Easing inflation narrative bolstered by UK CPI print

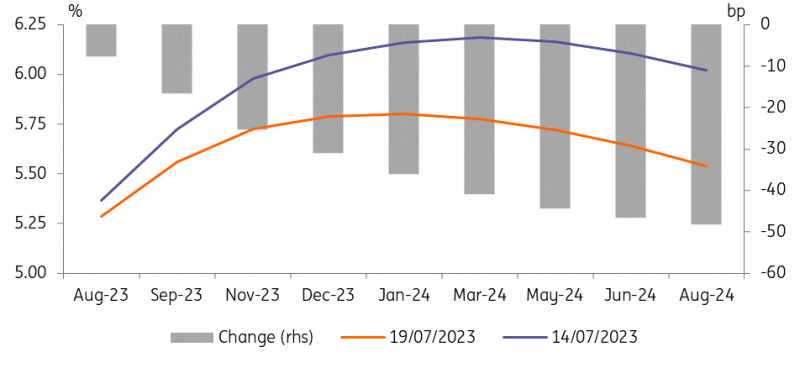

Markets have pared back their near-term rate hike expectations over the past few days. The final element, which had a significant impact on sterling rates, was the UK CPI print yesterday morning, which also saw services inflation fall below what the Bank of England itself was projecting. At 7.2%, it is still elevated but could make the difference between another 50bp move or a smaller 25bp hike at the upcoming central bank meeting in August. It certainly made a difference for the terminal rate markets are anticipating, which further declined to just over 5.8% coming from a peak of pricing of 6.5% earlier this month.

The UK data print helped feed the general narrative that inflation dynamics are starting to look more encouraging. Even the European Central Bank could point to its very own 'supercore' inflation measure, which posted a third monthly decline in a row yesterday (albeit still painfully high at 5.7% year-on-year). The data was released along with the final eurozone inflation data for June, which saw the official YoY core reading being revised up by a tenth to 5.5%.

BoE rate expectations were substantially trimmed after the CPI print

A dovish moment for EUR rates

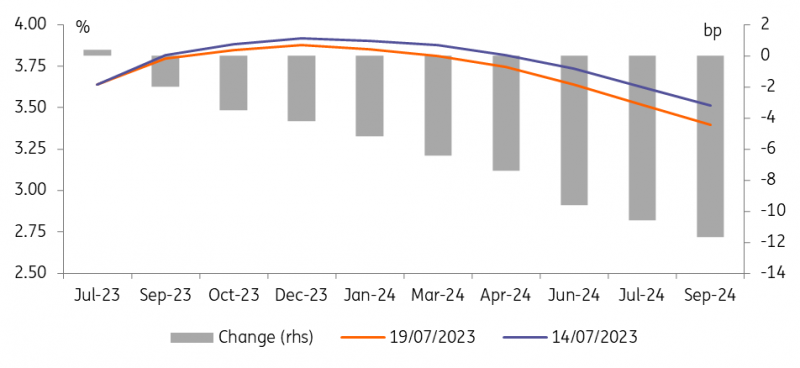

EUR rates also reacted to the UK data initially, but their bigger move had already occurred the day before on the back of the unusually dovish comments by one of the ECB’s hawks Klaas Knot. A July hike is a “necessity”, he remarked, while anything beyond July “would at most be a possibility but by no means a certainty.” Bundesbank President Joachim Nagel had also sounded less determined with regards to September earlier this week, stressing that the decision would emerge from a data-dependent approach.

Market pricing for the September ECB meeting now sees a rate cut hanging in the balance, although markets are still more inclined to see the ECB hiking once more after July before the year is over, putting the probability of the ECB reaching a 4% depo at 80%. It will indeed be more questionable whether we will get as firm a commitment for the next meeting in the upcoming press conference as we did in June for July. At the same time, the ECB is also unlikely to signal the end of its tightening cycle.

Over the summer, the ECB will this time have two CPI releases (for July and August) to contemplate and will also have new forecasts available in September. Other ECB officials such as Governing Council member Gediminas Simkus also reminded us yesterday that there are still scenarios where the central bank might do more, including a revisit of quantitative tightening discussions next year. The ECB has set the bar it has to clear with regards to inflation relatively high, not wanting “to be surprised again by sudden and significant changes in the wrong direction”.

Against that backdrop, it might not surprise that the EUR front end was reluctant to further trim the chances of a September hike to below 50%.

ECB expectations already shifted lower after Knot's dovish comments

Direction for Treasuries still moderately bearish, even if there is no material direction of late

It’s unusual to see eurozone rates and US rates moving in opposite directions, but that is exactly what we saw yesterday. The US market saw the higher-than-expected inflation print as an issue for the eurozone to price in, and by implication without consequence for the US. At the same time, the US has already re-priced to reflect the relative robustness of its economy. The Fed funds strip continues to account for this, with the liquid portion of the strip out to early 2025 not dipping below 3.75%. Further out it gets down to 3.6%, but there are no volumes to speak of out there. Either way, adding a 30bp term premium to this suggests that the US 10yr yield could easily be closer to 4% here.

It’s far from a perfect model, but it does help to explain why the 10yr yield has not collapsed lower, and in fact, we rationalise this as a factor that can force US yields higher as a tactical view. It goes against the consensus out there that the inflation story is behind us, but is rationalised by the reality that macro robustness can always reignite the inflation bubble in the months and quarters ahead. For this reason, we maintain a moderate bearish stance on the directional view, expecting market rates to remain under moderate rising pressure. The fact that risk assets remain in risk-on mode pushes in the same direction.

Today’s events and market view

As we approach summer, many investors are taking chips off the table and trading is becoming more choppy surrounding the competing narratives of easing inflation and economic resilience. At the moment, the market seems to take the middle ground, attaching a growing possibility to the most benign outcome of a 'soft landing'.

As for today, the main focus is on US data, with the release of the initial jobless claims as the highlight. The consensus is for very little change, which would support the notion of a resilient jobs market, but surprises here have seen some volatility in the past. Other releases are the Philadelphia Fed business outlook and existing home sales. The Conference Board’s Leading index is seen extending its fall, and it has been pointing to weaker economic activity ahead already for more than a year.

European supply will come from France and Spain. The French nominal bond auctions are targeting shorter maturity bonds out to 6 years, but France will also launch a new 11-year linker. Spain will active out to the 27-year maturity. The US Treasury launches a new 10Y TIPs inflation linked bond.

First published on Think.ing.com.