Cable has found support after coming under considerable pressure. The diverging monetary policies between the US and the UK saw it slump to its worst week in over a year. A solid day yesterday saw it claw back some of the losses but is this merely a dead cat bounce?

The Cable shed over 400 pips in its worst week since August 2014 as a perfect storm brewed. The Bank of England held interest rates steady once again, which came as no surprise to the market. What was a surprise was BoE Governor Mark Carney giving a more dovish than expected statement after the decision. In it, the bank pushed back their expectation of a rate hike from Q2 2016 to Q1 2017 which is disappointing. The only thing underpinning the pound recently was the hope that the BoE would follow closely behind the Fed in any rate hike. Those hopes have been dashed.

Compounding the troubles in the Cable was a double blow from the US. The US Nonfarm Payrolls were released and were much stronger than expected. The US economy added 271k jobs in October versus 183k expected which will only strengthen the case for a rate rise. US Federal Reserve Chairwoman Janet Yellen testified to Congress, reiterating that they were looking at the December 17th meeting as a live one, hinting rates could rise then.

The market has given a 66% chance of a rate rise in December, which means any further economic data to support it will only serve to weaken the Cable. Already this week we have seen a number of FOMC members talking and reiterating the hawkish stance. That is lining the fundamentals up against the pound which could see the recent lows tested.

The week ahead will see UK employment figures, but more importantly, a speech by BoE Governor Carney. If he remains dovish, expect more downside to the Cable. Yet more FOMC members are due to speak at various times throughout the week which could compound the losses further.

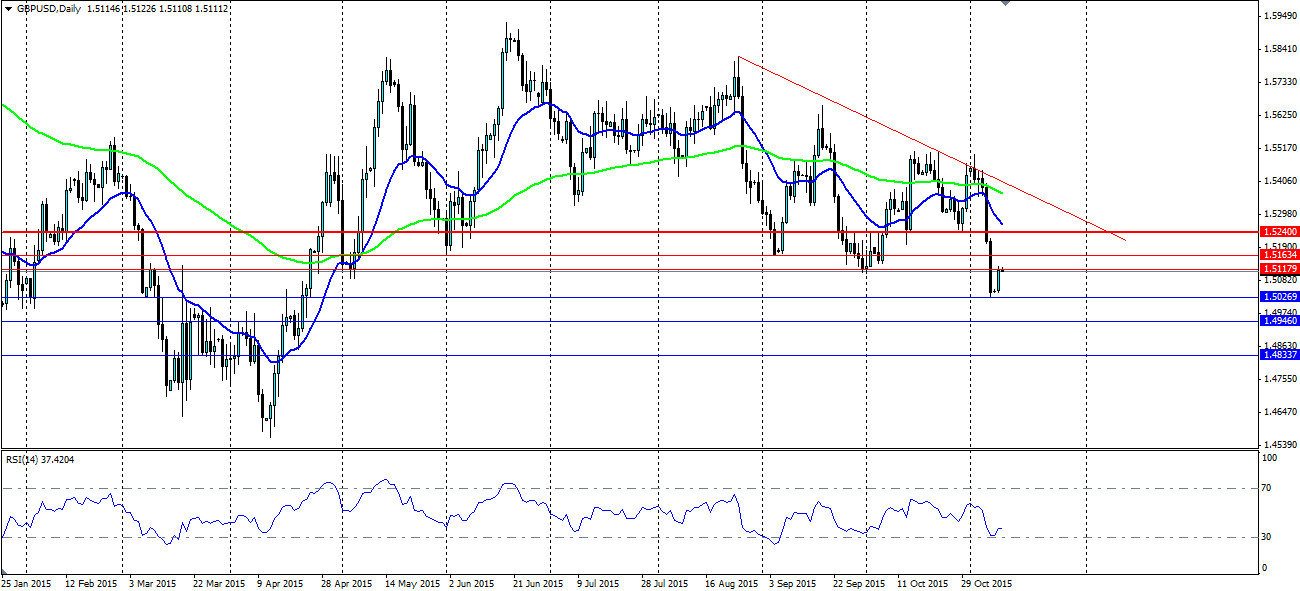

From a technicals perspective, all levels of support were wiped out as the pair got hammered at the end of last week and we are now looking back to April for relevant levels. Support was eventually found at 1.5030 where profits were taken and traders looked for short-term gains. This is looking like a text book dead cat bounce with resistance being found at 1.5117. That level is a rather solid one, having formed the swing low at the end of September, and being a point of interest as price slid down to the mid-1.40s earlier this year.

RSI did not quite reach oversold and has pulled back to a more neutral level. That opens the door for an extension to the downside for price and a push into oversold for the RSI. The moving averages are looking to turn bearish which is indicative of the overall bearish trend accelerating.

Look for support at 1.5026, 1.4846 and 1.4833, while resistance is at 1.5117, 1.5163 and 1.5240.