- Broadcom and Marvell have stolen Nvidia's thunder.

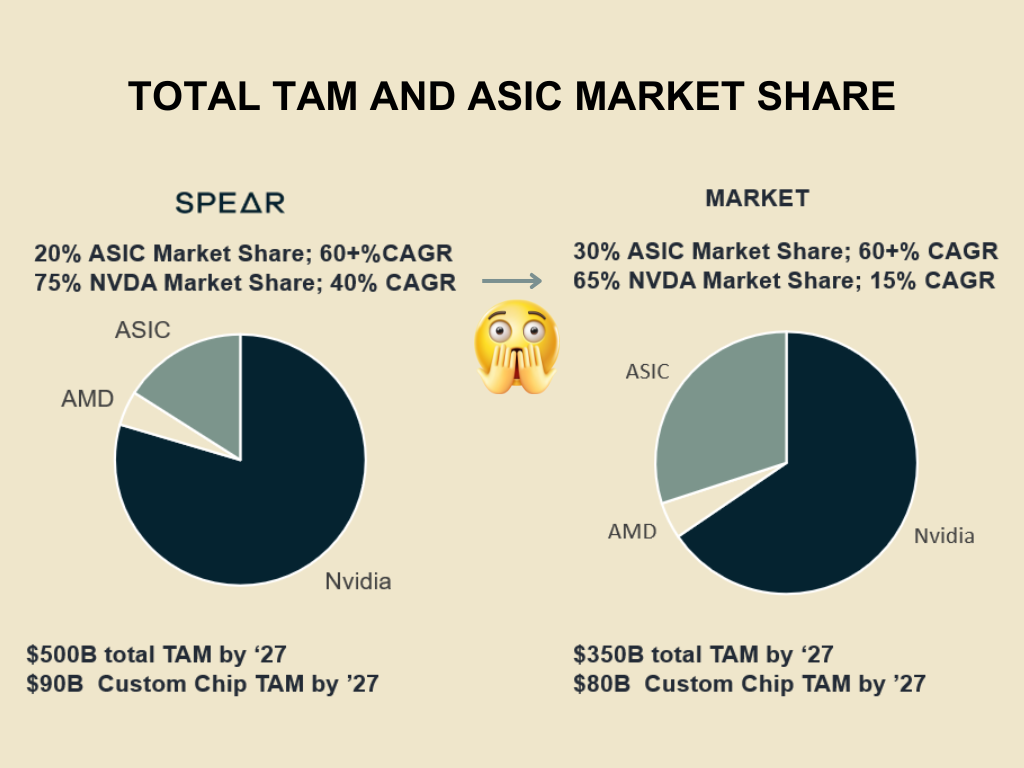

- The custom chip opportunity will be $90 billion by 2027.

- What does this mean for Nvidia?

Our weekly digest is intended to keep you on the cutting edge of investments in data infrastructure, software, and cybersecurity.

Nvidia vs. Custom Chips

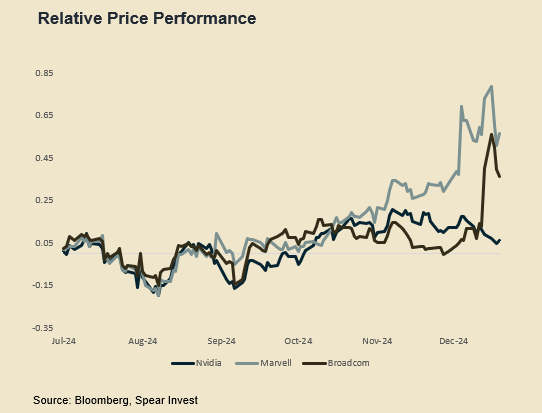

Broadcom (NASDAQ:AVGO) and Marvell (NASDAQ:MRVL), both leaders in custom chips (ASIC), stole Nvidia's thunder, significantly outperforming the tech giant by ~30% and 50%, respectively, since the end of the second quarter.

The market finally woke up to the custom chip opportunity as tech giants such as Amazon (NASDAQ:AMZN), Google (NASDAQ:GOOGL) and Microsoft (NASDAQ:MSFT) are developing and ramping the production of their own in-house chips.

How Big is the Custom Opportunity?

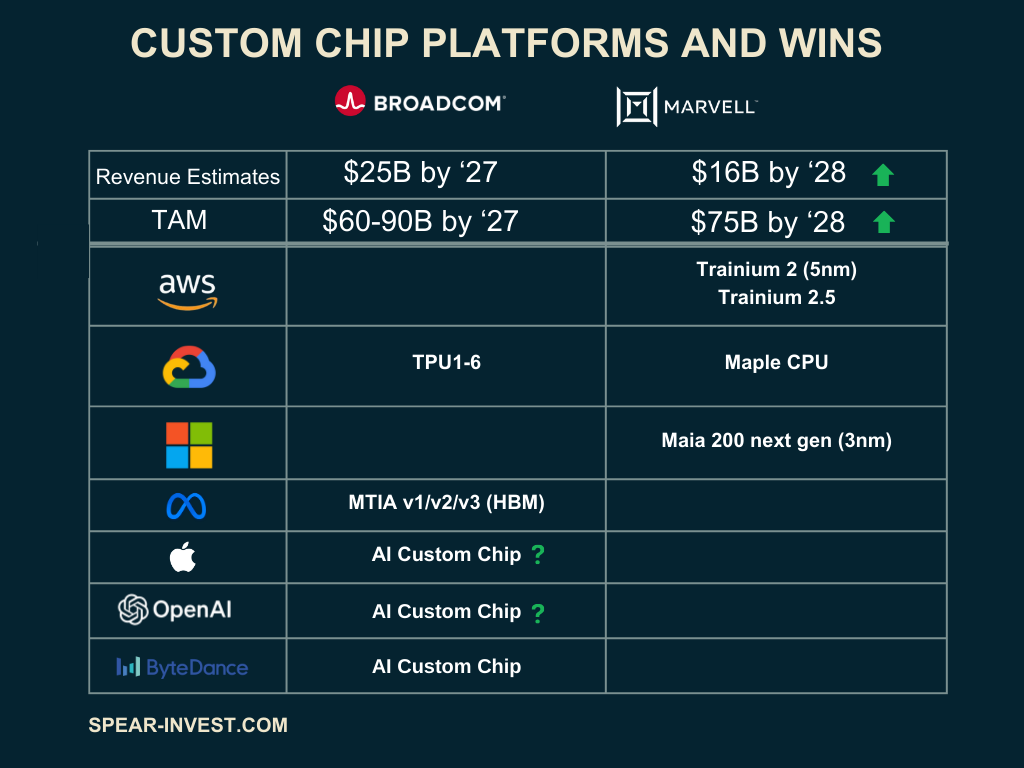

We estimate that the custom chip opportunity will be $90B by 2027, or a 60%+ CAGR, based on comments from the two custom chip leaders. Marvell provided a more conservative guide of $75B by 2028 earlier in the year but implied that there is an upside after seeing the early customer ramp. Broadcom wow-ed the market with a $60-90B market opportunity by '27.

Both companies have strong platforms with Marvell's biggest customers, Amazon and Microsoft, and Broadcom's, Google, Meta (NASDAQ:META), and ByteDance. Where is each company positioned to win?

Marvell

- Marvell guided to $75B in AI Addressable Market by '28, with the bulk of it, $42B, in costume computing, implying a 45% custom compute CAGR and ~30% overall AI CAGR.

- The company's largest customers are: Amazon, ramping in '25, and Microsoft, ramping in '26.

- Implied that their market estimates are conservative after having more visibility on the Amazon and Microsoft ramp.

Broadcom

- Broadcom provided an even more aggressive estimate of $60-90B in AI Addressable Market by '27.

- The company's largest customers are: Google, Meta, and Bytedance, each moving to 1M XPU-sized clusters into the FY27 timeframe.

- Broadcom reportedly won two more customers (likely Apple (NASDAQ:AAPL) and OpenAI)

What Does This Mean for Nvidia?

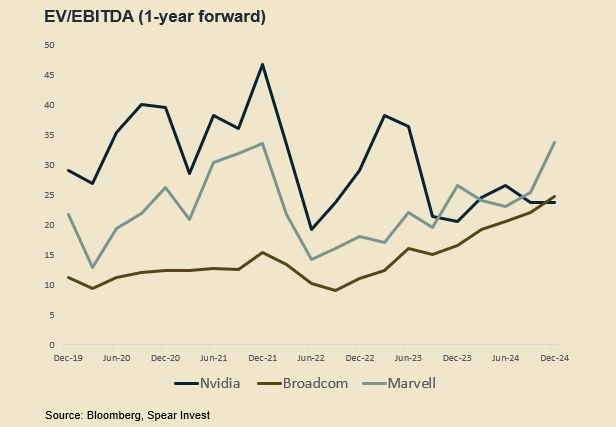

Nvidia's (NASDAQ:NVDA) stock has stalled to a point where the company is now less expensive on an EV/EBITDA basis than both Marvell and Broadcom.

Investors are now assuming a significantly lower market share for Nvidia in 2027 and, consequently, lower topline growth. But there are two points that the market is underestimating:

- The CUDA Advantage

- The one-year product improvement cycle

We think the CUDA advantage limits the amount of custom chips the cloud service providers (CSPs) can push onto their customers. With cloud representing ~50% of the total market, we believe that gaining ~half this market in the '27-'30 timeframe will be a huge win for the custom chip providers.

The market currently assumes that the majority of CSP (LON:CSPC) revenue will go to the custom providers, per Broadcom's CEO comments, but this could prove to be aggressive.

In addition, it remains to be seen if custom chips can keep up with the 1-year product intro cadence that Nvidia is leading with - each new generation offers significant performance improvements. Our best estimate is that competitors are still on a ~1+ to 2-year innovation cycle.