Wall Street went up yesterday

Tuesday has been a positive day for the US stock market.

All three major indexes closed in profit.

The S&P 500 finished at +1.65%, the Nasdaq ended the trading session at +2.14% and the Dow Jones closed at +1.06%.

The positive movement has been driven by yesterday's CPI data that have shown an inflation of 6%, in line with expectations.

The previous reading was 6.4% so, the monetary policy implemented by the federal reserve to reduce inflation is working.

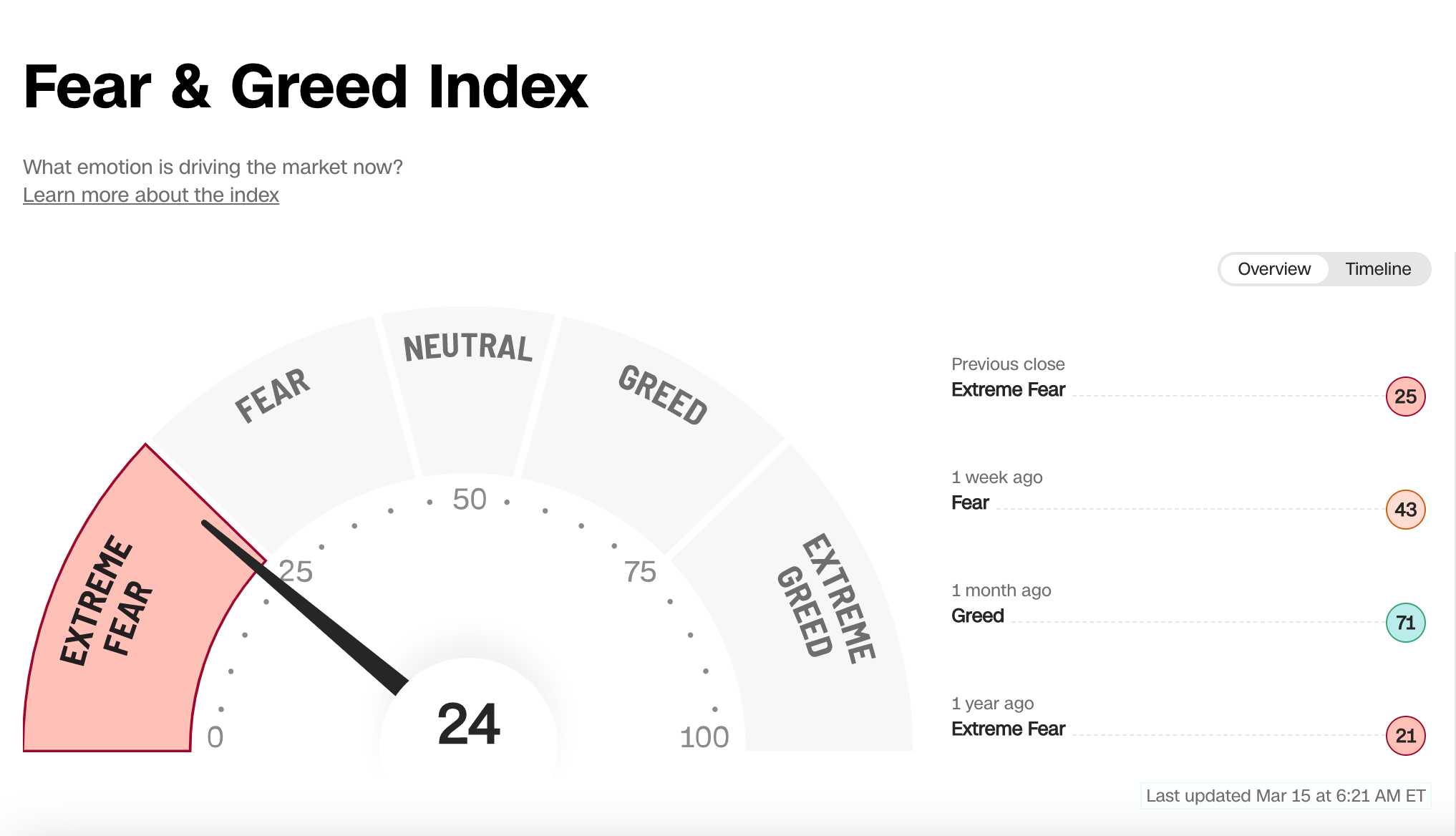

The investors' sentiment is Extreme fear, as indicated in the graph below:

Sentiment indicator - Fear & Greed Index

The market sentiment is 24, in “Extreme Fear” mode.

Stabilising the financial system is, now, the focus

The Federal Reserve will gather on 21 and 22 March to decide on the next monetary policy move.

In order to take a decision the Fed needs to take into consideration the following:

- The stability of the financial system. Last week, Silicon Valley Bank collapsed along with the other two banks and the Federal Reserve had to intervene to make sure that all depositors can access all their money.

- Price stability. The latest inflation data have shown a decrease compared to the precedent months.

Given the above information, the Fed can focus on financial stability since inflation is slowing down.

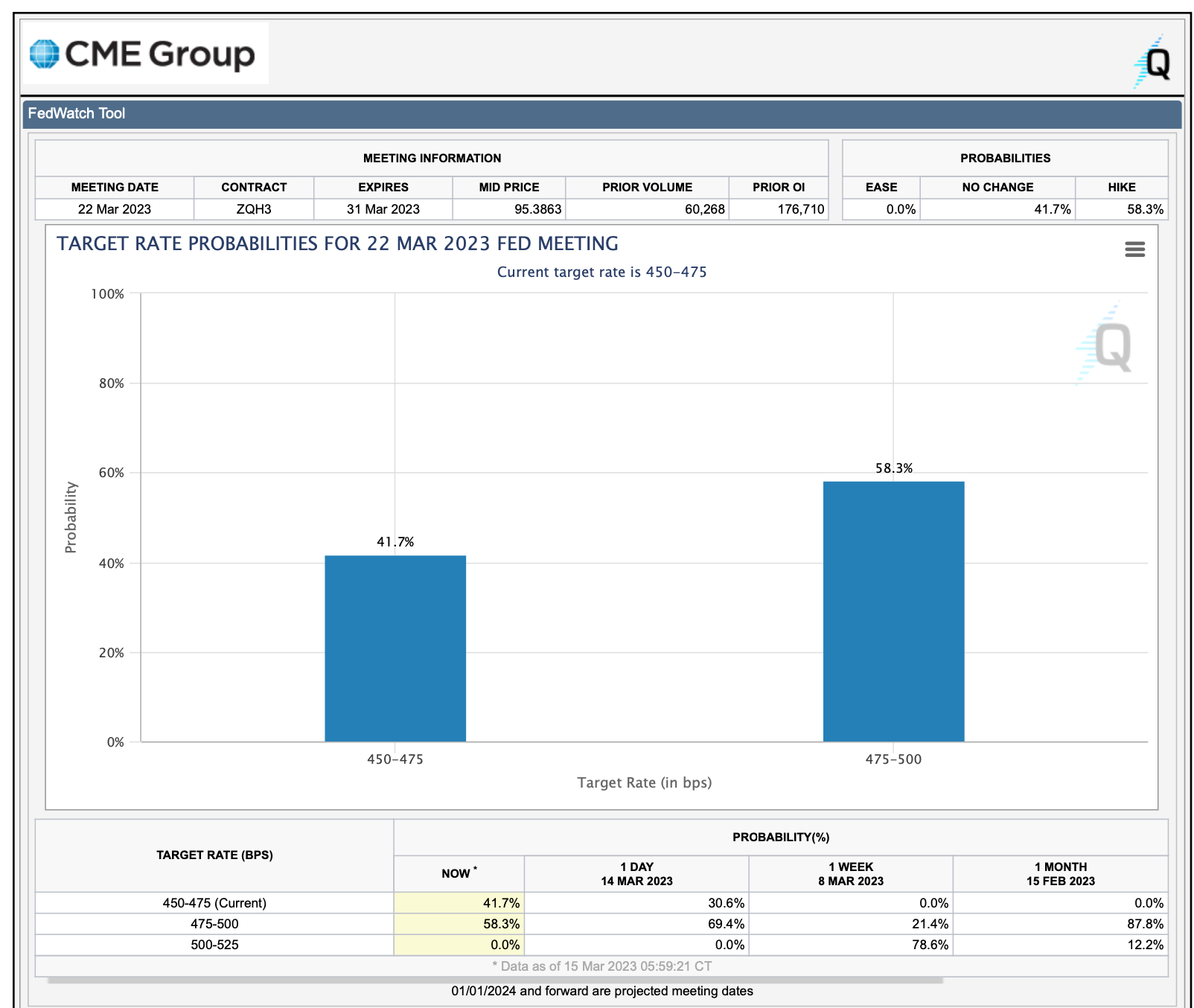

Investors are divided between an interest rate hike of 25 basis points or no rate increase at all, as shown in the graph below:

41.7% of the investors believe in no change in the current interest rate.

58.3% of investors are expecting a rate increase of 25 basis points.

No other options are considered at this time.

What to watch today

The Producer Price Index (PPI) is going to be published today at 12:30 GMT.

At the same time, is going to be released the Retail Sale data.

Both reports are fundamental to understanding the inflation level.

Markets will continue to be volatile today, due to these events.

Follow me

If you find my analysis useful, and you want to receive updates when I publish them in real-time, click on the FOLLOW button on my profile!