Patria Private Equity Trust's (LON:PPET) (PPET’s) distributions from its primary fund investments have increased recently, supported by a revival in private equity (PE) deal activity. Its portfolio valuations continue to be validated by uplifts upon exits, which in the nine months to end-June 2024 averaged 23.3% (in line with the long-term average of 25%). Valuations and liquidity were also assisted by the successful £180m secondary sale in October 2024 at a limited 5% discount to carrying value.

While PPET’s 12-month NAV total return (TR) to end-October 2024 (based largely on end-June 2024 valuations) was muted at c 2% (broadly in line with peers), it posted five-year and 10-year NAV TRs of 15.0% and 14.6% pa, respectively. This was well ahead of listed equities in the UK and continental Europe and also above the MSCI World Index’s TR of c 13% pa in sterling terms. However, PPET’s current discount to NAV is 28% (above the 10-year average of 24%).

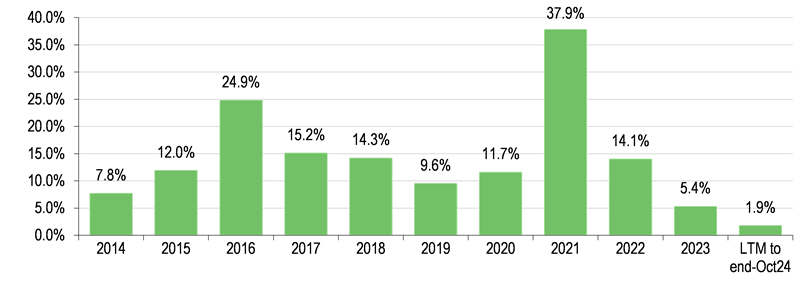

PPET has delivered a strong NAV TR over the last five and 10 years

Source: PPET

Mid-market private equity remains attractive

The PE mid-market (which PPET focuses on) offers several potential advantages: 1) many of the acquired companies have not been owned by PE before, potentially providing an opportunity for value creation; 2) portfolio exits are less dependent on the IPO market; and 3) deals are less reliant on funding via syndicated loans and often use less leverage. PE transaction activity has been stabilising and gradually improving throughout 2024, and PitchBook estimates that European deal value and count in 2024 is on track for growth of 27.5% and 11.5% y-o-y, respectively.

Excellent balance sheet flexibility

We believe that the recent pick-up in distributions from PPET’s primary investments, coupled with the secondary sale, greatly reduces any balance sheet risks, as PPET’s short-term resources at end-October 2024 stood at £325.1m (or c 28% of NAV). This puts PPET in a comfortable capital position with respect to new investments, deleveraging and shareholder returns.

PPET maintains its progressive dividend policy and is on track to pay out 16.8p per share in FY24, up 5.0% y-o-y and translating into a 3.1% dividend yield. It has also been performing share buybacks since January 2024, using some of the proceeds from its partial exit from Action in 2023. Additional attractions of the trust are the growing share of direct investments (co-investments and single-asset secondary investments) and that it is not charged a performance fee by its investment manager.

NOT INTENDED FOR PERSONS IN THE EEA

Global M&A and PE markets gradually warming up

Global PE transaction activity has been stabilising and gradually improving throughout 2024, increasing by 36% y-o-y in the first nine months of 2024 (9M24), according to EY’s Private Equity Pulse: Key Takeaways from Q3 2024 publication, citing Dealogic data. EY stated that the gap between buyers’ and sellers’ price expectations has begun to narrow, supported by a turn in the interest rate cycle and improving conditions in the debt financing markets.

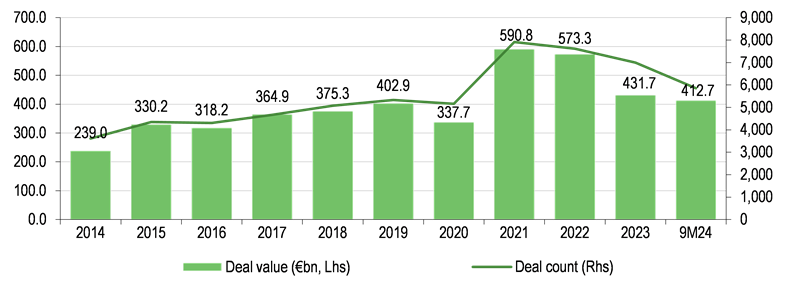

The latter is illustrated by Partners Group’s comment in its Quarterly Liquid Credit Market Commentary Q3 2024 that investor demand continues to outstrip supply in the new leveraged loan issuance market, leading to tighter single-B loan spreads. According to EY’s PE Pulse Survey, 74% of general partners expect a pick-up in capital deployment over the next six months, up from 63% recorded at the beginning of the year. This is underpinned by the high level of dry powder accumulated in recent years, with continued strong fund-raising in Europe of €109.6bn in 9M24 (compared with full-year volumes of €122.1bn in 20023 and €104.6bn in 2022), including healthy mid-market fund-raising (ie fund-raising between €100m and €5bn), according to PitchBook. PitchBook estimates that European deal value and count in 2024 are on track for growth of 27.5% and 11.5% y-o-y, respectively.

Alan Gauld, PPET’s lead portfolio manager, highlighted in our recent EdisonTV interview that deal activity has started to broaden beyond the more recession-proof assets with recurring revenue, in sectors such as business-to-business mission-critical software, healthcare and consumer staples, into businesses operating in more discretionary sectors. Regarding European exits, there were some initial signs of the IPO market opening up, while exits to corporates remain modest. As a result, sponsor-to-sponsor deals accounted for more than half of European deals for the first time since 2014, according to PitchBook, which estimates that European exit value will finish 2024 at a roughly flat year-on-year level, still 34.3% below 2021 highs.

Exhibit 1: European PE deal value

Source: PitchBook. Note: Data as of end-September 2024.

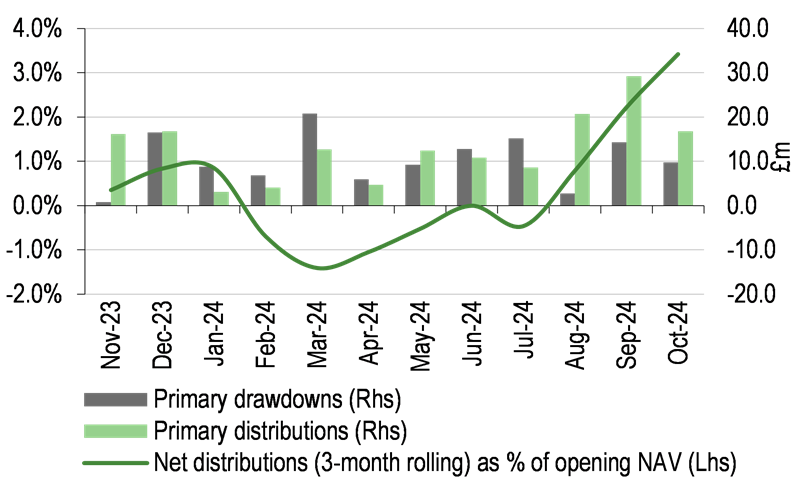

PPET’s primary distributions above capital calls lately

Despite the still relatively subdued exit activity across the market, the warming up of the M&A and PE markets resulted in PPET’s distributions outpacing capital calls from primary fund investments in recent months (see Exhibit 2). We estimate (based on PPET’s monthly NAV updates) that the trust’s 12-month primary distributions to end-October 2024 reached c £150m, compared to capital calls of around £124m.

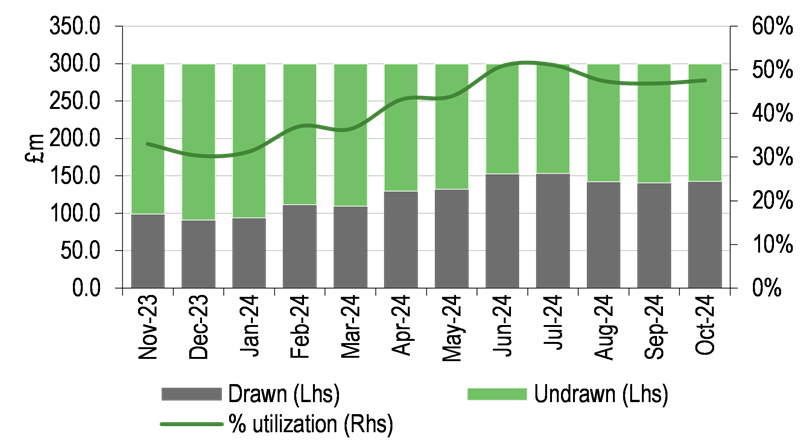

Meanwhile, PPET’s activity in terms of new capital commitments (across direct and primary fund investments) remained cautious, with total capital committed of around £160m (or c 14% of opening NAV), which is broadly in line with its 12-month distributions. As a result, PPET’s utilisation of its £300m credit facility peaked in July 2024 at c 51% and subsequently fell slightly to 48% (or £157.3m) at end-October 2024 (see Exhibit 3).

Exhibit 2: PPET’s historical capital calls and distributions from its primary fund investments

Source: PPET, Edison Investment Research

Exhibit 3: Utilisation of PPET’s credit facility

Source: PPET, Edison Investment Research

Secondary sale boosts liquidity and validates NAV

In October 2024, PPET seized the opportunities arising from the favourable demand in the secondary market with a successful secondary sale of a portfolio of 14 older vintage and non-core investments for c €216m (c £180m or 13% of PPET’s end-August 2024 NAV; see our flash note for details). This represents a minor 5% discount to the carrying value of the sold assets at end-March 2024 (H124) and translates into a robust 1.9x multiple on invested capital and a 16% internal rate of return. We believe that the price of PPET’s transaction provides a strong validation of PPET’s portfolio valuations.

The transaction allowed the trust to further shift its portfolio weighting to the PE mid-market and provides it with significant additional liquidity, which can be used for a combination of new investments, deleveraging and corporate activities (eg buybacks). In this context, we note that the sale proceeds exceed the entire drawn amount of PPET’s credit facility. At end-October 2024, PPET had £325.1m of short-term resources, consisting of cash balances, deferred consideration from the secondary sale and the undrawn part of its credit facility. We calculate that this brings PPET’s pro-forma overcommitment ratio (outstanding commitments in excess of cash and equivalents and undrawn credit facility divided by portfolio NAV) to 27%, below the lower bound of its targeted 30–75% range.

Continued shift to direct investments

- PPET’s new co-investments over the 12 months to end-October 2024 included:

- €10.5m alongside Latour Capital into European Digital Group, an integrated services provider in the digital transformation and digital marketing segments;

- €5.0m alongside Exponent (NASDAQ:EXPO) into Chanelle Pharma, an Ireland-based manufacturer of generic animal and human health products;

- €10.0m alongside PAI Partners into Nutripure, a direct-to-consumer French sports nutrition, and health and wellness food supplements brand; and

- €10.6m alongside Latour Capital into SYSTRA, a global consulting and transportation engineering company.

PPET also made follow-on co-investments into: an undisclosed European-headquartered technology business in the healthcare sector; small and medium-sized enterprise software business Visma; GoodLife, a manufacturer of frozen snacks in Europe; and an undisclosed US-based consumer business alongside one of the company’s core PE managers. The trust saw the first full realisation from its direct portfolio of Mademoiselle Desserts (a French premium sweet bakery manufacturer, which was PPET’s first co-investment back in 2019) in the second half of 2024. Finally, PPET made a €10.4m undisclosed secondary investment into a continuation vehicle of a ‘leading global healthcare private equity specialist’ in April 2024.

As a result, PPET’s portfolio continues to shift in favour of direct investments, which provide greater control over capital deployment, and PPET is not charged any fees by the underlying general partners on these. PPET introduced direct investments relatively recently (in 2019) and primary fund investments with PPET’s high-conviction general partners will remain the core part of the portfolio, with a share of the total portfolio that is higher than for its peers. However, direct investments already made up 23% of its end-June 2024 portfolio (vs 19% at end-September 2023), with a target of 27% by end-June 2027. It is worth noting that, unlike its close peers, PPET does not charge a performance fee, therefore any returns from the co-investment portfolio are fully NAV-accretive.