I previously discussed a slate of recessionary indicators with high correlations to recessionary onsets. However, as we head into 2024, many Wall Street economists predict a “soft landing” or “no recession” outcome for the economy.

Are these recessionary indicators with near-flawless track records wrong this time? Will it be a soft landing in the economy or something worse?

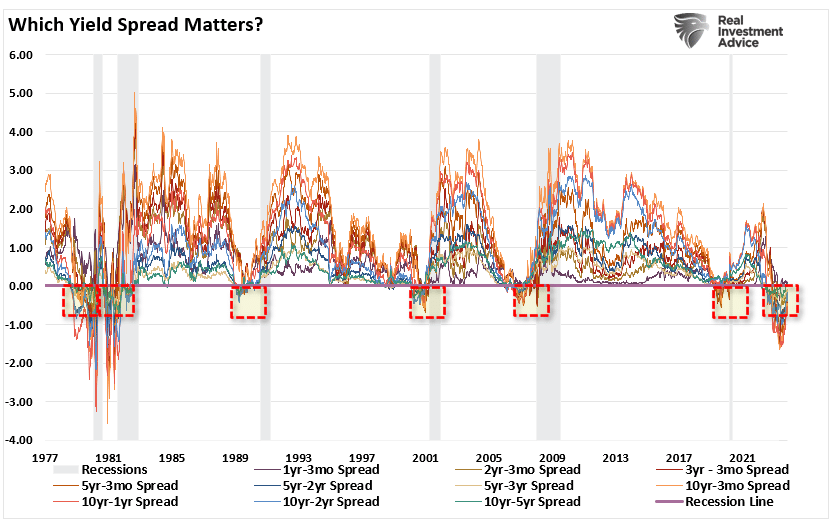

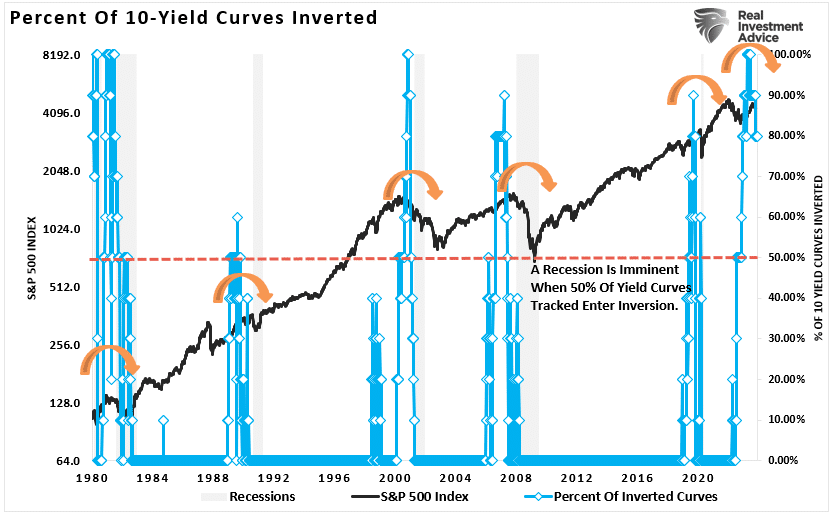

We must start our recessionary indicator review with the “Godfather” of them all – “Yield Curve Inversions.”

Bonds are essential for their predictive qualities, so analysts pay enormous attention to U.S. government bonds, specifically the difference in their interest rates. As such, there is a high correlation between the yield curve’s slope and where the economy, stock, and bond markets generally head longer term.

Such is because everything from volatile oil prices, trade tensions, political uncertainty, the dollar’s strength, credit risk, earnings strength, etc., reflects in the bond market and, ultimately, the yield curve.

Regarding yield curve inversions, the media always assumes this time is different because a recession didn’t occur immediately upon the inversion. There are two problems with this way of thinking.

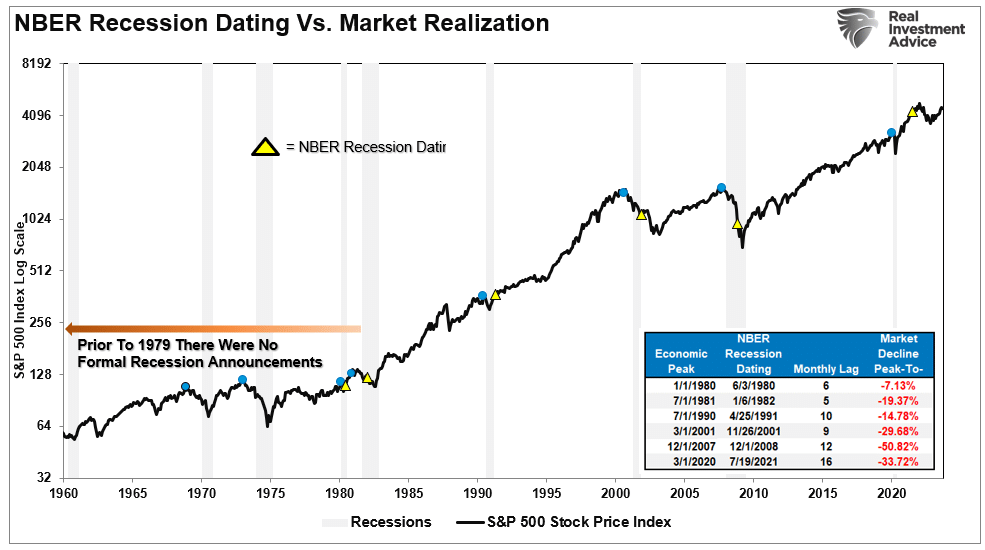

- The National Bureau Of Economic Research (NBER) is the official recession dating arbiter. They wait for data revisions by the Bureau of Economic Analysis (BEA) before announcing a recession’s official start. Therefore, the NBER is always 6-12 months late, dating the recession.

- It is not the inversion of the yield curve that denotes the recession. The inversion is the “warning sign,” whereas the un-inversion marks the start of the recession, which the NBER will recognize later.

As discussed in March last year, if you wait for the official announcement by the NBER to confirm a recession, it will be too late. To wit:

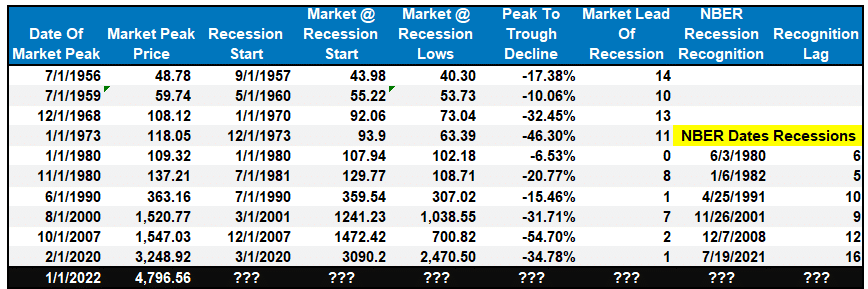

“Each of those dots is the peak of the market PRIOR to the onset of a recession. In 9 of 10 instances, the S&P 500 peaked and turned lower prior to the recognition of a recession.“

Here is the analysis in table form. It is worth noting that the market’s lead to the economic recession has shrunk markedly since 1980. As such, given the rally in the market this year, it is not surprising a recession has not been recognized as of yet.

Which Yield Curve Matters

Which yield curve matters mostly depends on whom you ask.

DoubleLine Capital’s Jeffrey Gundlach watches the 2-year vs. 5-year spreads. Michael Darda, the chief economist at MKM Partners, says it’s the 10-year and the 1-year spread. Others say the 3-month and 10-year yields matter most. The most-watched is the 10-year versus the 2-year spread.

While most mainstream economists focus on a specific yield curve, we track ten different economically important spreads from short-term consumption to long-term investments. Most yield spreads we monitor, shown below, are inverted, which is historically the best recessionary indicator. However, technically, the UN-inversion of the yield curve is the recessionary indicator.

Notably, when numerous yield spreads turn negative, the media will discount the risk of a recession and suggest the yield curve is wrong this time. However, the bond market is already discounting weaker economic growth, earnings risk, elevated valuations, and a reversal of monetary support. As such, a recession followed when 50% or more of the tracked yield curves became inverted. Every time.

But it isn’t just the yield curve as a recessionary indicator that we are watching.

Are Leading Indicators Wrong?

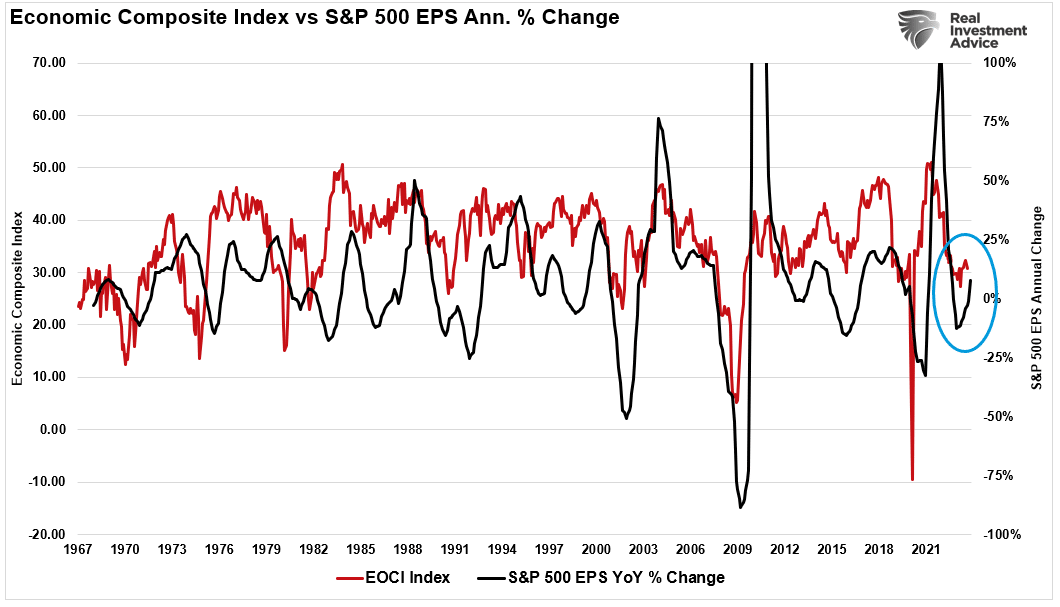

We wrote about economic cycles in July after a significant drop in many leading economic indicators. To wit:

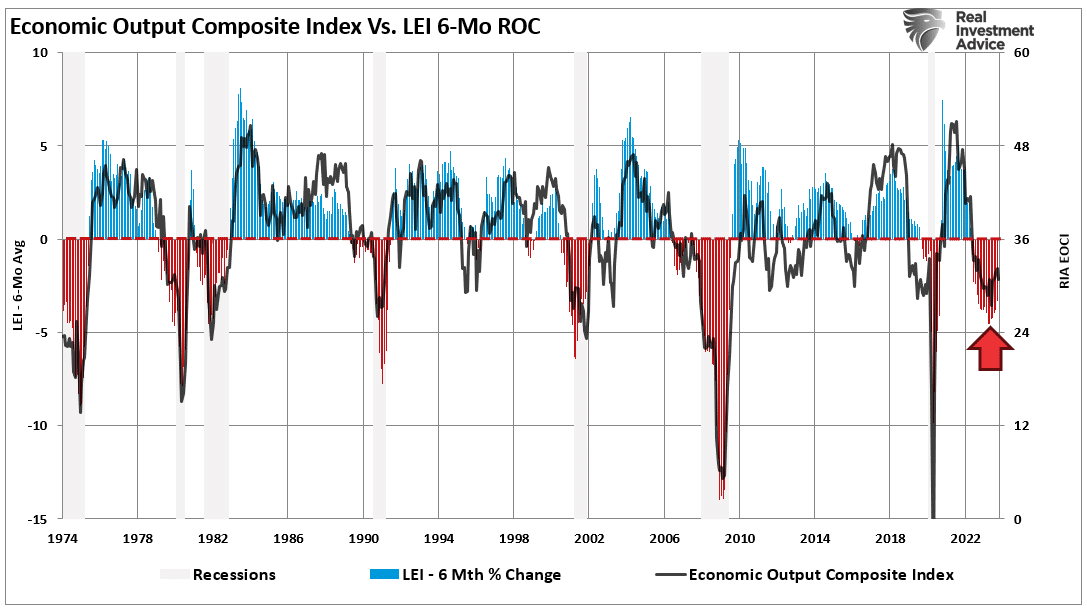

“As with market cycles, the economy cycles as well. There is little argument that the current economic data is fragile, whether you look at the Leading Economic Index (LEI) or the Institute Of Supply Management (ISM) measures. As with the market cycle, long periods of slowing economic activity will eventually bottom and turn higher.

The Economic Composite Index, comprised of 100 hard and soft economic data points, clearly shows the economic cycles. I have overlaid the composite index with the 6-month rate of change of the LEI index, which has a very high correlation to economic expansions and contractions.”

As shown, the data has bottomed since July and has started to improve. Notably, these economic measures are at levels that previously marked the bottoms of economic contractions outside financial crises or economic shutdown events. As noted in July, the improvement in economic activity seen in Q3 and Q4 was expected. That improvement also supports the earnings cycle we have seen as of late.

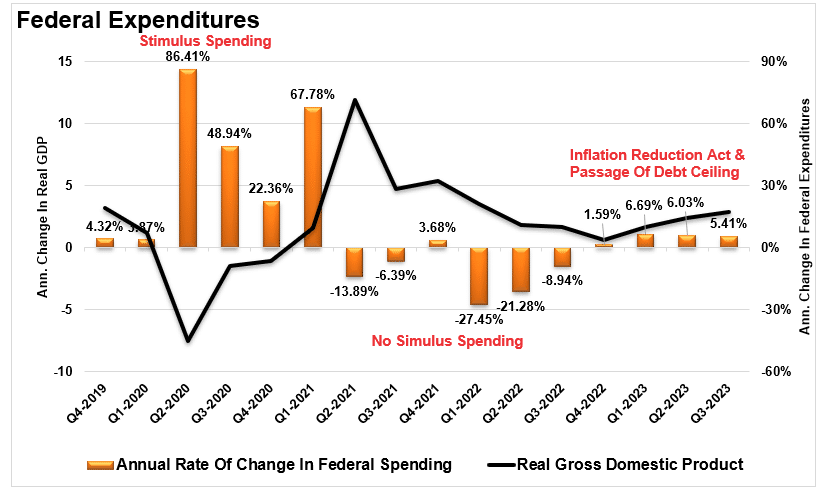

While there are reasons to remain suspect of an upturn in the current economic and market cycles, it is difficult to discount the historical evidence completely. Yes, the Federal Reserve has hiked rates aggressively, which weighs on economic activity by reducing personal consumption. However, the government continues to increase spending levels sharply, i.e., the Inflation Reduction Act and the CHIPs Act, which support economic activity.

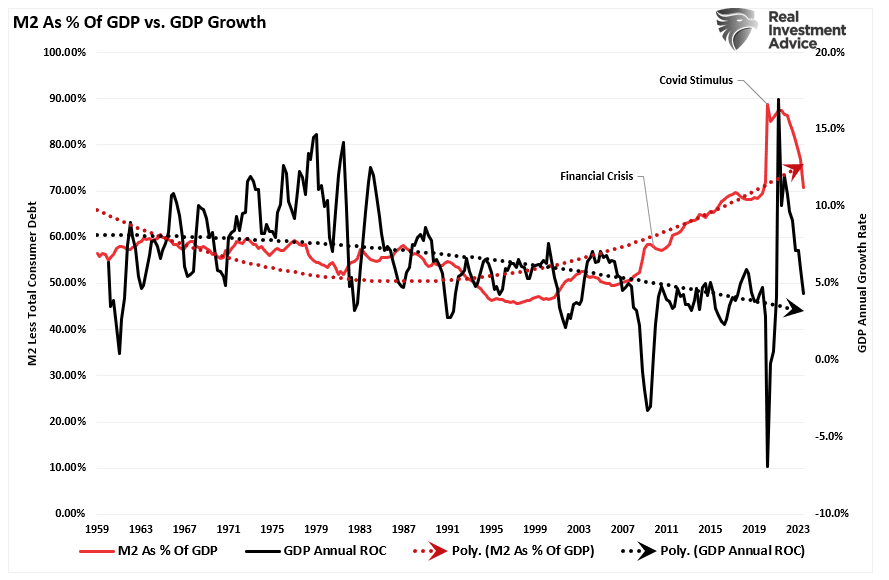

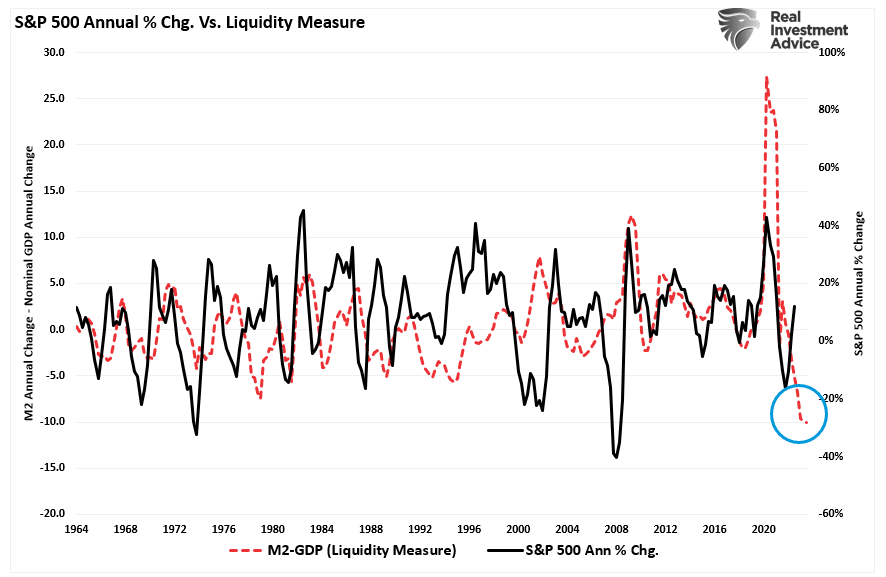

We see that same support to economic activity in the monetary supply (M2) as a percentage of the economy. While those monetary and fiscal supports are reversing following the “pandemic-related” spending spree, both are reversing.

Eventually, the support provided by those massive infusions into the economy will fade. The hope is that the economy will return to normal functioning by then. The only issue is that we have no historical precedent to base those hopes on.

Soft Landing Or Recession?

The question of a “soft landing” or an outright “recession” is difficult to answer. It is certainly possible that all of the tell-tale signs of economic recession may be wrong this time. There is another possibility. Given the massive increase in activity due to a shuttered economy and massive fiscal stimulus, the reversion may take longer than expected. Both scenarios support the rising optimism of Wall Street economists in the near term. However, such also brings to mind Bob Farrell’s Rule #9:

“When all experts agree something else tends to happen.”

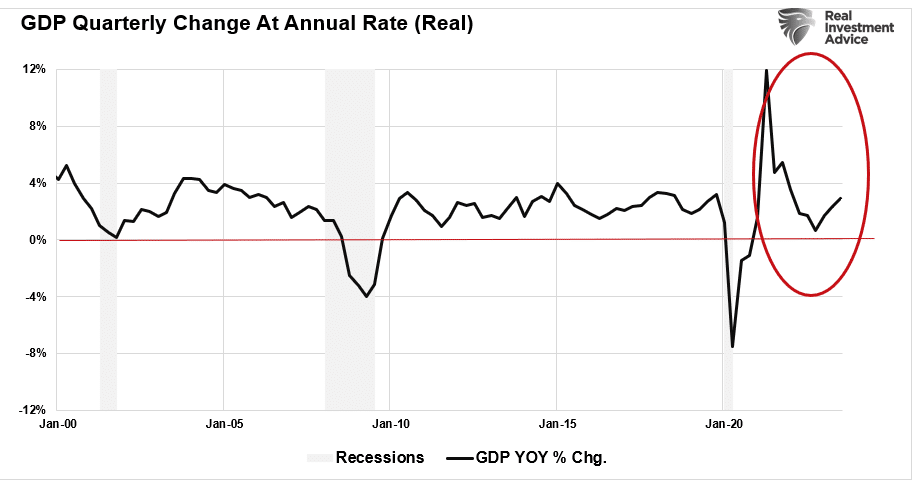

As noted previously, we would already be in a recession if we had entered this current period at previous growth rates below 4%. The difference is the contraction began from a peak in nominal GDP of nearly 12%. As noted above, a bounce in activity is not surprising after a significant contraction in the economic data. The question is whether that bounce is sustainable. Unfortunately, we won’t know the answer for quite some time.

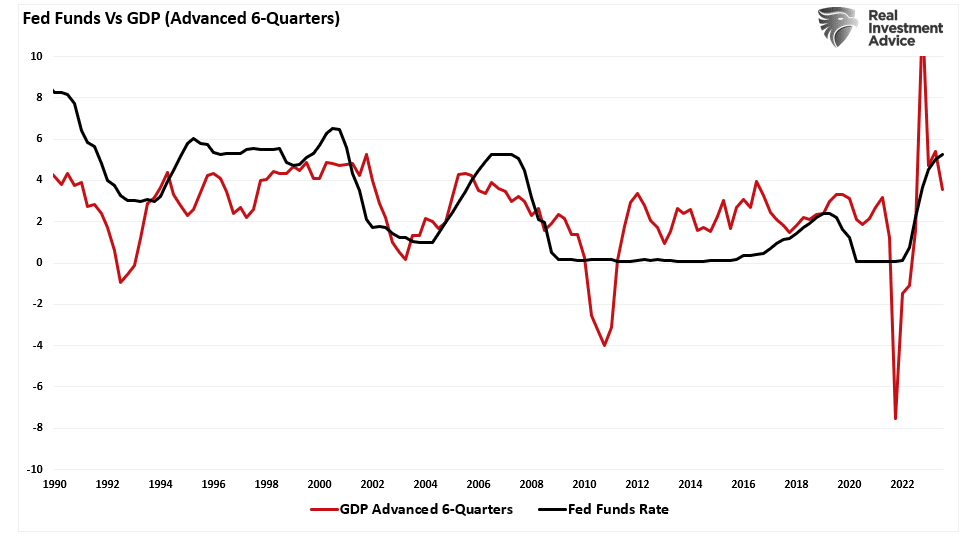

We know that Federal Reserve actions regarding hiking rates have about a 6-quarter lead over changes to economic growth. Given the last Fed rate hike was in Q2 of this year, such would suggest a further slowing in economic activity into the end of 2024.

Investor Implications

As noted above, the massive surge in monetary stimulus (as a percentage of GDP) remains highly elevated, which gives the illusion the economy is more robust than it likely is. As the lag effect of monetary tightening continues to weigh on consumption, the reversion to economic strength may surprise most economists.

For investors, the implications of reversing monetary stimulus on prices are not bullish. As shown, the contraction in liquidity, measured by subtracting GDP from M2, correlates to changes in asset prices. Given that there is significantly more reversion in monetary stimulus to come, this suggests that lower asset prices will likely follow.

However, the markets have recently been betting that a reversal of liquidity is coming. Given the inflationary implications of providing monetary accommodation, i.e., rate cuts and quantitative easing, it seems unlikely the Federal Reserve will act before the onset of a recession. If that assumption is correct, investors may set themselves up for disappointment.

As we update our recessionary indicators, there is still no clear visibility regarding the certainty of a recession. Yes, this “time could be different.” The problem is that, historically, such has not been the case.

Therefore, given this uncertainty, we must continue to weigh the possibility that Wall Street economists are correct in their more optimistic predictions. However, we must remain open to the probabilities that still lie with the indicators.

No one knows what the future holds with any degree of certainty. Therefore, we must remain nimble in our investment approach and trade the market for what it is rather than what we wish it to be.