Volatility is here to stay, but supply shock indicates higher prices ahead.

The energy roller coaster ride continues…

Following a record six-day oil rally from $90 to $130 per barrel, prices revisited mid-$90 territory last week, leaving shell-shocked traders behind. But over the past few days, both the European benchmark Brent and WTI each moved back above the $100 level.

The correction briefly wiped out the entire risk premium created from Russia’s invasion of Ukraine, before prices stabilized and recovered above $100:

Despite the collapse in prices, little changed in terms of the growing supply risks in today’s oil market. In fact, the International Energy Agency (IEA) just warned that the oil market faces “the biggest supply crisis in decades.”

In this post, I’ll review the latest supply and demand trends that indicate continued market tightness and higher prices ahead. But first, let’s examine the key factor driving current extreme price swings—the collapse in oil trading activity. We can see this in the collapse of open interest in both crude oil and refined product futures contracts, which have plunged to multi-year lows:

This drop in trading activity is due to commodity brokers boosting margin requirements, forcing traders who normally provide a volatility buffer to step away from the market. Anyone trading in these markets has likely noticed the lack of liquidity via price spreads blowing out. Whereas, you might normally see a one or two penny spread between bid and ask; spreads currently are routinely $0.05-$0.10 or wider.

As such, we can expect the daily price movements to remain exaggerated—both up and down—going forward. However, if we look through the noise of daily price movements, the fundamental outlook for oil remains as bullish as ever.

Let’s start with the single biggest factor of all—the situation with Russian oil exports.

Even a Ceasefire Might Not Restore Russian Supply

The initial catalyst cited for the recent oil price declines was news of diplomatic progress from Russian officials, citing the prospect of a potential imminent ceasefire in Ukraine. Of course, with the benefit of hindsight, we now know those reports were overly optimistic and the conflict continues to rage as it enters its second month. Naturally, from a humanitarian perspective—and for the sake of avoiding WW3—we all hope for an imminent ceasefire in Ukraine.

But it’s a big mistake for the market to assume any talk of a ceasefire means an immediate lifting of sanctions and a return to business as usual for Russian energy. Given the sheer scope of destruction and human tragedy Russia has inflicted upon Ukraine, the conflict has, at this point, moved beyond any chances of an easy resolution. Entire cities have been leveled and over 10 million Ukrainian refugees have been forced from their homes. Plus, reports continue to increase of Russia intentionally targeting Ukraine civilians.

At the very least, this means a long and difficult negotiation to achieve a lasting peace deal, even after a ceasefire can be reached.

Meanwhile, the geopolitical rift between Russia and the West is also progressing past the point of easy resolution. Consider just a week ago, Wednesday, US President Biden and Secretary of State Blinken both labeled Putin a “War Criminal” because of Russia’s indiscriminate killing of innocent civilians.

This was followed by a similar claim from the Vice President of the European Commission Josep Borrell:

These are serious claims with serious implications.

It could mean keeping Western sanctions on Russia indefinitely, even after a formal peace deal in Ukraine. It shows that the West is digging in for a protracted cold conflict with Russia, whereby sanctions could remain in place indefinitely even after a resolution in Ukraine. This Wall Street Journal op-ed from former US assistant secretary of defense Bing West captures the growing chorus of voices pushing for regime change in Russia, which would result in keeping sanctions in place so long as Putin remains in power.

In short, Western policymakers are pushing to turn Russia into the next Iran or Venezuela. Given this backdrop, the reputational damage of doing business with Russia continues causing Western countries to “self sanction” themselves out of the country.

In the energy sector, it began with oil supermajors like Exxon (NYSE:XOM), Shell (NYSE:SHEL), and BP (NYSE:BP) exiting their activities in Russia. These moves will mostly have a long-term impact on Russia’s ability to grow production, albeit with little short-term impact.

However, things escalated further on Friday, when oilfield service giant Halliburton (NYSE:HAL) announced it would immediately end its business in Russia as well. Just one day later, both Schlumberger (NYSE:SLB) and Baker Hughes (NYSE:BKR) announced a halt to all further investment in Russia, which may set the stage for both companies pulling out of the country completely.

This is a big deal. Like many foreign oil producers, Russia relies on Western service companies for technology, spare parts, and human capital to keep its oil and gas operations running efficiently. Russia can’t replace these services and spare parts overnight, which means a potential impairment to near-term production.

Finally, there’s the most immediate threat to Russian exports—the simple refusal by many countries to buy Russian crude oil and refined products, due to the direct and indirect effect of Western sanctions. So far, the volume of disruptions here has been rather minimal, as the deals signed weeks ago have continued working their way through the physical market. However, when the full effect of sanctions kicks into gear next month, the market faces the imminent prospect of a major disruption in Russian oil production.

Russian Supply Losses Could Reach 3–4 Million Barrels Per Day

The IEA published its first official estimate of Russian supply losses last week…and it was staggering. The agency is forecasting a massive 25% decline in Russian production starting in April. In other words…

An already-fragile global oil market could lose 3 million bbl/d starting next month.

The IEA report warned the market to brace for “oil’s biggest supply crisis in decades.” Meanwhile, famed commodities trader Pierre Andurand is calling for an even bigger supply hit. While making his case for $200 oil on the Odd Lots show, he estimated that Russian supplies could face a roughly 4 million bbl/d disruption. He also reiterated the point that an easy resolution in Ukraine remains unlikely:

“I don't think that suddenly they stop fighting, the oil comes back. It's not going to be the case. The oil’s going to be gone for good.”

If either of these supply loss estimates is close to accurate, today’s bull market could quickly turn into an energy crisis. That’s because the latest inventory data reveals that, right now, the oil market has no room to handle even a 1 million bbl/d disruption, let alone 3–4 million bbl/d.

Global Oil Inventories at Dangerously Low Levels

In the IEA’s latest monthly data update, the agency reported a monstrous drawdown of 60 million barrels from global inventories in December. The early data for January showed a further drawdown of 13.5 million barrels, which puts global inventories at multi-decade lows.

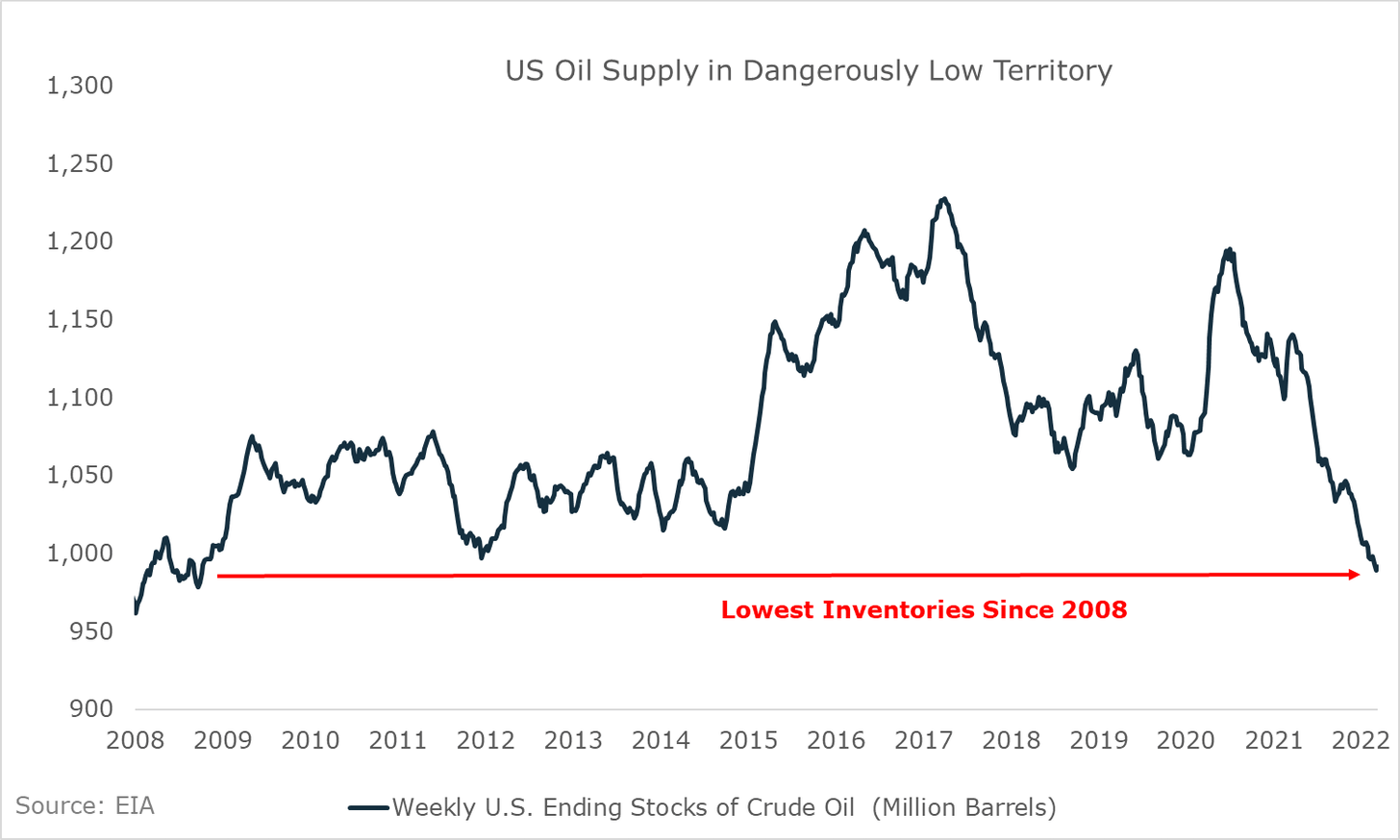

For a more real-time view of the inventory situation, we can examine the weekly data from the U.S. Over the last several weeks, total U.S. oil inventories have dropped below 1 billion barrels for the first time since 2011, and currently sit at the lowest levels since 2008:

As a reminder, the last time oil inventories were this low, oil was on its way to $145 per barrel. This shows just how tight the market is before any meaningful disruption from Russian exports.

Tomorrow, we'll examine the latest supply trends to see what the prospects might be for potentially filling in a 3–4 million bbl/d supply hole.

This post was originally published at the Ross Report.