Renewi’s Q3 update flagged a continuation of favourable recyclate prices and incremental windfall gains reflected in increased FY22 guidance. In a historical context, these earnings benefits are likely to be temporary – cash benefit is retained of course – and the rating perhaps suggests that investors are not fully focused on the more significant and sustainable strategic profit uplift being targeted by FY25.

Secondary materials prices remain firm in Q3

Renewi’s Q3 update included substantially similar trading features to those seen in the first half. Some further volume disruption in the Netherlands and Belgium relating to local lockdown conditions in the period was noted, but this has been more than compensated for by sustained strength in recyclate prices, further boosting the expected contribution from the Commercial Waste division in particular. Elsewhere, Mineralz & Water income streams are as previously reported. A flagged legislative update on the use of recycled materials in secondary mineral products would be welcome in principle – providing suppliers and users alike with greater clarity regarding applications – although the timing and conclusions of such a review are indeterminate at this stage. At the end of December, pre-IFRS 16 net debt had reduced further to just over €300m, leaving plenty of headroom for the company’s strategic investment programme.

Taking windfall gains and investing for growth

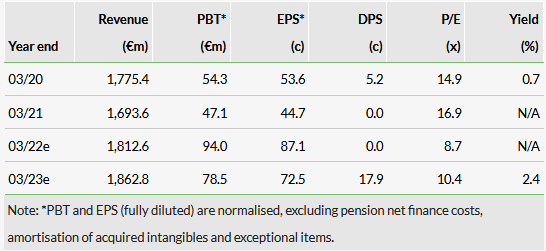

The company has set out a clear, three-pronged growth strategy and is robustly maintaining the near- (€5m EBIT benefit from Renewi 2.0 in FY22) and medium-term (€60m EBIT increment versus FY20 by FY25) expectations set out previously. For FY22, EBIT guidance has again been raised to ‘at least €120m’; the uplift in our estimates to this level is essentially driven by the inferred €14m further recyclate margin contribution in H2 flagged in the update. With no estimate changes beyond FY22 at this stage, headline earnings progression is distorted by the expected c €40m y-o-y gain from higher recyclate prices in FY22. Permanent gains from strategic investment should more than replace these windfall benefits in due course and we would expect this to be recognised in the company’s rating.

Valuation: Earnings and share price moves opposed

Since hitting an 840p 12-month high in November (following H122 results), Renewi’s share price has re-traced by almost 25% to current levels. As a result, the company is sitting on FY23e P/E and EV/EBITDA multiples of 10.4x and 5.3x respectively. No H121 dividend was declared and no timing guidance issued for a return to making payments; the position is being kept under review in the context of wider group capital allocation requirements.

Share price performance

Business description

Renewi is a leading waste-to-product company in some of the world’s most advanced circular economies with operations primarily in the Netherlands, Belgium and the UK. Its activities span the collection, processing and resale of industrial, hazardous and municipal waste.

Click on the PDF below to read the full report: