We suggest keeping a close eye on the monthly close on NZD, given the importance of the technical juncture it sits at.

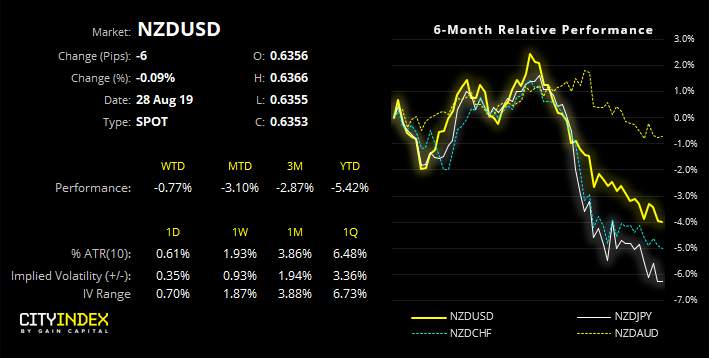

We can see on the monthly close that that NZD/USD is on the cusp of testing a key, long-term level. Prices are trading just above the August 2015 low and close to testing the bullish trendline for the October 2000 low, placing key support around 0.6344. Furthermore, a four-year topping pattern is also on the cusp of being confirmed which, if successful, could see NZD/USD drop to the mid-50’s.

Now it’s not every day a market gets to approach such a long-term level. In fact, NZD has only been close to this trendline three times since. And whilst most retail traders tend to focus on smaller timeframes (and use bar of candlestick charts), it’s worth noting that large fund managers or investors still observe closing prices, especially around such significant. Therefore, regardless of your timeframe, we suggest you keep an eye on the monthly close is it could have a material impact on prices through September.

However, we could see NZD/USD bounce from current levels over the near-term, before extending losses:

Monday produced a bullish hammer to show a hesitancy to break lower, although prices are sniffing around those lows at time of writing. If we are to see a bounce, traders could look for areas of weakness below 0.6482 to consider fading into. However, if we’re to see momentum shift notably higher (like a V-bottom), then we’d want to step aside over the near-term.

Obviously, let price action be your guide, so don’t fight the trend; if it breaks lower, so be it. But do remember to keep an eye on the monthly close as we’ve seen a few instances this year (i.e., Euro to name just one) where we saw a false break of key support heading into a new month, only to see prices violently reverse before month-end. Besides, given the size of the topping pattern on the monthly chart, there could be plenty of opportunities to short it over the coming months if it does indeed break convincingly lower.

"Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation, and needs of any particular recipient.

Any references to historical price movements or levels are informational based on our analysis, and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions."