The FTSE and European markets are following Asian markets overnight and tanking lower. Risk aversion is back with a bang, even after the Federal Reserve threw the kitchen sink at shielding the US economy from coronavirus.

On Sunday evening, the Federal Reserve made another emergency rate cut. This time slashing rates by 100 basis points bringing interest rates to 0-25%. The Federal Reserve also pledged to restart QE, purchasing $700 billion in treasuries. The Fed also cut reserve requirements for banks to 0%.

These moves will go some way to easing potential blockages in the system. However, the markets are still plunging this morning. This is because the market does not consider that the moves by the Fed and other central banks across the globe will sufficiently compensate for the economic hit that is coming from the coronavirus outbreak.

Central banks action not enough

More countries are closing their borders, more people ae in lock down or isolation or quarantine and businesses are grinding to a halt. The supply shock demand shock will be unprecedented and airlines are already warning that they may not survive this crisis. Central banks across the globe have thrown what they can at the problem. However, the markets don’t consider it to be enough. Policymakers now need to step in to pick up and show that they are able to not only prop up the global economy but also stop the pandemic. G7 and G20 policy responses will now be in focus.

Fear in the driving seat

Fear is driving the markets. We have seen that policy moves so far have done little to stem this fear. The markets are unlikely to start showing signs of recovery until there is an improved prognosis surrounding coronavirus or until data out of China starts improving. This is likely to be a long way off yet given the dire Chinese data overnight. Chinese industrial production output fell to its lowest level on record in the first two months of this year after coronavirus brought the world’s second largest economy to a halt.

FTSE levels to watch

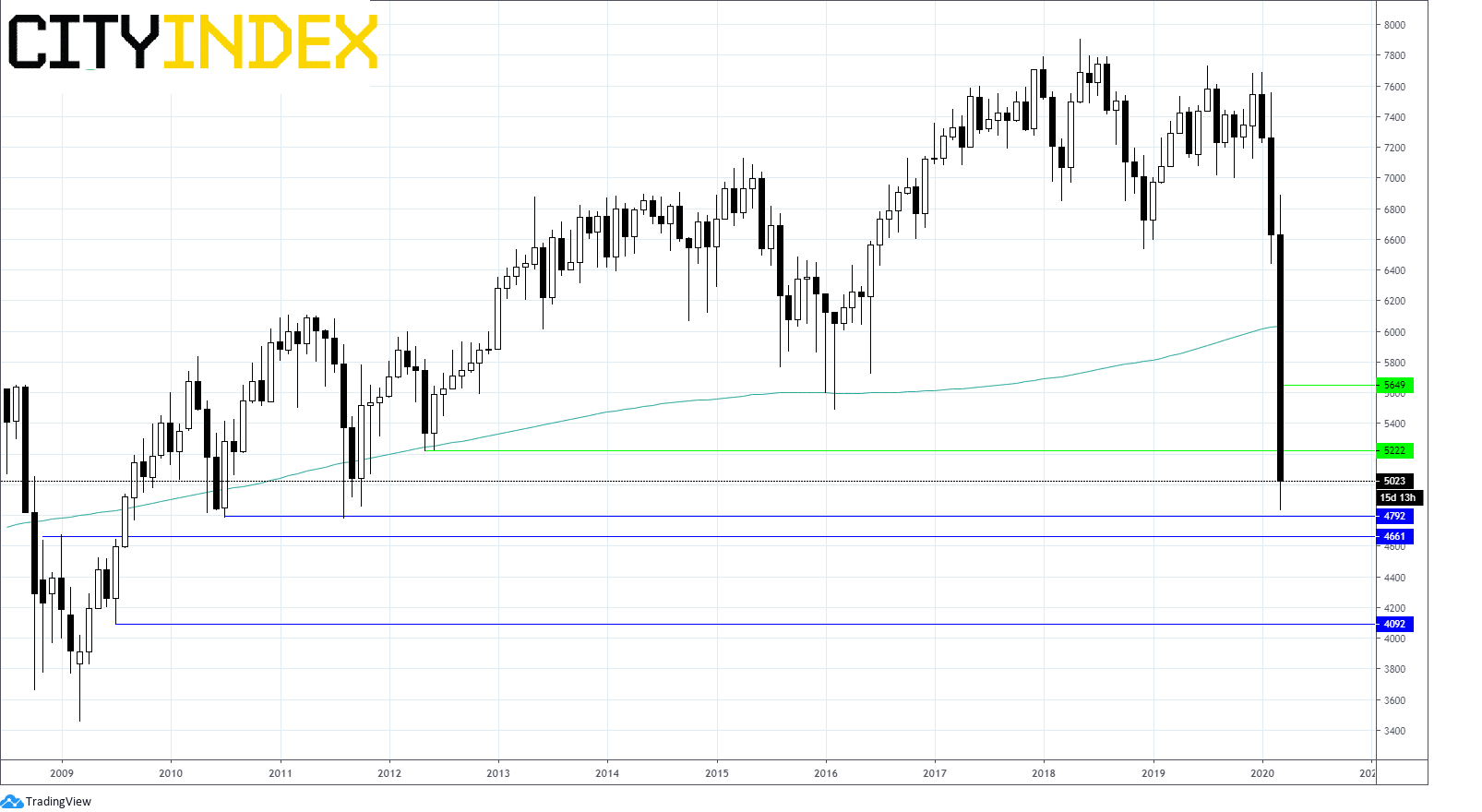

FTSE is trading 6.4% lower at 5020 after having rebounded off the low of 4841. The chart remains strongly bearish with the FTSE trading below 50, 100 and 200 sma.

Immediate support can be seen at 4841 (today’s low), 4795 (low July’10 and Aug’11). 4650 also offers support from resistance turned support in 2009.

On the upside resistance can be seen at 5220 (support turned resistance May’12) and today’s high at 5320, prior to 5650.

"Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient.

Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions."