The S&P 500 finished the day flat yesterday as markets braced for Nvidia (NASDAQ:NVDA) earnings on Wednesday afternoon. 'Braced' may be an overstatement based on today’s implied volatility levels; the market has all day Wednesday to prepare for NVIDIA’s results.

Outside of Nvidia moving higher, yesterday was a dull day, except JPMorgan (NYSE:JPM) dropping by more than 4% after Jamie Dimon noted that he may retire sooner than investors had thought.

Despite that, JPM shares surged more than 50% off their October lows and nearly came all the way back to that broken trendline. It is not uncommon at all to see a retest of a broken trendline, but for now, that trendline is resistance.

The S&P 500, meanwhile, has also been finding resistance around a trendline of around 5,300 in recent days.

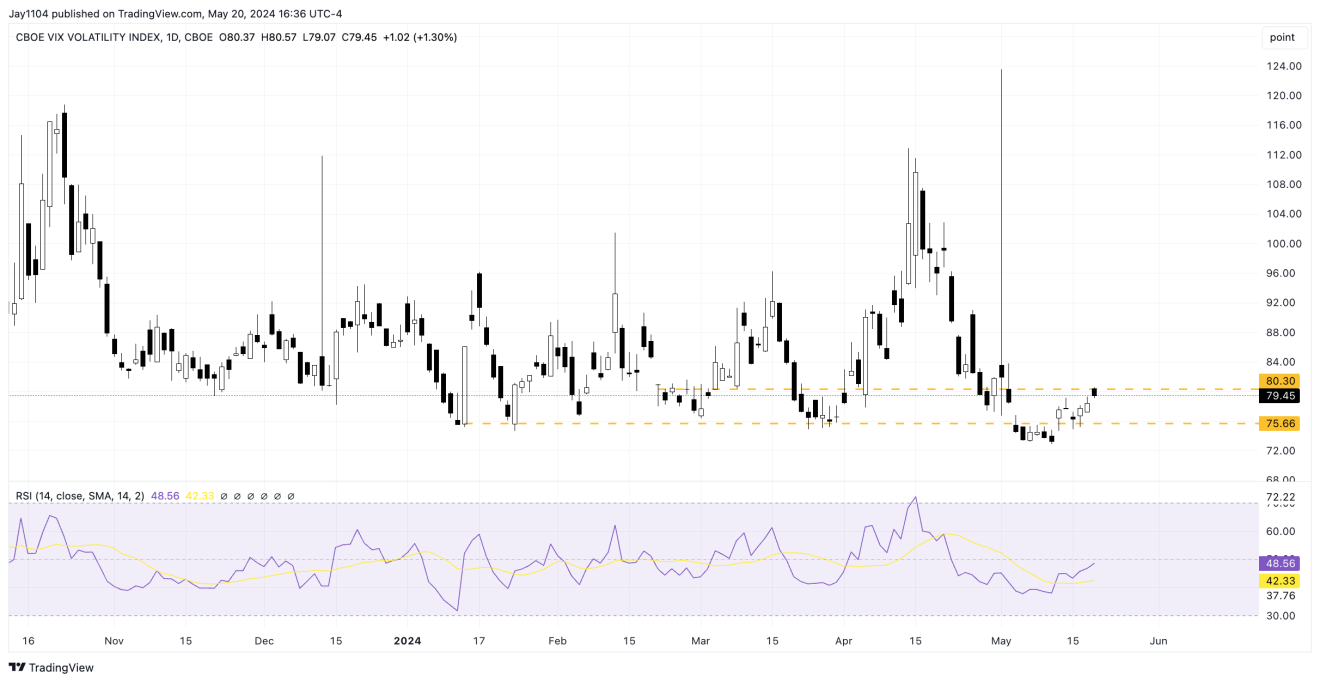

The one thing that may come into play here is the VIX opex on Wednesday because if the VIX has stalled out, then the equity market won’t have the juice from declining implied volatility to push higher. After Wednesday and the VIX open, it is a different story.

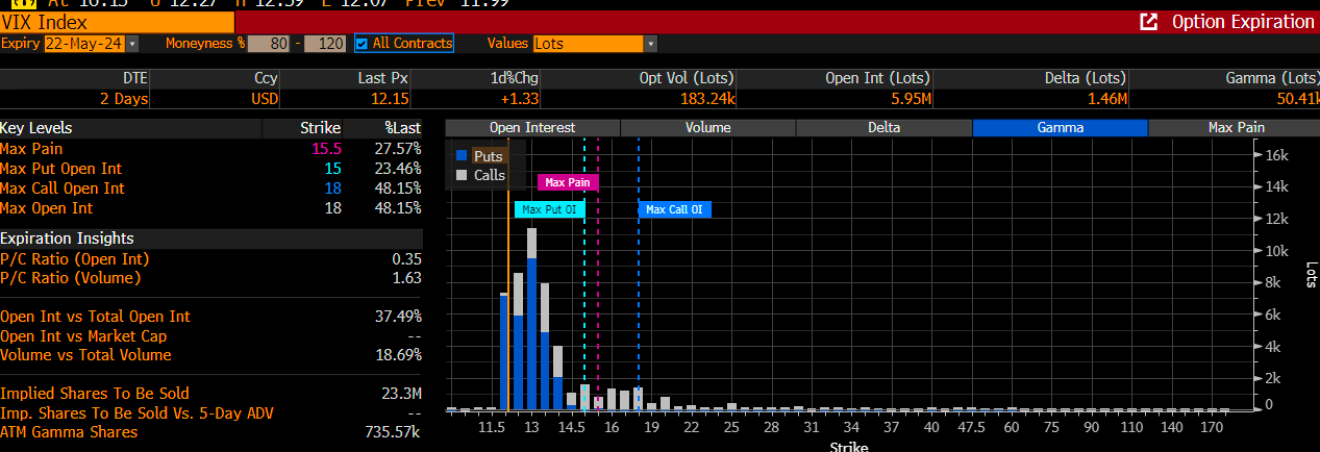

Right now, Put gamma is built up in the VIX options at the 12 and 13 strike prices, which is one reason we have likely seen the VIX hold on to those levels the past couple of days. It seems that level may hold again today as well, or we may even see the VIX move up.

The VVIX was also higher for the third day in a row and is moving back to the 80 level. We can watch the VVIX as a signal that sometimes tells us the direction of the VIX index and can even be a leading indicator.

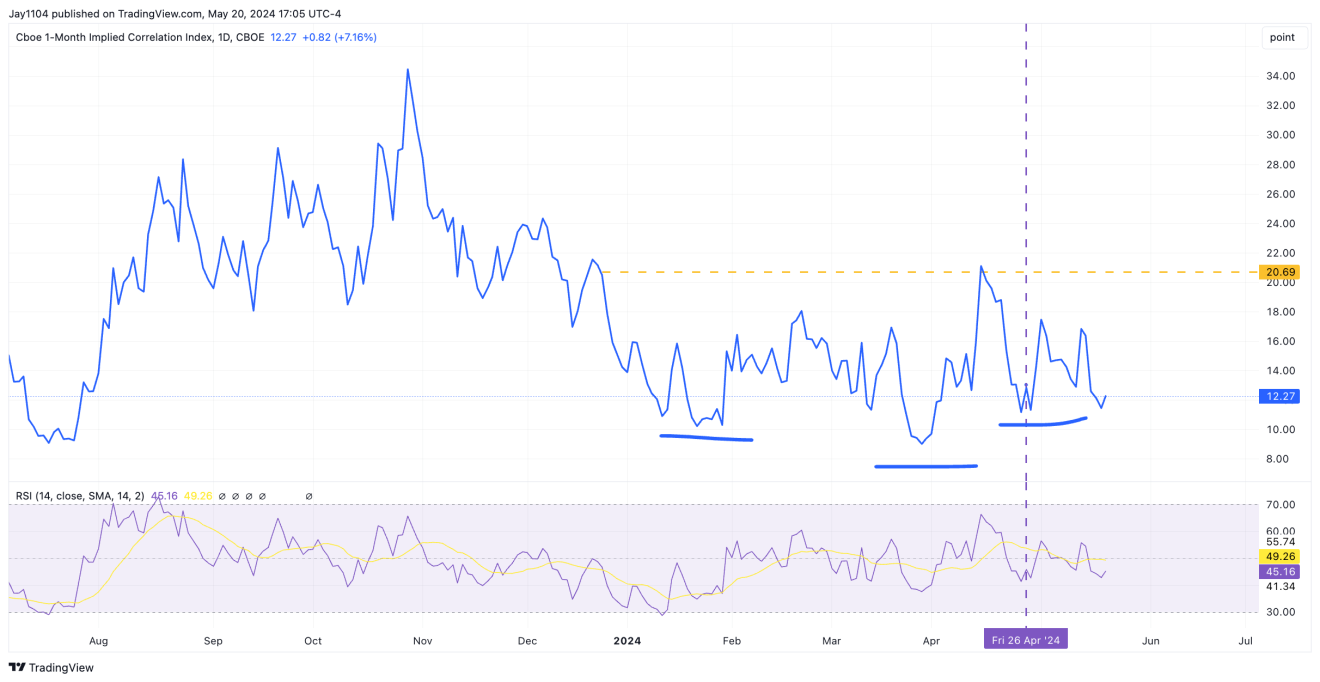

The implied correlation index was up, with the VIX rising. Something we will continue to monitor.

10-year rates were higher and have now recovered their move lower following the CPI.

Three things could be pushing rates higher at this point: higher copper prices (inflationary), talk by a few Fed officials of a higher neutral rate, and rates in Japan moving higher. The 10-year JGB closed yesterday at its highest level since 2012.

Rising rates in Japan will work to lift rates globally as the global anchor for low rates is reset.

Meanwhile, the market is also removing the odds for a November rate cut again, pricing in just 1.06 cuts for November, down from 1.35 on CPI day. So, it is really important not to get overly emotional about what happens to the market following a CPI report. In the end, the market needs the time to digest the information.

Have a good one!