- Pepsico is a classic low-beta defensive stock

- Shares have returned a total of 24% over the past 12 months

- The Wall Street consensus outlook is bullish, but with little expected upside over the next year

- The market-implied outlook (calculated from options prices) continues to be bullish, with low volatility

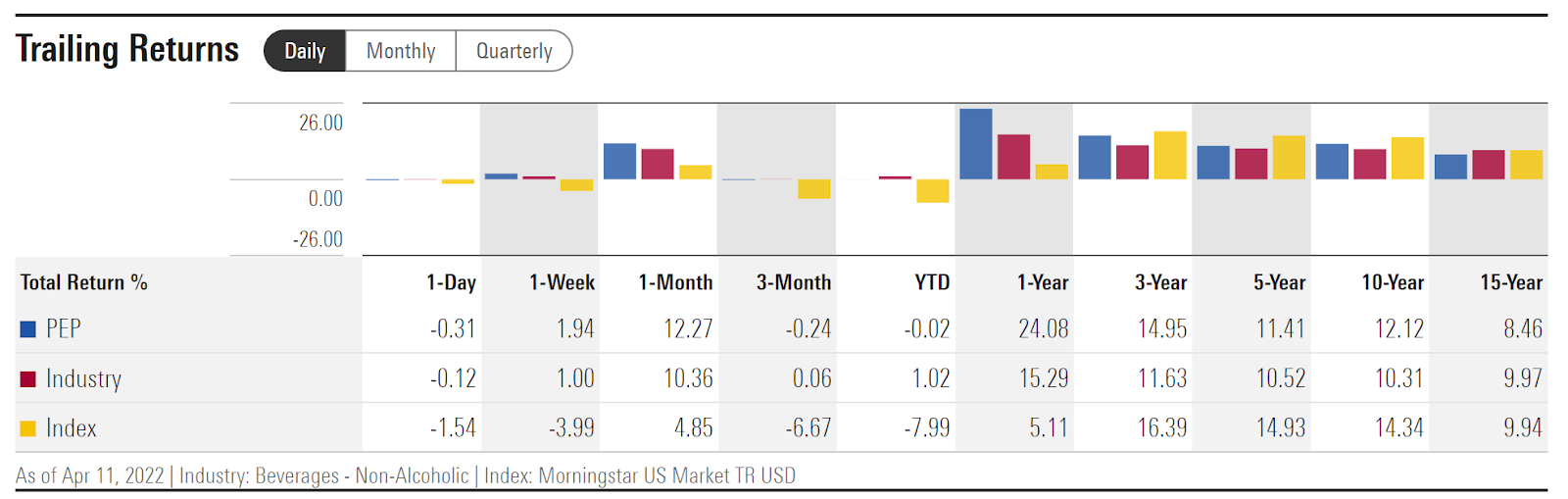

PepsiCo (NASDAQ:PEP), the global beverage and snack food giant, has substantially outperformed the US equity market over the past 12 months, with a total return of 24.1% vs. 8.4% for the S&P 500. PEP is often cited as being able to thrive even as inflation rises.

Supporting this view, the company reported solid Q4 earnings on Feb. 2, very slightly beating expected EPS. Part of PEP’s gains are probably due to investors shifting money from growth stocks to defensive, low-beta assets.

Source: Investing.com

The global food and beverage behemoth has substantially outperformed the non-alcoholic beverage industry over the past year, as well as beating the industry by a narrower margin over the last 3-, 5-, and 10-year periods.

Source: Morningstar

Even though PEP has consistently exceeded consensus EPS estimates for years, the company’s earnings growth is modest. EPS for Q4 of 2021 was $1.53 per share, barely higher than Q4 of 2018, with EPS of $1.49 per share, for example. It is not, therefore, surprising that PEP’s current P/E, at 31, is on the very high end of historical levels.

Source: E-Trade

PEP’s 3-, 5-, and 10-year dividend growth rates are 5.0%, 7.4%, and 7.6%. With expected EPS growth of 7.2% per year for the next 3 to 5 years, these historical dividend growth rates are sustainable. With the 2.4% current dividend yield and assuming future dividend growth of 5%, the Gordon Growth Model estimated expected total returns of 7.4%.

On Sept. 22, 2021, I rated the shares a buy. And since then, they have returned a total of 14.3%, as compared to 1.2% for the S&P 500 over the same period.

Even though the valuation was quite high at that time, with a P/E of 26, I settled on the bullish rating primarily because of two different types of consensus outlooks that were both bullish. The first of these was the well-known Wall Street analyst consensus outlook, with a 12-month price target that implied a total return slightly above 10%. The second form of consensus that I looked at was the market-implied outlook, which represents the collective view of options traders. The market-implied outlook was bullish to the middle of 2022.

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock reflects the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probabilistic price forecast that reconciles the options prices. This is the market-implied outlook and represents the implicit aggregate view among buyers and sellers of options. For readers who want a deeper dive into market-implied outlooks than I provide here or in the previous link, I recommend this excellent monograph that is available at no cost from the CFA Institute.

With more than 6 months since my last evaluation, I have updated the market-implied outlook for PEP through the end of 2022 and compared this with the current Wall Street consensus outlook.

Wall Street Consensus Outlook for PEP

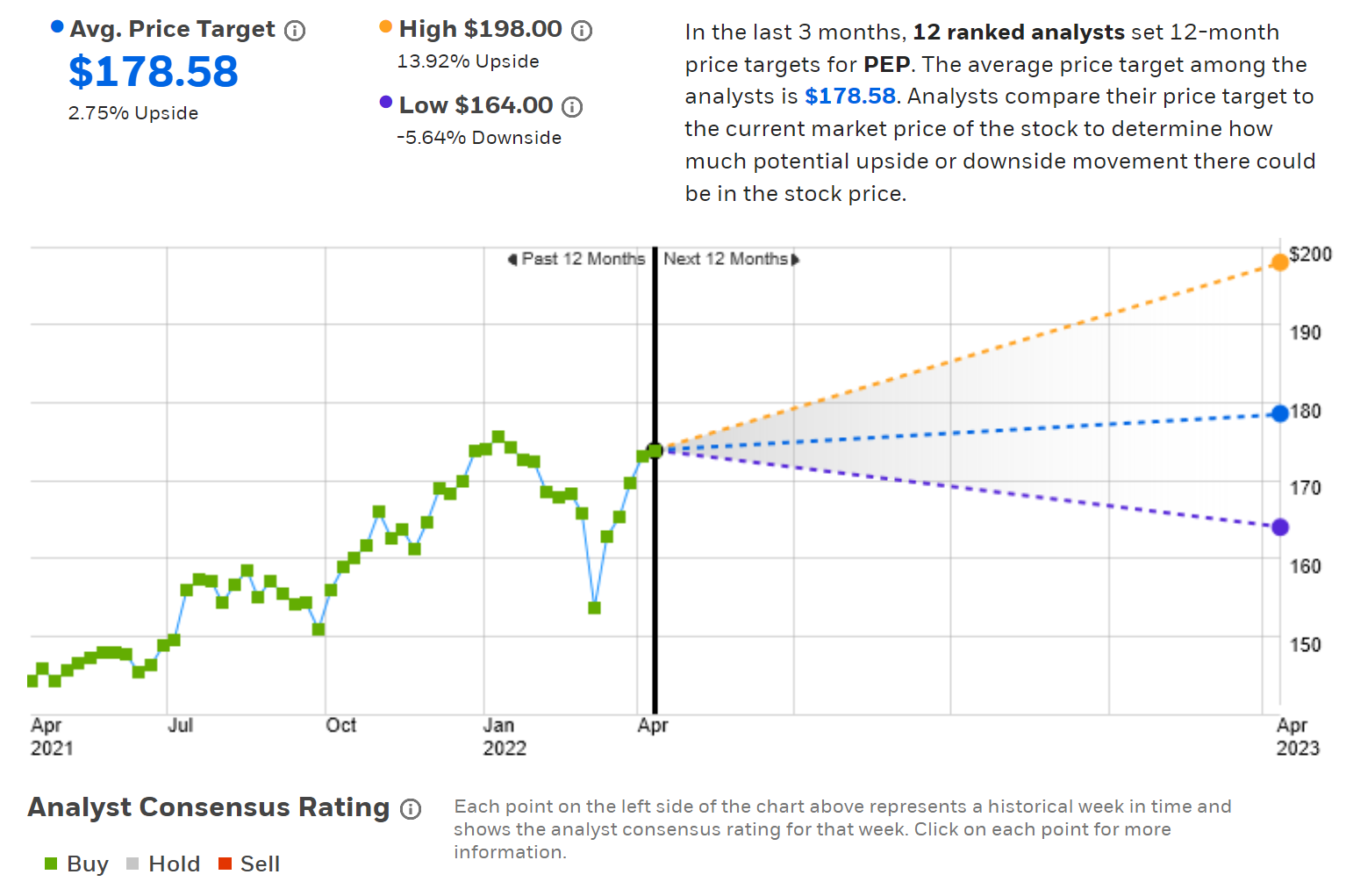

E-Trade calculates the Wall Street consensus outlook for PEP by combining the views of 12 ranked analysts who have published ratings and price targets within the past 90 days. The consensus rating continues to be bullish and the consensus 12-month price target is 2.75% above the current share price. The price target has increased substantially since my last analysis, but the share price has risen more, so the expected 12-month price appreciation is smaller.

Source: E-Trade

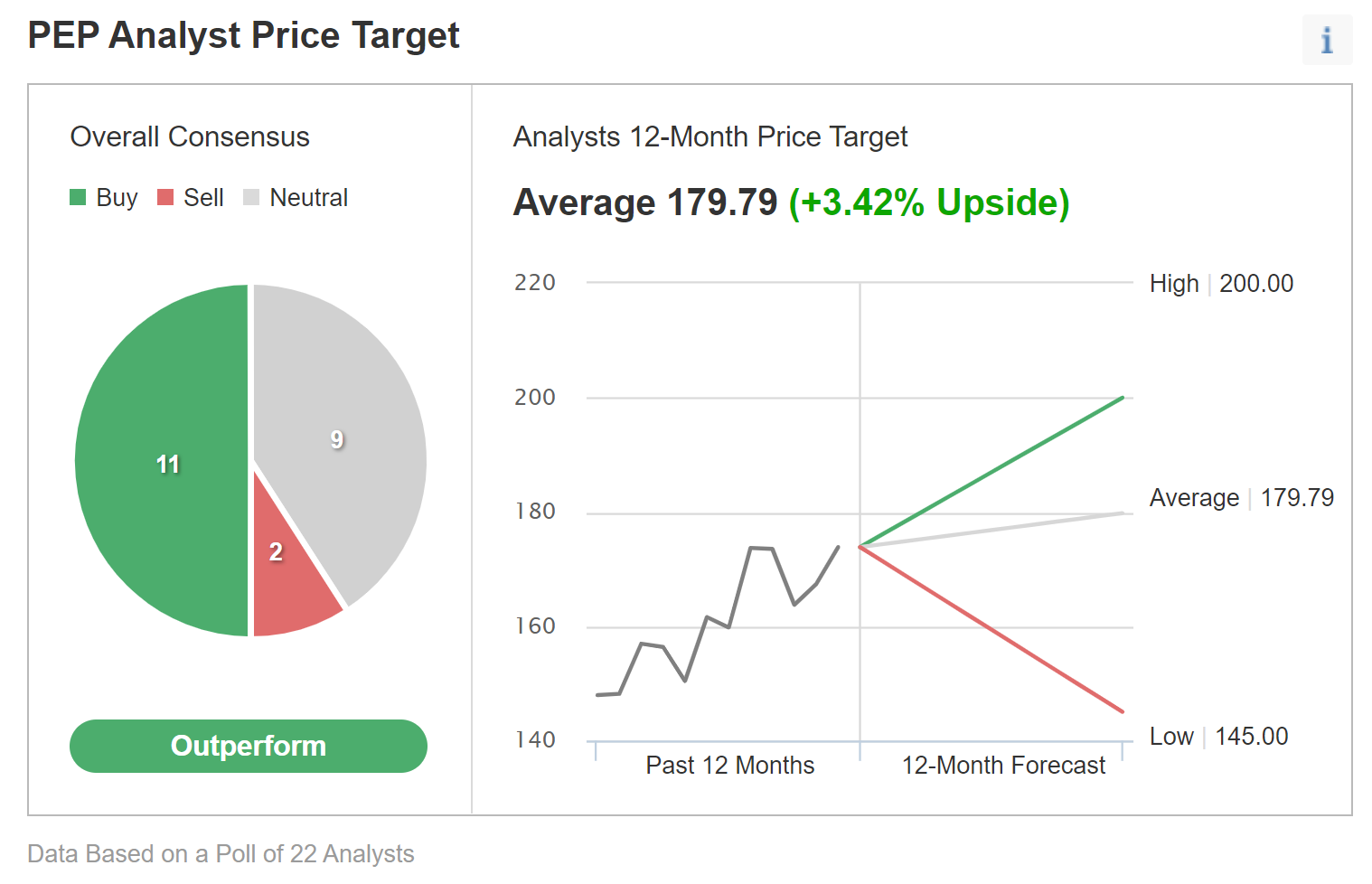

Investing.com calculates the Wall Street consensus outlook using ratings and price targets from 22 analysts. The consensus rating is bullish and the consensus 12-month price target is 3.4% above the current share price.

Source: Investing.com

With a bullish consensus outlook, but expected 12-month total return of only 5.5% (averaging the price targets values from Investing.com and ETrade and adding the dividend), is PEP worth the risk?

Market-Implied Outlook for PEP

I have calculated the market-implied outlooks for the 2.2-month period from now until June 17, 2022 and for the 9.3-month period from now until January 20, 2023, using prices of options that expire on these two dates.

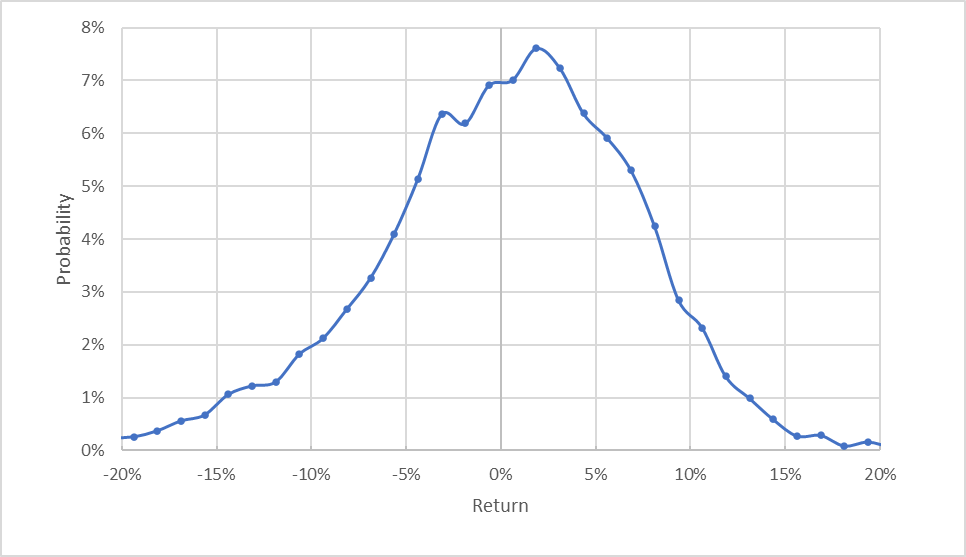

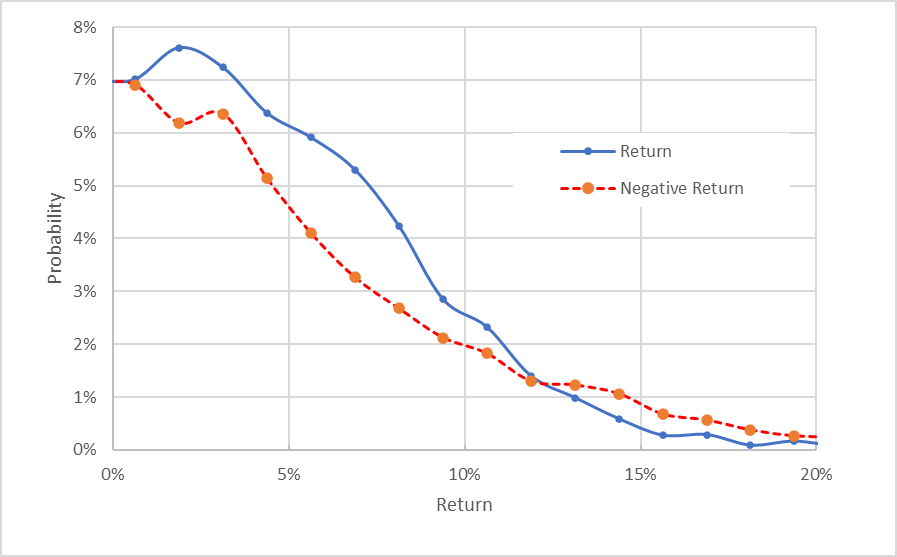

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Source: Author’s calculations using options quotes from E-Trade

The outlook for the next 2 months is generally symmetric, although the maximum probabilities are tilted to favor positive returns. The maximum probability corresponds to a price return of +1.9%. The expected volatility calculated from this distribution is 21% (annualized), which is low for an individual stock and very close to the result from my September analysis.

To make it easier to directly compare the probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Source: Author’s calculations using options quotes from E-Trade

This view clearly shows that the probabilities of positive returns are consistently higher than the probabilities of negative returns of the same magnitude, across a wide range of the most-probable outcomes (the solid blue line is above the dashed red line over the left ½ of the chart above). This is a bullish outlook for PEP to the middle of 2022.

Theoretically, the market-implied outlook should tend to have a negative bias because risk-averse investors overpay for downside protection (put options). While there is no way to measure if this effect is present, the potential for a negative bias reinforces the bullish view.

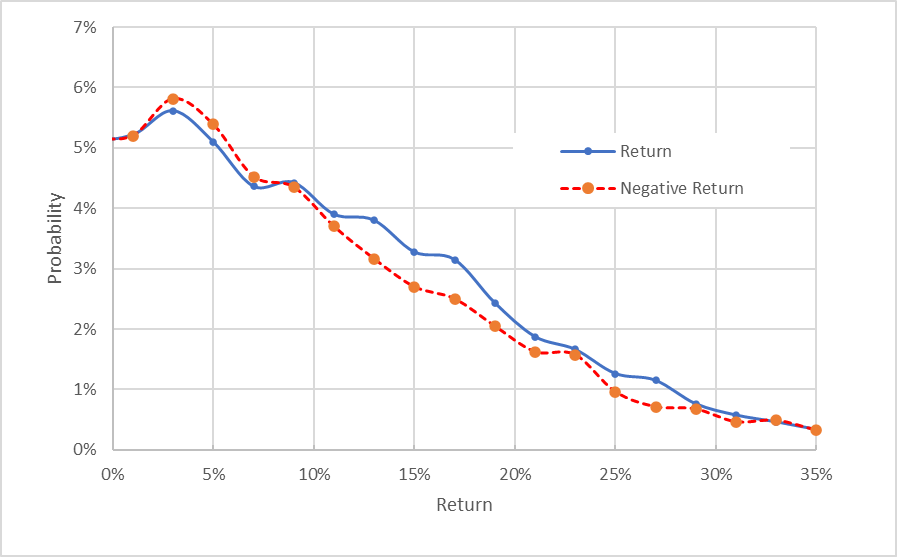

The market-implied outlook for the next 9.3 months, from now until Jan. 20, 2023, exhibits a closer match between the probabilities of positive and negative returns. Even so, the probabilities of positive returns tend to be slightly higher than the probabilities for positive returns of the same size. Especially considering the expected negative bias, this market-implied outlook is slightly bullish. The expected volatility calculated from this distribution is 21% (annualized).

Source: Author’s calculations using options quotes from E-Trade

The market-implied outlook for PEP is bullish to the middle of 2022 and slightly bullish to early 2023. The expected volatility is low, at 21%, and is the same for both of these periods.

Summary

Pepsico has delivered on earnings expectations and provided investors with high returns over the past year, even as inflation has been rising. The shares have benefited as investors have favored defensive stocks.

Its P/E is over 30, which is a concern. The Wall Street consensus outlook continues to be bullish, although the expected upside is very limited. The consensus for expected total return over the next 12 months is 5.5%.

As a rule of thumb for a buy rating, I want to see an expected 12-month return that is at least half the expected annualized volatility (21%) and Pepsico fails to meet this criterion.

That said, low-beta stocks justify an allocation because of their risk mitigation properties, even when they may not look attractive on a standalone basis. The market-implied outlook for PEP is bullish to the middle of 2022 and slightly bullish to early 2023. Even with the stretched valuation and limited upside, I am maintaining my buy rating.