The equity market fell last week, with the indexes plunging sharply on Friday. This was mostly due to OPEX, as the supportive flows we observed at the beginning of last week have vanished since the quadruple witching is behind us. Additionally, economic data last week continued to strengthen the notion that the economy’s expansion has accelerated and that inflation remains a concern, driving up rates, real yields, and the dollar.

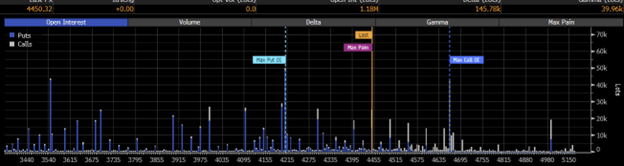

Lastly, oil continues to surge, further contributing to inflationary pressure that weighs heavily on the equity markets. The expiration of the JPM collar on September 29th is a significant options event that could impact the market. The highest open interest levels are 4,665, 4,210, and 3,550. While the 3,550 level may not be as influential, the 4,665 and 4,210 levels could attract attention, especially if the market drifts in one of the directions.

Fed

This week will also be the FOMC meeting, BOJ, and BOE. All have their own importance. I think the Fed will leave rates unchanged this week but signal one more hike in the Summary of Economic Projections. Additionally, I think they will likely remove rate cuts from the projections. (See more: The Fed May Shatter The Rate-Cut Fantasy This Week)

S&P 500 (SPX)

Based on the technical patterns and what we know about the macro forces, it seems that drifting towards 4,210 may be the market’s preferred path.

The S&P 500 has been flirting with the 50-day moving average for some time and moved below it on Friday. The same is true of the 10-day exponential moving average. But if you want to look beyond the short-term momentum factors, the S&P 500 had its second consecutive lower high this past week.

Additionally, we saw the S&P 500 break a short-term uptrend this week, falling below 4,465, which places the next big support levels around 4,430 and then 4,420. The problem is if 4,430 breaks, a larger diamond reversal pattern will break, which could set up a return to 4,200 or lower, a level I have been looking to return to since June.

NASDAQ 100 (NDX)

The NDX has a similar diamond pattern (red lines) but also has a bear flag (blue lines) and head and shoulders (black curves) pattern still forming. The level to watch for the NASDAQ is at 15,150 because if that level breaks, the bear flag will break, and the diamond pattern will break, setting up a test of the neckline in the head and shoulders pattern at 14,670. This would set up a drop to around 13,300 if we project the head and shoulders pattern out. The diamond pattern suggests a return to the origin around 12,750 over time.

10-Yr

Additionally, we saw rates push higher back to the upper end of the trading range, with the 10-year rate pushing higher to 4.33%. The 10-year rate appears poised to break out and push well beyond the recent highs. The last couple of times the 10-year rate reached these levels, the RSI was already around 70. This time, the RSI is only at 63, which suggests that the 10-year is not in an overbought position and that a push above resistance at 4.35% could send the 10-year higher to around 4.7%, a level last seen in 2007.

The last time the 10-year rate was at 4.7% was back in October 2007, and that was a level of resistance back then. If the 10-year has broken out of a bull flag, which it appears to me it has, then it could see that move higher come soon.

30-Yr

The same goes for the 30-year rate, which is up against resistance at 4.42% and an RSI of just 64. So again, the 30-year, like the 10-year, appears to be positioned to make that next big move higher and potentially reach around 4.8%.

The last time the 30-year was at 4.8% was in February 2011. At that time, 4.8% acted as resistance as well.

20+ Treasury ETF (TLT)

A move higher in the 30-year also means that the TLT heads lower from these levels and moves below the October 24 intraday low of $91.85. That probably means that TLT heads back into the upper-$80s.

Dollar (DXY)

A move higher in rates should further strengthen the dollar after breaking out of a consolidation in the past few days. It seems possible for the dollar index to push higher from current levels and continue on beyond resistance at 106.

AMD (AMD)

Meanwhile, AMD has been battered and continues to trade within a descending triangle. The stock has been making lower highs for months, and the RSI is suggesting momentum is very negative. AMD is now testing support again, around $100 for the second time. A break of support at $100 sets up a drop to around $93 and potentially to $82.

Salesforce

Salesforce (NYSE:CRM) also has a potential head and shoulders pattern forming. The big support level for CRM comes around $206.50.

KB Home

There is also a head and shoulders pattern forming on KB Home (NYSE:KBH), which is similar to what we have seen in other parts of the market, with the neckline around $47.75 and a break of support setting a further decline from current prices.

This week’s Free YouTube Video:

Have a good week