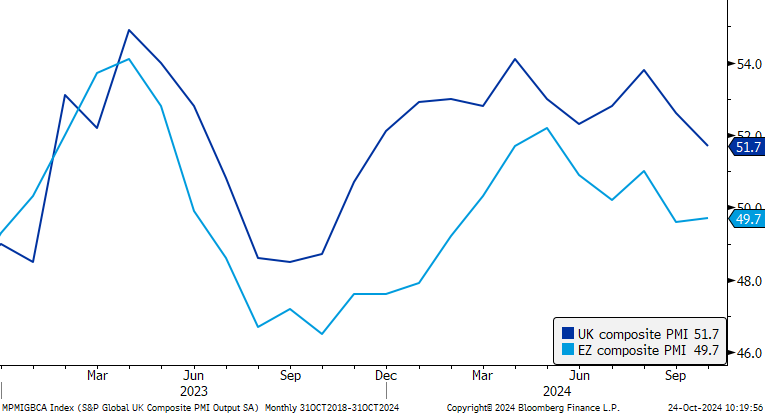

Private sector eurozone activity posted a marginal contraction in October, according to the latest flash PMIs. Activity in the UK, by contrast, continued to expand, but at the slowest pace since November 2023. In both cases, political uncertainty is weighing on growth.

Specifically, a UK budget is set to be presented by Rachel Reeves on October 30th, while Michel Barnier is struggling to win support for his tax and spending proposals in France. With this in mind, firms are exhibiting a degree of caution at the beginning of Q4, awaiting the outcome of these processes. As a result, the growth wedge that had opened up between the eurozone and the UK, has narrowed for the time being.

While we think this is likely to be temporary, it does serve to highlight that the relative growth exceptionalism that has seen GBPEUR grind higher over the course of this year, should not be taken for granted.

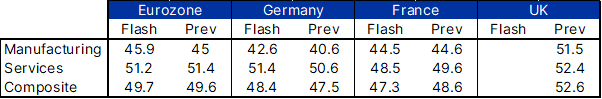

Turning first to the eurozone figures in more detail, the composite PMI nudged 0.1 points higher in October, essentially flatlining at 49.7. This was driven largely by manufacturing which rose from 45.0 to 45.9, while the services reading slipped by 0.2 points to 51.2.

That said, more interesting to us were the individual country readings for Germany and France.

The former is looking like less of a laggard, with a composite activity reading that rose from 47.5 to 48.4. Granted Manufacturing remains deep in contraction at 42.6. But this still marked a 2.0-point rise from September’s 40.6 reading and was notably higher than consensus projections.

While German activity surprised to the upside, this was largely offset by a disappointing set of readings in France.

The composite French PMI fell from 48.6 to 47.3 in October, with weakness visible across both the manufacturing and services readings. Underpinning this softening seems to be continued uncertainty around the budget, combined with fading stimulus from the Paris Olympics. We suspect neither of these factors will reverse in the near future, offering worrying signs for France’s near-term growth prospects.

Indeed, looking ahead for the eurozone as a whole, the short-term outlook remains grim. These latest PMIs once again highlight that demand conditions remain weak, the labour market is beginning to unwind, and both price pressures and business confidence are falling. For ECB speakers that have started to flirt with the idea of accelerating the pace of policy easing over recent days, we think this round of PMIs offers plenty of ammunition to support those arguments.

At face value, a similar argument could be made for the UK too. The composite PMI unexpectedly dropped from 52.6 to 51.7, having printed as high as 53.8 just two months ago. This sharp deceleration was also broad-based, with slowing activity growth across both manufacturing and services. Moreover, just as in France, political uncertainty is playing a role in the UK, with anecdotal evidence suggesting that many firms are nervously awaiting the outcome of the October budget.

That said, while this is depressing growth for now, we think there is greater cause for optimism in the UK too.

As we have noted previously, the past month has seen a concerted effort by the government to lower expectations ahead of the budget. This leaves risks skewed toward a fiscal event that is ultimately greeted with some relief. If we are right, this should see a modest recovery for UK readings in November.

Taken as a whole, these latest figures have seen the gap between UK and eurozone PMIs narrow, with this being reflected by FX markets. In a reversal of recent post-PMI release trends, GBPEUR is trading under pressure, coming after a strong initial start to the day.

Even so, given our views on the relative balance of political risks on either side of the channel, we think this is likely a blip, not the start of a sustained reversal of fortunes. As such, we continue to see upside risks for GBPEUR heading toward year-end.

October’s flash PMIs have seen the gap between UK and eurozone readings PMI close, albeit we think this is likely to be temporary, posing upside risks for GBPEUR moving forward

This content was originally published by our partners at Monex Europe.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI