This article was written exclusively for Investing.com

- Recent economic data has been much weaker than forecasts

- Q2 reporting season about to begin, major banks issuing results next week

- Volatility appears inexpensive as we enter renowned risky period for S&P 500

Fasten your seatbelts. Earnings season is about to get underway. We have already heard cautious words from firms such as Meta Platforms (NASDAQ:META), Restoration Hardware (NYSE:RH), and Micron (NASDAQ:MU), just to name a few.

While top and bottom line numbers will remain important, the guidance numbers and comments from management teams will matter the most.

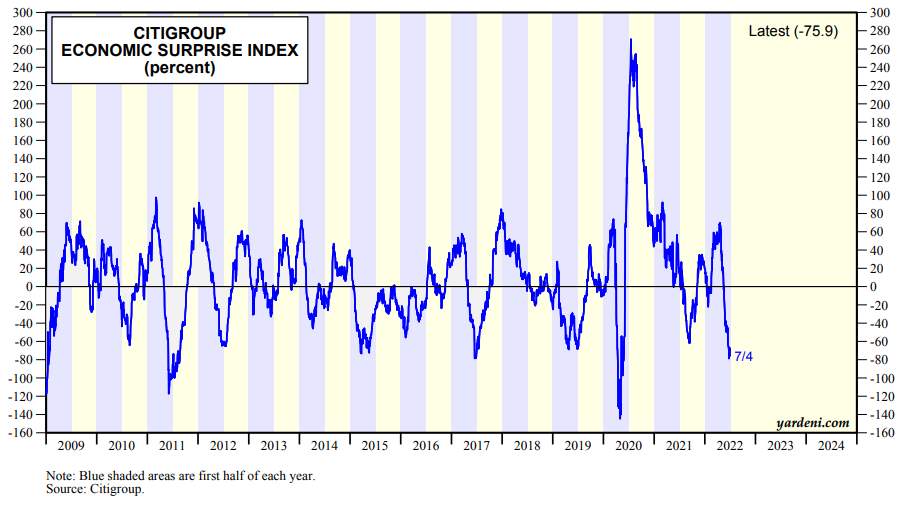

The corporate world may look to sandbag their outlooks to temper expectations, given the downturn in recent economic data. According to the latest reading of the Citigroup Economic Surprise Index, US data points have verified much worse than Wall Street’s expectations of late.

June’s Economic Data Verified Weak

Source: Yardeni.com

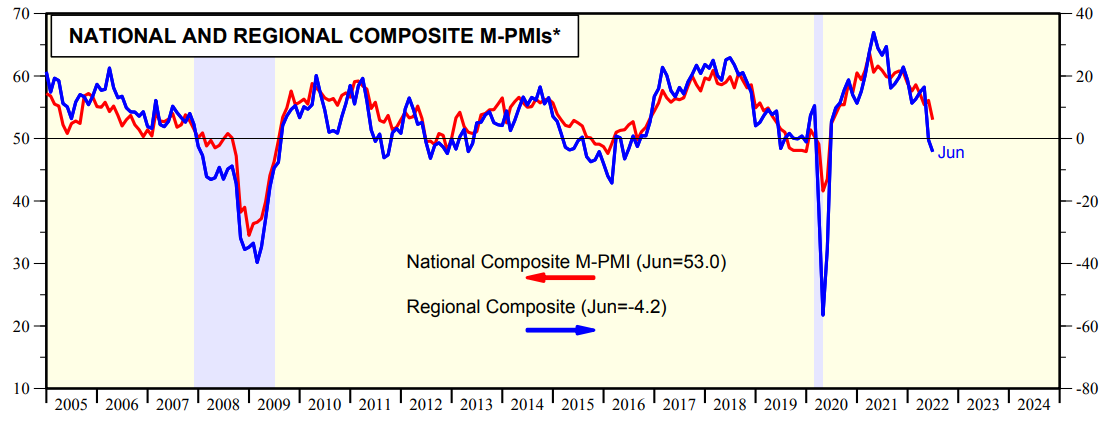

Much of the data has been dreadful on its own (not simply compared to the consensus forecasts). For instance, June’s regional Fed surveys suggest the economy might already be in a mild recession.

Regional PMIs In Contraction Territory

Source: Yardeni.com

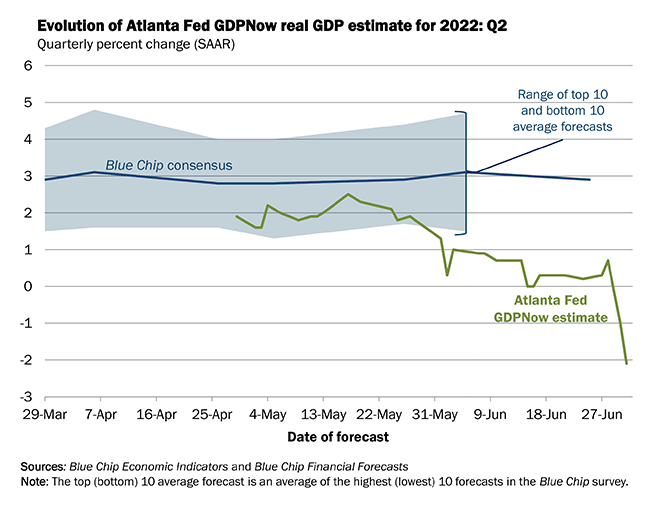

One more point about the macro picture, the Atlanta Fed GDPNow model portends a negative Q2 growth estimate. That comes after a -1.6% real GDP growth rate figure from Q1, according to the Bureau of Economic Analysis. An economic contraction might have begun just as the S&P 500 peaked at 4,818 intraday on Jan. 4.

A Recession Reality? Q2 Real GDP Growth Could Be Negative

Source: Atlanta Federal Reserve

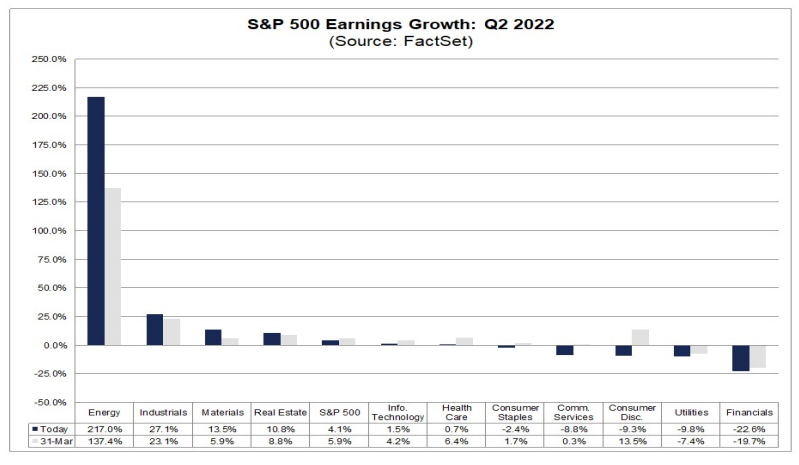

Analysts and investors are clearly not feeling so rosy as the second quarter reporting season starts. The Earnings Insights weekly feature published by John Butters at FactSet shows the latest earnings estimates for the S&P 500 and its sectors as well as a look at valuations which provides context.

Last week’s outlook noted that the S&P is expected to report its lowest earnings growth rate since Q4 2020. The +4.1% nominal profit rise from the same period in 2021 is negative when you back out the current high inflation rate (above 8%). Remove the energy sector’s massive 217% anticipated EPS rise, and SPX earnings are even worse.

S&P 500 Earnings Growth Focused On Energy Sector

Source: FactSet

So, what’s the play here? How shall investors trade what might be the nerviest reporting season in recent memory?

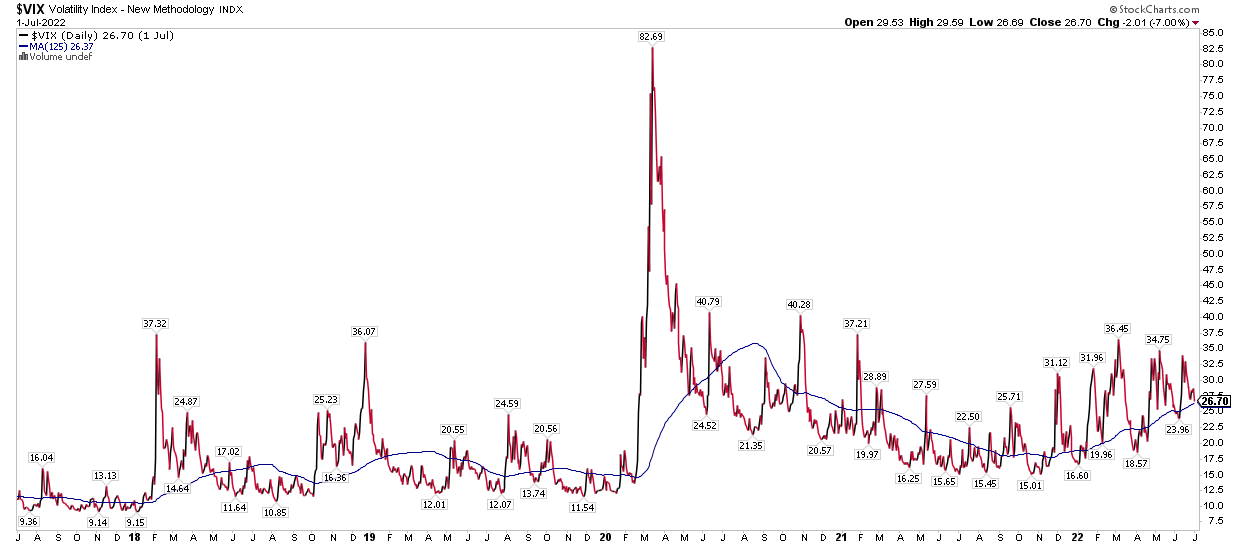

I think volatility is pretty cheap right now. Consider that the CBOE Volatility Index (VIX) has been hovering stubbornly near 30 for much of 2022. The five-year daily chart of the VIX shown below has a 125-day moving average (the number of trading days so far this year).

Notice how the VIX has been in an uptrend since October 2021, though in consolidation mode since the March 2022 spike above 36. A VIX under 27 implies a daily move of just 1.7% on the SPX. I think we could see much bigger swings than that through earnings season and the rest of Q3 (a notoriously risky period during a mid-term election year).

CBOE VIX Index: Turning Upward In 2022

Source: Stockcharts.com

The Bottom Line

Earnings season has arrived. The third quarter through October tends to be a dicey time for the bulls—particularly ahead of the mid-terms. A VIX significantly under 30 looks too cheap to me. Going long, volatility through SPX options or even on single stocks could be a way to play the market right now.