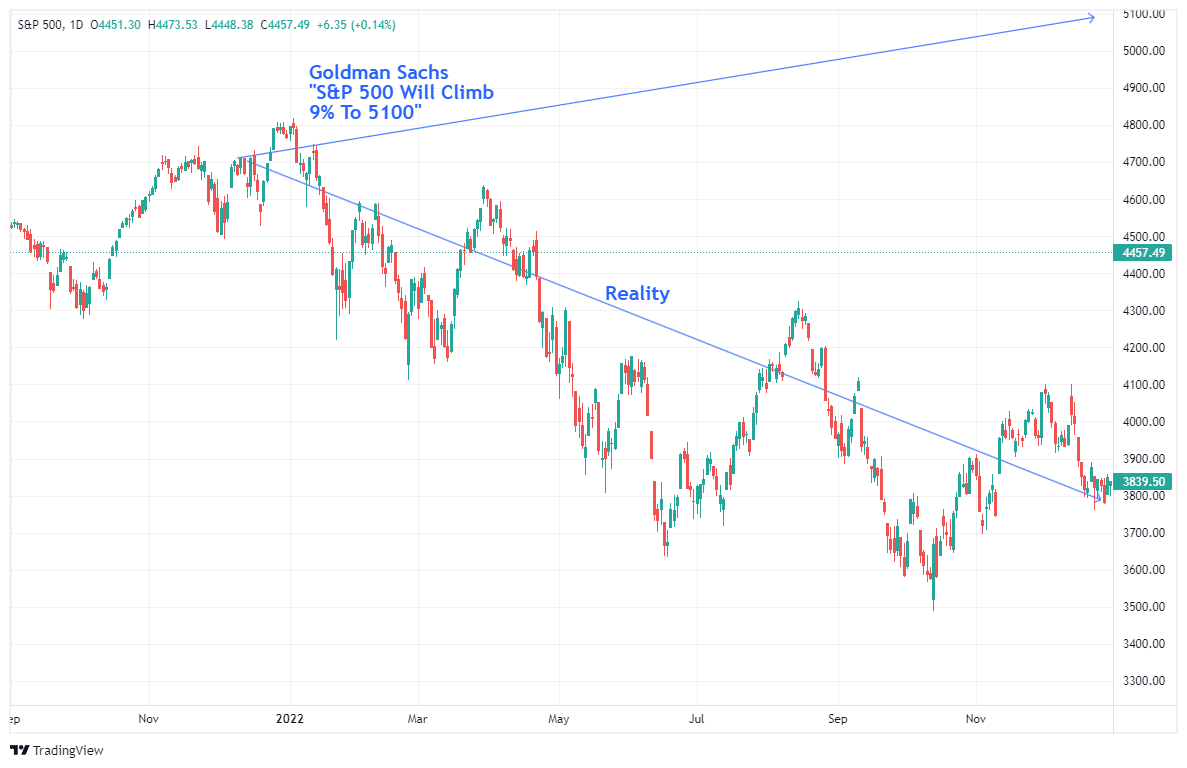

You get the idea. While analysts are currently very optimistic about economic and earnings growth going into 2025, there are risks to those forecasts. For example, on December 7th, 2021, we wrote an article about the predictions for 2022.

“There is one thing about Goldman Sachs that is always consistent; they are ‘bullish.’ Of course, given that the market is positive more often than negative, it ‘pays’ to be bullish when your company sells products to hungry investors. It is important to remember that Goldman Sachs was wrong when it was most important, particularly in 2000 and 2008.

However, in keeping with its traditional bullishness, Goldman’s chief equity strategist David Kostin forecasted the S&P 500 will climb by 9% to 5100 at year-end 2022. As he notes, such will “reflect a prospective total return of 10% including dividends.”

The problem, of course, is that the S&P 500 did NOT end the year at 5100.

While analysts are currently rushing to “out-predict” the other guys, it is worth noting:

- Markets are pushing historic levels of extreme overbought conditions,

- 2nd highest level of valuation on record,

- Extreme deviations from long-term growth trend lines,

- Investor sentiment and confidence pushing extreme bullishness, and

- Investors fully committed to the market with low levels of cash.

In other words, after 15 straight years of a bull market advance, The “risk” of something derailing continued optimistic expectations has risen significantly.

While the odds of a positive year in 2025 are more or less balanced, one should not dismiss the potential for a decline. With the current market already well advanced, pushing more extreme overvaluations, and significant deviations from long-term means, the risk of a decline is not minuscule.

How We Are Trading It

With this in mind, we suggest focusing on what is important to you: your specific goals, risk tolerance, and time frames, and conservatively growing your savings to outpace inflation.

This is why we always focus on risk management. Greater returns are generated from managing “risks” rather than attempting to create returns. Although it may seem contradictory, embracing uncertainty reduces risk while denial increases it.

Another benefit of acknowledging uncertainty is it keeps you honest.

“A healthy respect for uncertainty and focus on probability drives you never to be satisfied with your conclusions. It keeps you moving forward to seek out more information, to question conventional thinking and to continually refine your judgments and understanding that difference between certainty and likelihood can make all the difference.” – Robert Rubin

We can’t control outcomes; the most we can do is influence the probability of specific outcomes. Thus, managing risks daily and investing based on probabilities rather than possibilities is vital to capital preservation and investment success over time.

I read most mainstream analysts’ predictions to gauge the “consensus.” This year, more so than most, the outlook for 2025 is universally, and to some degree exuberantly, bullish.

What comes to mind is Bob Farrell’s Rule #9, which states:

“When everyone agrees…something else is bound to happen.”

The real economy is not supportive of asset prices at current levels. The more extended prices become the greater the potential for a future market dislocation. For investors close to or in retirement, some consideration should be given to capital preservation over chasing potential market returns.

Will 2025 turn in another positive performance? Maybe. But, honestly, I don’t know.

As noted last week, the stock market reflects both challenges and opportunities. Therefore, we can take action to participate if the market continues its bullish trend but hedge against the risk of something going wrong.

- Build a diversified portfolio and adjust based on evidence, not fear.

- Keep perspective,

- Focus on your financial goals and;

- Communicate with your financial advisor to remain steady amid uncertainty.

While there is no reason to be bearish, this does not mean you should abandon risk management.

Feel free to reach out if you want to navigate these uncertain waters with expert guidance. Our team specializes in helping clients make informed decisions in today’s volatile markets.

Have a great week.